Fighting rumors and increasing losses, can NIO continue to win on two fronts

![]() 11/29 2024

11/29 2024

![]() 648

648

A decade of grinding and now it's time to test the edge!

Editor: Gedo

Fengpin: Yiming

Source: Shoucai - Shoucai Finance Research Institute

What doesn't kill me makes me stronger! Since its inception, doubts about Li Bin and NIO have never ceased.

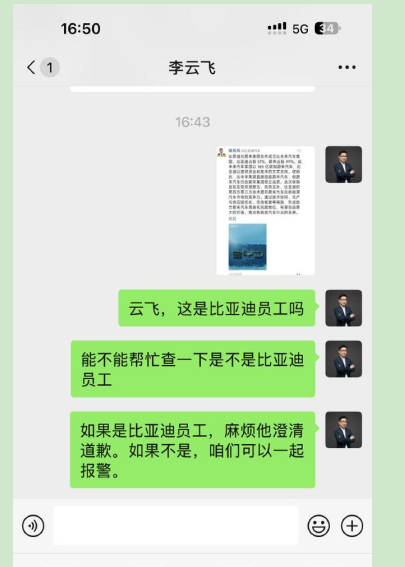

Recently, a screenshot from a WeChat Moments post circulated claiming that NIO would be acquired by BYD. On November 22, Ma Lin, Assistant Vice President of NIO, responded by saying that "there are too many bad people" and attached a chat record with Li Yunfei, General Manager of BYD Brand Public Relations. He asked the latter if he could help check whether it was done by BYD employees. Li Yunfei replied, "The rumored investment and cooperation information related to BYD and NIO is seriously false information! Please do not believe or spread rumors."

In the end, NIO still chose to report the incident to the police. On November 23, NIO's Legal Department tweeted that the company had obtained information on the entire process of spreading the rumor and the network accounts involved in the initial dissemination on multiple platforms, and had submitted relevant evidence to the police, who had officially filed a case for investigation.

The latest news shows that the rumor-monger has been administratively detained by the police. To be honest, it's not surprising that NIO chose to fight back firmly; things have been quite troublesome for them lately. Just a few months ago, there were rumors that NIO was "bankrupt." On August 31, NIO's Legal Department issued a "Statement on Recent Malicious Rumors," with the core content being that someone had posted false information about "bankruptcy" on the internet, which was widely and maliciously spread.

Timely refutation to stabilize internal and external confidence is necessary. But as mentioned at the beginning, doubt is not always a bad thing. Continuously dispelling doubts and growing amidst them is the norm for many emerging enterprises. Although rumors are hateful, as the saying goes, flies don't bite into flawless eggs. After the false alarm, faced with waves of turmoil, NIO also needs to consider why it is constantly being questioned, whether it has any shortcomings to address, and how healthy its operations are.

1

Losses exceeding 5 billion for four consecutive quarters

Debt ratio exceeds 84%. When will the money burning stop?

At least judging from the performance of the secondary market, it's not too demanding. The company's share price has been on a rollercoaster ride in recent years. Starting around $6 in the second half of 2020, it peaked at $66.99 per share in January 2021 within just six months. It then gradually returned to previous levels, closing at $4.380 per share on November 28, 2024, already halved from the opening price of $9.07.

It's normal for capital to adjust expectations based on performance. Considering the performance, it's no wonder investors are voting with their feet. According to Ifeng Auto, from January 2023 to September 2024, NIO incurred a total loss of 36.01 billion yuan over 21 months.

Shortly before the rumor of "acquisition" spread, NIO released its third-quarter report on November 20, 2024, reporting revenue of 18.67 billion yuan, a year-on-year decrease of 2.1%, and a net loss of approximately 5.06 billion yuan, an increase of 11% year-on-year, marking the fourth consecutive quarter with losses exceeding 5 billion yuan. Looking at other new energy vehicle makers, excluding the significantly profitable Lixiang Auto, XPeng, Zeekr, and NIO Auto respectively incurred losses of 1.81 billion yuan, 1.14 billion yuan, and 690 million yuan, while Xiaomi Group, a late entrant, lost 1.5 billion yuan. NIO's loss pressure is significantly greater.

There is also good news. In the third quarter, sales hit a record high of 61,855 units; revenue reached 18.67 billion yuan, an increase of 7.0% quarter-on-quarter; and the gross margin of vehicles rose to 13.1%, maintaining an industry-leading position. Meanwhile, NIO issued its strongest quarterly guidance ever: fourth-quarter delivery guidance reached 72,000 to 75,000 units, an increase of 43.9% to 49.9% year-on-year; fourth-quarter revenue guidance was 19.68 billion to 20.38 billion yuan, an increase of 15.0% to 19.2% year-on-year, both guidance figures setting new highs.

However, these seem insufficient for turning a profit. According to ECNS, Li Bin, the founder, chairman, and CEO of NIO, said on the earnings call that "with sales doubling next year, overall operations will continue to show positive growth, and losses are expected to narrow, with the goal of achieving profitability by 2026." In other words, even with doubling sales, NIO will still not turn a profit within a year.

If we extend the timeline further, Li Bin's profit timeline for NIO has been repeatedly delayed. It remains to be seen whether the company will truly achieve profitability in 2026 as planned. As early as the end of 2022, Li Bin predicted that the NIO brand could become profitable in the fourth quarter of 2023, and the company hoped to achieve break-even in 2024; in June 2023, Li Bin revised this prediction, saying that the break-even timeline would be pushed back by a year; now it has been delayed again by another year, with the operating goal being profitability in 2026.

Whether this is "pie in the sky" or overly optimistic remains to be seen, and time will tell. What is certain is that with the continuous rise in asset-liability ratio, the company's financial health needs to be vigilant. As of September 30, 2024, NIO's asset-liability ratio reached 84.55%, the highest since 2021.

Fortunately, companies that "burn money" are not necessarily short of cash. As of the same period, NIO's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits amounted to 42.2 billion yuan.

However, considering the losses exceeding 5 billion yuan for four consecutive quarters, if this pace continues, even the most abundant wallet may eventually run dry. What's terrifying is not burning money but failing to burn it to create core competitiveness and sufficient self-sustainability.

Taking the third quarter of 2024 as an example, despite benefiting from cost optimization and increased vehicle gross margins, NIO's R&D investment was still as high as 3.32 billion yuan, a year-on-year increase of 9.2% and a quarter-on-quarter increase of 3.1%. During the same period, Lixiang Auto and XPeng invested 2.6 billion yuan and 1.63 billion yuan in R&D, respectively. NIO's volume and proportion were the largest, with cumulative R&D investment exceeding 53 billion yuan since 2016. General and administrative expenses (non-GAAP) were 3.9014 billion yuan, a year-on-year increase of 13.9% and a quarter-on-quarter increase of 8.5%, with both growth rates higher than revenue growth during the same period.

With such huge expenses, if the company wants to win in the long run and develop healthily, it must improve its self-sustainability. Blindly burning money to pursue growth and sacrificing financial health for scale is undoubtedly a dangerous game.

2

The joys and sorrows of a multi-brand strategy

The key is to fully leverage cost-effectiveness

Ultimately, the automobile industry is a typical scale industry. To get rid of losses and improve financial security, rapidly increasing sales volume is the only way.

The awkward thing is that relying solely on the high-end NIO brand, sales contributions are still limited. In the third quarter of 2024, NIO delivered a record high of 61,855 new vehicles, but monthly sales hovered around 20,000 units. In the same camp, Lixiang Auto's monthly sales have surpassed 50,000 units. After experiencing the pain of model upgrades and launching the MONA M03, XPeng has also embarked on a fast track, achieving eight consecutive monthly sales increases, with October deliveries reaching 23,917 units, a record high.

The tide washes away the weak, and those who do not advance will fall behind. To boost sales, NIO has focused on a multi-brand strategy. In May 2024, the company launched the Ledo brand to enter the low- to mid-end market. The first model, the Ledo L60, was launched on September 19, with two models priced between 206,900 and 235,900 yuan.

According to the plan, NIO will continue to launch a third brand called "Firefly." Li Bin announced that the first product will share the same name as the brand, which will be unveiled at NIO Day 2024 on December 21, with the first model to be delivered in the first half of next year.

As a result, sales in 2025 will be contributed by the NIO, Ledo, and Firefly brands. NIO will also form a closed loop covering the entire price range from high-end to low-end markets. The NIO brand will focus on the high-end market, with prices ranging from approximately 300,000 to 600,000 yuan; Ledo will target the mid-end market, with prices ranging from approximately 200,000 to 300,000 yuan; according to Southern Metropolis Daily, the newly launched Firefly brand is expected to have a starting price of 140,000 yuan for more compact models.

Following the multi-dimensional closed-loop logic, the collaborative promotion of multiple brands can help NIO rapidly increase sales volume and better spread operating costs. Li Bin attributed the increase in gross margin in the third quarter to the continuous optimization of component costs and the improved manufacturing efficiency brought about by the growth in production and sales scale.

However, whether this momentum can be sustained remains to be seen, such as in terms of delivery capacity matching. Taking the Ledo brand as an example, only 832 units were actually sold in the first month after its launch. This is quite a gap compared to the 2,819 units sold by the Link&Co Z10 in its first month on the market. The outside world questioned whether the orders for the "explosively popular" Ledo L60 had been overestimated. According to the China Real Estate Business, delivery issues also led to complaints from several prospective car owners about the chaotic delivery order of the Ledo L60, with accusations of "shady dealings" and "unfair queue-jumping."

Although Ai Tiecheng, President of Ledo Auto, said that orders for the Ledo L60 far exceeded expectations and that every effort was being made to fulfill them, with production orders scheduled until the first quarter of next year, as of November 14, the total deliveries of the Ledo L60 were just over 7,000 units. The goal is to deliver over 10,000 units in December alone. How does this compare to the online rumors of over 30,000 orders within 72 hours of launch, over 60,000 orders within five days, and 45,000 confirmed orders?

The reason is that although Ledo has lowered its profile compared to NIO, competitors in the same segment have also aggressively expanded into lower price brackets, making competition in the same price range increasingly about cost-effectiveness and quality-to-price ratio. Companies such as Geely, BYD, and Changan have already deployed significant resources in this area. If Ledo wants to make a difference, it must make greater efforts in intelligent driving, battery life, and other aspects to fully leverage cost-effectiveness, quality-to-price ratio, and unique experiences while balancing costs.

Looking deeper, with the launch of Ledo and Firefly, it presents both an opportunity and a challenge for improving NIO's future profitability.

The gross margin of NIO's vehicles is around 13.1%, while that of Ledo is only around 10%. If Firefly's gross margin declines further, although it will bring some incremental growth, how to substantially improve profitability is also a test.

Industry analyst Wang Yanbo believes that NIO, which focuses on the mid- to high-end market, needs to break free from the constraints of its brand positioning. It is undeniable that relying on its high-end image, NIO has indeed made a name for itself, but down-to-earth products tend to generate higher sales volumes. Especially in the current market environment, with the downward expansion of luxury brands and the outbreak of price wars in the industry, NIO's high-end barriers have been thinned out. Now that NIO is starting to earn money by lowering its profile, this step was inevitable, but it is a brand-new attempt. Whether it can succeed and create new opportunities is crucial for NIO to turn a profit.

Indeed, a multi-brand strategy means more room for growth but also more competitors and expenses. In the third quarter of 2024, NIO's selling, general, and administrative expenses increased by 13.8% year-on-year and 9.5% quarter-on-quarter. The increase was due to the addition of sales personnel and the increase in sales and marketing activities related to new product launches. Li Bin said that investment would continue to increase in the fourth quarter, expanding the number of Ledo stores from the current 190+ to around 300.

According to the 21st Century Business Herald, NIO stated that this was mainly due to expenses related to the sales network construction and sales preparation of Ledo. These expenses will also increase in the fourth quarter of 2024. After the basic effectiveness of Ledo is in place in the first quarter of next year, the input-output ratio will be relatively good. Before then, the sales expense ratio will be relatively high and will return to normal after the first quarter of next year.

In the view of industry analyst Sun Yewen, running multiple brands is not just about having "more" but involves various aspects such as brand positioning, resource allocation, internal collaboration, breakthroughs in unique features, quality control, and risk control. New opportunities and challenges are intertwined, increasingly testing a company's comprehensive management ability and crisis response capability. For example, as mentioned above, the Ledo L60 faced questions about chaotic delivery orders, "shady dealings," and "unfair queue-jumping" when it was first delivered. How to accurately formulate corresponding strategies, pre-empt risks, and achieve both quantity and quality, speed, and stability is the key to achieving the desired sales volume in the short term, successfully turning a profit in the long term, and improving financial health.

3

The ambition of battery swapping

"Moat" or "straw that breaks the camel's back"

Upon review, NIO is currently at a critical juncture, striving to climb uphill. With huge losses on one hand and a multi-brand strategy on the other, it must ensure the normal operation of its existing business while considering future layout and cultivation. Stepping out of its comfort zone, facing the brutal market, and innovating on its own, the executive team is well aware of the courage and pressure involved.

Fortunately, Li Bin has experienced big scenes and dark times. In other words, without Li Bin, NIO might not have survived to this day. Regarding Li Bin, there is much controversy on the internet. The phrase, "Buying a gasoline car is only good for smelling gasoline; what else is there?" is attributed to him.

Public information shows that Li Bin is a member of the post-70s generation who grew up in poverty in a remote mountain village in Taihu County, Anhui Province. Eager to see a broader world, Li Bin studied hard and was eventually admitted to Peking University. During his university years, he demonstrated his business acumen by co-founding Nanji Technology with several classmates, whose main business was providing internet services to enterprises, such as server rental, website establishment, and domain name sales.

In 2000, the 26-year-old Li Bin keenly perceived that there would be more and more private cars in China and founded the vertical automobile website Yiche.com. However, the entrepreneurial journey was not smooth sailing. At the end of 2000, the internet bubble burst, and Yiche.com faced withdrawal of investment. At this time, Li Bin demonstrated strong resilience, not only returning the remaining 6 million yuan to investors but also converting 4 million yuan into his own debt. Relying on this tenacity, Yiche survived the winter and eventually reaped the benefits of the upcycle, listing on the New York Stock Exchange in 2010 with a market value of hundreds of millions of dollars, becoming China's first overseas-listed automotive internet company. Li Bin held nearly 20% of the shares, achieving financial freedom at the young age of 36.",

Facing the newly hatched sub-brand NIO Life, NIO still chooses the strategy of prioritizing infrastructure construction. Combined with the previously announced "county-to-county" battery swap plan, the overall layout of battery swap stations is likely to further accelerate next year, and the corresponding high investment it brings deserves scrutiny.

Industry analyst Wang Tingyan said that the automotive industry is currently in a stage of transition between old and new. Intense competition among various parties has led to rapid development, prosperity, and fiery changes in the industry. Products, technologies, business models, and operational models have been rapidly iterating. What was once a competitive advantage can quickly turn into a development burden or even a trap. It is too early to say whether battery swap stations are NIO's "moat" or a straw that breaks the camel's back. One thing is certain: after multiple rounds of market reshuffles and education through thunderstorms, investors are becoming increasingly rational. Scale and speed are taking a back seat, while profitability and certainty are becoming the king. This trend change is something that NIO and Li Bin, who are persistently placing their bets, need to deeply consider and promptly recognize.

4

Ten Years of Sharpening the Sword

Two-Front Battle, Another Victory?

The difference between pioneers and martyrs, besides luck, lies in precise positioning. From another perspective, successful enterprises always need some gambling spirit and a sense of adventure. Risks and rewards go hand in hand. If Li Bin and NIO truly succeed in this endeavor, they will undoubtedly be the biggest beneficiaries.

To accelerate the layout of its charging and battery swap network, NIO has launched the "Power-Up Partner Program" to open up cooperation with the entire society for the construction of charging and battery swap stations. According to Qin Lihong, co-founder and president of NIO, there are three modes for NIO's "Power-Up Partners": the first is the charging station franchise model, suitable for partners with venue and power resources, where both parties share service fee revenue; the second is the fixed-income model for charging and battery swap stations, suitable for partners with low capital costs who pursue long-term and stable returns, earning fixed service fee revenue; the third is the guaranteed minimum + revenue sharing model for charging and battery swap stations, suitable for partners seeking potentially higher returns, earning guaranteed minimum revenue + a share of service fee revenue.

The battery swap model is also gaining recognition from consumers. Taking the National Day travel period as an example, browsing some social platforms, many users have truly felt the convenience and joy: while other electric vehicles are fighting over a single charging pile, my NIO vehicle can be fully charged in just 3.5 minutes, and the battery swap stations are all within your driving range, completely eliminating the anxiety of insufficient range for electric vehicles. Kudos to NIO.

In addition, NIO is also active in the currently popular smart home sector. It continues to increase corresponding R&D investment and recruit talent, such as bringing in computer vision expert Ren Shaoqing from top autonomous driving startup Momenta. The number of its intelligent driving team has expanded from 500 in 2021 to 1,500.

On November 25, NIO celebrated its 10th anniversary. In an internal letter, Li Bin stated that the most intense and brutal phase of the qualification race in the smart electric vehicle industry has arrived, and only a few outstanding enterprises will survive in two or three years. "Next, we will face higher-dimensional competition. We cannot have weaknesses, nor can we achieve a quick victory." The next two years are crucial. Continuously launching competitive new products, continuously improving operational efficiency, doubling sales next year, and achieving corporate profitability by 2026 are tasks that cannot be compromised.

Carefully chosen words reveal both confidence in development and awe of the crisis. It can be said that this positive mindset is the best response to rumors of "being acquired" or "going bankrupt".

However, true doubts can only be dispelled by solid performance and sales figures. After experiencing the stormy seas of 2019, a more brutal reshuffle is unfolding as we look ahead to 2025. After this rumor debunking, NIO and Li Bin have regained ground in the battlefield of public opinion. However, the time for pure electric and battery swap self-verification is still urgent. Can they achieve another victory and stage another comeback on the battlefield of market and performance?

Ten Years of Sharpening the Sword, Testing the Edge in One Day. Can it continue to win on both fronts?

This article is originally created by Caijing.

Please leave a message if reprinting is needed