Nezha Auto walks on a tightrope towards listing

![]() 12/03 2024

12/03 2024

![]() 500

500

New Energy View (ID: xinnengyuanqianzhan) Original

Full text: 2818 words, reading time: 7 minutes

Similar to not releasing October sales data in early November, Nezha Auto now also wants to hide its November data.

However, the China Passenger Car Association (CPCA) revealed Nezha Auto's October sales figures, showing domestic sales of 6,022 units, a year-on-year decrease of 40%. Considering that Nezha Auto faced internal and external factors such as departmental adjustments, delayed deliveries, and tight cash flow in November, sales may further decline.

Some voices have suggested that the so-called "silent period before listing" is merely an excuse for low sales, noting that Zero Running also released sales data on time before its listing.

However, it is certain that if Nezha Auto indeed plans to list in Hong Kong early next year, as rumored, these months will indeed be crucial.

1. One more drop, and it's game over?

Early December is usually when automakers release their November sales results, but as of press time, Nezha Auto had not disclosed its sales report. Based on the latest available data, Nezha Auto sold a cumulative total of 92,000 vehicles from January to October, a year-on-year decrease of 16%, falling short of its annual target of 300,000 vehicles by nearly 70%.

In stark contrast, two years ago, Nezha Auto was at its peak, selling a total of 152,000 vehicles throughout the year, earning it the title of the top-selling new energy vehicle brand among emerging players.

Unfortunately, this good fortune did not last long, and in 2023, Nezha Auto officially entered a downturn. Facing the all-out market onslaught from many emerging auto brands, Nezha Auto's annual sales of 127,500 vehicles placed it at the bottom of the pack.

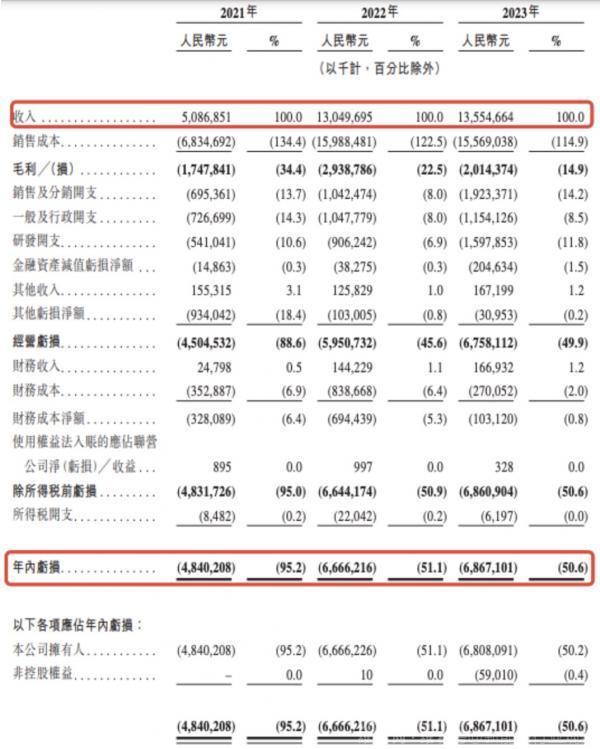

It is important to note that underwhelming sales performance is directly linked to corporate profits. It is understood that Hezhong New Energy, the parent company of Nezha Auto, incurred net losses of 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan from 2021 to 2023, respectively, totaling over 18.3 billion yuan in losses over three years.

Image/Hezhong New Energy Financial Status from 2021-2023

Source/Screenshot from New Energy View

Undoubtedly, 2024 has been a tumultuous year for Nezha Auto, and its losses this year may intensify.

Specifically, at the beginning of 2024, Nezha Auto was thrust into the spotlight due to the "delayed year-end bonuses," with CEO Zhang Yong personally responding on Weibo that the bonuses would be paid in March.

Since then, Nezha Auto has been exposed to a series of issues such as layoffs, salary cuts, work stoppages, slow deliveries, and unpaid supplier invoices. Recently, Caixin reported that Nezha Auto has initiated large-scale layoffs, affecting up to 70% of its workforce. Efort also announced that it had filed a lawsuit against Nezha Auto Yichun Branch for unpaid project funds totaling approximately 48 million yuan.

In mid-November, Dongfeng Technology officially stated that its subsidiary Dongfeng Yanfeng had filed an arbitration application against Hezhong New Energy, the operating entity of Nezha Auto, for unpaid invoices totaling 12.7303 million yuan, and a pre-litigation mediation has been reached.

Additionally, it is worth noting that as of early December, it has been four months since Nezha Auto submitted its IPO application to the Hong Kong Stock Exchange, but the exchange has not yet disclosed any hearing information related to Nezha Auto. It is worth mentioning that during the IPO processes of Li Auto and Xpeng in Hong Kong, it only took three months from submission to hearing approval.

Image/Nezha's IPO application has been pending for over four months

Source/Screenshot from New Energy View

In conversations with New Energy View, most Nezha Auto owners expressed concern upon seeing these news reports, fearing that Nezha would follow in the footsteps of HiPhi and that after-sales service promises would become empty.

In fact, it is not only long-term owners who are troubled. According to multiple consumers from various regions, Nezha Auto is currently experiencing difficulties in vehicle deliveries. "I've been waiting for two months without a car, and when I went to the store to request a refund of my 2,000 yuan deposit, the salesperson refused!""Before purchasing, I was told I could pick up the car within 30-60 days, but now 60 days have passed and I haven't received any pickup information. They just say I have to wait, but they don't know how long it will take."

2. A decade of turmoil, picking up sesame seeds while dropping watermelons

How did the story of Nezha Auto, which once thrived, evolve into its current state?

Back in 2022, Nezha Auto quickly gained popularity with models like the Nezha U and Nezha V, which were positioned in the low-end market. At that time, most models from emerging brands like NIO and Li Auto focused on the mid-to-high-end market.

Image/Nezha U - Nezha V

Source/Screenshot from New Energy View

As is well-known, behind low prices and high sales volumes, automakers inevitably earn lower profits. Realizing this, Nezha Auto, not wanting to continue losing money, began to focus on the mid-to-high-end market, successively launching the Nezha S and Nezha GT models.

Image/Nezha GT - Nezha S

Source/Screenshot from New Energy View

However, the mid-to-high-end market was already dominated by models like the Tesla Model 3 and NIO ET5 at that time, and each of these models was clearly more competitive than the Nezha S and Nezha GT.

In conversations with New Energy View, multiple consumers with recent car-buying intentions and budgets exceeding 200,000 yuan believed that Nezha Auto's positioning is more akin to that of a "ride-hailing" vehicle, and they might consider it with a budget of around 100,000 yuan.

As a result, Nezha Auto, which has yet to stabilize in the low-end market and struggles to gain a foothold in the mid-to-high-end market, has gradually lost ground in the market due to the confusion in its product positioning.

It is important to note that market development is ever-evolving. In this era of intelligence, a lasting share of the market naturally requires a focus on technological innovation. From 2021 to 2023, Nezha Auto's total R&D expenditure was only 3.045 billion yuan, compared to NIO, Li Auto, and Xpeng's R&D expenditures of 13.431 billion yuan, 10.586 billion yuan, and 5.277 billion yuan, respectively, in 2023, highlighting a significant disparity.

In 2024, influenced by the warm reception of Xiaomi's SU7 and the "king of traffic" Lei Jun, Nezha Auto began to focus its marketing efforts. First, there was the promotion by Zhou Hongyi, the founder of 360 Group, followed by Nezha Auto's plan to change its name and CEO Zhang Yong's involvement in manual labor at the factory, demonstrating Nezha Auto's dedication to attracting attention.

It is undeniable that the personal IP building of Zhou Hongyi and Zhang Yong has indeed brought considerable market attention and traffic to Nezha Auto. However, it is important to recognize that the effectiveness of marketing can only be temporary and not perpetual. A company that lacks a solid product, has unclear product positioning, and only indulges in self-promotion is destined to fail in retaining consumers' hearts amidst the frequent launches in the market.

It is reported that as of now, there have been up to 1,178 complaints about Nezha Auto on the Heimao Complaint Platform. From January 1 to December 2, 2024, there have been nearly a hundred complaints about Nezha Auto on the Auto Quality Complaint Platform, mostly related to issues such as body rust, in-car system failures, quality defects in the bumper beam, unfulfilled promises, and poor after-sales service.

Mr. Xiong (pseudonym) from Beijing purchased the Nezha S Yaoshi Edition for 340,000 yuan due to its unique design. "To be honest, I regret it. I paid for something niche and ended up encountering problems like malfunctioning window buttons and air conditioning issues. Now I always comfort myself by thinking that although there are constant minor issues, they can all be fixed after a couple of months."

Image/Nezha S Yaoshi Edition

Source/Screenshot from New Energy View

Mr. Xiong also revealed that many Nezha owners he knows are in similar situations.

3. Self-rescue? What are the odds of success?

"Time is running out for Nezha Auto.""

This was the warning given to HiPhi initially, and now the tables have turned, falling on Nezha Auto.

This year, as competition in the new energy vehicle industry intensifies, automakers have resorted to various tactics to seize market share, such as tapping into lower-tier markets, shifting from a direct sales model to embracing dealership models, focusing on the advancement of intelligent driving technology, and expanding technological pathways.

Undoubtedly, influenced by this "involutionary" trend, automakers will face even greater competitive pressure in 2025.

Based on this, facing an increasingly crowded new energy sector in the future, if Nezha Auto wants to stay afloat, it should quickly shift its focus from marketing to product development itself. After all, for the market and consumers, a good product speaks louder than words.

In product development, in addition to accurately targeting the needs and preferences of the target user group, Nezha Auto should also focus on enhancing the quality and durability of its products.

Regarding the many models currently on sale under the Nezha Auto brand, multiple consumers have complained online about the plastic feel of the interiors. "I really can't stand the plastic feel of the interiors. Pressing on certain parts causes noise. Making cars requires some internal strength; obsession with superficial glitz and glamour will eventually lead to failure."

Image/Owners complain about abnormal noises from the interior panel of the Nezha S in summer

Source/Screenshot from New Energy View

In terms of technology, Nezha Auto can increase R&D investment and choose to collaborate with major manufacturers to create a more intelligent and convenient in-car interaction system, equipped with more sophisticated intelligent driving technology.

In terms of after-sales service, Nezha Auto should promptly improve the efficiency and convenience of maintenance and repair services, establish a rapid response mechanism, and shorten customer waiting times for repairs. According to feedback from multiple Nezha owners, the two-month waiting period for parts like brake components is too arduous for them.

More than half of the hundred consumers surveyed also revealed that, in addition to the product itself, they are most concerned about whether the after-sales service provided in the future is reassuring, smooth, and hassle-free.

Therefore, while a good marketing strategy can indeed be very effective for a company, it is crucial to understand that there is a clear correlation between products, reputation, and sales. In the future, if Nezha Auto continues to focus only on "talk" without taking concrete actions, it may well become the "next HiPhi."

Fortunately, Nezha Auto has received financial support from the Nanning Industrial Investment Supply Chain. If it successfully lists next year, it could be a new chapter in its story.