Monthly sales of 10,000 vehicles is the lifeline for new forces

![]() 12/02 2024

12/02 2024

![]() 434

434

Almost everyone at the poker table has tasted the dividends of the times.

As the year draws to a close, new energy vehicle sales continue to surge under the boost of the golden September and silver October. With favorable policies, surging sales have become the main theme for new forces.

Although all brands talk about avoiding internal competition, sales posters for November were still released on time on the first day of December. Even though it was a weekend, the first sales poster was released at 7 am on time, which is quite competitive.

The good news is that for most new force automakers, November was a season of harvest, with significant year-on-year and month-on-month sales growth. They should be able to deliver a satisfactory year-end report for 2024.

Leapmotor surpasses 40,000 sales, intensifying head-to-head competition

Unlike in October, there is one more brand that surpassed 40,000 sales in November. The top new forces have evolved from a three-way battle to a four-way contest, with the gap between them gradually narrowing. Perhaps only those consistently maintaining sales above 50,000 can secure the top spot.

With sales of 48,740 vehicles in November, Li Auto retained its position as the top-selling new force. Notably, Li Auto did not maintain its October sales of over 50,000 vehicles to widen the gap with competitors behind it. Instead, sales declined by about 5%, making it one of the few new forces to experience month-on-month declines.

On the other hand, after reaching the top, Li Auto can hardly rest easy as more and more brands are chasing after it. Especially as more automakers turn to the extended-range market, Li Auto's uniqueness in the market faces significant challenges. Extended-range technology can no longer give Li Auto an edge.

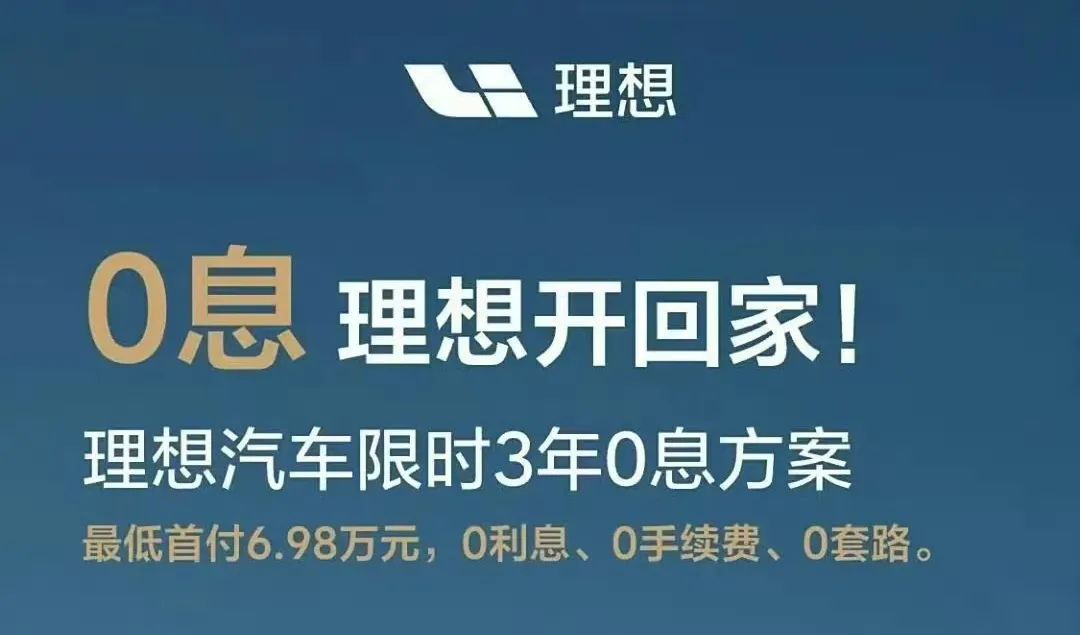

Facing such difficulties, Li Auto has not come up with a good response strategy yet. After the failure of the MEGA model earlier this year, the highly anticipated pure electric model has been internally delayed. It has become difficult to maintain a sufficient advantage with the L series alone, especially after a price adjustment. The only solution Li Auto can offer is a three-year interest-free promotion, hoping to attract hesitant consumers.

It remains to be seen whether Li Auto will further follow up with Tesla's five-year interest-free policy to ensure a perfect close to December sales.

Aion, coming in second, has demonstrated with its strength that pure electric models still have great potential in the new energy market. Maintaining sales above 40,000 again shows the huge potential of pure electric models. Since the second half of the year, Aion has continuously launched new models, finally getting sales back on track. Behind the double growth in year-on-year and month-on-month sales is the popularity of new models.

Although Aion did not mention specific models in its sales poster, according to sources, Aion RT achieved sales of 10,000 in its first month on the market. Aion won the market with its absolute cost-effectiveness, offering lidar and advanced intelligent driving assistance at a price of 150,000 yuan. Perhaps as the market says, there are no poorly selling models, only poorly priced ones.

Meanwhile, Aion's next model was also unveiled at the Guangzhou Auto Show. The Aion UT model will target a lower market segment, the A0-class market with a price of 100,000 yuan. Focusing on this segment has become the main theme for automakers this year, as capturing the market and sales is crucial for survival.

After integrating sales data this year, Hongmeng Zhixing's sales performance has remained in the top three, but its competition with Li Auto has gradually waned. This month, it unfortunately slipped to third place.

Hongmeng Zhixing's most important task at present is the growth of its three brands other than AITO. Although Zhijie has been on the market for nearly a year, its sales are still some distance from being "extremely impressive." Sales significantly improved after the launch of the second model, Zhijie R7.

To boost Zhijie's sales, Yu Chengdong has also started aggressive marketing. On December 1, he personally attended the delivery event of the new Zhijie S7, demonstrating his dedication. After all, among the current "four realms," only AITO and Zhijie can generate significant sales volumes. Xiangjie and Zunjie may struggle to support larger sales figures due to their positioning and pricing.

As a newcomer to the 40,000-vehicle-per-month club, Leapmotor has demonstrated the unlimited potential of new forces with its actions. In less than a year, it has risen to the top of new forces, leaving behind its former competitors and creating its own sales miracle.

Leapmotor's strategy is actually quite simple. As Zhu Jiangming said in an advertisement, Leapmotor has successfully won over consumers with its good-quality-yet-affordable pricing, which aligns well with the demand for consumption transformation in this era. Although it has been called a cheaper alternative to Li Auto, Leapmotor has indeed achieved precise positioning and balanced trade-offs, successfully capturing consumers who hesitate over price.

In this fiercely competitive environment, the top rankings may seem unchanged, but there are undercurrents. No one can guarantee that their ranking will remain rock-solid. Only by continuously widening the gap can one retain the hard-won title of a leading new force.

The battle continues among second-tier players

As competition intensifies, the threshold for the middle tier is also rising, with sales of 20,000 vehicles required to qualify. Meanwhile, brands with sales above 30,000 are constantly chasing the top spots. Although they are all competitors, they do not seem to be competing directly with each other.

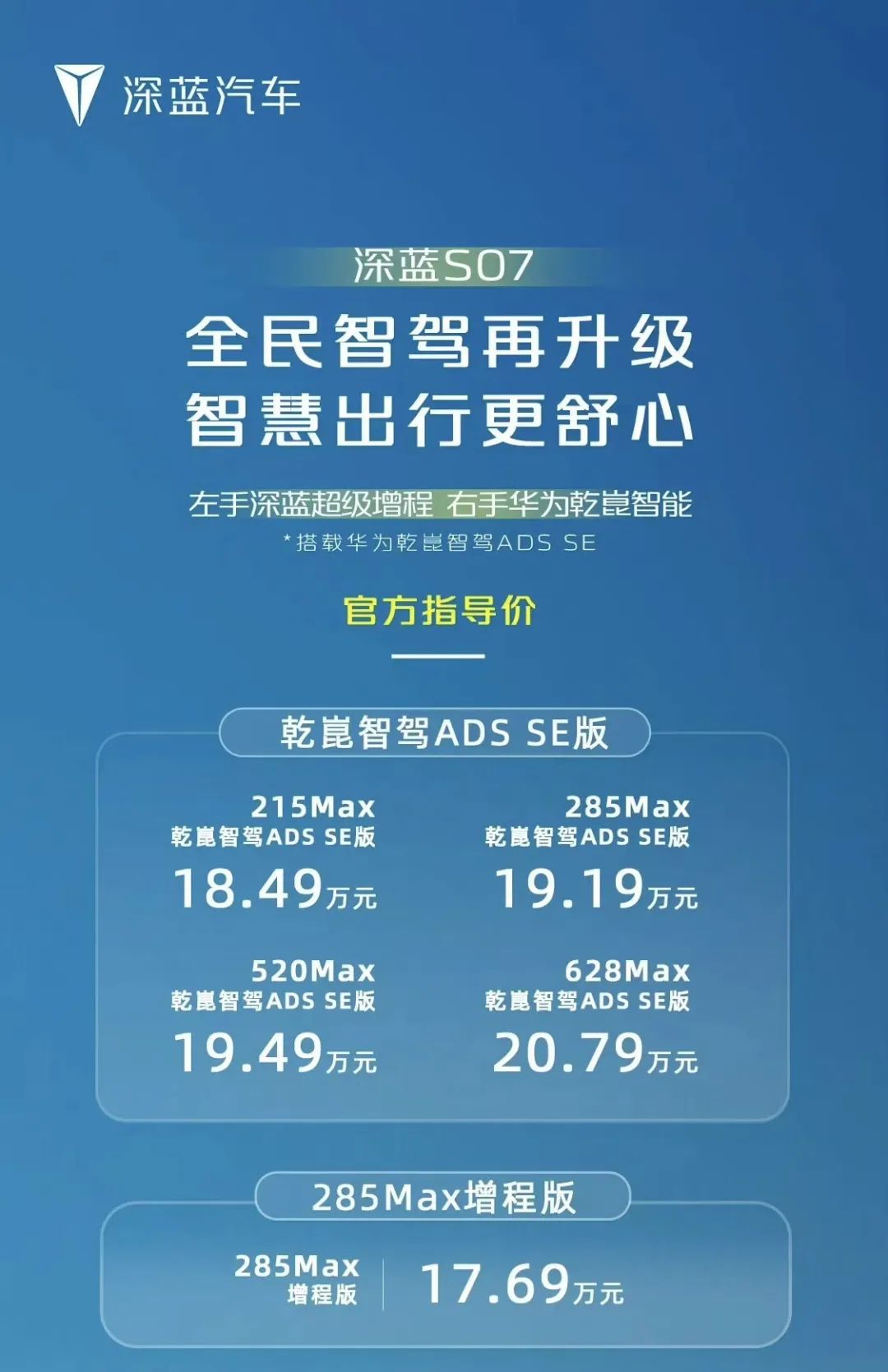

With sales of 36,026 vehicles, Deep Blue has secured a leading position in the middle tier. Deep Blue can be said to have seized the two hottest resources in the new energy sector: Huawei's Kunlun intelligent driving and Changan's super extended-range technology. With this combination, Deep Blue has effectively captured the lower-tier market that Hongmeng Zhixing has not yet reached.

Relying on these technological advantages, Deep Blue became the brand with the fastest month-on-month growth in November, surpassing the surging XPeng with a 29.30% increase. This proves that with Huawei's technological support, consumers are willing to pay for better technology.

It can only be said that the lower-tier market that Hongmeng Zhixing cannot reach in the future will all fall to Deep Blue. Relying on its first-mover advantage, Deep Blue has become the best-selling non-Hongmeng Zhixing model equipped with Huawei's intelligent driving system.

XPeng summarized November as a "new starting point." After a decade on the market, XPeng's sales finally reached 30,000 vehicles per month, achieving a successful turnaround with sales of 30,895 vehicles. After a long period of adjustment, He Xiaopeng finally discovered the secret to market sales, inspired by Lei Jun and Xiaomi Automobiles.

With the MONA M03 and XPeng P7+ models, XPeng, which had been silent for years, finally emerged from its development bottleneck, with sales steadily increasing. This has allowed He Xiaopeng to finally experience the pain brought by success, as insufficient production capacity has become XPeng's most pressing issue.

However, the scale of capacity expansion has become the biggest contradiction. After all, the market changes too quickly, and no one can guarantee that large-scale expansion will not be followed by a decline in sales. Balancing delivery and production has become a contradictory choice for He Xiaopeng.

Of course, the sales increase has brought more confidence. XPeng quickly made a new move, announcing that the XPeng X9 will launch an eight-seat version. Judging from the product positioning, this model is more likely to target business travel, as the free policy for minibuses only applies to seven-seat and smaller models. The eight-seat version should appeal more to business users.

Perhaps by removing the lidar, the overall vehicle price can be reduced, stirring up the MPV market and making an already fiercely competitive segment even harder to call.

Compared to other brands, ZEEKR's performance in November can only be described as steady. With a combination of six models, year-on-year sales growth exceeded 100%, indicating that the sales growth brought by the models is significant, especially for mainstream models like the 007 and 7X.

With guaranteed sales, ZEEKR can explore more options. Innovative models like the ZEEKR X and ZEEKR MIX also bring some different solutions to the new energy market.

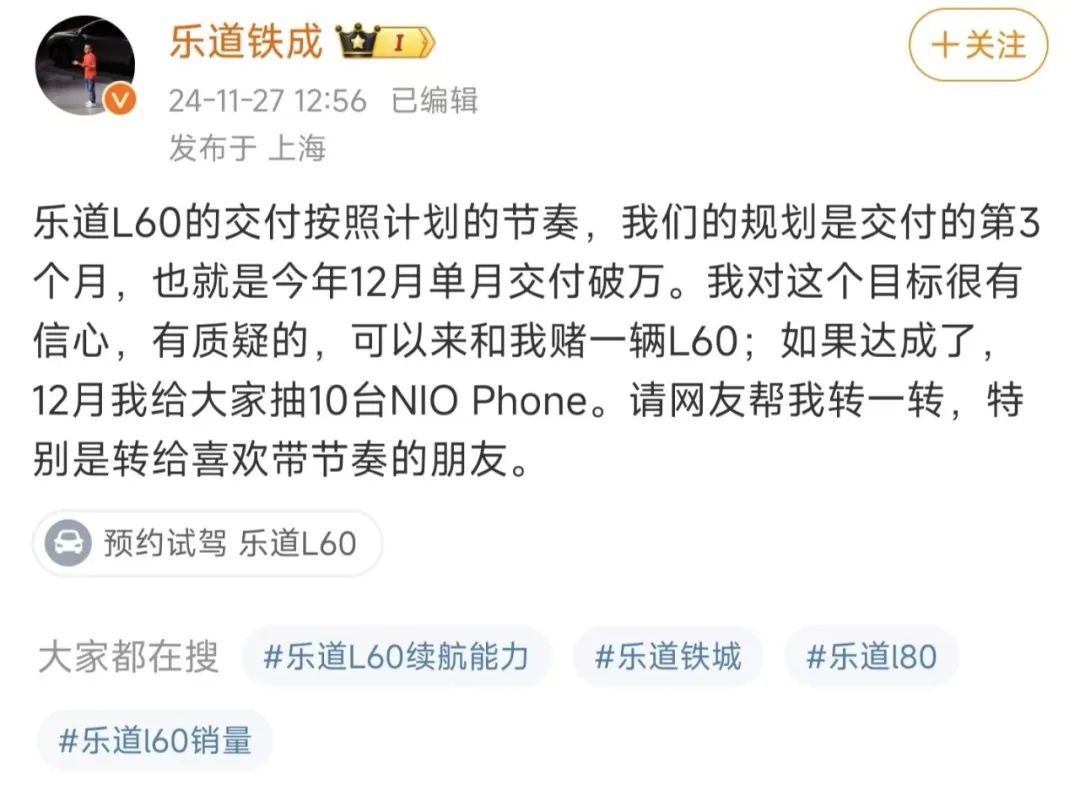

NIO's sales have stagnated since rising to 20,000 vehicles. Especially after the launch of the NIO L60, the expected surge in sales did not materialize. NIO mostly attributed this to insufficient production capacity.

After two months of difficult deliveries, NIO finally achieved its goal of delivering 10,000 vehicles on the first day of December. True to NIO's style, a bottle of red wine was given to all car owners to celebrate. According to NIO, more than 10,000 vehicles will be delivered in December, returning to normal. Even Ai Tiecheng made a bet with netizens about it.

The once-glorious "WXL" (Wei Xiaoli, referring to NIO, XPeng, and Li Auto) has undergone changes in just one year. XPeng has smoothly returned to the right track, and Li Auto remains at the forefront of new forces. However, NIO seems to be stuck in place, which is quite regrettable.

The mysterious Xiaomi still presented its sales poster with a figure of 20,000+ vehicles. The only confirmation is that Xiaomi Automobile completed its delivery target of 100,000 vehicles in November, becoming the first new force automaker to achieve its 2024 sales target.

Of course, driven by increased production capacity, Xiaomi Automobile has set a higher annual target, increasing from 120,000 to 130,000 vehicles. As for whether it can be achieved, my personal view is that Xiaomi can definitely do it. After all, such a promotional strategy is what Xiaomi Automobile excels at. Since the start of deliveries, Xiaomi Automobile has almost completely followed the plan without any deviation. Even the 100,000th vehicle rollout was completed before the Guangzhou Auto Show.

Xiaomi has successfully shaped its success through a progress-tracking promotional strategy. From the outside, it seems that Xiaomi can achieve every goal it sets. Subconsciously, everyone believes in Xiaomi Automobile's success, which has smoothly completed brand building. Moreover, as the promotional rhythm progresses, more details about Xiaomi's second model are gradually being revealed. It can be said that Xiaomi has provided a practical marketing lesson for the entire automotive industry in 2024. How many competitors can learn from it depends entirely on their own fortune.

For models with sales below 20,000 vehicles, sales growth is even more evident, especially with year-on-year growth rates doubling. It can be said that after successfully surviving the year, the dawn of victory is finally drawing near.

However, not all news is good. Nezha Auto, which was once on the list, has given up on the sales ranking, failing to announce sales for two consecutive months. Although it is still active on various social platforms, the future of Nezha seems uncertain from the outside.

More importantly, the founder Fang Yunzhou, who once comfortably resided behind the scenes, has begun to frequently appear in the spotlight, while Zhang Yong, who was once in the forefront, has become silent. Zhang Yong's Weibo also stopped after interacting with Zhou Hongyi on October 14. From the outside perspective, changes are afoot at Nezha.

Looking back at November's sales of new forces, with policy support, most automakers achieved their best annual sales performance. It can be said that as long as automakers persevere to the present, they will have good results. In the domestic market, where the penetration rate of new energy vehicles is rapidly increasing, they can always ride the dividends of the times forward.

As the final battle, the race for the last sales is officially underway from the day the sales posters are released. All available discounts begin to be concentrated to push sales to a new level in 2024.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.