Four Dimensions to See the Great Changes in the New Energy Vehicle Industry by 2025

![]() 12/03 2024

12/03 2024

![]() 593

593

In the past two days, many new energy vehicle companies have announced their monthly sales figures for November, with several of them setting new highs in deliveries.

BYD sold 506,800 vehicles, a year-on-year increase of 67.87%; Zero-Run delivered 40,169 vehicles, a year-on-year increase of 117%, and monthly sales exceeded 40,000 vehicles for the first time; XPeng delivered over 30,895 new vehicles in a single month, a year-on-year increase of 54%, and exceeded 30,000 vehicles for the first time, etc.

This trend has also driven the continued rapid growth of China's new energy passenger car market in the fourth quarter of this year.

Cui Dongshu, Secretary-General of the China Passenger Car Association, recently stated that domestic sales of new energy passenger cars in China are expected to reach 3.55 million in the fourth quarter of 2024, a year-on-year increase of 39%.

Behind this, since Tesla entered China in 2014, China's new energy vehicle industry has been accelerating for ten years.

In these ten years, China has become the world's largest new energy vehicle market, with sales of new energy passenger cars accounting for more than 60% of the global market.

The world's largest battery manufacturer, Contemporary Amperex Technology Co. Limited (CATL), has emerged in the Chinese market, with its global market share stabilizing at 37% this year; Similarly, BYD has also benefited greatly from this wave of industrial development. From January to September this year, it sold 2.4666 million new energy vehicles, with a market share of 34.6% in the Chinese market, making it the world's top-selling new energy vehicle company.

So far, most of the new automakers you can name, from U.S. stocks to Hong Kong stocks, have also entered the capital market.

However, these are just one aspect of the rise of China's new energy vehicle industry.

Image/China Passenger Car Association

On the other hand, over the past decade, the industry's growth momentum has shifted from policy-driven in the early stages to price- and technology-driven in recent years. However, most automakers have not yet entered a truly "healthy zone":

Apart from those who have already been eliminated in the knockout rounds, many more automakers have not yet achieved self-sufficiency;

Even automakers that have firmly established themselves in the market cannot relax their guard. A failed launch event or an inappropriate marketing strategy can plunge them into crisis;

Competitive factors in the industry continue to diversify. In the era of "chaos combat," any shortcoming can be infinitely magnified, and any strength can be surpassed;

...

From today's perspective, the window period for entering the vehicle manufacturing industry may have already closed, or even earlier.

When Xiaomi first entered the vehicle manufacturing industry, Lei Jun said that some people believed at the time that Xiaomi had missed the window period for entering the market. In the past two years, there have been fewer and fewer new players announcing their entry into the vehicle manufacturing industry.

To some extent, this also means that the market competition landscape is accelerating towards a new stage—the knockout round.

A few days ago, on the occasion of NIO's tenth anniversary, founder Li Bin pointed out in an internal letter that the competitors from ten years ago are completely different from today's. He said, "In the next two or three years, this will be the most intense and brutal stage for the entire industry, and only a few excellent companies will survive."

Earlier, He Xiaopeng, Chairman of XPeng Motors, and Lei Jun also publicly stated that the industry knockout round will truly begin in 2025, and no more than five brands will remain on the table.

Now that 2025 is approaching rapidly, no company can be sure that it will remain on the table. They must remain sufficiently sensitive to the market, highly vigilant about competition, and cautious enough in decision-making.

01

Intelligent Driving, "Cost-Effectiveness," and Product Systems: The "Three Major Battles" That Cannot Be Lost

If we were to extract a few keywords from the industry changes in 2024, they would undoubtedly be:

Price war, intelligent driving, PHEV (Plug-in Hybrid Electric Vehicle), and multi-model and multi-brand layouts.

Among them, a price war seems to be the simplest and most effective method to drive sales growth.

In recent days, Tesla, which has frequently initiated price wars in the past, has lowered its prices again—the price of the Model Y has been reduced by 10,000 yuan. According to relevant personnel from Tesla China, this price reduction is mainly related to sprinting towards the company's annual sales target for 2024.

Currently, there are not many automakers following Tesla's price war. Lixiang One launched a limited-time "3-year interest-free" campaign on November 29.

Objectively speaking, there is indeed a potential for a new round of price wars in the industry. From a short-term perspective, automakers need to sprint towards sales. From a long-term perspective, as product homogenization intensifies in the new energy vehicle market, when a player in the industry takes the lead in reducing prices, other players may also be forced to follow suit due to competition.

Wilson Consulting previously predicted that "according to the automotive product cycle, (the price war) is expected to last at least five more years."

Beyond the price war, the competition in intelligent driving capabilities is even more crucial and intense, with a more profound impact on automakers.

This year, automakers have also accelerated their layout around intelligent driving—they are either accelerating their efforts to compensate for shortcomings or continuing to consolidate intelligent driving technology and accelerating its implementation.

BYD, which sells the most vehicles in the industry, is somewhat representative.

Previously, BYD's performance in intelligence was not outstanding, and intelligence was not even the focus of investment for a long time. Citing a previous Caixin report, a new energy vehicle company personnel stated that BYD's main audience had low requirements for intelligent driving at that time, and BYD's shortcomings in intelligent driving did not affect its market demand.

However, the market situation is changing rapidly.

According to monitoring data from the GaoGong Institute of Intelligence, from January to September this year, the delivery of new energy passenger cars priced below 200,000 yuan in the Chinese market accounted for 64.49% of total deliveries; over the same period, the delivery of high-level intelligent driving systems at this price point increased nearly fivefold year-on-year.

Behind this, traditional entry-level L2 assisted driving is accelerating into the upgrade cycle of high-speed NOA, while mid-to-high-end models with relatively low cost sensitivity are also witnessing a major inflection point for the large-scale implementation of urban NOA.

BYD must change and accelerate its catch-up efforts.

A while ago, according to an ECNS report, BYD established a forward-looking department focusing on end-to-end technology implementation.

In addition, BYD's in-house intelligent driving team "Tianlang" also integrated the R&D personnel of another in-house team "Tianxuan" and collectively referred to as one in-house team, with a focus on the mass production and implementation of high-level intelligent driving on a low-level platform, aiming to adapt 50 models by March next year. In BYD's plan, the low-level platform focuses on realizing high-speed pilot functions, while the high-level platform focuses on urban NOA without maps.

BYD's strategy is, to some extent, a microcosm of automakers' intelligent driving layout—on the one hand, sinking intelligent driving capabilities to strengthen competitive advantages in the more mainstream low-price market, and on the other hand, hoping to strengthen brand perception through intelligent driving capabilities and win competition in the mid-to-high-end market.

From another perspective, there is another reason for BYD to increase its investment in intelligence.

At present, major new energy vehicle companies have successively added new powertrain models or models in new price ranges, and BYD is under pressure in all segmented markets.

On the one hand, there are not many automakers that still only adhere to the pure electric route in the current market. This year, almost all automakers have begun to choose a dual-track layout strategy of "pure electric + plug-in hybrid/extended-range hybrid."

The reason is that PHEVs have shown higher growth rates. Only focusing on pure electric vehicles or only on PHEVs is equivalent to handing over market share to others.

According to data from the China Passenger Car Association, from January to October this year, based on retail sales statistics, 4.793 million pure electric vehicles were sold, a year-on-year increase of 19.9%, while 3.532 million plug-in hybrid new energy vehicles were sold, a year-on-year increase of 80.5%—compared with the first half of the year, the growth rate difference has further widened.

Image/China Passenger Car Association

On the other hand, there are not many automakers that only focus on a single price range in the current market. This year, many automakers have begun to add sub-brands or new models with different price positioning.

Some of them are more aggressively exploring high-end product lines.

One typical representative is Hongmeng Zhixing. After releasing the Xiangjie S9, jointly developed with Beijing Automotive Group and priced at 400,000 yuan in August, it recently launched the Zunjie S800, priced in the 1-1.5 million yuan range and jointly developed with JAC Motors. Yu Chengdong said it will compete with ultra-luxury brands such as Maybach and Rolls-Royce. Earlier, Huawei's old rival Xiaomi released the mass-produced version of the Xiaomi SU7 Ultra a month ago, priced at over 800,000 yuan.

More automakers are also continuously moving downwards, attempting to seize market opportunities in lower price ranges.

For example, NIO launched its second brand "Ledao" in May this year and began delivering its first model, the L60, at the end of September. The standard range version is priced at 219,900 yuan, 80,000 yuan cheaper than the lowest-priced ET5 and ET5t in its main NIO brand. In December this year, it will also launch its third brand, codenamed "Firefly," positioning itself as a boutique compact car priced between 100,000 and 200,000 yuan; XPeng Motors released the MONA MO3 at the end of August with a starting price of 120,000 yuan. The prices of its other models are mostly concentrated around the 200,000-300,000 yuan range. And so on.

In summary, the deterministic competitive trends among automakers in the dimensions of price wars, intelligent driving, and product systems are already evident, and the competitive landscape will continue to intensify.

In other words, from the underlying intelligent driving technology to the cost-effectiveness and quality-price ratio of products, to the product system that affects long-term market competitiveness, every aspect is crucial for every automaker, and there can be no shortcomings.

02

AI and End-to-End: A Must-Fight Battleground

Since 2024, "end-to-end" has been another high-frequency term in the new energy vehicle market.

Compared with traditional modular architectures, the end-to-end architecture has significant advantages. Its core is "data-driven" rather than "rule-driven," which is expected to significantly improve the upper limit of intelligent driving. The so-called "end-to-end" refers to inputting environmental data information such as images at one end, undergoing a multi-layer neural network model similar to a "black box" in the middle, and directly outputting driving commands such as steering, braking, and acceleration at the other end.

Earlier this year, Tesla began rolling out the end-to-end autonomous driving system FSD V12 within a certain range in North America, demonstrating autonomous driving potential that has received unanimous high praise from the industry.

According to Tencent Tech, Brad Porter, who once served as Chief Technology Officer of Scale AI and Vice President of Amazon Robotics, called FSD V12 "like the arrival of ChatGPT 3.5. It's not perfect, but it's impressive. You can see that it's something completely different, and I can't wait to see it evolve to GPT 4"; He Xiaopeng, founder of XPeng Motors, also expressed, "This year's FSD is completely different from previous Tesla autonomous driving capabilities. I am very impressed."

Behind this, algorithms, computing power, and data have long become the core competitive elements for automakers to build autonomous driving capabilities, and the importance of AI is accelerating in each of these aspects.

For example, at the data level, with the support of AI technologies such as end-to-end, data screening, annotation, training, and verification gradually form a full-link closed loop, which can accelerate the iteration of intelligent driving solutions;

At the algorithm level, the algorithm architecture has been evolving over the years, and autonomous driving algorithms have undergone several iterations. Nowadays, they have evolved from rule-based to neural network-based and from modular to end-to-end. In the long run, this is actually solving the problem of making the intelligent driving experience more "human-like";

Then, at the computing power level, Cinda Securities pointed out in a research report that end-to-end models are highly similar to large models. The data-driven development form makes the model highly dependent on the scale of computing power to improve the iteration rate.

Against this background, since 2024, automakers have entered the fray around end-to-end and other AI technologies.

Among them, XPeng Motors is the most aggressive and fastest-progressing.

In May this year, at the "520 AI DAY," XPeng globally premiered the domain-wide large language model XGPT and simultaneously released the AI Tianji AIOS, which the company claims is the world's first operating system that applies AI to intelligent cockpits and intelligent driving. XPeng also announced that it has fully entered the AI era.

Then, at last month's "XPeng AI Technology Day," focusing on AI automobiles, XPeng released the Turing AI intelligent driving system centered on large models, including cloud-based large models, in-vehicle models, Turing AI chips, and the Canghai platform. In addition, it also released the "XPeng Kunpeng Super Electric System," which is also an AI application scenario.

Prior to this, at the XPeng P7+AI Intelligent Driving Technology Sharing Conference, XPeng also provided a clear intelligent driving timeline: By the third quarter of 2025, XPeng's end-to-end large model will achieve L3-like intelligent assisted driving, with less than one takeover per hundred kilometers; then, by 2026, it will achieve L4-level driving in some low-speed scenarios without a driver in the driving seat.

"Starting this year, XPeng Motors has clarified its development direction for the next decade, namely, to become a global AI automobile company," said He Xiaopeng at the "XPeng AI Technology Day."

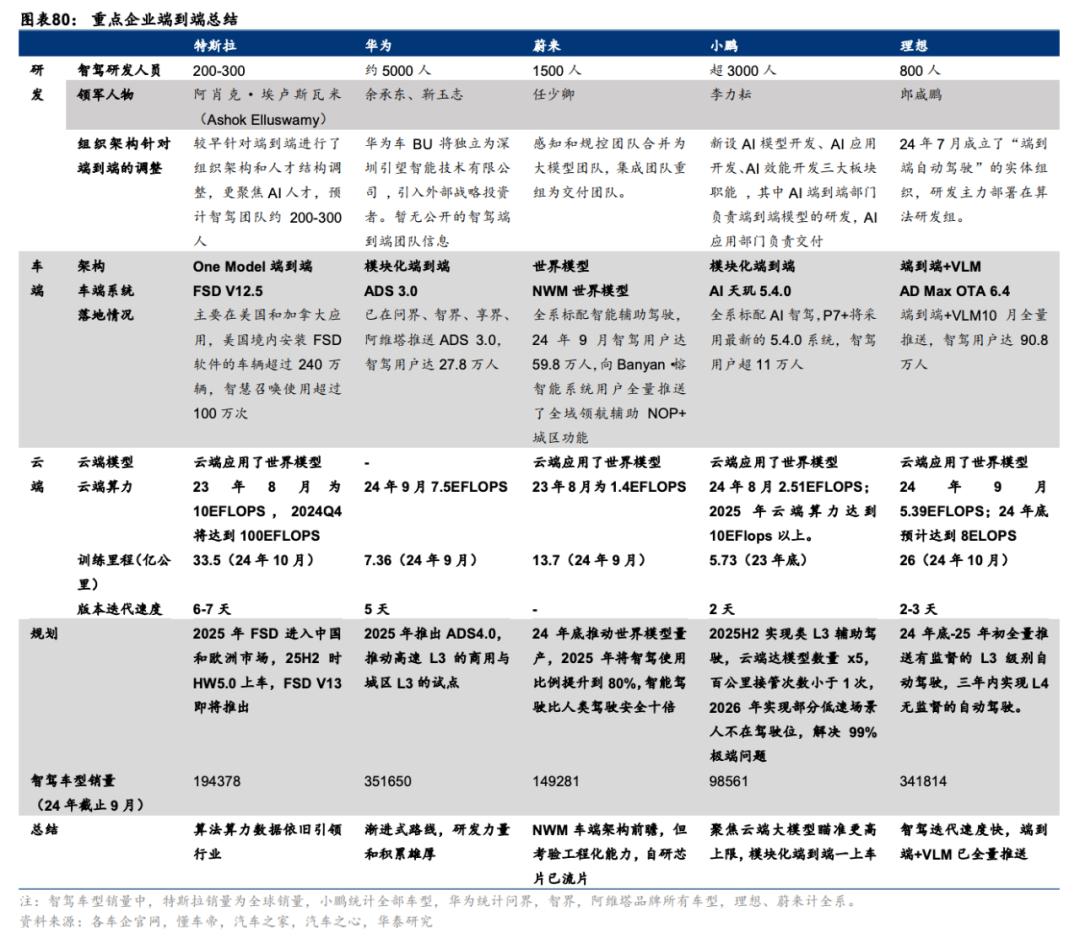

Image/Huatai Securities

Apart from XPeng Motors, as shown in the above figure, more automakers have accelerated the process of implementing end-to-end technologies.

It is foreseeable that in the coming years, competition and gamesmanship among automakers will only intensify around end-to-end autonomous driving.

03

Making Money, Making Money, Making Money: A Major Test of "Self-Sufficiency"

According to data from the China Passenger Car Association, from January to October this year, the combined retail sales of the top 10 manufacturers in China's new energy vehicle market accounted for 78.1% of the market share. From new energy brands under traditional independent brands to Li Auto and Thalys, the top 10 already include most of the current car manufacturing forces in the Chinese market.

Image/China Passenger Car Association

Among the car manufacturing forces outside the top 10, important new car manufacturing brands also include XPeng Motors, NIO, Zero-Run, Xiaomi, ARCFOX, and Voyah.

Looking back, in 2023, among China's new energy vehicle companies, only Tesla, BYD, and Li Auto achieved full-year profitability—if the conditions are more stringent, only Tesla achieved profitability through pure electric vehicles.

This situation may undergo some subtle changes in 2024.

Thalys is also likely to achieve full-year profitability. In the first three quarters of this year, Thalys has already achieved profitability, with a net profit attributable to shareholders of listed companies reaching 4.038 billion yuan.",

Even so, continued losses are expected to remain the mainstream status quo for new energy vehicle enterprises for some time to come.

The core reason is that from Tesla to BYD to Li Auto to Thalys, their key profit factors are almost impossible to replicate.

For example, BYD's profitability is built on economies of scale, giving it greater bargaining power in the upstream supply chain. Additionally, in recent years, BYD has been vertically integrating its supply chain, which helps reduce costs and increase efficiency. This is also the foundation for BYD's previous aggressive pricing strategies.

Caixin previously reported that someone familiar with BYD said that BYD Chairman Wang Chuanfu participates in cost reduction meetings every month and requires all models to be updated every six months to maintain market interest, regardless of the size of the changes.

On November 26, a screenshot of an email from BYD to its suppliers circulated online, stating that BYD hoped suppliers who received the letter would reduce their supply prices by 10% from January 1, 2025.

This email quickly pushed BYD into the spotlight. A senior automotive industry expert told the media that in the past, the annual price reduction for auto parts was generally 5% or less, and the price war in the auto market was relentless, leading to generally low profit margins for auto parts companies.

Li Auto's profitability is built on several foundations: its early extended-range hybrid models had almost no competitors, its clear family user positioning, and its effective early cost control.

Li Auto has been established for 10 years. Currently, except for the Li Auto MEGA, which was launched in March this year and is a pure electric vehicle, all other sales come from extended-range hybrid models.

As we mentioned earlier, Li Auto's early cost management ability was actually forced out of necessity due to limited funds. According to Toubao Research Institute data, before the first mass-produced vehicle of new car-making forces was launched, the financing amounts for NIO, WM Motor, XPeng, and Li Auto were 16.311 billion yuan, 13.32 billion yuan, 4.791 billion yuan, and 3.88 billion yuan, respectively.

From another perspective, from 2018 to 2020, compared to Tesla, NIO, and XPeng, Li Auto's R&D investment was the lowest – in 2020, Li Auto's R&D expenditure was only 11.31% of Tesla's, 44.21% of NIO's, and 63.73% of XPeng's. Of course, this is also closely related to the fact that Li Auto initially had a single model, and the cost of extended-range models is indeed objectively lower than that of pure electric models.

However, these advantages are not stable. For example, in July 2022, within three days of the launch of the AITO M7, orders exceeded 60,000, which directly affected Li Auto's sales performance. In August of that year, Li Auto's sales fell to 4,571 units, a decrease of over 50%.

In the following year of 2023, although Li Auto delivered its best performance since its inception, the process was not easy.

In June 2023, Li Xiang, the founder and CEO of Li Auto, posted on social media that the AITO M7 directly crippled the Li One: "We have never encountered such a strong competitor before, and for a long time, we were powerless to fight back. Huawei's superior capabilities directly led to the collapse of Li One sales and its early discontinuation." He also revealed to Caixin that due to the early discontinuation of the Li One, the company paid 1 billion yuan in compensation to suppliers.

Correspondingly, relying on its cooperation with Huawei, Thalys has quickly increased its production volume with the AITO brand and accelerated towards the inflection point of profitability among its competitors.

From 2021 to 2023, Thalys was still in continuous losses, with net losses of 1.82 billion yuan, 3.83 billion yuan, and 2.45 billion yuan, respectively. However, the launch of the new AITO M7 in September last year reversed this situation.

The reason is simple: the new AITO M7 is expensive but sells well.

Image/Thalys Official WeChat Public Account

As of November 27, the cumulative deliveries of the new AITO M7 this year have exceeded 180,000 units. During the same period, from January to November this year, Thalys' cumulative sales of new energy vehicles reached 389,566 units, an increase of 255.26% year-on-year.

In other words, the new AITO M7 alone contributed nearly half of Thalys' sales. The price of this model is over 500,000 yuan.

Against the above background, as we mentioned earlier, under the pressure of price wars, the strategy of automakers to vigorously expand new models and brand matrices, and with intelligent driving becoming a must-win battle, every market segment is filled with competitors. For other automakers in the industry, it is not easy to break free from the current situation of "selling one, losing one" and achieve self-sufficiency as soon as possible.

04

From user relationships to marketing strategies, a delicate balance

Three months before the Xiaomi SU7 launch event at the end of March, Lei Jun, who claimed it would be "the last startup of his life," posted nearly 60 Xiaomi SU7-related tweets on his personal microblog to maintain the heat for his "three-year car-making journey."

At the event, the typical "Xiaomi-style marketing" also brought actual conversions for the Xiaomi SU7 – within 27 minutes of its launch, orders exceeded 50,000, and first-day orders approached 90,000.

Compared to the verbal battles and essays of Internet celebrity CEOs from previous automakers, the phenomenal spread and conversion brought by "Lei Studies" have shocked the automotive circle. Even bosses from traditional automakers have begun to flood into live streaming rooms –

Yin Tongyue, chairman of Chery Holding Group, live-streamed a long-distance highway driving challenge to warm up for his products. Wei Jianjun, chairman of Great Wall Motor, and Xia Yiping, CEO of G-Auto, also entered live streaming rooms, began to learn from Lei Jun by stepping into the spotlight, building their founder IPs, and personally becoming Internet celebrities, getting involved in this battle for traffic.

This corresponds to the fact that for automakers, good user relationship maintenance and good marketing strategies and methods can raise the upper limit.

But this is obviously not easy. Since the beginning of this year, quite a few automakers have had setbacks in their marketing strategies. Two typical examples are ZEEKR and NIO.

On August 13, ZEEKR launched the 2025 models of its 001 and 007 vehicles. However, due to the rapid pace of upgrades, higher configurations, and lower prices of the new models, and ZEEKR's failure to adequately preheat the launch of these two new models, it immediately triggered dissatisfaction among a large number of existing car owners and plunged into a public relations crisis.

The 001 is ZEEKR's first model and has contributed the most sales to date. A brand-new version was just launched at the end of February this year. This time, less than half a year later, the 2025 model was launched, with significant upgrades made to the 001 in terms of product configuration, including the integration of a self-developed intelligent driving system and the adoption of NVIDIA chips (with a total computing power 10 times that of the 2024 model).

The 007 is ZEEKR's new model, launched on December 27 last year. The latest 2025 model is equipped with the latest ultra-fast charging battery, and its price is 20,000 to 30,000 yuan lower than the old model.

In the turmoil ZEEKR faced, what upset car owners the most was not the upgrade itself – but ZEEKR's attitude towards the upgrade.

There are mainly two points:

First, as early as the first half of this year, there were constant rumors in the market that the ZEEKR 001 would soon switch to a self-developed intelligent driving system. The most recent rumor was in July, stating that ZEEKR would release a revised 001 at the end of the month.

ZEEKR denied these rumors.

Second, many car owners reported that before purchasing the 2024 ZEEKR 001, they repeatedly confirmed with salespeople whether a revised model would be released, and were consistently denied.

For example, according to media reports, an owner who picked up their car on August 4 said that ZEEKR sales announced at the end of July that benefits would be reduced in August, emphasizing the need to place orders for immediate delivery.

However, a subtle point is that during this process, many sales outlets did not even know about the ZEEKR 001 revision plan. According to a self-media report, salespeople from two ZEEKR outlets in Beijing said they were unaware of the ZEEKR revision plan before the announcement.

At the same time, ZEEKR's sales strategy during this period is also questionable.

On July 13, ZEEKR indirectly reduced the price of the 001 by introducing a one-month "July Limited-Time Car Purchase Benefits" period, during which users could enjoy a maximum car purchase benefit of 35,000 yuan – this timing was also delicate, as it was exactly one month before ZEEKR announced the 2025 model of the 001.

ZEEKR's intention is not hard to understand: to digest as much inventory of the 2024 model of the 001 as possible before the launch of the revised 001 to make way for the new model.

However, ZEEKR remained silent about the announcement of the revised 001 and repeatedly refuted rumors, which, to some extent, deprived some car owners of their right to choose.

Now let's look at NIO. Shortly after the Xiaomi SU7 was launched, under the urging of Zhou Hongyi, chairman of the investment group 360, Zhang Yong, co-founder and CEO of NIO, publicly stated on social media that he accepted Zhou's criticism and would learn from Lei Jun in marketing.

However, Zhang Yong's "imitation" was clearly not yet up to par. Later, during a live stream, Zhang Yong, who was sitting with his legs crossed, was perceived by viewers as arrogant and far less humble than Lei Jun. Zhang Yong responded using the term "lickspittle." Perhaps due to his innate straightforwardness or an incomplete system, Zhang Yong, who is making up for his lack of marketing skills, is now known for his "setbacks." When searching for keywords like "NIO" and "Zhang Yong," the most common results are about his "setbacks."

Zhang Yong previously responded to netizen questions and later deleted the post. Image/Zhang Yong's personal microblog

However, now perhaps none of this matters. The issue Zhang Yong faces is no longer whether he can learn good marketing from Lei Jun but rather the survival of NIO. Since October, Zhang Yong has only posted one tweet in two months, which was a repost of Zhou Hongyi's decision to take a driving test.

Behind this, NIO has not had any good news in the past two months, but a series of rumors of unpaid wages and layoffs.

In the first three quarters of this year, NIO delivered 85,900 vehicles, a year-on-year decrease of 12.13%, underperforming the overall market – during the same period, the overall sales growth rate of new energy vehicles in China exceeded 30%.

Combined with media reports, it appears that NIO has been delaying salary payments since October and began communicating layoffs with employees in November. Caixin reported that the layoff ratio was even as high as 70%, although the official later denied this figure. On November 8, Efort Intelligent Equipment Co., Ltd., an industrial robot company, announced that NIO owed it 48.195 million yuan in project payments.

In addition, there have also been rumors in the market in recent days that CEO Zhang Yong has resigned. Currently, neither the company nor Zhang Yong himself has responded.

Combining the above, it is not difficult to see that for automakers, good user relationship maintenance and good marketing strategies can raise the upper limit. However, it is not easy to determine how to implement them, formulate strategies, and grasp the rhythm. Slight carelessness can easily lead to "setbacks."

Of course, the decisive factor still needs to focus on products and technology. Only with the "1" in front will the "0"s behind have meaning.