Sales down nearly 50%, super luxury brands 'stall' in China

![]() 11/15 2024

11/15 2024

![]() 583

583

Introduction

Although super luxury brands enjoy great prestige, a fact that cannot be ignored is that their market share in China is rapidly shrinking.

'If they don't make money, we'll shut them down. We can't afford brands that don't make money.'

In an interview in July this year, Carlos Tavares, CEO of global automotive giant Stellantis Group, said. This news led many to speculate that Maserati, which had underperformed this year, would be sold, as the brand's sales performance fell far short of overall expectations. In the first half of this year, Maserati sold only 6,500 new vehicles, a decrease of more than 50% compared to the same period last year.

Affected by the decline in sales of its luxury brands, Stellantis Group's overall revenue and net profit also declined during the same period this year. Adjusted operating income was 8.463 billion euros, a year-on-year decrease of 40%; net profit was 5.65 billion euros, a year-on-year decrease of 48%.

Despite its poor performance, Stellantis stated that it would not sell Maserati and would unconditionally support the brand to ensure a bright future. To revitalize the brand, Santo Ficili succeeded Davide Grasso as the new CEO of Maserati. With sales declining significantly, the pressure on Santo Ficili is easy to imagine.

However, compared to Maserati, McLaren, another super luxury brand, has not been so lucky. The British sports car manufacturer has changed hands twice this year. Last month, it was reported that CYVN Holdings from Abu Dhabi had signed a non-binding agreement to acquire 100% ownership of McLaren Automotive.

Behind these events lies the financial pressure caused by a significant deterioration in market performance. From a global perspective, the general decline in brand sales is closely related to the slowdown in China's market growth.

More importantly, such difficulties are not limited to the two brands mentioned. Many well-known luxury brands, including Aston Martin, Rolls-Royce, Bentley, and even Porsche, are facing similar challenges.

In China, none of them are spared

At this year's Guangzhou Auto Show, apart from Ferrari continuing its previous practice of not participating, Rolls-Royce was also absent. As the year-end approaches, brands must choose whether to participate in the auto show to expand publicity or simply reduce related marketing expenses. Such choices are clearly based on their own pressures.

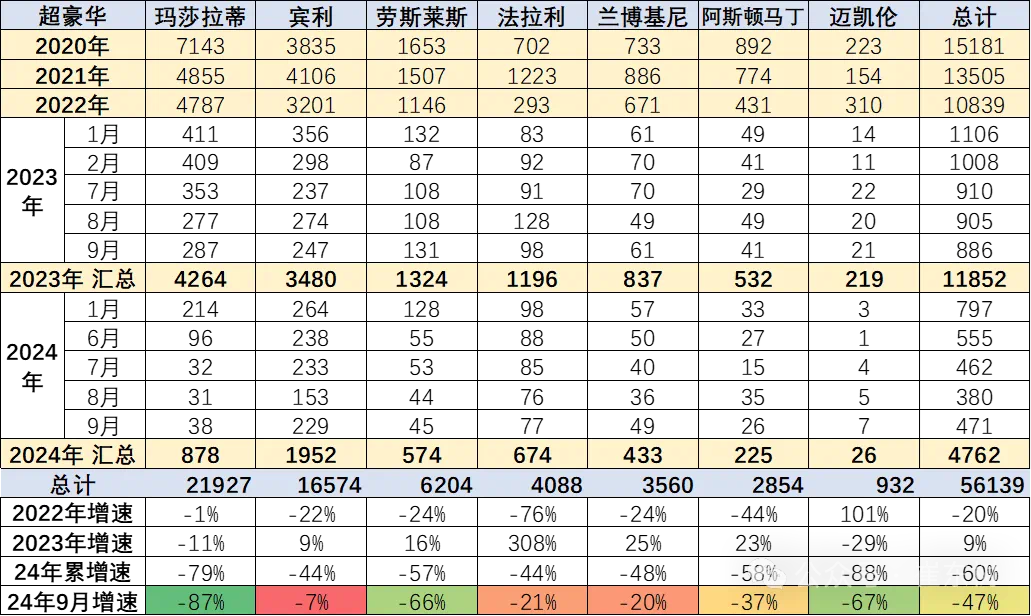

According to data from the China Passenger Car Association (CPCA), the total sales of imported super luxury brands in September this year were 471 vehicles, a year-on-year decline of 47%; cumulative sales from January to September were 4,762 vehicles, with a year-on-year decline of up to 60%. How to make the annual sales figures look better has become a common challenge.

From a broader perspective, the overall sales of the imported car market are also declining significantly. In September, automobile imports were 55,000 units, a year-on-year decrease of 20% and a month-on-month decrease of 27%. Considering the market stimulus effect of the 'golden September and silver October', even Cui Dongshu, Secretary-General of the CPCA, wrote that this was a 'huge decline in September rarely seen in recent years.' From January to September, domestic automobile imports totaled 530,000 units, a slight year-on-year decrease of 4%, showing a negative growth trend for three consecutive years.

From the brand perspective, McLaren's performance is the most severe, with cumulative sales declining by 88% in the first three quarters of this year. In contrast, although Bentley and Ferrari's declines are relatively smaller, they still reach 44%.

Due to the absence of the 750S, McLaren faced unprecedented challenges in the Chinese market this year, selling only 26 new vehicles in the first nine months. Looking back at 2022 and 2023, its annual sales were 310 and 219 vehicles, respectively, and such a significant decline is indeed surprising.

However, considering that even more well-known competitors such as Ferrari and Lamborghini have also seen significant sales declines, McLaren's current situation no longer seems exceptional.

To increase sales, price reductions are necessary to close deals. It's hard to imagine that price wars have also spread to the super luxury car market.

Moreover, unlike popular brands that offer discounts of several thousand or tens of thousands of yuan, due to their high price base, super luxury cars often see price reductions of hundreds of thousands or even millions of yuan. Many super luxury brand dealers are even selling at a loss. Recently, a Rolls-Royce dealership in Guangzhou revealed a cash discount of 1.11 million yuan for the 2024 model year five-seater Rolls-Royce Cullinan.

Selling a product worth millions of yuan, yet the seller makes no profit; this was previously unthinkable. Not long ago, a letter addressed to all employees of Harmony Auto was circulated online, revealing that even leading domestic luxury and super luxury car brand dealers are facing salary cuts for all employees. The pressure on other dealers is easy to imagine.

When pressure cannot be relieved, some dealers even go so far as to protest jointly with the brand. In May this year, Porsche dealers in the Chinese market collectively sent a letter to the German headquarters demanding compensation for recent new vehicle sales losses. Due to the continued backlog caused by declining sales, dealers face enormous financial pressure, and about 65% of dealer investors have decided not to take delivery of new vehicles.

Although not stated directly, the formal inauguration of Mr. Alexander Pollich as the new President and CEO of Porsche China on September 1 fully demonstrates Porsche's anxiety and urgency about the current situation in the Chinese market. In 2023, China was no longer Porsche's largest single market globally. In the first three quarters of this year, sales again declined by nearly 30% year-on-year.

Faced with such market challenges, Porsche urgently needs a leadership figure who can turn the tide. Otherwise, failure in China will affect the overall situation. After all, Porsche's total global sales last year only increased slightly, and with another decline in the Chinese market this year, a decline in global sales is inevitable.

Everyone understands how important China is. In response, changing leadership has become a common tactic for automakers when problems arise in the Chinese market. Besides Porsche, Maserati also changed its senior management in China this year. At the end of September, Hubertus Troska was appointed as the General Manager of Maserati China, and revitalizing brand sales has become a top priority for him.

In the blink of an eye, electrification has hit traditional luxury brands by surprise, like a tidal wave, which is one of the reasons for the decline in sales. Although they have all launched their respective electrified products and related plans, they still feel like they are 'going through the motions' and not showing full sincerity.

Luxury cars go electric, but electric cars become luxurious

It's difficult for elephants to turn around. For these traditional powerhouses, benefiting from the technological accumulation and brand precipitation of the fuel era, they have already made a fortune. Unless there are external constraints, it is indeed difficult for them to actively engage in the transition to electrification.

For example, Ferrari and Lamborghini, which are both declining in the Chinese market, are still performing strongly globally, especially in terms of revenue and profit.

According to relevant financial report information, Ferrari delivered 3,383 new vehicles globally in the third quarter, a year-on-year decrease of 2.2%, but revenue increased by 6.5% year-on-year to 1.64 billion euros; adjusted EBITDA was 638 million euros, an increase of 7.1% year-on-year. In the first three quarters, total sales remained basically flat, with only an increase of 9 vehicles, but revenue growth was as high as 11%.

On the other hand, Lamborghini's situation is similar. From January to September 2024, the brand delivered a total of 8,411 vehicles globally, a year-on-year increase of 8.6%. Revenue increased by 20.1% year-on-year to 2.434 billion euros. Although the operating profit margin declined slightly, from 30.5% in the previous year to 27.9% this year, operating profit increased by 9.8% year-on-year to 678 million euros.

Facing the profound changes in the new energy vehicle market, although both supercar giants have launched new energy products, and Lamborghini has even transformed into a fully hybrid brand with the launch of the Temerario, their pure electric models are still some time away from being available.

According to plans, Ferrari is expected to launch its first pure electric model in 2026, while Lamborghini's pure electric product will not be mass-produced until 2028.

In China, while no domestic brands can threaten the status of super luxury brands such as Ferrari, Lamborghini, Bentley, and Rolls-Royce, whether it's supercars or luxury sedans, when new products gradually lose their previous luster due to new technologies during the transition of the era, sales declines are inevitable.

For example, the once fanatical performance of a thousand or eight hundred horsepower is now achievable with the help of electric motors, and new vehicles costing two or three hundred thousand yuan can also achieve the acceleration capabilities of supercars. On the other hand, the concept of intelligence has made electric vehicles more intelligent and luxurious. Features like electrically opening and closing doors and quieter cabins are no longer worth mentioning in the new energy era.

For these still-stuck-in-their-ways super luxury brands, when existing consumers cannot see the highlights of new products, they naturally will no longer be willing to spend a lot of money to update their vehicles. As a result, luxury cars become like an experience ticket; once owned, there is no desire to buy another one because there doesn't seem to be much difference.

Without significant upgrades for over a decade, even updates often feel like minor tweaks. Product replacements resemble mid-cycle refreshes, and mid-cycle refreshes resemble annual model updates. In contrast, Chinese new energy vehicles see numerous models with major updates every year, and the speed of upgrades exceeds imagination. Having eaten up the development dividends of the past, there is naturally not much room left for brand growth.

I dare not say that an Ideal L9 or AITO M9 can compete with a Rolls-Royce Cullinan, but for the Spectre, it's hard to say what advantages it has over Chinese pure electric coupes. Perhaps the biggest advantage is the car logo, but it seems to stop there. Most people still have considerable doubts about the electrification process of these traditional super luxury brands.

Indeed, these skeptical people are not the target customers of Rolls-Royce. Rolls-Royce owners do not need voice control; they are already accustomed to the convenience of not needing to operate personally, and any needs can be instructed to the driver. People who buy Ferraris definitely don't care about whether there are autonomous driving assistance features because the most important thing for them is pure driving pleasure.

China's automobile industry is progressing, and there is no doubt about that. However, it definitely does not pose a threat to the status of super luxury brands at present. However, in the process of constructing the automotive pyramid, the order is constantly being broken from the bottom up. Although the top-tier 'Ferraris' remain stable, luxury brands in the middle section are already on edge, such as Porsche.

Porsche's sharp decline in sales in the Chinese market this year is closely related to its slow electrification transformation. In 2019, Porsche launched its first pure electric model, the Taycan, which amazed everyone upon its debut. However, when Porsche brought its second pure electric model, the Macan EV, this year, the general market reaction was disappointment.

Five years later, there has not been much technological progress seen in Porsche's two electric vehicles. In contrast, autonomous brands' new energy vehicles have undergone tremendous changes. From 400V to 800V platforms, from voice interaction to intelligent cockpits, and from NoA to end-to-end large model applications, each technology is at the forefront of the industry.

Therefore, we have seen brands like BYD, NIO, and AITO continuously making inroads into the luxury market, making not only Porsche but also traditional luxury brands such as BBA feel quite nervous. After all, the principle of 'he who controls China controls the world' has long been understood during their decades of deep cultivation in China.

Indeed, domestic brands still cannot shake the status of super luxury brands at present. However, companies ultimately aim to make a profit. Whether due to economic factors or market changes, a fact that cannot be ignored is that the market share of these super luxury brands in China is rapidly shrinking. How to respond is the fundamental way forward.