ZEEKR spends over 9.3 billion yuan to acquire a controlling stake in Lynk & Co: intensifying intra-brand competition

![]() 12/02 2024

12/02 2024

![]() 861

861

During the strategic transformation phase of Zhejiang Geely Holding Group (hereinafter referred to as "Geely Holding"), the merger of the two major Geely brands, ZEEKR (ZK.N) and Lynk & Co, has attracted market attention. Geely Holding and Volvo Cars will sell their shares in Lynk & Co to ZEEKR. ZEEKR will pay a total of 9.367 billion yuan for equity transfers and capital increases. Upon completion of the transaction, ZEEKR will hold a 51% stake in Lynk & Co.

Stockstar notes that the reason for brand integration is that ZEEKR and Lynk & Co have overlapping products and vague brand positioning to some extent, limiting their respective development. However, both brands are currently losing money, and ZEEKR is also facing a year-on-year decline in gross margin in the third quarter, putting considerable pressure on its own operations. Coupled with the broader market coverage after the merger, it remains to be seen whether the combined "1+1>2" positive development can be achieved in the fiercely competitive new energy vehicle market.

01. ZEEKR's reverse acquisition

Recently, Geely Holding announced that it would transfer an 11.3% stake in ZEEKR to Geely Automobile (00175.HK). Upon completion of the transaction, Geely Automobile's stake in ZEEKR will increase to approximately 62.8%.

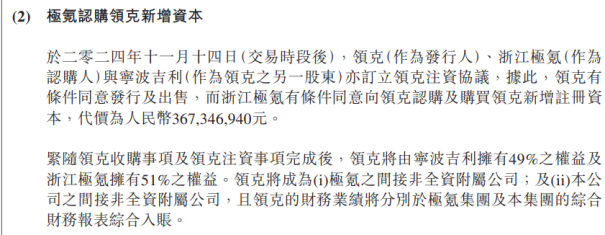

At the same time, the group is also optimizing the equity structure of Lynk & Co to promote comprehensive strategic synergy with ZEEKR. According to an announcement issued by Geely Automobile, Geely Holding will transfer a 20% stake in Lynk & Co to Zhejiang ZEEKR for 3.6 billion yuan, while Volvo Cars will transfer a 30% stake to Zhejiang ZEEKR for 5.4 billion yuan. Upon completion of the transaction, Ningbo Geely and Zhejiang ZEEKR will each hold a 50% stake in Lynk & Co, and Volvo Cars will completely exit.

Meanwhile, ZEEKR will increase the registered capital of Lynk & Co by 367 million yuan. In summary, by investing 9.367 billion yuan, ZEEKR will hold a 51% stake in Lynk & Co, thereby gaining control, while Ningbo Geely will hold a 49% stake.

Stockstar notes that ZEEKR may need external financing to cover the first phase of costs. Specifically, the transaction will be carried out in two steps. At the closing date, ZEEKR needs to pay 70% of the consideration, approximately 6.3 billion yuan, to Geely Holding and Volvo Cars, with the remaining 30% to be paid within the following 12 months. As of the end of the third quarter of this year, ZEEKR's cash and cash equivalents amounted to 5.641 billion yuan. This means that ZEEKR will not be able to fully pay the 70% consideration in the first phase of the transaction. Geely Automobile also expects the acquisition to be funded from ZEEKR's internal cash reserves and external financing.

According to information, both ZEEKR and Lynk & Co are brands under Geely. Among them, Lynk & Co, established in 2017, represents Geely's brand advancement. The predecessor of ZEEKR was the electric vehicle division of Lynk & Co, and its first model, the ZEEKR 001, was previously the concept car Lynk & Co ZERO. This merger also means that Lynk & Co has been reverse-acquired by ZEEKR, which it incubated.

At Geely Automobile's third-quarter earnings conference, Geely Automobile's CEO and Executive Director, Gui Shengyue, stated that although the two brands have different positioning, their pricing overlaps. Without integration, this would inevitably lead to industry competition issues. Meanwhile, internal conflicts have arisen during the operation of ZEEKR and Lynk & Co, as their new products compete with each other in the market. Additionally, both brands have seen repeated investments in areas that could have been shared, such as research and development, architecture, and sales.

Clearly, this integration is aimed at avoiding intra-brand competition. According to the initial plan, Lynk & Co focused on gasoline and hybrid vehicles, while ZEEKR specialized in pure electric vehicles. Amid the wave of new energy, Lynk & Co launched its first pure electric sedan, the Z10, this year, with a price range highly overlapping with that of the ZEEKR 001 and 007, directly diverting users.

Simultaneously, ZEEKR has also undergone a new strategic shift, announcing its entry into the hybrid vehicle sector. At Geely Automobile's mid-year earnings conference this year, An Conghui, President of Geely Holding and CEO of ZEEKR, revealed that ZEEKR's large flagship SUV model will feature two powertrain options: pure electric and super hybrid, with an expected release in the fourth quarter of 2025.

Regarding the development plans after the integration of the two brands, An Conghui responded at ZEEKR's third-quarter earnings conference that the merger is not a simple combination but a deep reorganization of their businesses. The two brands will maintain a dual-brand strategy, remaining relatively independent and distinct from each other.

02. Pressure on listed companies and target performance

As passenger vehicle brands incubated within Geely Automobile, both ZEEKR and Lynk & Co have maintained rapid sales growth this year. Data shows that Lynk & Co sold 31,074 vehicles in October, setting a new record with year-on-year and month-on-month growth rates of approximately 26% and 20%, respectively, with new energy vehicles accounting for over 64% of sales. From January to October, Lynk & Co sold a cumulative total of 226,700 vehicles, representing a year-on-year increase of nearly 38%. ZEEKR delivered 25,049 vehicles in October, with year-on-year and month-on-month growth rates of 92% and 17%, respectively. From January to October, it delivered approximately 167,900 new vehicles, representing a year-on-year increase of 82%.

However, due to the intensifying price war in the domestic new energy vehicle market, both ZEEKR and Lynk & Co are currently incurring losses. Lynk & Co achieved profitability in its second year of operation but saw its performance decline as the market share of gasoline vehicles shrunk. In 2023, it swung from profit to loss, incurring a significant loss of 1.11 billion yuan. In the first half of this year, Lynk & Co generated revenue of 21.3 billion yuan, with losses narrowing year-on-year but still reaching 250 million yuan.

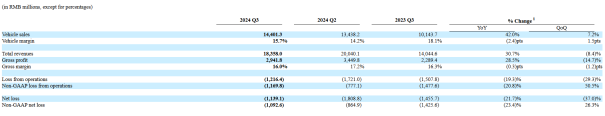

ZEEKR is also facing difficulties, accumulating losses of over 20 billion yuan from 2021 to 2023, with a cumulative net loss of 4.97 billion yuan in the first three quarters of this year. In the third quarter, it generated revenue of 18.358 billion yuan, up 30.7% year-on-year but down 8.4% month-on-month, with a net loss of 1.139 billion yuan, representing a year-on-year decrease in losses of 21.7% and a month-on-month decrease of 37%.

Despite reducing losses, ZEEKR's vehicle profitability has not improved. Its third-quarter vehicle gross margin was 15.7%, compared to 18.1% in the same period last year and 14.2% in the second quarter of this year. Although sales increased by over 50% in the third quarter, its profitability was lower than in the same period last year. Regarding the change in gross margin, ZEEKR stated that the year-on-year decrease was mainly due to lower average selling prices, with varying product mix and pricing strategies between the two quarters, while the month-on-month increase was mainly attributed to changes in product mix.

Amid losses, the newly integrated ZEEKR will cover a broader market space, meaning it will face more competitors. An Conghui stated that ZEEKR previously targeted the 250,000 to 500,000 yuan market segment. After integration, it will encompass the 150,000 to 300,000 yuan range, allowing ZEEKR to cover approximately 60% of the Chinese automotive market's sub-segments.

Currently, ZEEKR's main competitors are NIO, XPeng, Li Auto, Xiaomi SU7, etc. After merging with Lynk & Co, it will cover even more competitive models, such as traditional manufacturers' models like the BYD Han and Deep Blue S07, as well as new force models like the Zero Run C11. The 200,000 to 300,000 yuan price range is the most fiercely competitive segment and the main battleground for automakers.

It is worth mentioning that Geely Holding plans to build ZEEKR and Lynk & Co into globally leading high-end luxury new energy vehicle groups with annual production and sales of one million units by the end of 2026.

ZEEKR, deeply entrenched in losses, has spent nearly 10 billion yuan to acquire the loss-making Lynk & Co. Besides intensifying financial pressure on the profit side, it will also face greater market competition. Whether the merger can ultimately achieve a "1+1>2" effect remains to be seen over time. (This article was originally published on Stockstar, authored by Lu Wenyan)

- End -