Over 1.5 million car owners are 'secretly' upgrading to new cars

![]() 11/04 2024

11/04 2024

![]() 724

724

Introduction

Introduction

In this industrial upgrade disguised as a 'trade-in' policy, favorable discounts meet potential market demand, leading to a phased victory for the policy.

This year, China's auto market is experiencing an unprecedentedly hot 'golden September and silver October.'

According to data released by the China Passenger Car Association, in September this year, retail sales of narrow-sense passenger vehicles in China reached 2.109 million units, an increase of 4.5% year-on-year and 10.6% month-on-month. In the previous nine months, the year-on-year growth rate in the domestic market was 2.2%, less than half of September's growth rate. Entering October, the automotive market remained hot. Especially during the National Day holiday, sales of new energy vehicles alone increased by 45.8% year-on-year.

On the other side of the booming auto market, the car trade-in market is equally bustling.

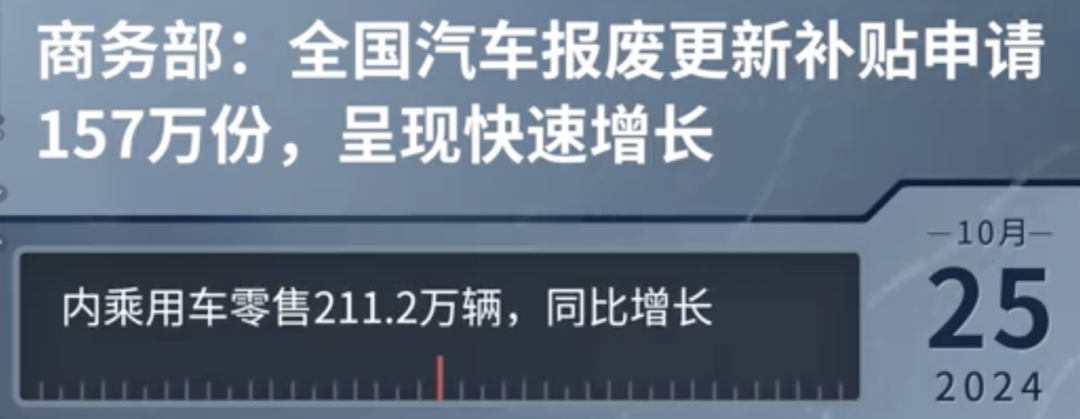

Data from the Ministry of Commerce shows that as of October 24th, there have been 1.57 million applications for scrap and renewal subsidies nationwide and 1.26 million applications for local car replacement and renewal subsidies, ushering in a phased prosperity in the car trade-in market.

Obviously, this is a positive feedback demonstrated after consumers' enthusiasm was significantly stimulated following the 'Notice on Further Improving the Car Trade-In Policy' (hereinafter referred to as the 'Notice') issued by the Ministry of Commerce and six other departments on August 16th. The implementation of the trade-in policy provides consumers with intuitive and considerable subsidies, successfully stimulating demand for car upgrades.

Eager car owners

'Promoting large-scale consumer goods trade-ins can increase the proportion of advanced production capacity... It can both stimulate consumption and investment, increase advanced production capacity, and improve production efficiency... It can be said that it benefits both enterprises and the people, killing two birds with one stone.'

As early as the 'voices from the Two Sessions' at the beginning of the year, it was already clear that 2024 would be the 'Year of Consumption Promotion,' and the country would vigorously promote trade-ins of durable consumer goods such as home appliances and cars.

As a result, we saw the 'Detailed Rules for the Implementation of Car Trade-In Subsidies' issued in April, clarifying that eligible scrapped and newly purchased new energy vehicles/fuel vehicles would receive subsidies of 10,000 yuan/7,000 yuan, respectively. With the joint promotion of multiple parties, the effects of the car trade-in policy began to emerge.

Data from the Ministry of Commerce shows that it took 25 days for the car scrap and renewal subsidy information platform to receive the first car scrap and renewal subsidy application nationwide and for the number of applications to exceed 10,000; it took only 7 days from the 10,000th to the 20,000th application; and it took only 4 days for the 30,000th application... As of the end of June, the trade-in information platform had received 113,000 car scrap and renewal subsidy applications.

Under the influence of the policy, the domestic auto consumer market has also begun to show vitality.

In the first full month after the introduction of the car trade-in policy (May), national car retail sales reached 2.271 million units, an increase of 8.7% year-on-year, with new energy passenger vehicle retail sales increasing by 38.5% year-on-year; used car transactions reached 1.585 million units, an increase of 5.9% year-on-year; and scrap car recycling reached 523,000 units, an increase of 55.6% year-on-year.

In this industrial upgrade disguised as a 'trade-in' policy, favorable discounts meet potential market demand, leading to a phased victory for the policy. While providing users with a better consumption experience, it has also expanded the share of new energy vehicles in China's new energy vehicle industry, laying a solid foundation for the development of the new energy vehicle industry.

Of course, with only 113,000 cars eligible for subsidies, it can be seen that the trade-in conditions at that time were relatively high, and this phenomenon appears insufficient for an economy with a monthly car sales volume exceeding 2 million.

Four months later, we saw a new round of car trade-in policies with a maximum replacement subsidy of 20,000 yuan. The 'Notice' raises the subsidy standards for individual consumers who scrap old cars and purchase new ones in accordance with the 'Detailed Rules for the Implementation of Car Trade-In Subsidies' from 10,000 yuan for purchasing new energy passenger vehicles and 7,000 yuan for purchasing fuel passenger vehicles to 20,000 yuan and 15,000 yuan, respectively. In addition, it optimizes the review, allocation, and supervision of car scrap and renewal and strengthens the supervision and management process.

After the policy update, the number of applications for the national car scrap and renewal subsidy policy has increased rapidly since its implementation.

Data shows that it took 56 days from receiving the first scrap and renewal subsidy application on April 27th to exceeding 100,000 applications; it took 45 days from the 100,000th to the 500,000th application; it took 38 days from the 500,000th to the 1 millionth application... and on October 16th, the number of new subsidy applications exceeded 20,000 for the first time.

At a special press conference on October 25th, Li Gang, Director of the Consumption Promotion Department of the Ministry of Commerce, said that the national car trade-in information platform enables 'one-stop' handling of car scrap and renewal subsidy applications. The cumulative number of visits has exceeded 50 million, with over 330 million visits, and over 2.3 million consumers planning to apply for subsidies have completed registration on the platform.

It can be seen that after strengthening the policy, more car owners preparing to upgrade their cars are 'itching' to do so.

Subsidies are not easily obtained

However, with the sudden increase in insurance application subsidies, many consumers are experiencing difficulties in obtaining subsidies.

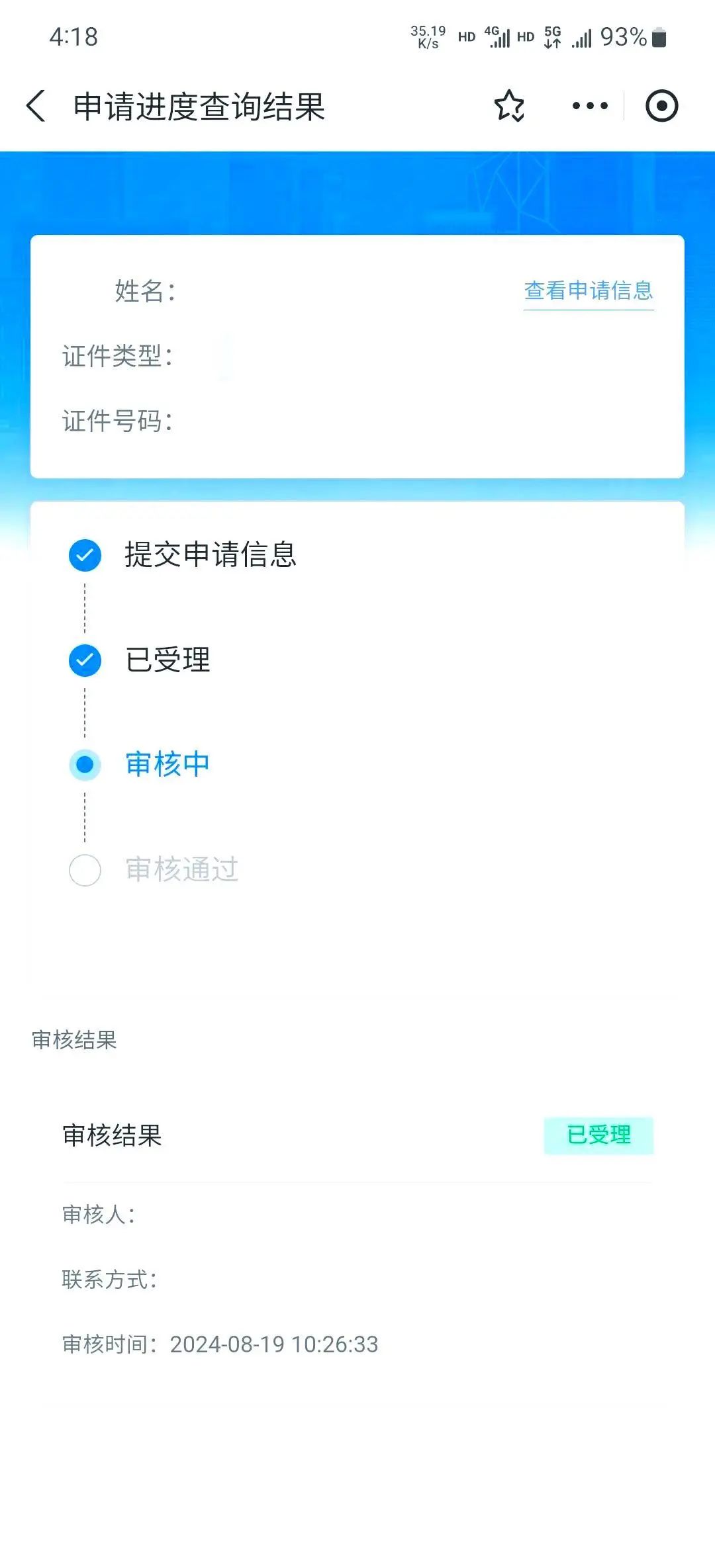

'It has been under review for some time, and I'm not sure if it will be approved.' In recent days, when discussing car upgrades with friends, one friend mentioned that he had participated in the new round of trade-in policy introduced on August 16th but had not heard any follow-up after submitting his subsidy application, which has been stuck in the review stage.

This is actually a foreseeable problem.

After all, the main reasons for the difficulty in applying for car trade-ins include complex review processes, system upgrades, and a large number of applications. Take the review process, for example; the review process for car trade-ins is relatively complex and involves joint reviews by multiple departments. For instance, the review process requires confirmation of related content such as scrap car recycling, vehicle deregistration, new car invoice issuance, and new car registration.

System upgrades and a large number of applications are also reasons for slow reviews.

For example, the commerce and foreign affairs bureau of a city in Anhui once experienced a nearly one-month system outage due to an upgrade of the car trade-in mini-program, causing a backlog of applications due to the system upgrade. The review time may be delayed due to the backlog of applications caused by the system upgrade. Coupled with the recent large number of applications, this can lead to slow review progress.

In addition, some applicants miss out on subsidies because their vehicles do not meet the standards.

From the perspective of the vehicles themselves, the policy stipulates that individual consumers can scrap fuel passenger vehicles that meet or exceed National III and below emission standards or new energy passenger vehicles registered before April 30th, 2018, during the period from April 24th, 2024, to December 31st, 2024, and purchase new energy passenger vehicles or fuel passenger vehicles with a displacement of 2.0 liters or less included in the Ministry of Industry and Information Technology's 'Catalog of New Energy Vehicle Models Exempt from Vehicle Purchase Tax.' Those outside this scope cannot receive subsidies.

At the same time, some netizens have posted on forums that 'as soon as the policy was announced, dealers increased prices, and the final subsidies ended up in the hands of the dealers.' Although the author inquired about the follow-up to related issues on the forum, no response was received.

However, several platforms, including Zhihu, have discussed the topic, 'How do you view the behavior of various merchants working overtime to raise prices overnight after the introduction of the 2024 national subsidy policy for trade-ins?' When looking at forums on the home appliance trade-in policy, there are also complaints about 'dealer price increases.'

Although 'dealer price increases' have not been confirmed, it is indeed true that news of domestic car dealerships going bankrupt has emerged endlessly since January this year. Public data shows that in the first half of this year, nearly 2,000 new 4S stores nationwide withdrew from the market or closed, almost equal to the number of withdrawals for the entire previous year.

In addition, some netizens have stated that 'scalpers have also infiltrated car trade-ins.'

The reason is that the subsidy has a deadline of the end of December. Based on this calculation, consumers must pick up their cars within 10 weeks; otherwise, they may not be able to enjoy the national subsidy. Therefore, some users who have reserved popular car models but may not catch up with the government subsidy choose to purchase orders from 'scalpers.'

...

Although there are various obstacles to obtaining subsidies, overall, this round of car trade-ins has a significant stimulating effect on economic growth.

Especially with the government collaborating with automakers, financial institutions, etc., to launch a 'scrap and renewal/replacement and renewal + corporate discounts + manufacturer concessions + financial discounts + insurance services' car trade-in operation process, consumers can also enjoy a comprehensive discount of up to 60,000 yuan from enterprises and manufacturers after receiving national policy subsidies. This not only encourages consumers to upgrade their cars but also promotes the transformation and upgrading of the local automotive industry.