JD.com's 'Car-Making' Venture: Aiming to Be Partially Huawei-like

![]() 10/25 2025

10/25 2025

![]() 556

556

Source: YuanSight

The automotive industry continues to attract a growing number of participants.

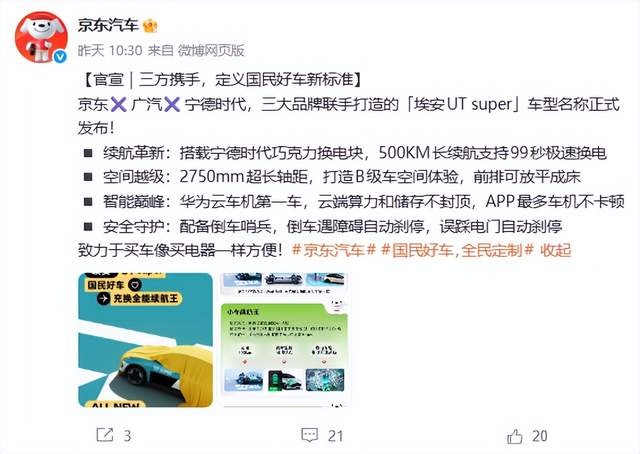

On October 23, JD.com, CATL, and GAC Group officially unveiled the name of their 'National Good Car' model as the 'Aion UT Super.' According to official introductions, this model boasts 'GAC Huawei Cloud Connected Vehicle' technology, a large-capacity 500KM range battery that supports both charging and battery swapping, along with features like 'reverse parking sentry.'

Screenshot sourced from Weibo @JD Car

Prior to this announcement, JD.com had already expressed its intention to integrate the capabilities of the two aforementioned companies in car manufacturing, battery sales, and services. Its goal is to drive consumer upgrades through innovations in consumption, production, and customization models.

Currently, the new energy vehicle industry has entered a new phase of competition, with cross-industry players reshaping the industry landscape. Before JD.com's entry, Huawei, leveraging its HarmonyOS and ADS intelligent driving technologies, had already ventured into the automotive sector with a technology-empowerment approach. Additionally, internet giants such as Alibaba and Baidu have also entered the automotive market to varying extents.

In comparison, JD.com, with its long-standing focus on retail and supply chain management, shares certain similarities with Huawei in terms of sales and channel strategies within the automotive business, both adopting an 'asset-light' approach. However, due to their inherent differences, the two companies have also taken markedly distinct paths.

01 Asset-Light Entry

Overall, JD.com's current automotive business primarily focuses on providing consumer insights and exclusive sales services, without directly engaging in the heavy-asset manufacturing sector.

By leveraging its main business strengths, JD.com offers support to automakers in terms of user acquisition, traffic generation, data analysis, and channel distribution. This means that in the so-called 'car-making' business, GAC is responsible for vehicle production, CATL provides battery technology, and JD.com acts more like a dealer and technology service provider.

In this regard, JD.com can indeed mobilize a vast array of ecological resources.

QuestMobile data reveals that in the second quarter, JD.com's daily active users increased by 35% year-on-year, monthly active users by 17%, and the average daily usage time per user rose by 25%. During the 618 shopping festival, the peak DAU of the JD App reached 212 million.

Besides major online platforms like JD.com and JD Finance, JD.com is also continuously expanding its offline presence.

Data indicates that JD.com has opened 26 JD Mall stores nationwide, covering over 10 key cities including Xi'an, Shenyang, Wuhan, and Beijing, with plans to accelerate expansion in cities like Beijing and Nanjing by 2025. Additionally, JD.com continues to expand its offline store presence in sectors such as home appliances, home furnishings, fresh produce, and outlets.

JD Mall Offline Store

In August of this year, JD.com officially completed the acquisition of Hong Kong's Jiabao Food Supermarket. In September, Germany's antitrust authority, the Federal Cartel Office, also approved JD.com's acquisition of European consumer electronics retailer CECONOMY.

In the automotive aftermarket, JD Auto has over 3,000 stores nationwide, continuously meeting demands for vehicle maintenance, fault repairs, and tire replacements.

It is conceivable that, perhaps in the near future, JD.com will, like Huawei, bring its cooperative models with GAC into the halls of JD Malls.

Under its current asset-light strategy, JD.com's core goal is to build a comprehensive system for consumers, from car purchase decisions to daily usage, offering online ordering and offline services. Essentially, it acts as a full-cycle 'dealer' for users, replicating the one-stop e-commerce shopping logic into the automotive field.

Recently, nearly 200,000 onlookers (referring to those who watched) JD.com's new car auction data, further demonstrating its ability to convert traffic into sales.

02 Half Huawei

In many ways, JD.com's significance to automakers like GAC does bear similarities to Huawei's.

Over the years, Huawei has continuously collaborated with automakers such as Seres and Chery, providing technical solutions like HarmonyOS cockpits and intelligent driving systems without directly participating in vehicle manufacturing. It also intervenes in the product sales environment through its extensive offline channels, integrating into joint brands like 'Harmony Intelligent Mobility.'

Screenshot sourced from the Harmony Intelligent Mobility official website

This strategy of 'not making cars but participating in car-making' allows for rapid market entry while reducing the risks associated with heavy-asset investments.

However, JD.com and Huawei differ in terms of consumer data and technical data, each with its own focus.

Although there is currently limited official information and data on JD Auto, it can be inferred that JD.com leverages user consumption data to analyze car purchase preferences, price sensitivity, etc., enabling reverse customization based on sales.

Additionally, the chargeable and swappable models launched by JD.com in collaboration with GAC and CATL will utilize CATL's chocolate battery swap stations. This model, similar to NIO's Baas (Battery-as-a-Service) sales scheme, may also be introduced into JD.com's financial service system, allowing consumers to complete car purchases, battery subscriptions, and financial arrangements online.

In contrast, Huawei's automotive business has a stronger 'technical' flavor. Whether it's Yu Chengdong frequently appearing at automaker launches or directly placing models like the Luxeed and Aito in offline stores, Huawei has long provided certain support to its cooperative automakers in terms of channels and marketing.

In terms of technical services, Huawei continuously optimizes cooperative automakers' autonomous driving algorithms and user interaction experiences through cloud data and AI models. It also aims to connect cars with smartphones and smart homes, centered around Harmony Intelligent Mobility, constantly attempting to transform users' one-time car purchases into long-term service value through ecological layout.

03 Differentiated Roles

From its current collaboration with GAC and CATL, JD.com is attempting to provide more support to automakers in upstream areas like data while acting as a channel hub.

In contrast, after years of business accumulation, Huawei's strategic positioning in the automotive business is more akin to that of a service provider and technical standard setter.

Huawei's ambition lies in gaining industry influence through technology licensing, building an intelligent automotive ecosystem.

Comparatively, JD.com adopts a resource aggregation model in its business approach, maintaining flexible cooperation with automakers and battery manufacturers without intervening in R&D decisions. Currently, it focuses more on monetizing traffic, lowering the threshold for automakers to sell cars, and leveraging subsequent service chains for growth. This model has controllable risks; even if new car sales fall short of expectations, profitability can still be achieved through traffic monetization and services.

Huawei, on the other hand, employs a technology 'rental' and brand co-construction model, including technology licensing and channel revenue sharing for automakers. This model has high barriers, allowing it to diversify from reliance on a single model and enhancing its risk resistance.

Huawei's automotive business advantage lies in driving upstream innovations in intelligent manufacturing. Its technology output has made intelligent cockpits and high-level intelligent driving accessible to the mass market, previously exclusive to luxury cars, accelerating the transition from fuel-powered to electric vehicles.

JD.com, through its 'National Good Car' initiative based on consumer data-driven reverse customization, precisely matches market demands, further promoting the popularity of new energy vehicles. Its sales-service model also offers automakers a new approach to production based on sales, reducing inventory pressure.

However, it should be noted that both JD.com and Huawei, despite their accumulations in technology, channels, and brands, still face a series of challenges in assisting their cooperative automakers.

For Huawei, the contradiction between technology empowerment and brand encroachment persists. Automakers' fear of being reduced to 'contract manufacturers' may limit the breadth and depth of their cooperation with Huawei. Balancing technological dominance with relinquishing some industry influence will be a long-term challenge for Huawei.

JD.com, on the other hand, needs to continuously form technological synergy with its partners while expanding its automotive brand cooperation portfolio. It also faces challenges in cross-departmental coordination and product alignment.

Nevertheless, as more and more 'new forces' enter the automotive industry, all parties will explore diverse possibilities for upgrading China's automotive industry.

Some images are sourced from the internet. Please inform us for removal if there is any infringement.