Futuretek rushes to the Hong Kong Stock Exchange: backed by Geely, Li Shufu as the largest shareholder

![]() 12/01 2024

12/01 2024

![]() 626

626

Produced | Zidan Finance

Design | Xing Jing

Audit | Song Wen

Another "Geely" enterprise has launched an attack on the capital market.

On November 22, the intelligent driving enterprise Futuretek (Zhejiang) Intelligent Technology Co., Ltd. (hereinafter referred to as: Futuretek) submitted a prospectus to the Hong Kong Stock Exchange. The lineup was quite luxurious, with CITIC Securities, China International Capital Corporation, Huatai International, and HSBC as joint sponsors.

In the first half of this year, during the "Wenjie M7 Yuncheng accident", it was revealed that Futuretek was suspected to be the supplier of the intelligent driving system of the accident model, bringing this intelligent driving company, which has only been established for 8 years, under the spotlight. However, Futuretek has never spoken out on this matter.

In the prospectus, the company did not mention Thalys, Wenjie, or Huawei at all. However, it is worth noting that at the beginning of the company's establishment, Huawei Investment held a small amount of equity in Futuretek through Suzhou Jinshajiang.

However, the company has a closer relationship with Geely. Before the IPO, Li Shufu, chairman of Geely Holding Group, and his children held equity in Futuretek through controlled companies. Moreover, Geely is also a major customer of Futuretek.

Even with Geely's full support, Futuretek has still not emerged from losses. As of June 30, 2024, the company had accumulated losses of nearly 2.9 billion yuan.

Will this IPO in Hong Kong bring a new development opportunity for Futuretek?

1. Backed by Geely, Li Shufu and his children have invested

In recent years, China's intelligent driving industry has flourished, nurturing a group of intelligent driving enterprises. Multiple star enterprises, represented by Horizon Robotics, Black Sesame Technologies, and WeRide, have successfully landed on the capital market.

Futuretek, which has only recently submitted its prospectus to the Hong Kong Stock Exchange, can be considered a "latecomer". As a supplier of intelligent driving solutions, Futuretek has not been established for a long time—it was founded in September 2016 and has only been around for more than 8 years.

In the prospectus, the company stated that the founder is Zhang Lin, an American Chinese. However, a review by "Zidan Finance" revealed that Zhang Lin was not present at the beginning of Futuretek's establishment. Instead, Li Shufu and his children appeared early on the list of initial shareholders.

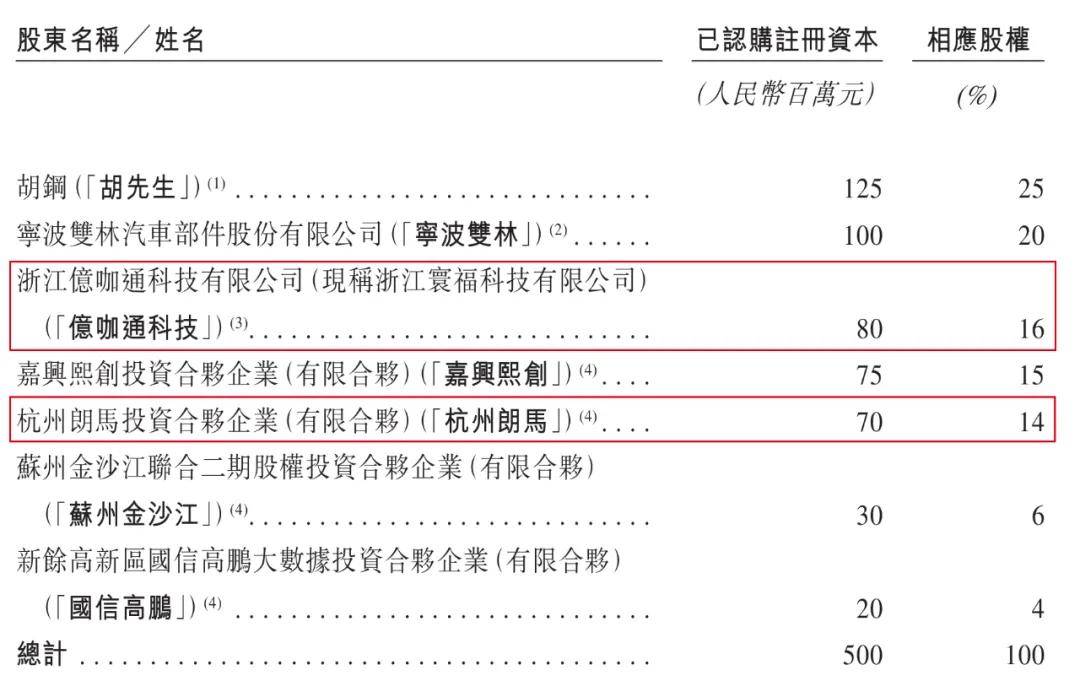

The prospectus shows that when it was established, Ecarx (now known as Zhejiang Huanfu Technology Co., Ltd.), which was co-founded by Li Shufu, held a 16% equity stake in Futuretek.

At the same time, a company named Hangzhou Langma Investment Partnership held a 14% stake, with Li Shufu's daughter Li Ni and son Li Xingxing holding over 99% of the equity.

(Picture / Futuretek Prospectus)

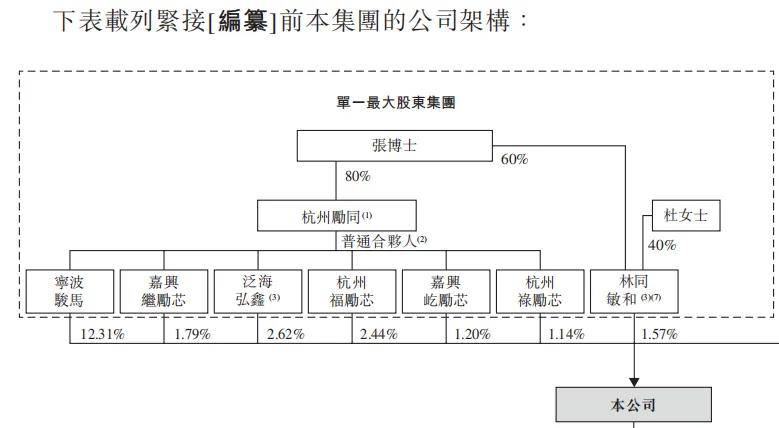

In subsequent developments, the Geely system has carried out a series of equity transfers for Futuretek and is still the company's largest institutional shareholder. Before the IPO, Ningbo Junma, where Li Shufu held over 90% of the shares, was the company's single largest shareholder, controlling 12.31% of the equity.

On the other hand, Zhang Lin's shareholding was quite fragmented. According to Tianyancha, Zhang Lin held equity in Futuretek through multiple equity incentive platforms and Ningbo Junma, with an equity ratio of less than 3%, far less than that of the Geely system.

(Picture / Futuretek Prospectus)

Regarding whether Zhang Lin invested at the time of establishment and whether there was any nominee holding behavior, and why Zhang Lin's shareholding ratio was so low as the founder, "Zidan Finance" attempted to inquire with Futuretek but had not received a response as of press time.

In fact, the management of Futuretek has deep ties with Geely. From April 2011 to February 2016, Zhang Lin served as Vice President of Geely Holding Company. In addition, Co-Secretary Guo Lei and Vice President of Human Resources and Integrated Administration Peng Wenshuai both worked at Geely, while Non-Executive Director Yang Jian has served as Vice Chairman of Geely Holding Company since December 2012.

On the business side, Geely has continuously supported Futuretek.

The prospectus shows that from 2021 to the first half of 2024, the company generated revenues of 333 million yuan, 328 million yuan, 908 million yuan, and 312 million yuan. During this period, Geely Group has always been one of the company's top five customers.

(Picture / Futuretek Prospectus)

In 2023, Geely Group became Futuretek's largest customer, contributing 393 million yuan, accounting for 43.3% of total revenue. In the same year, Futuretek's revenue surged, increasing by 177% year-on-year.

Escorted by Geely all the way, Futuretek has come to the door of the Hong Kong Stock Exchange. However, Futuretek should understand that in the future, regardless of whether it goes public or not, the company should learn to "walk" independently.

2. Starting with low-end products and thin profits, accumulating losses of nearly 2.9 billion yuan

The prospectus shows that Futuretek's products cover Advanced Driver Assistance Systems (ADAS) and Autonomous Driving Systems (ADS) technology solutions.

Unlike Horizon Robotics, Pony.ai, and other companies that focus on high-level intelligent driving at L3 and L4, Futuretek chose to be the first to implement simple L0 and L1 intelligent driving solutions when it started.

This approach is inherently a "double-edged sword".

On the one hand, low-end intelligent driving technology is relatively mature, allowing Futuretek to achieve product commercialization early.

On the other hand, the low threshold for low-end intelligent driving technology means that products are mainly invested in hardware, which also means that such suppliers have less say in front of automakers. Automakers that are engaged in a "price war" are bound to compress parts costs, thereby squeezing suppliers' profits.

In the prospectus, Futuretek candidly admitted that the automotive OEM supply chain is highly competitive, with a limited number of automotive OEMs served. In the supply chain, competition between existing participants and new market entrants is becoming increasingly fierce, further exacerbating pricing pressure.

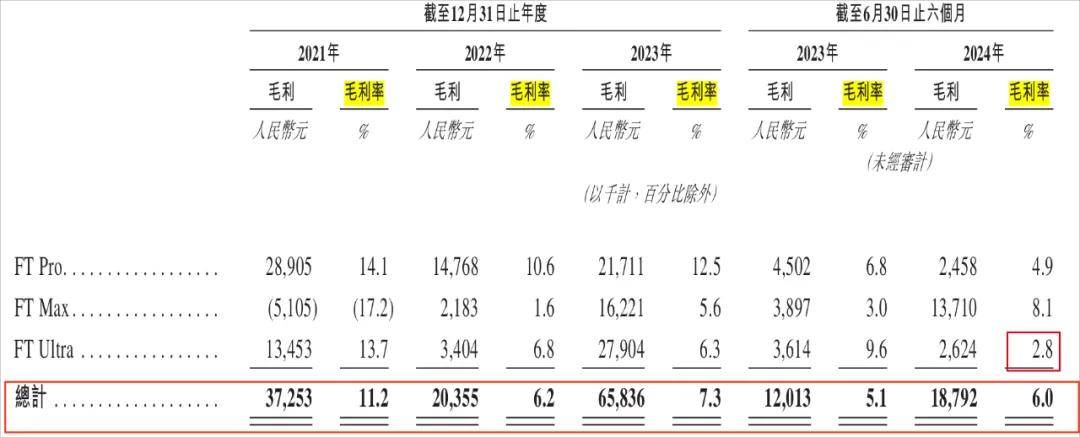

From past data, Futuretek's profits have been quite thin. From 2021 to the first half of 2024, the company's gross profit margins were 11.2%, 6.2%, 7.3%, and 6.0%, respectively, showing an overall downward trend.

(Picture / Futuretek Prospectus)

Even though it has already offered significant discounts, Futuretek's inventory levels continue to rise. From 2021 to the first half of 2024, the company's inventory was 151 million yuan, 389 million yuan, 419 million yuan, and 427 million yuan, respectively.

(Picture / Futuretek Prospectus)

More importantly, its inventory turnover rate has slowed down. During the same period mentioned above, the company's inventory turnover days were 135.8 days, 316.3 days, 172.8 days, and 259.9 days, respectively.

(Picture / Futuretek Prospectus)

Against this backdrop, it was "expected" that Futuretek would incur losses.

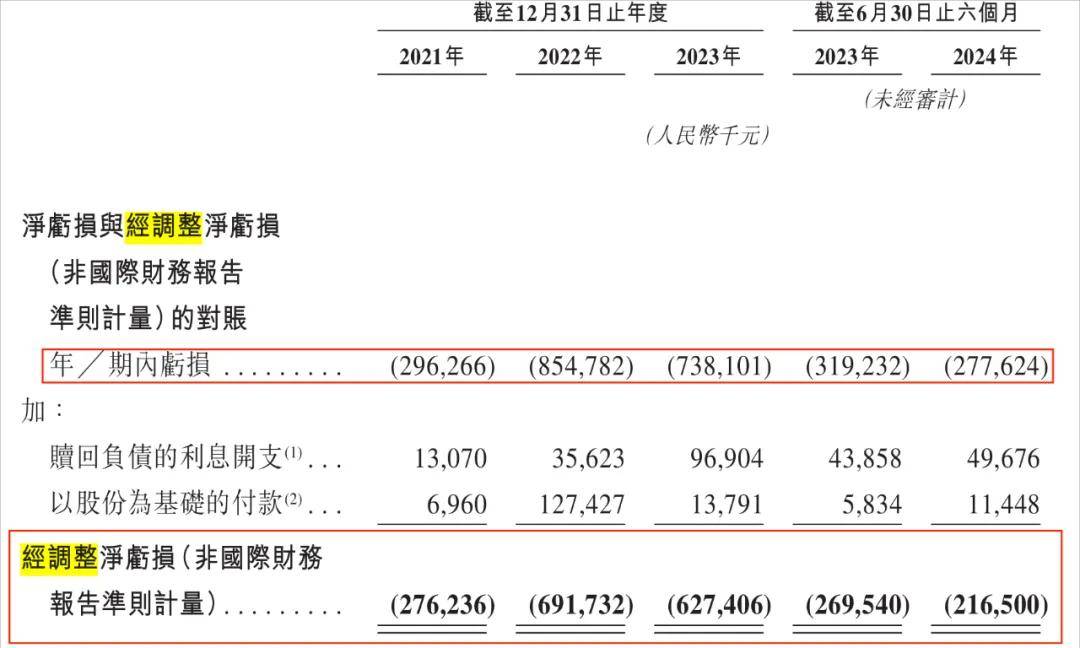

The prospectus shows that from 2021 to the first half of 2024, Futuretek incurred net losses of 296 million yuan, 855 million yuan, 738 million yuan, and 278 million yuan, respectively; adjusted net losses (measured under non-IFRS) were 276 million yuan, 692 million yuan, 627 million yuan, and 217 million yuan, respectively.

(Picture / Futuretek Prospectus)

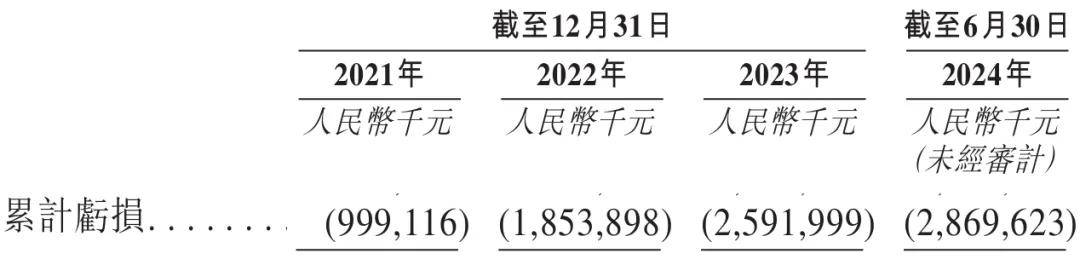

Years of cumulative losses have pushed Futuretek's total losses to a high level. The prospectus shows that as of June 30, 2024, the company had accumulated losses of 2.87 billion yuan.

(Picture / Futuretek Prospectus)

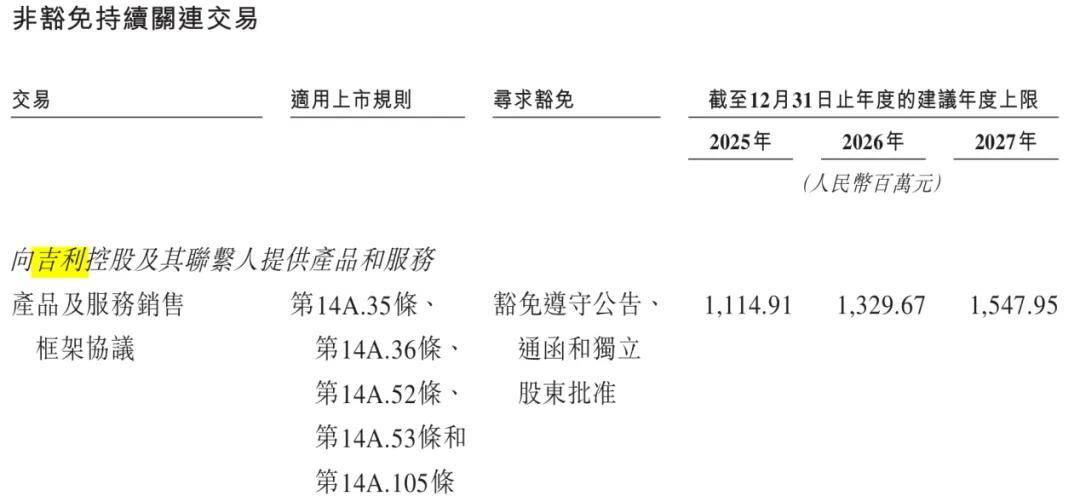

Fortunately, Geely has given Futuretek a "reassurance pill". The prospectus shows that from 2025 to 2027, the upper limit for the company to provide products and services to Geely Holding and its contacts will be 1.115 billion yuan, 1.33 billion yuan, and 1.548 billion yuan, respectively.

(Picture / Futuretek Prospectus)

With these cooperation agreements in place, Futuretek should be able to navigate the next three years with relative ease.

3. Raising 1.6 billion yuan in three years, cash flow under pressure

As the largest automobile market in the world, China provides vast opportunities for the commercialization of intelligent driving technology. According to data from Zero2IPO Intelligence, by 2028, the market size for mass-produced intelligent driving solutions in China is expected to reach 210.3 billion yuan.

Every blue ocean is not short of competitors.

Futuretek candidly admitted that the industry faces fierce competition. To break through in this brutal elimination game of "advance or fall behind," one must either have a sufficiently strong scale effect to achieve sufficiently low prices or occupy the technological high ground and become an indispensable partner for automakers. This requires continuous large investments in research and development to upgrade and iterate products.

Judging from Futuretek's actions, the company is constantly upgrading its products and technologies. Its intelligent driving solution technology has gradually been upgraded to the L2++ level, and it is now advancing the development of L3-level solutions.

The prospectus shows that before the IPO, Futuretek's product matrix expanded from FT Pro and FT Max to the more advanced FT Ultra. Among them, FT Pro has been iterated to the second generation, and FT Max to the third generation.

In addition, in 2022, the company also released the ODIN platform, an integrated intelligent driving technology platform that combines hardware and software.

(Picture / Futuretek Prospectus)

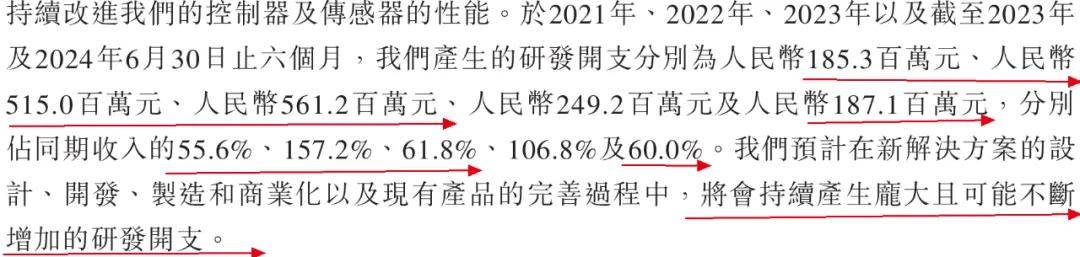

These research and development efforts have consumed a huge amount of funds. From 2021 to June 2024, the company's research and development expenditures were 185 million yuan, 515 million yuan, 561 million yuan, and 187 million yuan, respectively, accounting for 55.6%, 157.2%, 61.8%, and 60.0% of revenue for the same periods, respectively.

Futuretek expects that the company will continue to incur large and potentially increasing research and development expenditures during the design, development, manufacturing, and commercialization of new solutions and the improvement of existing products.

(Picture / Futuretek Prospectus)

So, where does the money come from?

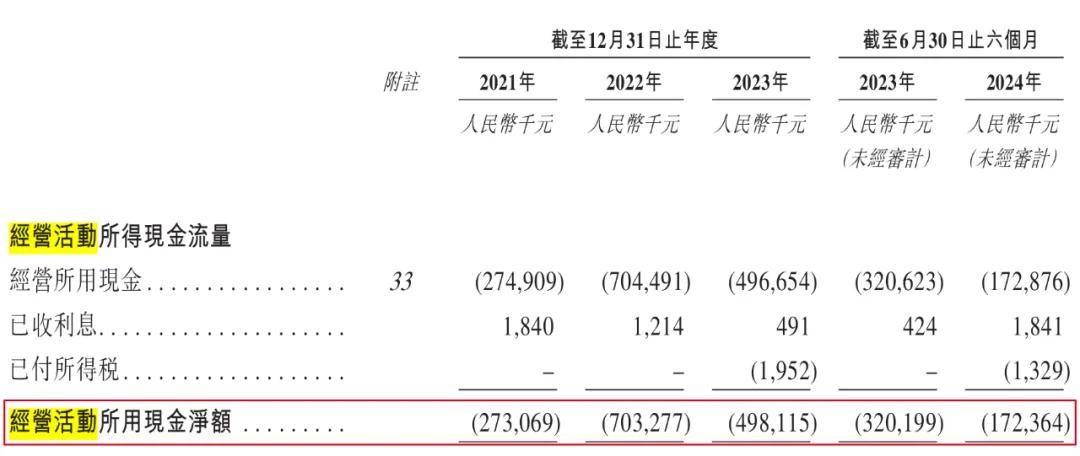

From the perspective of the enterprise itself, the company lacks "blood-making ability". From 2021 to the first half of 2024, the company achieved net operating cash flow of -273 million yuan, -703 million yuan, -498 million yuan, and -172 million yuan, respectively, remaining in an outflow state for a long time.

(Picture / Futuretek Prospectus)

In the past, Futuretek was heavily reliant on investment. From June 2021 to May 2024, the company conducted nine rounds of funding, raising approximately 1.6 billion yuan, but these funds have been largely exhausted.

As of November 17, 2024, Futuretek had utilized 94.91% of the funds raised.

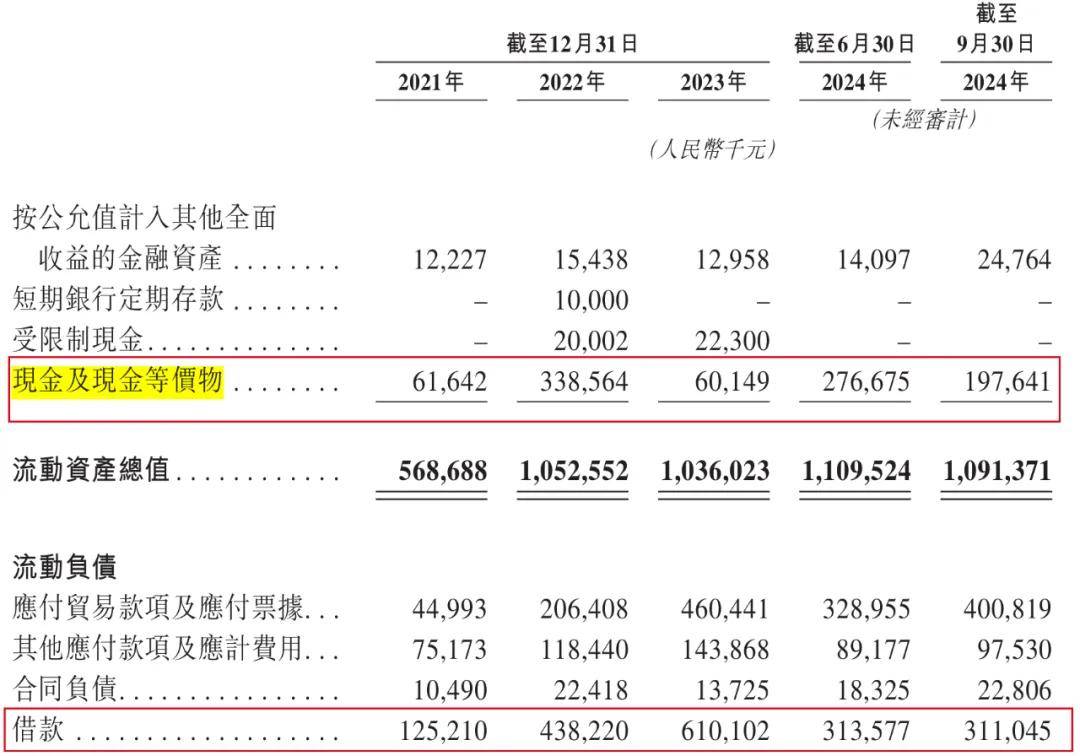

As of September 30, 2024, Futuretek had cash and cash equivalents of 198 million yuan and short-term borrowings of 311 million yuan, indicating significant pressure on its capital chain.

(Picture / Futuretek Prospectus)

According to Futuretek, as of September 30, 2024, the company had unused bank financing of 1.1 billion yuan. If used solely for daily operations, these funds can naturally support operations for a considerable period.

However, if these funds are to support high research and development investments, they may not last long. In the prospectus, Futuretek stated that its working capital could meet current needs and those for the next 12 months from the date of the document.

It is still noteworthy that if Futuretek uses bank financing in large amounts, it will not only increase debt but also incur certain financing costs. Going public only requires issuing new shares, which is more "economical" due to lower costs and higher financing limits. This provides some insight into why Futuretek chose to rush into the capital market at this time.

In the past few years, Futuretek has also been a favorite of capital. The prospectus shows that after the last round of funding this year, Futuretek's post-investment valuation has reached 6.06 billion yuan.

Next, "Zidan Finance" will continue to keep a close eye on whether Futuretek can successfully land on the capital market.

*The lead image in the article is from Shutterstock, based on the VRF agreement.