"Revenue exceeds 140 billion yuan, yet net profit is only 280 million yuan, a staggering 93.53% drop: What's wrong with this leading automaker?"

![]() 10/31 2024

10/31 2024

![]() 705

705

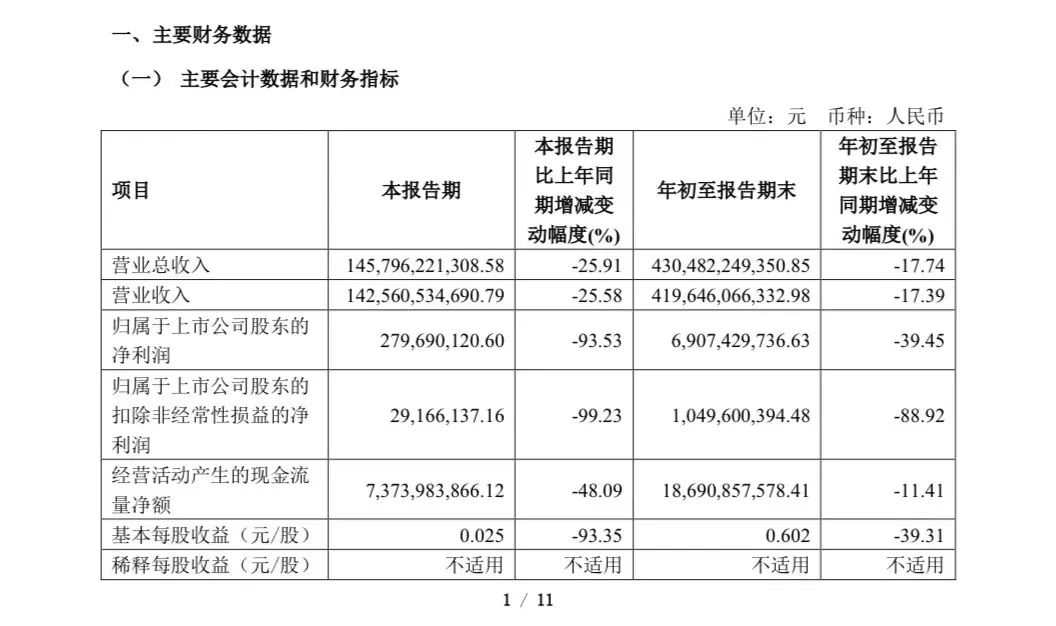

As China's largest automaker, SAIC Motor's third-quarter financial report stunned investors. On the evening of October 30, SAIC Motor released its third-quarter financial results, revealing that revenue for the quarter reached 142.56 billion yuan, a year-on-year decline of 25.58%. Amidst fierce competition, this figure was not entirely surprising. However, what was shocking was that net profit for the quarter stood at a mere 280 million yuan, a year-on-year decrease of 93.53%.

In the first half of this year, SAIC Motor's overall performance remained stable. Specifically, in the second quarter of 2024, the company's main operating revenue reached 141.614 billion yuan, a year-on-year decrease of 21.6%. Net profit for the quarter was 3.914 billion yuan, down 9.03% year on year. For the first quarter of the year, SAIC Motor reported revenue of 143.1 billion yuan, a year-on-year decline of 1.95%, with net profit of 2.714 billion yuan, down 2.48% year on year. Despite the decline in revenue, SAIC Motor managed to stabilize its profit margin. While revenue decreased by 12.43% year on year, net profit declined by only 6.45%, a smaller drop than revenue.

In its financial report, SAIC Motor attributed this change to "the decline in the gasoline vehicle market and unprecedented price competition, leading to reduced sales revenue, lower gross margins, and decreased cash inflows." The report showed that net cash flow from operating activities in the third quarter was 7.373 billion yuan, a year-on-year decrease of 48.09%. A detailed comparison of financial data from January to September 2024 with the previous year reveals a decrease of 92.9 billion yuan in total operating revenue, from 523.3 billion yuan to 430.4 billion yuan. Similarly, total costs decreased by 79.8 billion yuan, from 513.5 billion yuan to 433.7 billion yuan.

Within SAIC Motor's business structure, significant profit changes were observed in its joint venture segment. According to the financial report, the company's investment income from associates and joint ventures amounted to 3.264 billion yuan from January to September, compared to 7.369 billion yuan in the same period last year. In the first half of this year, the three major joint ventures contributed differently: SAIC Volkswagen generated 865 million yuan, up 62% year on year; SAIC GM suffered a loss of 2.275 billion yuan; while Wuling Motors reported a net profit of 97 million yuan. Considering that SAIC Motor Passenger Vehicle Company and IM Motors are currently operating at a loss, these segments are significantly impacting SAIC Motor's overall profitability.

General Motors, for its part, reported a loss of US$137 million in the third quarter in the Chinese market, compared to a profit of US$192 million in the same period last year. In the first nine months of this year, GM China incurred losses totaling US$348 million (approximately RMB 2.48 billion). While the specific performance of SAIC GM in the third quarter remains unclear, GM's financial data suggests that its losses in China are widening, implying that SAIC GM's losses are also expanding.

In response to these challenges, SAIC Motor is taking proactive measures. The company's new management team has even adopted a mindset of "enduring hardship and striving for success," signaling its intention to abandon illusions and fully engage in industry competition. However, SAIC Motor is not alone in experiencing a significant decline in net profit during the third quarter, as several other automakers, including Guangzhou Automobile Group and Changan Automobile, have reported similar situations. What happened during the third quarter, and what challenges did these companies face?

01 Shedding Burdens and Pursuing Strategic Focus

Facing harsh realities, SAIC Motor must take decisive action. The company's new management has already outlined a new plan. During the 2024 Mid-Year Cadre Conference held by SAIC Motor in early October, President Jia Jianxu, who had been in office for three months at the time, sharply pointed out the group's existing problems and outlined its future development strategy. Jia emphasized that SAIC Motor lacked a profound understanding of its current issues and difficulties and had not promptly optimized its business strategies.

He stressed the need for SAIC Motor to shed its burdens and focus on its core competencies. "Trying to do everything means doing nothing well, as the window of opportunity has already closed. From 2019 to the present, our biggest waste has been time, not money," Jia said. He believes that in the fiercely competitive market, SAIC Motor must concentrate on its seven key technological platforms to achieve remarkable results.

At the market level, Jia emphasized the importance of sales personnel understanding market trends, making bold predictions, enhancing efficiency, and grasping sales opportunities. In particular, they must master new marketing strategies, create IP, and excel in both online and offline marketing efforts. Reducing customer acquisition costs and improving conversion rates are crucial to success.

Jia also frequently mentioned the importance of cost reduction, prompting SAIC Motor to push for the transformation of its components segment. He noted that the biggest challenge lies in the game between vehicle manufacturers and component suppliers. He advocated for closer collaboration between these two entities, urging them to prioritize cost and capability rather than solely focusing on profit. By providing SAIC Motor with the best technologies and solutions, they can jointly achieve "integration and synergy," thereby supporting the company's overall cost structure and capabilities.

Individual vehicle manufacturers have also set clear strategies. For instance, SAIC Volkswagen aims to "boost gasoline vehicle sales, stabilize electric vehicle sales, and introduce Audi models." This involves increasing sales of profitable gasoline vehicles, stabilizing the brand and sales of loss-making electric vehicles by using profits from gasoline vehicle sales, and ensuring the successful launch of Audi models next year. In November, the Audi SAIC project team will introduce its first electric vehicle, marking a new chapter for SAIC Audi.

SAIC GM, on the other hand, is focused on "building confidence, ensuring survival, and pursuing development." Jia remarked, "Confidence is more precious than anything else at SAIC GM right now. Selling cars and creating a hit model will significantly reduce negative voices." Recently, SAIC GM has widely adopted a "fixed-price model" for its new vehicles, driving prices down to the lowest level and sparking a new round of price wars. This strategy has generated significant traffic and led to a rapid rebound in sales.

In terms of independent brands, SAIC Motor Passenger Vehicle Company aims to "enhance efficiency, rationalize model lineups, and pursue synergies." Wuling Motors seeks to "elevate its brand, increase vehicle prices, and boost profits." IM Motors strives to "embrace innovation, amplify its voice, and expand its scale." Currently, both SAIC Motor Passenger Vehicle Company and IM Motors are continuously launching new products and technologies. IM Motors has seen a notable sales increase after the revamp of its LS6 model, and the introduction of an extended-range version next year is expected to significantly improve profitability. Overall, most segments of SAIC Motor are showing positive trends, indicating better overall performance in the coming year.

02 Net Profit Plunges for Multiple Automakers in the Third Quarter

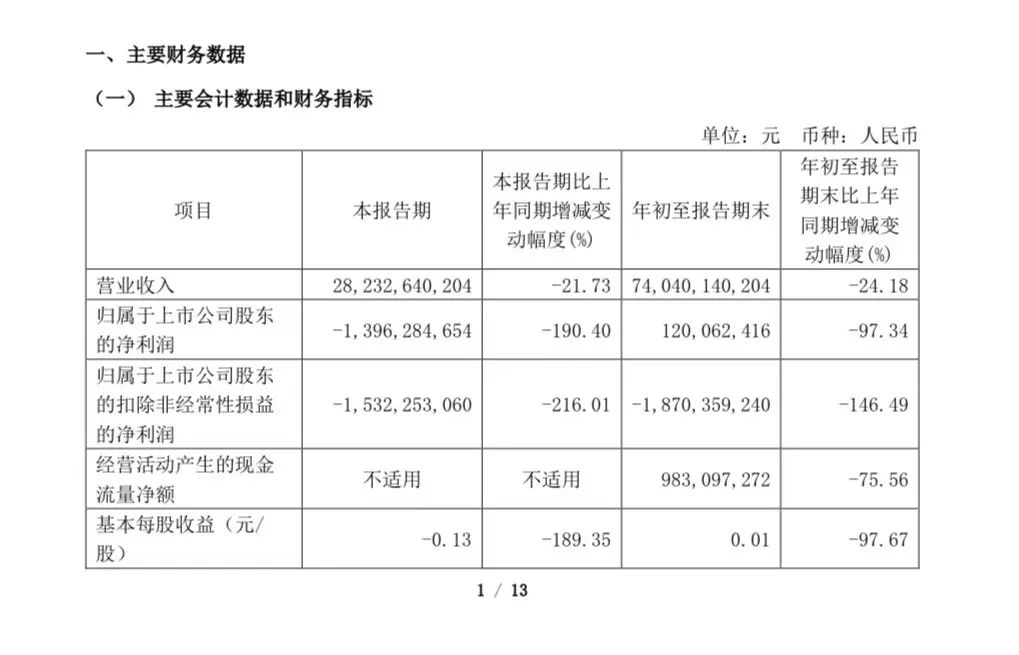

The third quarter was a challenging period for many automakers, including SAIC Motor. Several traditional automakers have reported substantial declines in profits. For instance, Guangzhou Automobile Group, which also released its third-quarter results on October 30, suffered a significant drop in profits due to declining sales at its two joint ventures, GAC Toyota and GAC Honda. GAC Group's revenue for the third quarter was 28.233 billion yuan, down 21.73% year on year, with a loss of 1.396 billion yuan, a staggering 190.4% year-on-year decrease. Cumulative profits for the first nine months were 120 million yuan, a 97.34% year-on-year decline.

GAC Group attributed this performance to declining auto sales, increased business and administrative expenses, lower profits, one-time expenses related to the optimization of redundant capacity at joint ventures, and increased exchange losses due to currency fluctuations. Notably, GAC Toyota and GAC Honda, which are major contributors to the company's profits, saw a significant drop in investment income from associates and joint ventures, from 7.07 billion yuan in the same period last year to 2.26 billion yuan in the third quarter of this year.

Within GAC Group, Trumpchi managed to turn a profit in 2023, but Aion lacks specific financial data, with revenue of 38.794 billion yuan and a net loss of 2.063 billion yuan reported for 2022.

Changan Automobile, which released its financial results on October 28, also experienced a substantial decline in net profit in the third quarter of 2024, though the decline was less severe than that of GAC Group and SAIC Motor.

In the third quarter, Changan Automobile reported revenue of 34.237 billion yuan, down 19.85% year on year. Net profit attributable to shareholders of listed companies was 748 million yuan, a decrease of 66.44% year on year. The decline in net profit was primarily due to the company's multiple new brands, which incurred significant losses. In the first half of the year, Changan's Deep Blue Automobile generated revenue of 13.981 billion yuan but incurred a net loss of 739 million yuan. AITO Automobile recorded revenue of 6.152 billion yuan but a net loss of 1.395 billion yuan. These two subsidiaries incurred cumulative losses of over 2 billion yuan in the first half of the year, putting considerable pressure on Changan's profitability.

Several other automakers have also released their third-quarter reports. BJEV reported revenue of 6.077 billion yuan in the third quarter, up 71.78% year on year, but still incurred a net loss of 1.92 billion yuan, though the loss narrowed year on year. BYD reported revenue of 201.125 billion yuan in the third quarter of 2024, up 24.04% year on year, with net profit attributable to shareholders of listed companies reaching 11.607 billion yuan, an 11.47% increase year on year.

Great Wall Motor reported third-quarter revenue of 50.825 billion yuan, a sequential increase of 4.65%. Net profit attributable to shareholders for the quarter was 3.35 billion yuan, marking the third consecutive quarter with net profit exceeding 3 billion yuan, albeit with a slight decline. Notably, Seres experienced a remarkable turnaround after becoming profitable this year. In the third quarter of 2024, Seres reported revenue of 41.582 billion yuan and net profit attributable to shareholders of 2.413 billion yuan.

Currently, BYD leads the pack in terms of net profit reported in the third-quarter financial reports, followed by Great Wall Motor and Seres. These three automakers form the top tier of profitability for the quarter. However, it is worth noting that NIO and Geely, both of which are listed on the Hong Kong Stock Exchange, have yet to release their third-quarter reports. It is expected that their financial results may alter the current ranking. Notably, BYD's profit for the quarter is roughly equivalent to the combined profits of the other automakers mentioned.