Tesla's Net Profit in Q3 Plummets by 37%; Musk 'Defends' His Trillion-Dollar Compensation Package

![]() 10/25 2025

10/25 2025

![]() 574

574

Produced by Leida Finance, Written by Peng Cheng, Edited by Meng Shuai

On October 22 (Eastern Time), after the market closed, Tesla, a global leader in the automotive industry, released its third-quarter financial results.

Although Tesla's revenue for the quarter reached a record high of $28.095 billion, its net profit attributable to common shareholders stood at only $1.373 billion, marking a significant 37% decline year-over-year (YoY).

Tesla attributed the profit decline to increased operating expenses, primarily driven by sales and general administrative costs, as well as R&D projects in AI. Additionally, higher stock-based compensation (SBC) expenses and a year-over-year decrease in one-time revenue recognition from Full Self-Driving (FSD) technology contributed to the downturn.

In fact, Tesla's revenue growth in Q3 was partly fueled by a surge in U.S. electric vehicle (EV) tax credit-induced demand, as consumers rushed to purchase before the policy expired.

With the policy officially ending on September 30, this early release of demand may exert downward pressure on Tesla's sales growth in the coming months. Globally, Tesla's market share slipped to third place in the first eight months, trailing behind BYD and Geely.

More concerning is the slower-than-expected progress of several technological transformation strategies highly anticipated by CEO Elon Musk. For instance, the adoption rate of the Full Self-Driving (FSD) system has been sluggish, with only 12% of Tesla's current vehicle fleet subscribing as paying customers. Both the Robotaxi and Optimus humanoid robot projects have faced delays, falling short of market expectations for commercialization.

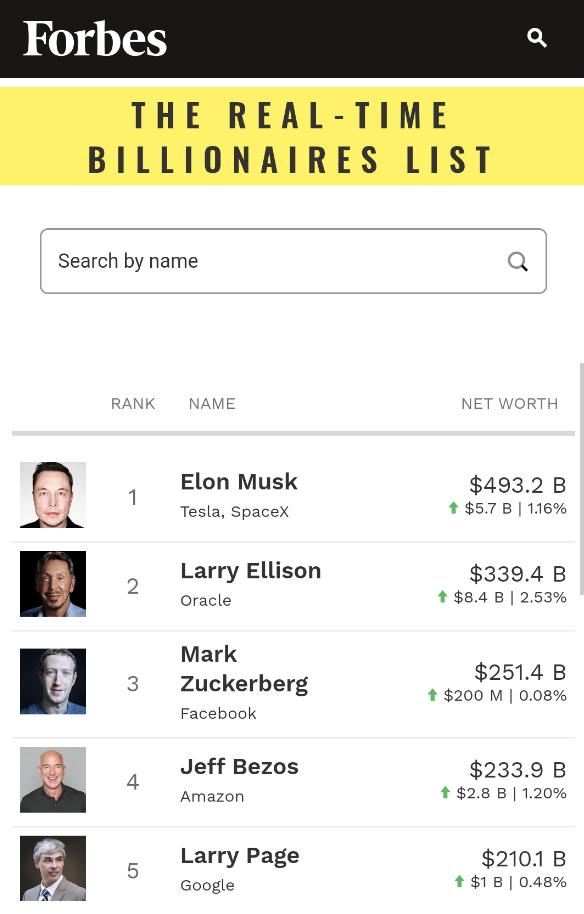

According to Forbes' real-time billionaire list, as of approximately 16:00 Beijing time on October 24, Musk ranked as the world's wealthiest individual, with a fortune of $493.2 billion.

Notably, at the conclusion of the latest earnings call, Musk launched a fierce critique against those attempting to block his $1 trillion compensation package.

He also stated, "I cannot comfortably remain here, building a robot army, only to be ousted due to foolish recommendations from ISS and Glass Lewis."

Q3 Revenue Hits Record High, Net Profit Plummets Nearly 40%

Financial results revealed that Tesla's total revenue for Q3 reached a record $28.095 billion, up 12% from $25.182 billion YoY. This surpassed Wall Street analysts' average expectation of $26.36 billion and marked an end to two consecutive quarters of decline.

Tesla's Q3 revenue growth was primarily driven by increased deliveries of new vehicles. In Q3, Tesla delivered 497,000 vehicles, up 7.4% YoY, setting a quarterly delivery record and significantly exceeding market expectations.

Benefiting from these record-high vehicle deliveries, Tesla's revenue from automotive sales increased by 8% YoY to $20.359 billion.

Significant growth in energy generation and storage also contributed to Tesla's revenue surge. In Q3, revenue from Tesla's energy generation and storage business soared by 44% YoY to $3.415 billion, marking it as the fastest-growing segment for the quarter.

Meanwhile, Tesla's energy storage product installations reached a new record high of 12.5 GWh in Q3.

However, Tesla's automotive regulatory credit revenue declined to $417 million from $739 million YoY, a 44% drop.

Tesla's profitability also raised concerns. In Q3, net profit attributable to common shareholders was $1.373 billion, down 37% from $2.173 billion YoY.

Tesla's gross margin was 18% in Q3, down 1.8 percentage points from 19.8% YoY. Excluding regulatory credit revenue, the automotive business gross margin was 15.4%, below the average expectation of 15.6%, indicating pressure on the core automotive business's profitability.

Operating profit was $1.624 billion in Q3, down 40.23% from $2.717 billion YoY; the operating margin plunged to 5.8% from 10.8% YoY, a 5 percentage point drop.

Operating expenses reached $3.43 billion in Q3, up about 50% from $2.28 billion YoY. Tesla attributed the increase to AI and other R&D projects, restructuring costs, etc.

Tesla CFO Vaibhav Taneja revealed during the earnings call that tariff impacts exceeded $400 million this quarter.

Tesla admitted in its earnings report, "Amid global trade and fiscal policy changes, the impacts on automotive and energy supply chains, cost structures, and durable consumer goods demand are difficult to quantify."

Reduced one-time FSD revenue recognition was also a key factor affecting Tesla's profits. As a crucial profit driver, fluctuations in FSD revenue recognition directly impact the company's quarterly earnings.

Market Performance Under Pressure, Global Share Declines

Amid intensifying global EV market competition, Tesla's market position faces severe challenges, with its global market share continuing to decline.

According to SNE Research data, from January to August 2025, Tesla's global sales were 985,000 units, down 10.9% YoY, with its market share dropping to 7.7%, surpassed by BYD and Geely, falling to third globally.

For comparison, BYD's sales reached 2.556 million units in the same period, up 14.1% YoY, with a market share of 19.9%, ranking first globally.

Geely Auto, in second place, sold 1.315 million units in the first eight months, up 67.8% YoY, with a market share of 10.2%.

Regionally, according to Cailian Press, data from the European Automobile Manufacturers Association (ACEA) showed an approximately 23% YoY decline in Tesla's EV registrations (a sales metric) in Europe in August, marking the eighth consecutive monthly drop.

ACEA stated that Tesla's EV registrations in Europe fell 32.6% in the first eight months. In contrast, total EV registrations in Europe grew about 26% YoY in the same period.

Analysts suggest Tesla's sales resistance in Europe may stem from European consumers' dissatisfaction with Musk's remarks and stance, as well as fierce competition from EV makers like Volkswagen and BYD.

In China, the world's largest EV market, Tesla faces intense attacks from numerous local brands like BYD, XPeng, Li Auto, and NIO.

Tianyancha shows Tesla (Shanghai) Co., Ltd. is located at No. 5000 Jiangshan Road, Lingang New Area, China (Shanghai) Pilot Free Trade Zone.

Even in its traditional stronghold, the U.S., Tesla's market position has been shaken. According to Cox Automotive data, Tesla's share of total U.S. EV sales dropped to 38% in August.

To counter the impact of expiring U.S. EV incentives, Tesla has resorted to "price cuts." Earlier this month, Tesla launched two lower-priced models, named "Standard Range Model Y" and "Standard Range Model 3."

The "Standard Range Model Y" starts at $39,990, while the "Standard Range Model 3" starts at $36,990, about $5,000 and $5,500 cheaper than previous versions, respectively.

While Tesla hopes the lower-priced models will boost sales, this move may further squeeze its profit margins.

Multiple Projects Lag, Uncertain Future Prospects

Tesla's technological transformation strategy is a core factor supporting its high valuation, but current progress shows several key technology projects are lagging, raising significant uncertainties about its future growth.

After the earnings release, Tesla CEO Elon Musk and CFO Vaibhav Taneja attended the earnings call. Musk stated Tesla is at a critical inflection point. He claimed FSD and autonomous taxis would transform the transportation industry, enabling Tesla vehicles to achieve full self-driving capability through a single software update. He also plans to expand production capacity as soon as possible within Tesla's capabilities.

However, Tesla's Full Self-Driving (FSD) system has seen slow progress. Tesla CFO Vaibhav Taneja revealed that only 12% of Tesla's current fleet pays for FSD Supervised.

Regarding the highly anticipated Robotaxi project, Musk adjusted expectations. He stated that by the end of 2025, Tesla will remove safety drivers from Robotaxis in parts of Austin and expand the service to 8-10 cities, significantly narrowing from the previous goal of covering 50% of the U.S. population.

Currently, Tesla operates Robotaxi services in Austin and the San Francisco Bay Area but still employs safety drivers, with emergency shutdown devices available as a safeguard.

The Cybercab (autonomous taxi), designed for full self-driving, is scheduled to begin production in Q2 2026. This vehicle, "without a steering wheel or pedals," is engineered for the lowest operational cost per mile.

The Optimus humanoid robot, dubbed by Musk as "potentially the grandest product ever," has seen its timeline delayed. Musk expects mass production of Optimus to begin by the end of 2026, with the V3 version of Optimus Prime ready to "debut" in Q1 2026.

Musk admitted that manufacturing Optimus is an "extremely difficult task." Tesla originally planned to produce 5,000 Optimus robots this year and 50,000 in 2026, but reports indicate Musk has abandoned this year's goal.

Some Analysts Remain Cautious, Musk Lashes Out at Compensation Opponents

Facing declining profitability metrics and increasing uncertainties about Tesla's future, Wall Street institutions hold differing views on Tesla.

For instance, Dan Ives, analyst at Wedbush, a traditionally bullish investment bank on Tesla, believes Tesla has made significant incremental progress in its AI strategy. He noted that Tesla's FSD (Full Self-Driving) fleet traveled over 1.3 billion miles this quarter, bringing cumulative FSD miles to 6 billion, creating a vast database to enhance FSD capabilities.

Ives stated, "We still believe that in the most optimistic scenario, Tesla's market value could reach $2 trillion by early 2026 and exceed $3 trillion by the end of 2026, entering its 'Golden AI Era.'"

However, Garrett Nelson, senior equity research analyst at CFRA, said, "We are entering a period filled with questions about Tesla's near- and medium-term earnings growth trajectory."

Colin Langan, analyst at Wells Fargo, maintained a "reduce" rating on the stock, citing continuous deterioration in Tesla's core business.

He pointed out that the commercialization scale of robotaxis and Optimus is expected to be slower than previously envisioned. "The earnings report offered little discussion on the core automotive business, which shows surprisingly limited operational leverage in growth, primarily affected by pricing, tariffs, and product mix. Overall, we see a lack of drivers to continue supporting stock price appreciation."

Haris Khurshid, Chief Investment Officer at Karobaar Capital, noted, "While some investors in the market and Musk's followers recognize Tesla as a comprehensive AI platform, the earnings report still reflects it as an automaker, and a declining one at that."

Dec Mullarkey, Managing Director at SLC Management, said, "There isn't much here to inspire investors. Tesla's earnings and profit margins remain below average and may stagnate for some time. Currently, Tesla seems to lack a reliable growth narrative and plan, making its stock price vulnerable to rapid market adjustments and negative earnings data."

Additionally, with Musk managing multiple companies, some investors worry he cannot fully devote himself to Tesla's management.

Notably, at the end of Tesla's latest earnings call, Musk launched a fierce critique against those attempting to block his $1 trillion compensation package.

Musk stated he wouldn't even call it "compensation" and insisted the real issue is whether he can retain sufficient voting rights to control Tesla's next phase of development in AI, autonomous taxis, and humanoid robots.

"I cannot comfortably remain here, building a robot army, only to be ousted due to foolish recommendations from ISS and Glass Lewis," Musk said at the meeting, labeling the two proxy advisory firms as "corporate terrorists."

Musk emphasized he needs "around 25%" voting rights to maintain "strong influence" at Tesla while still being removable if he "goes crazy."

As of the market close on October 23 (Eastern Time), Tesla's market value was about $1.49 trillion, over 20 times that of traditional auto giant General Motors. However, from a profitability perspective, Tesla's Q3 net profit attributable to the parent company was only slightly higher than GM's.

Some analysts believe this valuation discrepancy partly relies on market optimism about its technological transformation. If this expectation fails, Tesla may face significant market value adjustment risks.

As Musk stands atop the world's richest list, where will he lead Tesla next? Leida Finance will continue to monitor.