Trump's inauguration, the PK between Lei Jun and Yu Chengdong, ended early

![]() 11/11 2024

11/11 2024

![]() 500

500

Nearly a month ago, Ren Zhengfei's prediction about Huawei's survival actually foresaw the prospects after Trump's election.

The latest news is that starting from November 11, TSMC plans to suspend the production of advanced AI chips for Chinese customers.

On October 14, Ren Zhengfei said during a symposium, "To this day, we (Huawei) cannot say for sure that we will survive. 99% of Chinese companies can cooperate with the United States. They are not sanctioned, their chip computing power is higher than ours, and they can buy better things than us. We are still struggling."

What surprised the industry was that during that period, Huawei had just reported revenue of 585.9 billion yuan from January to September, with a net profit attributable to shareholders of over 62.8 billion yuan. China's first domestically produced mobile operating system HarmonyOS NEXT, a pure-blooded Hongmeng, was released. The cumulative shipments of wearable devices exceeded 150 million units, ranking first in the world. Huawei's mobile phone sales in the Chinese market once again surpassed Apple, and a series of performance reports were released.

In addition, Hongmeng Zhixing delivered 41,600 vehicles in October, with the AITO M9 maintaining its position as the sales champion of luxury vehicles priced above 500,000 yuan for multiple months. However, with the end of the US election, everything is full of new variables, especially regarding automotive intelligence.

When the world's factory meets the manufacturing industry's return in the Trump 2.0 era

Trump, who has repeatedly criticized electric vehicle proponents, will take office in late January 2025. Regarding the impact on the automotive industry, there have been numerous analyses. Agreed points include potential reductions or cancellations of electric vehicle subsidies in the United States, a possible final minor recovery for fuel vehicles, adjustments to the USMCA agreement, increased tariffs, and blocking the possibility of entering the US market through Canada or Mexico with lower tariffs.

Everything will bring tremendous uncertainty to the global industry, especially the automotive industry, because the United States is the world's second-largest automotive market, the highest-profit market, and has trends in technology and consumption.

In summary, excluding many sectors to be discussed and uncertainties, several things can be determined:

1. Entering the US automotive market will be very difficult, whether for Chinese or European automakers. Japanese automakers are different because they are deeply tied to the US market and have completed deep local localization. Additionally, the entry of Chinese batteries into the US has been halted, as Ford's plan to build a factory with CATL has been suspended;

2. The opportunity for Chinese automakers to enter the US market will become minimal. In fact, before the US election, relevant tariffs and laws in Canada and Mexico had already begun to change, removing the springboard effect;

3. Fuel vehicles may experience a small boom because they can be sold for a few more years, and emission regulations may be frozen at 2027 standards instead of banning the sale of fuel vehicles. It is worth noting that during his previous term, Trump withdrew from the Paris Agreement on climate change and encouraged the development of fuel vehicles. According to the latest news, preparations are underway to withdraw from the Paris Agreement again;

Of course, the above will not have a significant impact on the actual experience of most consumers. Chinese automakers themselves have not made particularly good achievements in the US market. Affected companies currently visible include NIO's previously proposed plan to enter the US market, Chery's plan to enter the US market, Lotus's sales in the US, and Volvo and Geely's Polestar, even if they build factories in the US, may not be able to sell there.

Fuel vehicles may struggle to some extent due to the rapid decline of the US automotive industry except for Tesla. Because Trump himself has a strong businessman attribute, the policies he leads are based more on the theory of reciprocity, and he is planning to formulate reciprocal trade laws.

That is, through trade wars and increased tariffs, the manufacturing advantages that the United States has lost will be brought back. Of course, European automakers will bear the brunt. During his campaign, Trump stated that if re-elected, he would increase tariffs, prevent the import of foreign goods, and encourage foreign companies to transfer their manufacturing bases to the United States. German automakers have issued related warnings, such as the possibility of German automakers becoming American automakers. The policy is that if the production base is established in the United States, the 21% corporate income tax rate will be reduced to 15%, and it will only apply to the local manufacturing industry in the United States.

The strategy focuses on consistency and continuity, so it continues to be "America First." It is evident that the United States reducing imports from around the world is already an inevitable answer. Another variable is that he is expected to make permanent tax cuts on personal income taxes that are about to expire in terms of personal consumption in the United States.

The global economic recovery is conservative, which may lead to changes in the import and export pattern again, affecting the process of the global new energy transition. Of course, even after the costs cannot be maximized, many production costs of vehicles have increased significantly, leading to price increases.

As the world's factory, China once again faces a situation where core conflicts cannot be resolved when facing the second wave of manufacturing return. As for the next trend, it depends on who the core members are in the newly organized cabinet.

The game between two individuals will directly determine issues such as whether Chinese cars will increase in price in the domestic market.

The two individuals are Elon Musk and Robert Lighthizer. Musk is expected to become the chair of the Efficiency Commission, aiming to cut at least $2 trillion from the $6.75 trillion federal budget. Because the Tesla Shanghai factory is irreplaceable for Musk, he will become an important variable in the trade competition.

Robert Lighthizer, Trump's previous trade representative, advocated for imposing a 10%-20% tariff on all countries' goods and a 60% tariff on Chinese goods to eliminate the US trade deficit. Next, he may be appointed as the Secretary of the Treasury, Secretary of Commerce, or Chief Economic Adviser.

Does China's intelligent automotive breakthrough have a one-year window?

Will there be another chip shortage? This is a topic of core concern for many automakers currently. Unlike the previous shortage of MCUs and IGBTs, because the new strategy of advocating for reciprocal trade may be implemented at any time, whether the advantages gained by Chinese automakers in intelligent driving and other fields will be compromised is not only a concern of the industry but also of consumers.

In fact, more than a year ago, restrictions on AI training chips and other aspects began to be implemented successively, including restrictions on NVIDIA A100, H100, and other chips. AI chips have a huge impact on today's automotive industry, even exceeding the impact of previous MCU and IGBT chip shortages.

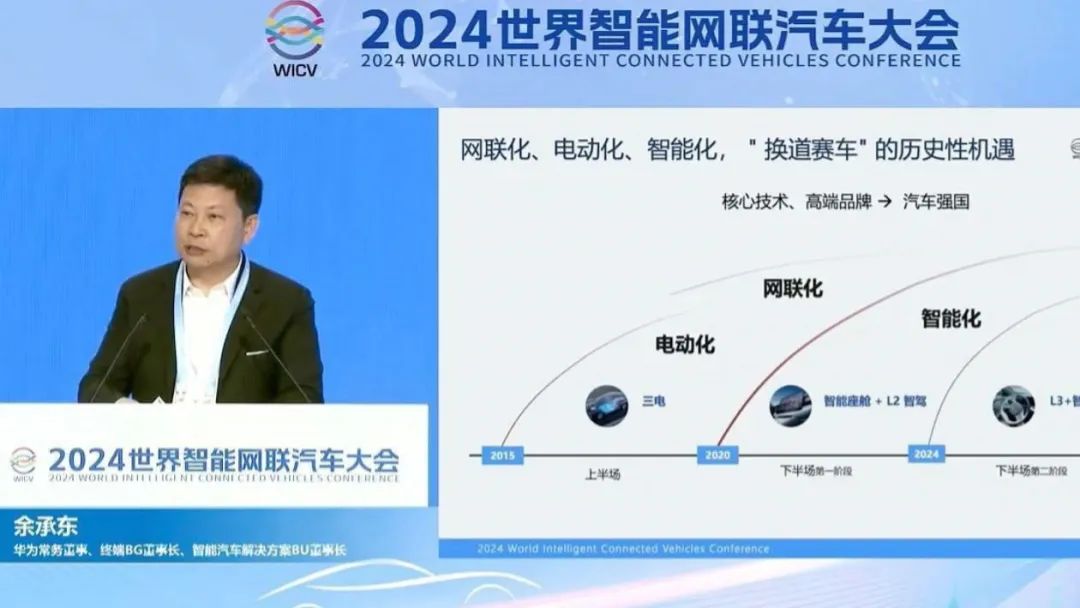

Not long ago, Yu Chengdong and Lei Jun had differing views at the same conference, with their final focus being on big data, AI training, computing, and other aspects. Lei Jun's outlook for Xiaomi's cars is that advanced intelligent driving mainly assists human drivers in commuting, etc. Yu Chengdong, on the other hand, proposed that Huawei's intelligent driving will achieve large-scale commercialization of L3 autonomous driving by 2025. On highway sections, Huawei's Hongmeng Zhixing will bring L3 commercial use, and in urban areas, it will bring L3 pilot projects.

The answer to this confrontation lies in who can have more powerful computing power to process the astronomical amount of big data produced by Chinese consumers.

Currently, Chinese automakers are collectively accelerating the promotion of intelligent driving. They believe that with the addition of intelligent driving, they can better improve sales performance. For example, ZEEKR, which has made great sacrifices, has undergone a major facelift for the ZEEKR 001 and promoted NZP, similar to LIXIANG ONE, which is benchmarking the progress of Huawei's intelligent driving system. In short, the number of players in the high-end intelligent driving tier is continuously increasing. Currently, widespread deliveries include Huawei's Hongmeng Zhixing, LIXIANG ONE, NIO, XPENG, IM Motors, ZEEKR, and Xiaomi cars.

In addition, recent news about BYD's all-in strategy for high-end intelligent driving has also been frequently reported, including its plan to provide corresponding high-end intelligent driving performance for entry-level models priced below 100,000 yuan in 2025, making intelligent driving gradually become a standard feature.

This is not only a natural choice brought about by market consumers but also an inevitable result of the development of global AI. Behind all this is the competition for computing power and algorithms. There is no doubt that Chinese cars have gained a first-mover advantage in related technology applications. In 2024, CCTV praised Chinese cars for their technological breakthroughs twice, once for NIO's SKY OS and once for Huawei's pure-blooded Hongmeng, both of which involve the recasting of software and code.

Relevant cases include the fact that even if Tesla's FSD comes to China, there are already many companies that can compete in the current automotive market. However, AI is a globalized project that cannot be fully completed by one country alone in the current model. Chip manufacturing equipment is deeply tied to Europe, chip production enterprises are deeply tied to East Asia, and chip design is mainly in the hands of China and the United States. Materials like photoresist are deeply tied to Japan.

In other words, whether it is Huawei's current MDC810 computing unit, NIO's successful tape-out of the world's first automotive-grade 5-nanometer intelligent driving chip "Shenji NX9031" announced in July this year, or XPENG's recently released self-developed AI chip Turing with a computing power of 750 TOPS, which is more than three times that of the well-known NVIDIA Orin X in the consumer market.

Next, under the principle of reciprocity, the pressure on computing power is explicit, especially since Huawei and ZTE have already been deeply sanctioned in the previous term, directly triggering a global chip shortage. Moving forward, regardless of how far ahead they claim to be in various press conferences, they will all face a realistic problem: the more advanced their research and development becomes, the more they must prevent and avoid sanctions.

Currently, there are only two companies capable of foundry services for 5nm processes globally: TSMC and Samsung. Due to past sanctions, Huawei adopts a computing unit model, where the Ascend AI chip with a specific domain architecture is responsible for computation. NIO's NX9031 uses a 5nm process, while Xpeng's AI chip is Turing, which is particularly vulnerable to sanctions.

The reason is that it is designed for large AI models, while NIO focuses more on enhancing assisted driving perception. Large models and AI computing are precisely what are under control and sanction. Xpeng's predicament does not stop there; the real issue lies in the fact that after repeatedly switching technical routes and removing LiDAR, higher computational requirements for chips have been introduced. Additionally, after being the first to introduce LiDAR, it attracted many buyers, who have now become a minority in OTA plans.

Recently, investigated TSMC reported four companies, two of which are design firms and two are AI chip procurement companies, due to suspicions of violating the ban on supplying chips to Huawei. The latest development is that TSMC is expected to suspend the supply of 7nm and below process chips.

The situation facing Chinese automakers will be that if they aim to compete with Tesla by adopting a pure vision approach, they will face tremendous pressure, as neither the software nor hardware is self-produced, lacking deep integration, and without Musk's aggressive cloud computing plans. Companies like Xpeng will be under significant pressure.

As for Huawei and many other Chinese automakers on different routes, the situation may be slightly easier. China's LiDAR-related technology is indeed far ahead, whether it's Huawei's 192-line or Hesai's latest products, which can share the computational pressure of intelligent driving. Moreover, after facing previous sanctions, Huawei has already prepared alternative plans like Plan B.

Given the consistent behavior pattern since the US election and with over two months remaining before Trump takes office, this provides a window of about a year for relevant Chinese companies to find solutions and maintain their current leadership position.

Final Thoughts

As Xia Yiping, CEO of Baidu and Geely's joint venture automaker Jiyue, previously said, everything has just begun after obtaining a large model. Each round of data infusion requires extensive computational power and high costs for training. The current pure vision approach, which focuses on AI, is considered a good way to reduce costs by many automakers. However, the situation is relatively clear: once chips and computational power are sanctioned, the upper limit of its effectiveness is actually not high.

On the contrary, those who adhere to the principle of "not putting all eggs in one basket," such as LiDAR and combined computing, have shown promising performance. Therefore, the pressure faced by companies like Huawei is evident, but even greater pressure lies elsewhere.

It seems that the previous route dispute between Lei Jun and Yu Chengdong may end prematurely with the introduction of a new round of policies.