Car manufacturers have two swords: one for themselves, one for suppliers

![]() 11/29 2024

11/29 2024

![]() 580

580

Focusing resources is the key to "surviving" the tough times.

Price wars are an old topic, but they have caused much pain in the industry.

No one wants to engage in a price war, but they have no choice. If you condense the pain caused by nearly 20 months of continuous price wars into eight characters, it would be, "In the world of business, one has no choice."

Recently, Tesla has started a new round of price wars. Considering the need to boost sales in the fourth quarter, Tesla reduced the price of its Model Y vehicles. Many other automakers have followed suit.

An automaker executive said that they have forgotten what it was like not to engage in price wars. "We are barely surviving now." No matter how difficult it is, we have to make do.

Of course, the chill will spread to everyone, and the pressure to reduce prices will inevitably be passed on to upstream and downstream players in the automotive supply chain, including suppliers and dealers.

Recently, there has been much talk about suppliers being asked to reduce costs. Besides an email from BYD, SAIC MAXUS and other companies have also expressed similar intentions.

It can be said that the entire industry is paying for the price war.

The price war that can't be won

Many people may still remember the two letters sent earlier this year. One was from He Xiaopeng, and the other from Gan Jiayue, CEO of Geely Group.

In his letter, He Xiaopeng stated that he viewed 2024 as the first year of "bloody" competition for Chinese automotive brands and the first year of the elimination round.

Gan Jiayue, CEO of Geely Automobile Group, said that as of 2024, competition in the Chinese automotive industry has intensified, the elimination round has fully begun, and the industry will enter a consolidation period with a reshuffle.

These two statements set the tone for the year – in one word, "competition".

In the words of Qi Xiaohui, Deputy General Manager of Beijing Hyundai, "Internal competition is unavoidable. Although joint ventures are under great pressure, competition is even fiercer among autonomous brands and new energy vehicles. It's just that their competitive measures differ."

However, the price war has now reached a point where its effectiveness is minimal. Most brands have not achieved the expected "trade-off between price and volume," instead experiencing a loss in both price and volume. "Only a handful of automakers can maintain profitable growth amid the price war."

Data shows that revenue per vehicle has increased from 294,000 yuan in 2017 to 341,000 yuan in the first three quarters of 2024. However, profit per vehicle has declined significantly, halving from 2017 levels.

Profit per traditional fuel vehicle has dropped from 23,000 yuan in 2017 to 16,000 yuan in the first three quarters of 2024, falling further to 11,000 yuan in September. New energy vehicle makers generally hover near the break-even point, with each vehicle sold resulting in a loss. Profitability remains a significant challenge.

Lei Jun's statement, "Xiaomi SU7 is definitely losing money; we lose money on every one sold," reveals the truth about the survival of new energy brands. Deng Chenghao, CEO of Deep Blue Auto, said in an interview, "Next year's price war will be even more intense, and only automakers with a gross margin of 15% can basically survive. Brands that lose money on every vehicle sold are likely to fail."

Let's look at some data from the China Passenger Car Association (CPCA).

In the first three quarters, the total revenue of the automotive industry was 7.3593 trillion yuan, a year-on-year increase of 3%; total profit was 336 billion yuan, a year-on-year decrease of 1.2%. The overall industry profit margin was 4.6%, far below the industrial average of 6.1% and nearly half of the 8.7% margin in 2015.

Moreover, even as prices continue to fall, sales have not increased significantly, leading to a decline in revenue. For example, according to GAC Group's financial report, revenue in the first three quarters of 2024 was 74.04 billion yuan, a year-on-year decrease of 24.18%, and net profit attributable to shareholders was 120 million yuan, a year-on-year plunge of 97.34%.

Whether from the perspective of profit per vehicle or corporate and industry profits, it is clear that the price war is no longer effective.

To survive, other approaches must be considered.

Layoffs and brand integration

"Reaching the milestone of selling 10 million vehicles per year is not easy, and new energy vehicle makers should prioritize profitability," said Lu Fang, CEO of Voyah Auto.

However, he believes that from a macro perspective, there will inevitably be a deceleration process during the transition. Just like running, you need to slow down when taking a turn or stop to make a U-turn. This is a necessary process during the transition.

How to navigate this "necessary path" and achieve profitability is a common challenge for all automakers.

It is well-known that the breakeven point for profitability is scale. With large sales volumes, R&D and manufacturing costs can be amortized, minimizing manufacturing costs as much as possible.

This is the ideal state. Currently, the only new energy vehicle makers that have achieved this are BYD, Tesla, and Lixiang Auto.

There is a consensus in the industry that the price war will continue next year. This has already been demonstrated by Tesla, which reduced prices again at the end of the year. In the future, market share will inevitably concentrate among the top players. Zhu Huarong, Chairman of Changan Automobile, once predicted that by the end of 2025, the difference between strong and weak automakers will become increasingly apparent. However, all automakers want to survive the elimination round.

"The word 'competition' reflects the process of an industry transitioning from a fragmented landscape to a unified and stable one. It is unavoidable and requires participation. The number of participants will significantly decrease, and the situation will improve as concentration increases. The keyword for this period is 'survival.' There are no good solutions," said Yang Dayong, Executive Vice President of Changan Ford Automobile Co., Ltd.

How to "survive"? In one sentence, reduce costs and increase efficiency.

The most direct approach is layoffs.

Companies such as XPeng, Volkswagen, Honda, Tesla, and Lixiang Auto have all conducted layoffs. Among them, Tesla's layoff of 14,000 employees, representing over 10% of its workforce, has attracted the most attention.

Zeng Qinghong, Chairman of GAC Group, lamented, "This kind of competition is not a solution. What is the purpose of a business? To make a profit. What do profits serve? Contributing to the country and society, paying taxes, and creating jobs. But now, it has come to layoffs. How many have been laid off?"

Accelerating brand integration has become another primary means of cost reduction.

In the past, automakers adopted a "multi-brand" strategy to capture more market share. However, "multiple children" mean more capital and resources, leading to silos and severe internal competition for R&D and channel resources.

In the past two years, competition has intensified, and brands with poor sales have faced increasing pressure. "Cost reduction and efficiency enhancement have become the focus of automakers currently," said Cui Dongshu, Secretary-General of the China Passenger Car Association. Automakers have chosen strategic contraction and brand integration as necessary means.

After "flying solo" for three years, SAIC Motor announced in September that Roewe and Feifan would merge. With the merger of the two brands, SAIC will reorganize the positioning and product lines of the Roewe and Feifan brands, a move seen as a critical moment for SAIC's "cost reduction and efficiency enhancement."

Also in that month, Geely Holding Group issued the "Taizhou Declaration," proposing to "promote in-depth integration and efficient fusion of internal resources." The Geometry brand was merged into Galaxy. Geely stated that Geometry would become Galaxy's series of intelligent compact cars.

On November 14, Geely Holding Group conducted another round of brand integration, optimizing the shareholding structure of Zeekr and Lynk & Co. After the integration, Zeekr will hold a 51% stake in Lynk & Co., with the remaining 49% continuing to be held by a wholly-owned subsidiary of Geely Auto.

Great Wall Motor has also signaled brand integration, choosing to return to its core categories and focus on a single Great Wall brand. In October this year, the Ora brand under Great Wall Motor issued an "Ora App Migration Announcement." "The integration of Ora and Haval brands, signaled by the integration at the channel level, is a clear indication," said an industry insider.

In November, GAC Group moved its headquarters from the CBD Zhujiang New Town to Panyu, returning to its entrepreneurial starting point. Although it did not integrate its brands, "efficiency" and "cost reduction" became the two loudest keywords in the "Panyu Initiative."

Two swords

In the process of cost reduction and efficiency enhancement, every automaker must pass the "cost hurdle."

There are two ways for automakers to reduce costs: "cutting themselves" and "cutting suppliers." Multi-brand integration is "cutting oneself," while reducing component procurement costs is "cutting suppliers."

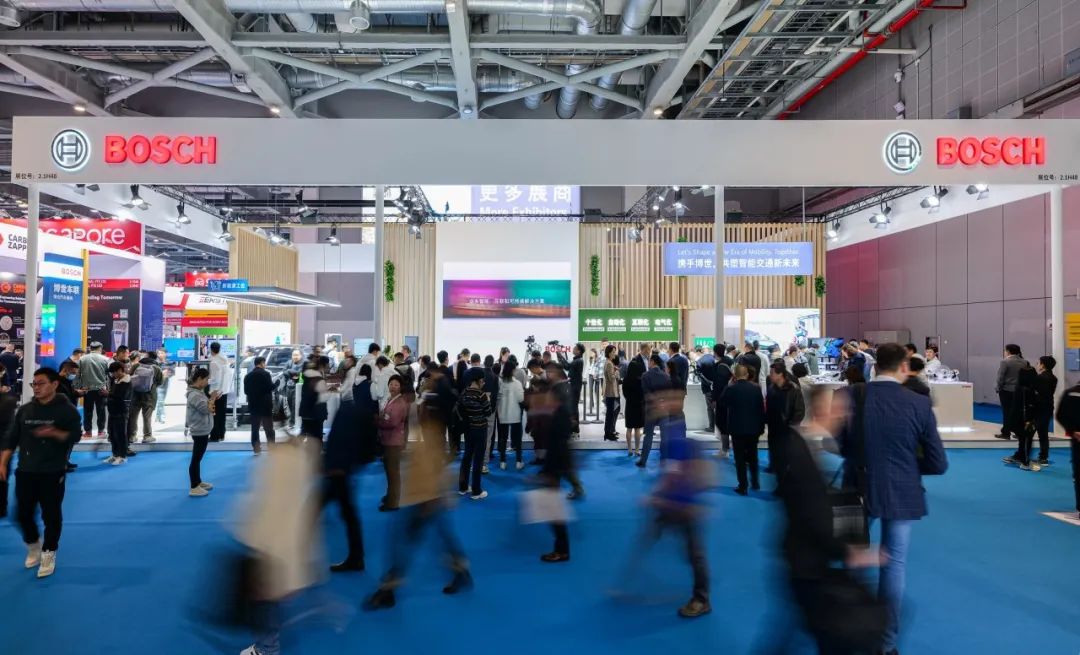

In 2023, Chen Yudong, the former president of Bosch China, said he received a sword inscribed with the words "Cut the Gordian Knot" from Fang, the general manager of Geely's Parts Procurement Company, hoping that Bosch would cooperate in reducing prices to enhance Geely's product competitiveness.

After initiating change, cost reduction became a frequent topic in He Xiaopeng's speeches. He criticized XPeng multiple times for its high procurement costs. One embarrassing dinner with Volkswagen executives stood out. At the time, Volkswagen said that after dismantling the XPeng G9, everything was good except for the high component costs. "This is 25% more expensive, and that's over 10% more expensive."

He Xiaopeng said, "That dinner was very stressful." Since then, cost reduction has been one of XPeng's primary focuses for change.

Exploring all possible cost-saving opportunities is a common logic among automakers. Approximately 60% of the total cost of a vehicle comes from purchased components, making suppliers the key to cost control. Automakers annually require suppliers to implement a "yearly reduction" in prices, typically around 3%-5%.

However, the reduction rate has exceeded 10% in the past two years. Recently, following heated discussions about BYD's request for a 10% price reduction from suppliers, SAIC MAXUS invited supplier partners to participate in cost control projects with a target reduction of 10%.

"Most customers now demand a 20% price reduction from us. If we agree to that, we might as well close down because not doing business might be better than accepting a 20% reduction," said Xu Daquan, President of Bosch China. In the past, annual price negotiations were typically conducted once at the beginning of the year, but these negotiations have become ongoing throughout the year in recent years.

"Can this product be replaced with another, or can engineering changes be made to reduce unnecessary features? We also need to negotiate cost reductions with our suppliers. Automakers ask us to reduce costs, and suppliers also need to contribute," said Xu Daquan. Tier 1 suppliers bear the brunt of automakers' cost reduction efforts, but the impact extends to Tier 2 suppliers and the entire industry chain.

"The auto parts industry achieves meager profits through mass production. This is an unchanging rule." Over the past decade, Bosch has invested approximately 8% of its sales in R&D annually, but its profit margin has not exceeded 5%.

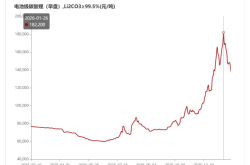

To maintain its market position and expand scale, even CATL, the leading battery maker, has begun to streamline production line resources and propose reducing battery prices. BYD's Fudi Battery has also urged its team to continue reducing costs.

However, there is limited room for cost reduction. BYD has publicly stated that there is little room for cost reduction in the procurement process. Therefore, to engage in price wars, sometimes "unconventional cost reductions" occur up and down the supply chain."Unconventional cost reductions force some manufacturers to cut corners or even falsify information. Once a quality crisis occurs, consumers ultimately foot the bill," said Wei Jianjun, Chairman of Great Wall Motor. Safety and quality are built on cost. "If you only focus on being cheap, product quality becomes extremely worrying."

"The cheaper the price war gets, the worse the quality and service experience become. If this continues, the business will fail," said Li Shufu, Chairman of Geely Holding Group, on September 20.

Asking suppliers to reduce prices is not a long-term solution. Automakers also need to explore new avenues for cost reduction and efficiency enhancement through technological innovation. Nowadays, lightweight technology, chassis integration technology, new low-cost materials, and novel architectural concepts are becoming new means for automakers to reduce costs and enhance efficiency.

For example, Tesla's integrated large die-casting technology can reduce costs by 40%, and battery technology iterations can save approximately 10,000-20,000 yuan per vehicle. Investing heavily in R&D to achieve efficiency improvements and cost reductions is also the confidence behind Musk's price wars.

Of course, Musk has also asked suppliers to reduce prices, once demanding up to a 10% price reduction from upstream component suppliers.

Returning to long-term thinking, to endure the marathon of competition, automakers need to keep a big picture in mind. As Yang Dayong said, if we add a few words to "cost reduction and efficiency enhancement," it would be "focusing on the norm and building systemic advantages."

"Analyze your company's strengths and strengthen the one or two that can help us survive the winter. Focusing resources is the key to 'survival.'

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.