The era of easy money is over, and Porsche plans to 'cut' dealers for self-preservation

![]() 11/01 2024

11/01 2024

![]() 535

535

The rise of new forces in recent years has greatly impacted traditional luxury brands. BMW, Benz, and Audi have all lowered prices to compete for market share, and even Porsche, which used to sit high on its pedestal, cannot remain unscathed.

Recently, as the price war continues to escalate, the topic of "Porsche prices falling below 400,000 yuan" has trended on social media. Coupled with a significant drop in Porsche's profits in the first three quarters, it is rumored that to cope with the dual pressures of declining sales and compressed profit margins in the Chinese market, Porsche has decided to take measures to significantly reduce its dealer network in China.

Falling below 400,000 yuan is unlikely, but slow sales are real

Not long ago, news spread online that a Porsche dealer in Shenzhen had significantly reduced the price of the Porsche Macan model. The quoted price for the bare 2024 Macan 2.0T model was as low as 358,000 yuan, while the manufacturer's suggested retail price for this model is 578,000 yuan, representing a 60% discount.

Since Porsche is one of the most valuable car brands, the topic of "Porsche prices falling below 400,000 yuan" quickly trended on social media.

However, according to investigations by AutoTalk, the current bare price for the entry-level 2024 Macan 2.0T model at Porsche dealers in Beijing, Shenzhen, and Guangzhou is all above 500,000 yuan, with the lowest on-road price being around 570,000 to 580,000 yuan.

Sales staff in the store stated that the prices seen online can only be purchased online. A 60% discount is just a gimmick, and an 80% discount is the real deal. With optional extras, taxes, and dealership fees, you can't take the car away for less than 600,000 yuan.

Local Porsche sales staff in Shenzhen explained that while the bare price of some Macan models is indeed around 400,000 yuan, these are special offer cars with limitations on models, colors, and even license plates. For example, while the discount on black Macans is low, they cannot be registered outside Guangdong Province due to regional restrictions imposed by the manufacturer this year. Additionally, sales staff indicated that if financing is chosen for the purchase, the on-road price may be more cost-effective.

Therefore, for those who hope to drive away a Macan for 350,000 or even 400,000 yuan, the idea is overly naive, not to mention additional expenses such as vehicle purchase tax, insurance fees, and license plate fees. Just considering Porsche's "build-to-order" system as an ultra-luxury brand, it is clear that one cannot take this car away for less than around 600,000 yuan.

Although the claim that Porsche Macan prices have fallen below 400,000 yuan is purely a gimmick, the decline in Porsche sales is an undeniable fact.

Not long ago, Porsche announced its global sales figures for the first three quarters of this year. The data revealed that while most global markets have performed poorly, with slight growth or decline, the entire Chinese market has seen a year-on-year decline of up to 29%.

Globally, Porsche cannot find a market where sales have declined more severely than in China. This is mainly due to the significant impact of new Chinese car models on Porsche. Taking the Macan model as an example, wealthy Chinese can purchase models like the Wenjie M9 and Lixiang L9, which offer stronger product capabilities at more affordable prices. Compared to the Macan, these latter models offer superior intelligence and autonomous driving capabilities, providing the middle class with higher emotional value.

The Chinese auto market is headache-inducing, and dealers are being cut with reluctance

During the era of automotive growth, due to Porsche's positioning as an ultra-luxury brand, combined with its high resale value, as well as hidden profit margins from optional extras and price markups, many investors with extra funds eagerly sought to join Porsche's dealer network. However, times have changed. With new force models taking center stage, the era of easy money for Porsche and luxury brands like BBA has come to an end.

In May this year, a joint boycott by Porsche dealers in China attracted significant attention. The incident arose when Porsche China chose to pressure dealers with inventory to meet sales targets, causing enormous financial pressure on dealers and intensifying conflicts between Porsche China and its dealers. Some Porsche dealers in China protested and boycotted, stopping vehicle deliveries and "forcing" the German headquarters to provide subsidies and replace relevant Chinese executives.

Subsequently, Porsche responded that both Porsche China and its dealers faced several complex issues and that they would jointly seek effective ways to actively respond to market changes and discover new opportunities amid challenges.

Porsche's response was very official and left the matter unresolved. However, Porsche's internal assessment is certain. In the era of new energy, profits and sales cannot be achieved simultaneously. Therefore, Porsche will also internally discuss whether it is necessary to operate such a large dealer network. As a multinational corporation, it must ultimately consider the weight of brand value and profits. In the future, Porsche is highly likely to choose to maintain its imported status and operate with light assets to preserve profits and brand tone.

Therefore, the rumor that Porsche will significantly reduce its dealer network is not unfounded.

Porsche's move to reduce dealers is also aimed at cutting costs, improving operational efficiency, and mitigating further impacts on profit margins. At the same time, the saved funds will be invested in technological research and development in the Chinese market.

It is rumored that Porsche China's R&D team is expanding, with one of its goals being to address shortcomings in intelligent cockpit and ADAS advanced driver assistance system R&D capabilities to meet the needs of the Chinese market.

Stopping losses in a timely manner, and joint venture brands will undertake a strategic "great retreat"

In the future, many luxury brands will also reduce their dealer networks and increase R&D investment in the Chinese market, similar to Porsche, all to survive.

According to the "Urgent Report on the Current Financial Difficulties and Shutdown Risks Faced by Auto Dealers" recently submitted by the China Automobile Dealers Association to relevant government departments, it is pointed out that the dual pressures of weak consumption and high wholesale volumes from manufacturers have kept dealer inventories at high levels. To reduce financial pressure and financing costs, dealers are forced to sell at low prices to survive.

Secondly, the "price war" has led to severe price inversions, with dealers losing more money the more they sell. At the same time, they face pressure from financing maturity and performance difficulties, and dealers face disrupted business cash flow and a sharp increase in the risk of capital chain disruption. Currently, the duration for which dealers' existing liquidity can be maintained has been compressed to its limit.

After the intense price war, many joint venture automotive brand dealers have already reached their limits.

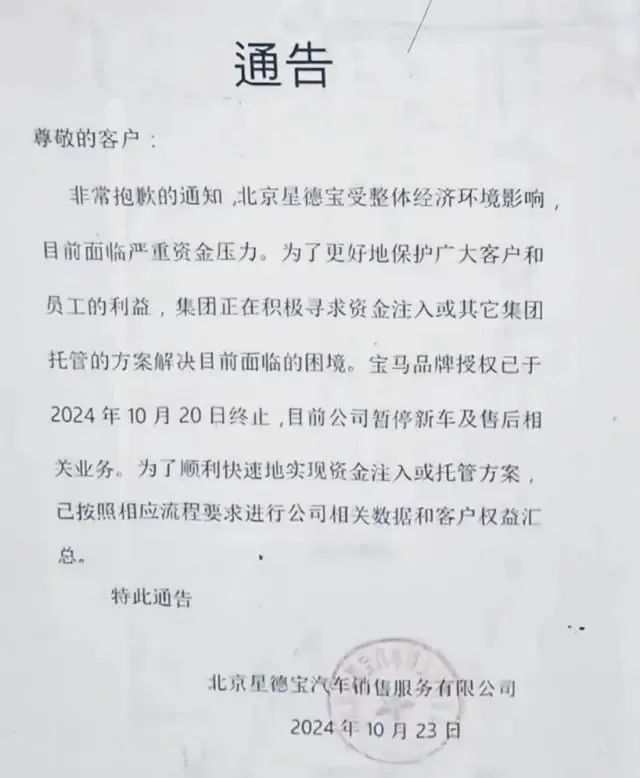

Not long ago, BMW's first global 5S store, Beijing Xingdebao Automobile Sales and Service Co., Ltd., posted a notice outside its door announcing its closure. Beijing Xingdebao stated that due to the overall economic environment, it is currently facing severe financial pressure. The group is actively seeking capital injection or other group trusteeship solutions to address the current difficulties.

Similarly, Mercedes-Benz, which saw declines in both sales and profits in the third quarter, stated in its financial report that subsidies to Chinese dealers in the third quarter were one of the reasons for the decrease in profits but did not specify the subsidy amount.

After delivering its worst performance in nearly three years, Mercedes-Benz plans to intensify cost-cutting efforts. Management stated at the performance meeting that subsidies comparable to those in the third quarter will still be provided in the fourth quarter but will be reduced in 2025 and beyond, and dealers need to enhance the sustainability of their own development.

After losing $210 million in the first half of the year, General Motors lost another $137 million in the third quarter in China, totaling $347 million (approximately $2.47 billion) in losses for the first three quarters of 2024.

"Especially from competitive electric vehicle brands in China, General Motors' market share in China has declined," said Mary Barra, Chair and CEO of General Motors, describing the Chinese auto market as "headache-inducing."

Under the shadow of the price war, dealer losses have become the norm. Most automakers are currently subsidizing dealers, including many independent new energy brands that are losing money to attract customers. However, many automakers have no choice but to follow suit; otherwise, they will be passive and suffer losses. Following suit, however, only plunges them into rounds of blind price wars, failing to bring substantive improvements to the brand and profits.

Therefore, in the long run, Porsche's reduction of its dealer network is also a wise move. Since it cannot win the price war, it chooses to preserve its brand and profits by stopping losses in a timely manner. It is believed that many joint venture brands will follow Porsche's strategy of reducing dealers in the future, preserving strength for subsequent strategic counterattacks. After all, as long as there is life, there is hope.