Musk's meeting brings in over 200 billion yuan

![]() 11/01 2024

11/01 2024

![]() 603

603

Produce at least 2 million Cybercabs annually

Author|Wang Lei, Liu Yajie

Editor|Qin Zhangyong

Overnight, Tesla's share price surged by over 20%, and its market capitalization reached $832.1 billion, marking the largest one-day gain in 11 years.

This also increased Tesla's market capitalization by $150 billion, almost equivalent to the market value of a Ningde Times. The previous 'deficit' was made up overnight.

Musk's net worth surged by $33.5 billion (approximately RMB 238.5 billion) from the previous day, reaching $267.8 billion (approximately RMB 1.9 trillion). It seems this is the reason why Musk views money as dirt.

On October 10, after the unveiling of the autonomous taxi Cybercab, investors were not pleased with Musk's lateness and hasty departure, and the share price fell by 10% at one point.

However, the turning point came with the third-quarter financial report and conference call. After the financial report was released, Tesla not only exceeded revenue expectations, but Musk also sent out many positive signals.

This sparked another fire in the capital market.

01 The affordable car is finally coming

During Tesla's financial report conference call held on October 24, Beijing time, Musk estimated that Tesla's sales growth in 2025 would be 20%-30%.

In the first three quarters of this year, Tesla's deliveries declined by nearly 6%. Facing such data, Musk remained optimistic, which is closely related to the new models and autonomous driving technology to be launched in 2025.

Tesla stated that although internally, they believe that the workload required to manufacture low-cost cars is very high, such as reducing costs by 20% being more difficult and painful than designing cars and building an entire factory from scratch, the core task moving forward remains cost reduction.

The purpose of cost reduction is very clear, which is to minimize the end-user price of the vehicles.

Tesla officials stated that the more affordable models that the outside world is concerned about will be launched in the first half of 2025, and the pricing of the new products will not exceed $30,000 (approximately RMB 213,000).

Regarding this highly anticipated product, Tesla did not reveal too many details, stating only that the breakthrough would not be as strong as initially planned.

It seems that after the previous conference, Tesla has begun to manage public expectations.

Moreover, the price of this car is not the rumored $25,000. Musk explained that Tesla would not produce affordable cars without an autonomous driving version.

The entry-level car will undoubtedly have an immediate impact on sales. In addition, there is also the Cybercab.

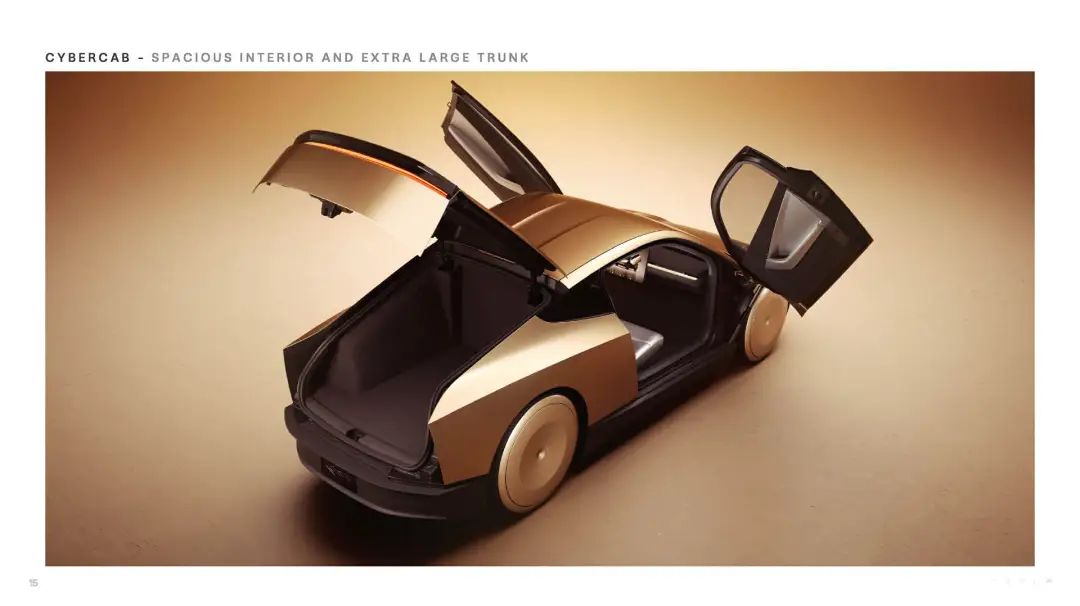

The Cybercab has no steering wheel or pedals. Not long ago, Musk also announced that the cost of the Cybercab is around $30,000, but during the conference call, he reduced this figure to around $25,000. As for how to further reduce costs, that is an internal matter for them.

Moreover, during the conference call, Musk also expressed doubts about hybrid vehicles, stating that producing a hybrid vehicle is not as good as focusing on manufacturing electric vehicles capable of autonomous driving. He always believes that the future belongs to autonomous electric vehicles.

In his eyes, all vehicles manufactured by Tesla can be considered Robotaxis. "Currently, we have produced nearly 7 million vehicles, and the vast majority have autonomous driving capabilities. Our current weekly production is around 35,000 units."

Regarding the mass production of the Semi (Tesla's semi-trailer truck), Tesla stated that it will begin construction of a mass production plant next year and commence full-scale production in 2026. The cost advantage of the Semi has created a huge demand, and the approximately 200 Semis already produced are all equipped with FSD hardware.

02 Release of FSD V13 version this year

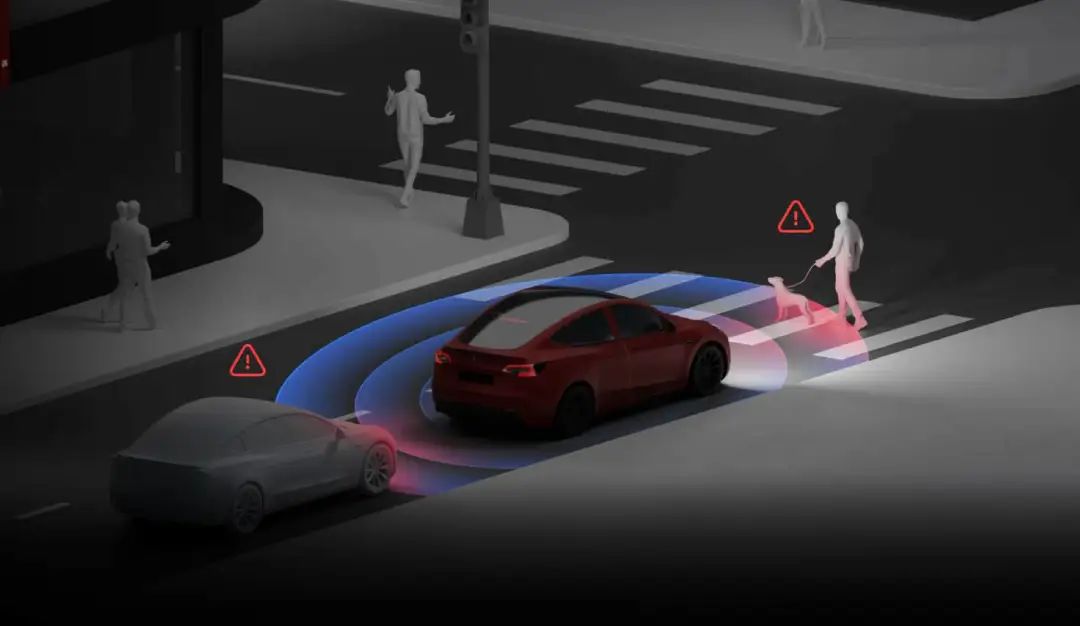

In terms of autonomous driving, Tesla also announced significant progress during the financial report conference call and revealed some information not mentioned at the Robotaxi conference.

As of the third quarter, the cumulative mileage of FSD's full self-driving capability (driver-supervised version) exceeded 2 billion miles, with over 50% achieved on the V12 version.

Currently, the FSD V12.5 version has been pushed to Cybertruck users. Tesla merged the codes for highway and urban intelligent driving, introduced an end-to-end neural network into highway intelligent driving, achieving considerable improvements.

The FSD V13 version will also be released later this winter, and it is expected that the mileage per takeover will increase by 5 to 6 times. Tesla expects the mileage per takeover of FSD to continue to increase by the second or latest third quarter of next year.

Moreover, it may even achieve safer performance than humans in the second quarter of next year and then continue to improve rapidly. "Without waiting for Robotaxis to achieve fully autonomous driving, we expect to achieve this goal through existing models next year."

Not long ago, Tesla launched the Robotaxi model, the Cybercab, and Tesla is currently testing its ride-hailing application with employees in the Bay Area.

Although accompanied by safety drivers, employees can place orders through their phones, and the vehicle will transport passengers to any location in the Bay Area. If regulatory approval goes smoothly, it is expected that autonomous ride-hailing services will be launched in Texas and California next year.

The Cybercab will also achieve mass production in 2026, with a goal of producing at least 2 million units annually, potentially reaching 4 million units.

In addition, Tesla's AI training is no longer limited by computing power, and the humanoid robot is considered Tesla's most valuable product ever.

In terms of autonomous driving computing power, Tesla is still investing heavily in expansion. In the third quarter, Tesla deployed a computing cluster composed of 29,000 NVIDIA H100 chips at the Gigafactory in Texas, and it is expected to increase these chips to 50,000 by the fourth quarter of this year, further enhancing training capacity.

The production of 4680 batteries has not stopped. Tesla believes that its self-developed 4680 batteries are likely to become the most competitive product in the United States. This means lower costs and more competitiveness than any other alternatives.

At the same time, Tesla's energy storage business has also grown significantly, with an annual production capacity of 40 GWh. The second energy storage factory will be built in Shanghai with an annual production capacity of 20 GWh, starting production in the first quarter of next year. Soon, Tesla's annual energy storage production capacity will reach 100 GWh.

03 Emerging from the profitability trough

In the third quarter of this year, Tesla also achieved a milestone: the cost of goods sold (COGS) per vehicle fell to an all-time low of $35,100 (approximately RMB 250,000), making it what Musk called "the brightest third quarter."

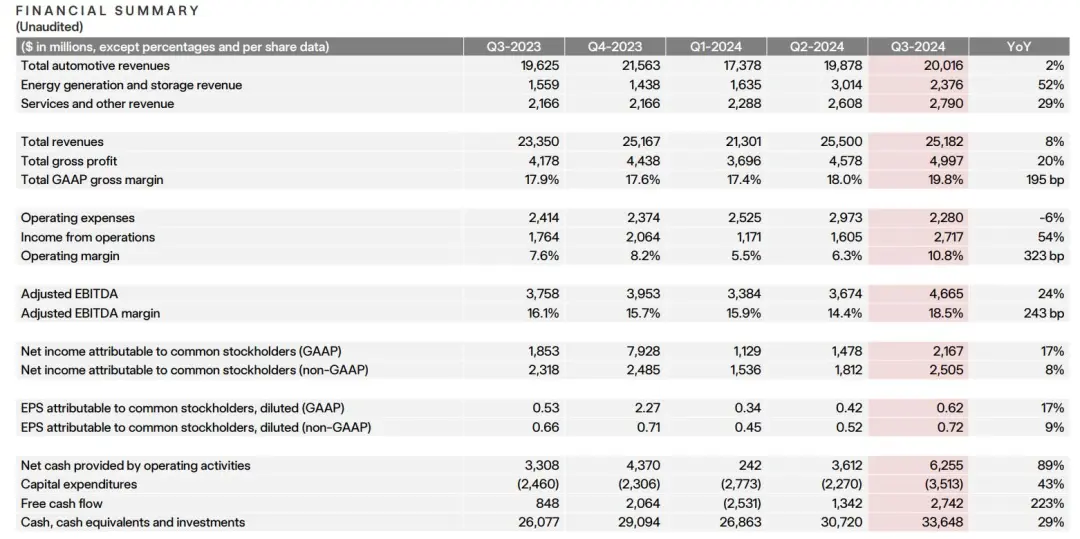

Tesla's total revenue in the third quarter reached $25.2 billion (approximately RMB 179.6 billion), a year-on-year increase of 8%, but a slight decrease of 1.2% from the previous quarter's $25.5 billion, failing to meet the expectations of Wall Street analysts.

According to the segmented revenue structure by business, revenue from the automotive business in the third quarter was $20.016 billion, a year-on-year increase of 2%, accounting for 79.5% of total revenue.

Revenue from energy production and storage businesses was $2.376 billion, a year-on-year increase of 52%, and revenue from services and other businesses was $2.79 billion, a year-on-year increase of 29%.

However, contrary to the expectations of many investment institutions, net profit did not decline but increased, with net profit attributable to common shareholders reaching $2.167 billion, a year-on-year increase of 17% and a month-on-month increase of 46.6%.

This also means that after declining year-on-year by 55% and 45% in the first and second quarters, respectively, Tesla's net profit finally resumed positive growth in the third quarter.

In addition, Tesla's gross profit margin in the third quarter increased by approximately 2 percentage points year-on-year to 19.8%, and the operating profit margin also reached 10.8%, with free cash flow of $2.7 billion (approximately RMB 19.24 billion).

However, there is still some controversy surrounding the surge in net profit.

Many analysts believe that the significant increase in profit margins is mainly due to the growth in carbon credit revenue rather than a decrease in sales costs.

Since Tesla only produces electric vehicles, it has a large number of unused carbon credits. Tesla has always sold carbon credits to generate revenue. Other automakers must obtain a certain number of regulatory credits each year. If these manufacturers fail to meet the standards, they can purchase them from new energy vehicle companies like Tesla.

In response, Tesla also explained in its financial report that the revenue from automotive regulatory credits (carbon credits) did indeed reach $739 million, a year-on-year increase of over 30%, making it the second-highest in history, second only to the $890 million in the second quarter of this year.

However, even after excluding the impact of carbon credits, Tesla's automotive business gross margin also increased by 2.4% month-on-month to 17.1%. Therefore, the key to profit growth lies in Tesla's all-time low sales cost per vehicle, which declined by approximately $2,000 compared to the same period last year.

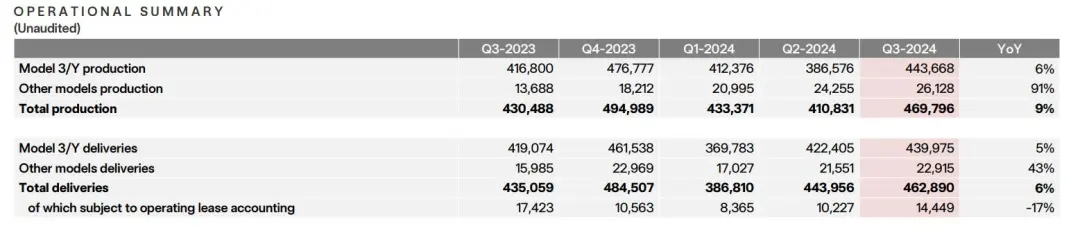

At the same time, it coincided with a new high in quarterly deliveries in 2024 in the third quarter, with approximately 463,000 electric vehicles delivered globally, an increase both year-on-year and month-on-month. The total number of vehicles produced also increased, approximately 470,000 units, a year-on-year increase of 9% compared to the 430,000 reported in the third quarter of last year. Among them, the Model 3 and Model Y accounted for over 90% of deliveries.

Interestingly, last year at this time, Musk was still complaining that producing the Cybertruck was "digging one's own grave." Nowadays, the Cybertruck is starting to support the family.

Tesla stated that Cybertruck production increased month-on-month, and as a result, the Cybertruck business, which began deliveries in November last year, achieved its first positive gross margin. The Cybertruck also became the third best-selling electric vehicle in the United States in the third quarter, trailing only the Tesla Model Y and Model 3.

Compared to the slight growth in the automotive business, the other two businesses have also become growth points that cannot be ignored by Tesla.

Tesla's energy generation and storage business in the third quarter saw revenue soar by 52% to $2.58 billion. The installed capacity of energy storage products reached 6.9 GWh, a year-on-year increase of 73%. The gross margin of the energy storage business reached 30.5%, setting a new record for the highest quarterly gross margin in this business.

Service and other revenue (including Tesla's non-warranty repair revenue) also increased by 29% to $2.79 billion.

Soon, Tesla will also welcome the annual production of 2 million Cybercabs. It seems that Tesla's business empire still has many stories to tell.