November domestic new energy vehicles: continued reshuffle, suppliers face an impending winter

![]() 12/03 2024

12/03 2024

![]() 597

597

Data Analysis of New Energy & Auto

Sales volume brings discourse power.

Total words in this article: 4756

Estimated reading time: 20 minutes

At the end of November, an email from BYD requesting price reductions from suppliers circulated widely on the internet.

In the letter, BYD demanded a 10% price reduction from January 1, 2025. There was little room for suppliers to negotiate.

After the incident escalated, Li Yunfei, General Manager of BYD Brand and Public Relations, responded,

'Annual price negotiations with suppliers are a common practice in the automotive industry. Based on large-scale bulk purchasing, we propose price reduction targets to suppliers, which are not mandatory. All parties can negotiate and move forward.'

But in reality, suppliers have little room for negotiation.

As the discourse power of downstream automakers increases, compressing costs upstream to trade for profits or further price reductions is almost an unavoidable trend.

#

Vol.1/ Continuously Setting New Highs

The most significant event in November was the Guangzhou Auto Show, which exhibited a total of 1,171 vehicles, including 512 new energy vehicles. Almost all exhibition stands featured new energy vehicles. New energy vehicles are accelerating the replacement of traditional fuel vehicles.

As the year-end approaches, many automakers have postponed new car launches to next year, so there were not many new car releases. But this did not hinder the surge in car-buying sentiment.

Since the second half of the year, automaker sales have grown almost unreasonably. After setting a new record in October, this month broke the record again.

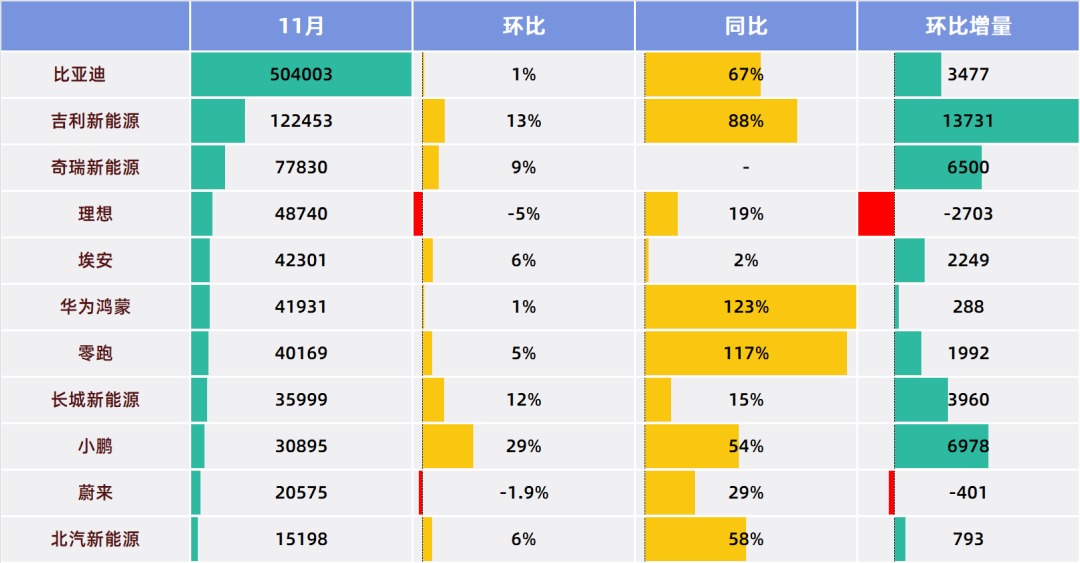

The total sales of the 11 automakers that have announced sales figures currently stand at 980,000 units, with an average sales volume of 89,099 units and a median of 41,931 units. Compared to the previous month, the total volume increased by nearly 40,000 units, the average sales volume increased by 8,730 units, and the median increased by 2,817 units. Among these 11 automakers, only Li Auto and NIO experienced slight month-on-month declines, while all others achieved year-on-year and month-on-month growth.

Six automakers set new record highs again. Among them, BYD, Geely, Chery, Leap Motor, and XPeng have continuously set new record highs for multiple months.

Geely and Chery have significantly widened the gap with mid-tier automakers, while mid- and low-tier automakers have accelerated significantly, narrowing the sales gap.

Thanks to this phenomenal growth, Chinese automakers have become global leaders. According to the China Passenger Car Association, China accounted for 68.9% of the global market share from January to October 2024, with China's new energy passenger vehicles accounting for 76% of the global market share in October.

The key factors driving sales growth are price reductions and trade-in policies. According to the Ministry of Commerce, the national scrap car recycling volume from January to October increased by more than 50% year-on-year. The China Council for the Promotion of International Trade stated that financial transformation subsidies, car purchase incentives, and exclusive service plans from financial institutions have simultaneously released market vitality on both the supply and demand sides of the automotive industry. The industry expects new energy vehicle production and sales to exceed 12 million units this year.

The trade-in policy is highly likely to continue into next year. Ministry of Commerce officials stated that the next step will be to scientifically evaluate the effectiveness of this year's policies and plan next year's car trade-in continuation policies in advance to stabilize market expectations, while continuing to implement existing subsidy policies and a series of supporting support policies.

With sustained rapid sales growth, inventory pressure has eased. In October, the comprehensive inventory coefficient for auto dealers was 1.10, a decrease of 14.7% month-on-month and 35.3% year-on-year. Inventory levels were below the warning line (1.50), entering a reasonable range.

As long as growth continues, automakers have hope. This is a consensus.

#

Vol.2/ Three Automakers Achieve Annual Targets Ahead of Schedule

Regarding specific automaker brands, most have achieved monthly sales of over 10,000 units.

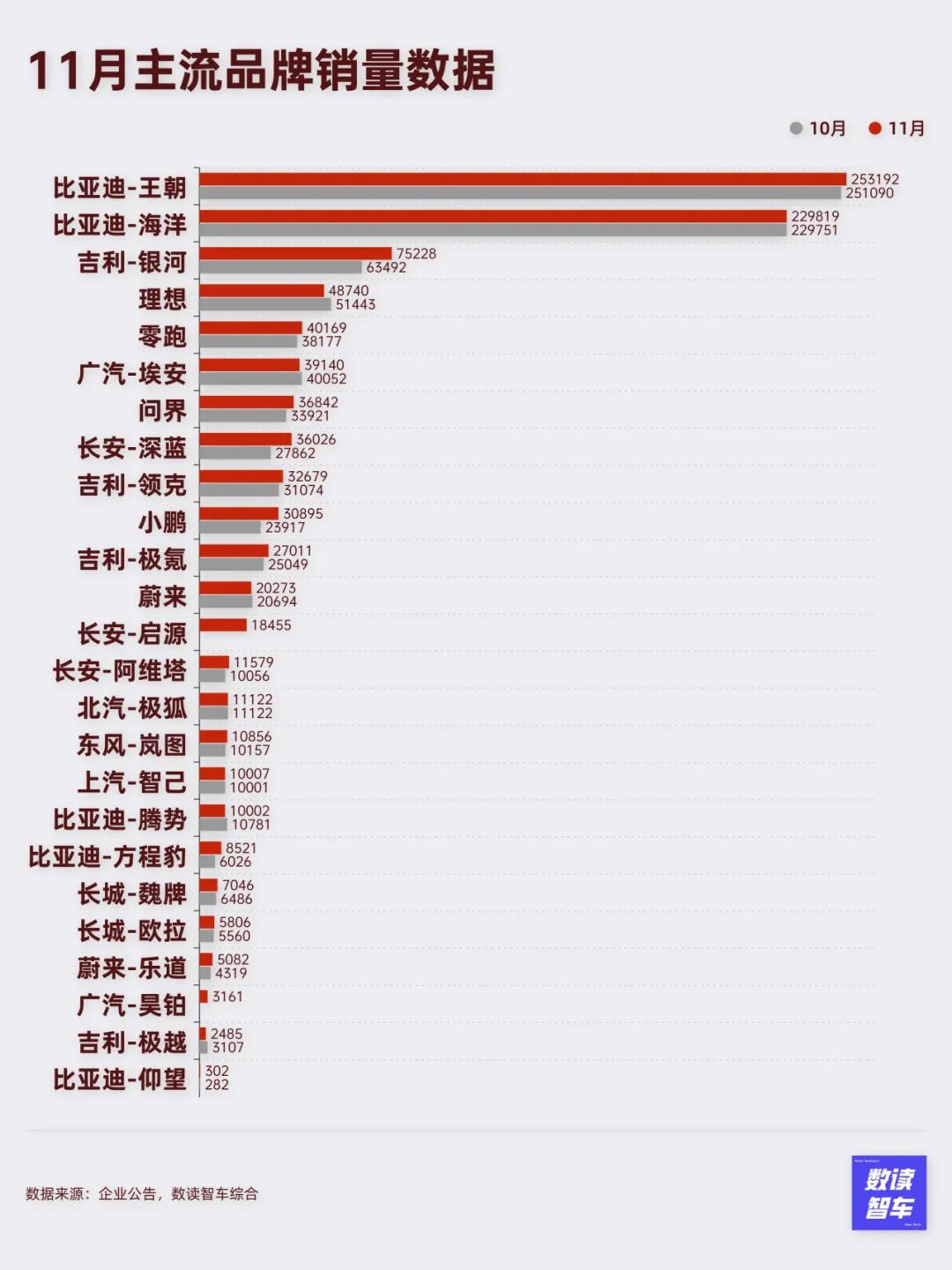

The average sales volume of 25 automakers and brands for which data is available reached 39,116 units, with a median of 18,455 units, which is already a very high level.

BYD Dynasty Series, Ocean Series, Fangchengbao Series, Geely Yinhe, Lynk & Co, Zeekr, Leap Motor, Changan Deep Blue, Qiyuan, Avita, XPeng, Dongfeng HOSEN, Great Wall WEY, and Ora all set new record highs.

Thanks to their extremely strong performance, BYD and Leap Motor have completed their annual targets ahead of schedule. BYD exceeded its annual sales target of 3.6 million units in November alone. Leap Motor's strong performance in the second half of the year made its target of 250,000 units seem low, and it has already surpassed that target.

On November 18, Lei Jun announced that Xiaomi SU7 deliveries had exceeded 100,000 units, completing the annual target ahead of schedule and aiming to deliver 130,000 new vehicles for the entire year.

In addition to automakers that have completed their targets ahead of schedule, Geely and its sub-brand Zeekr have completed 97% of their target sales volume, Li Auto has completed 92%, and it is highly likely that they will achieve their targets.

Furthermore, NIO and Almost have both completed over 80% of their target sales volume, giving them a strong chance of achieving their annual targets in December.

The remaining automakers have been unable to achieve their final targets due to significant early setbacks. Especially for XPeng and IM Motors, the targets set were not high, but there is still a significant gap, making this year difficult.

Sales volume brings discourse power. Previously, automakers were constrained by rising raw material prices and the scarcity of battery manufacturers, making it difficult to force price reductions. Nowadays, with a more mature industrial chain and fierce competition among suppliers, the balance of discourse power has quietly shifted towards automakers.

#

Vol.3/ Dealers' Hard Times

Dealers are already facing difficult times and may face even harder times ahead.

At this stage, the automotive market is characterized by increasing sales volume without corresponding income growth, and increasing income without corresponding profit growth. The China Automobile Dealers Association stated that price reductions as a means to stimulate car sales have gradually lost their effectiveness, and their negative effects have far exceeded expectations. Half of the nation's dealers are incurring losses, and automakers' goals and strategies in terms of vehicle and component supply, inventory structure, and after-sales support are severely out of sync with current market realities.

However, despite this, automakers' price wars will not cease.

Deng Chenghao, CEO of Deep Blue Auto, believes that next year's market price war will not stop and may even intensify. In such a situation, it is dangerous for a company to lose its basic health. Automotive companies need a gross margin of 15% to survive.

There is only room to squeeze the supply chain for gross margin.

Following BYD, SAIC MAXUS also sent a letter to its suppliers stating that with the massive launch of new vehicles, the imbalance between market supply and demand is expected to persist in the short term, making it difficult to quell the price war. "Cost competition" will be the main theme of the automotive industry in 2025. Suppliers are expected to reduce costs by 10%.

This trend can only be halted when the market enters a stock period and some enterprises cannot sustain the pressure. Wang Jun, President of Changan Automobile, stated that only three of the 71 passenger vehicle brands are profitable, and it is expected that over 80% of Chinese brands will face closure, merger, or restructuring in the future.

Before the closures, mergers, and restructuring are completed, internal competition among automakers is destined to continue, and dealers' hard times will at least extend into next year.

#

Vol.4/ Going Global is Not Just for Automakers

Automakers that survive the fierce competition are destined to go global.

The European market is turning around. Foreign media reported that the European Union and China are close to reaching a solution to eliminate the import tariffs imposed on electric vehicles from China.

In November, Chery's joint venture factory in Spain commenced production. The joint venture plans to expand its annual production capacity to 150,000 units by 2029 and create over 1,200 local jobs.

Hungary stated that BYD and German automaker BMW are building an automobile factory in the country, expected to commence production in the second half of 2025, contributing to the country's economic growth.

In the Latin American market, GAC Motor announced at the 2024 Autoferia Cofiño Auto Show in Guatemala that it has officially entered the Guatemalan market. At the auto show, GAC Motor unveiled models such as the Ying Su, Ying Ku, all-new second-generation GS8, GS4 MAX, and M6 Pro.

Neta Auto signed a general agency agreement with the largest automotive sales group in Bolivia, Grupo Saavedra, to jointly promote Neta Auto's channel construction and vehicle sales in Bolivia. Currently, Neta Auto has a presence in Brazil, Ecuador, and Costa Rica.

In the Asian market, NIO signed a strategic cooperation agreement with Green Car, announcing its official entry into Azerbaijan. Leap Motor signed a strategic cooperation agreement with NPK MOTOR, the highest-selling automotive dealer in Myanmar, to establish an assembly line in Myanmar.

In addition to automakers, automaker suppliers have also gained a leading edge in the process of continuous internal competition. In November, WeRide announced that its autonomous driving sanitation vehicle S6 and unmanned road sweeper S1 have commenced operations in Singapore. According to reports, this is the first commercially operated autonomous sanitation project in Singapore.

Domestic automakers have become the strongest global competitors. In October 2024, 44,000 imported vehicles entered China, a year-on-year decrease of 45% and a month-on-month decrease of 21% from September. China's imported car imports have declined from 1.24 million units in 2017 to only 800,000 units in 2023. After domestic competition becomes increasingly saturated, global competition will eventually commence.

#

New Forces: Leap Motor and XPeng Accelerate, Li Auto and Huawei Reach a Plateau

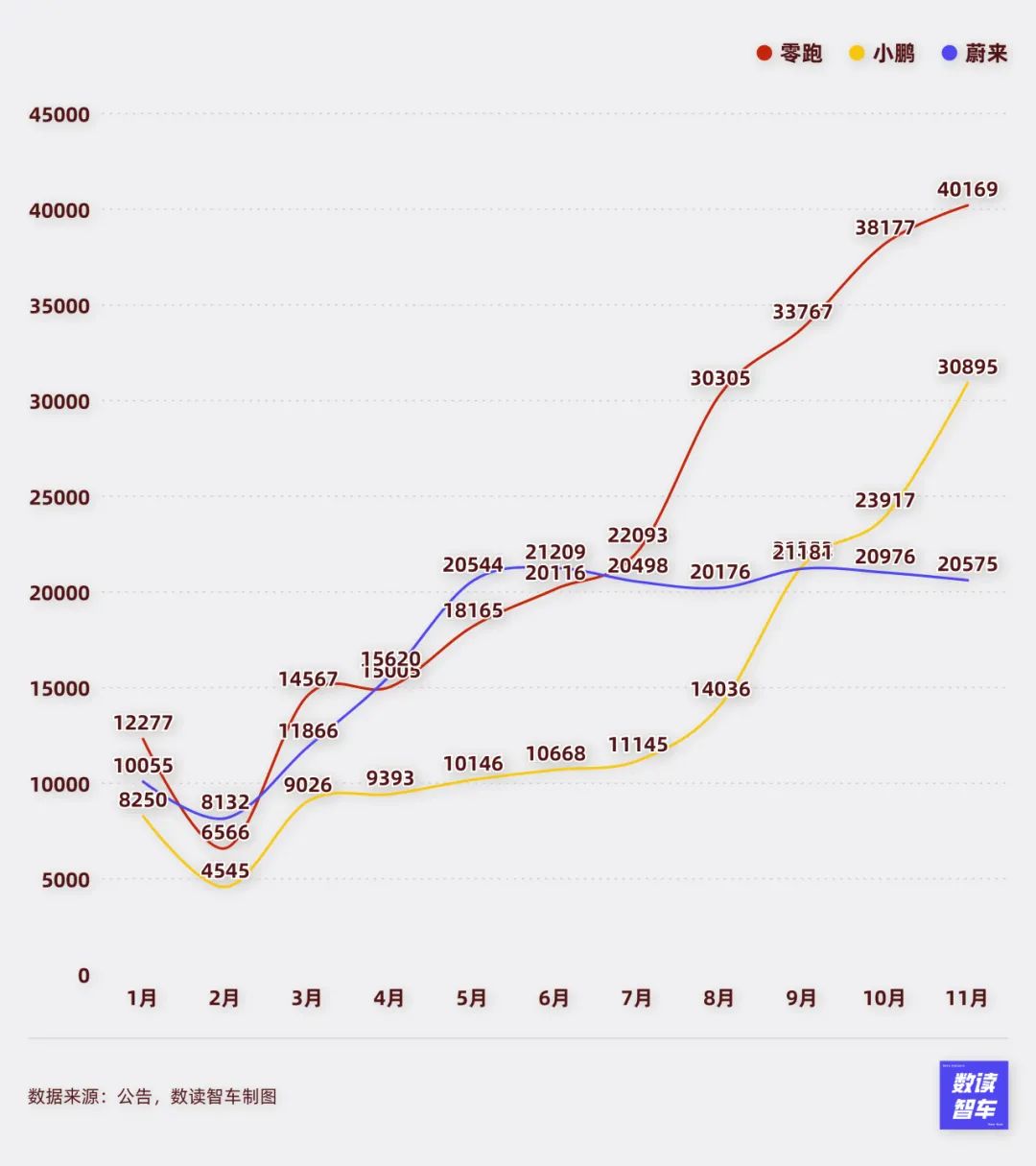

Leap Motor is the most notable automaker among the new forces.

Starting from June, Leap Motor has set a new record every month. This month, Leap Motor surpassed 40,000 units for the first time, reaching the same scale as Li Auto, Huawei HarmonyOS, and Aion. Of course, Leap Motor achieves this through cost-effectiveness and low prices, but increasing volume is not easy nonetheless. Neta Auto, which was once on the same starting line as Leap Motor at the beginning of the year, has completely fallen behind. In November, news emerged about asset preservation and shareholder assistance.

The continuous surge in sales has also boosted Leap Motor's confidence. Chairman Zhu Jiangming stated that three B-series products will be launched next year to increase market share. The sales target for 2025 is 500,000 units, doubling this year's target. The profitability plan will also be advanced.

Another automaker that has significantly accelerated is XPeng. In November, XPeng sold over 30,000 units for the first time in its history, setting a new record high for three consecutive months.

XPeng's products have gained market recognition. At the Guangzhou Auto Show, He Xiaopeng stated that the MONA M03 has sold over 10,000 units for two consecutive months since its launch. Currently, the main obstacle for lower-priced models is production capacity. He Xiaopeng revealed that the target monthly production capacity will reach 20,000 units by the Spring Festival. In addition to lower-priced models, the revamped XPeng P7+ was also launched in November, with over 10,000 pre-orders in just 12 minutes. It can be expected that once production capacity issues are resolved, XPeng's sales volume has the potential to reach a new level.

Compared to these two automakers, NIO's acceleration has been very slow. In November, NIO sold only 20,575 units, struggling to break through to a higher level. More troubling is that NIO's losses are more severe, and the pressure to achieve profitability is enormous. In an internal letter marking NIO's 10th anniversary, Li Bin stated that the next two years will be crucial. It is imperative to continuously launch competitive new products and improve operational efficiency. The tasks of doubling sales next year and achieving company profitability by 2026 cannot be compromised.

The growth performance of the Lido L60 is not good. This month, 5,082 units were delivered, with less impressive results compared to the MONA M03. Currently, NIO is planning a third brand named "Firefly," positioned in the high-end compact car market. It will be officially unveiled at the NIO Day 2024 on December 21, with its first model scheduled for delivery in the first half of 2025.

Three brands require extremely high efficiency and effective management, just as Li Bin said, the next period is crucial.

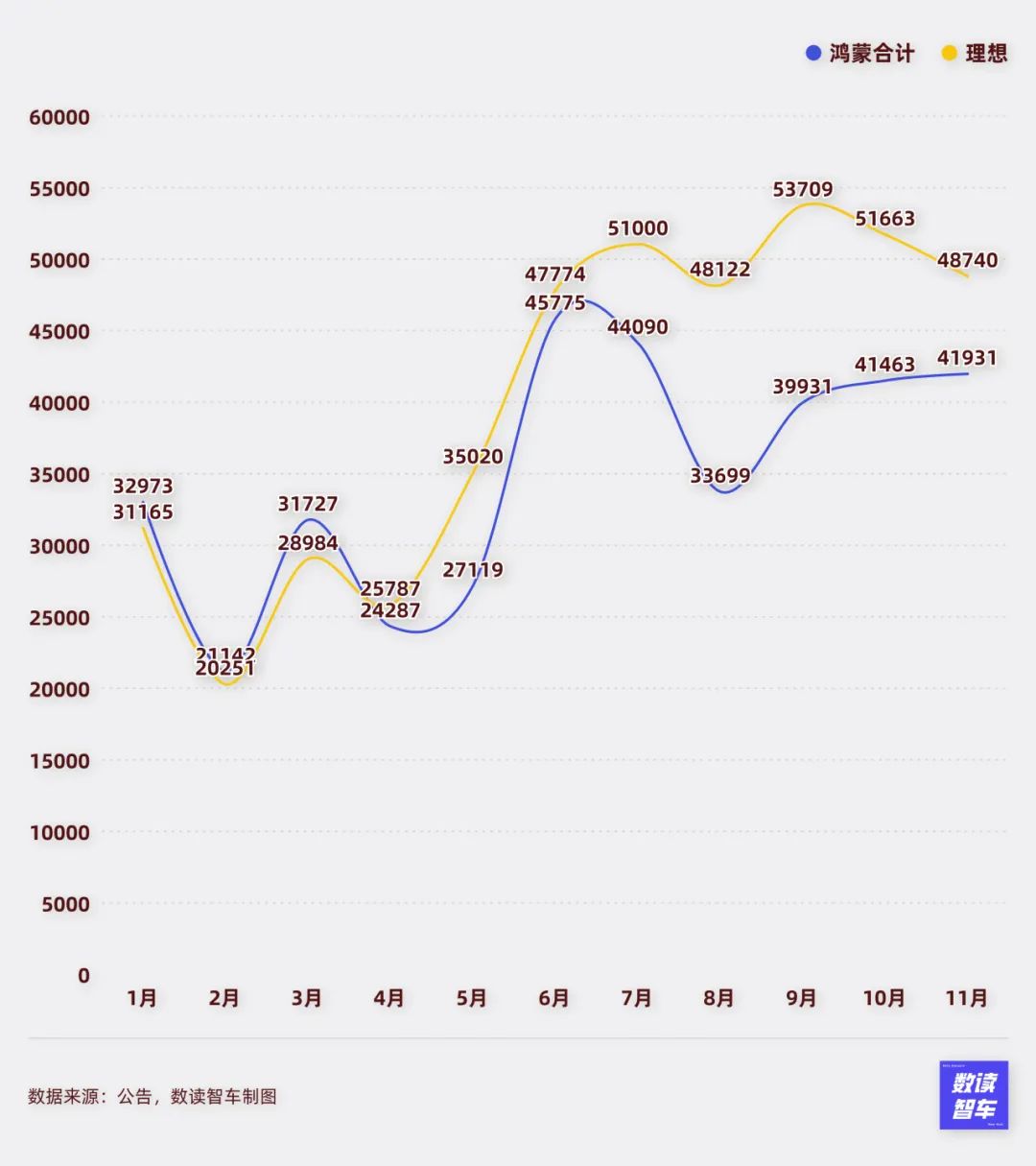

Li Auto and Huawei are currently in a sales growth plateau. Given the average prices of these two automakers, selling over 40,000 units per month is already a remarkable achievement. To further increase sales, price reductions or new model launches are options.

This month, with the addition of the Zun Jie S800, Huawei finally completed its "Four Realms" series. The Zun Jie S800 is priced between 1 million and 1.5 million yuan. In addition, Huawei has recently successfully applied for multiple trademarks, including "Xian Jie" (Fairy Realm), "Tian Jie" (Heavenly Realm), "Jun Jie" (Ruler Realm), and "Zheng Jie" (Magnificent Realm). It is evident that Huawei does not intend to reduce prices but rather hopes to maintain the brand's premium image and increase sales through expanding cooperation with automakers.

Li Auto's overall prices are trending downward, and the plateau is mainly due to the lack of new model launches. Originally, Li Auto planned to launch four extended-range and four pure electric models this year, but issues with the MEGA model disrupted the plan. To date, Li Auto has not introduced any relevant new models. 2025 may become a significant year for Li Auto in terms of product launches.

#

BYD and Geely: Striding Forward

BYD and Geely have already secured advantageous positions in the competition among new energy automakers.

BYD's sales volume in November continued to exceed 500,000 units. Although the month-on-month increase was not significant, it still set a new record high. From April this year to the present, BYD has set a new record high every month. It has sold 3.75 million units in one year.

The second model of Fangchengbao Autos, the Leopard 8, has been launched, and Fangchengbao sold 8,521 units in November, continuing to generate incremental sales. BYD is now in a state where it does not have to worry about sales volume.

According to plans, BYD plans to launch a new generation of blade batteries in 2025, which will increase the driving range of vehicles and extend the battery's lifespan. In the crucial battery supply chain, BYD is no longer constrained.

With monthly sales of 500,000 units and a wide range of industrial chain extensions, this is BYD's confidence in pressuring dealers.

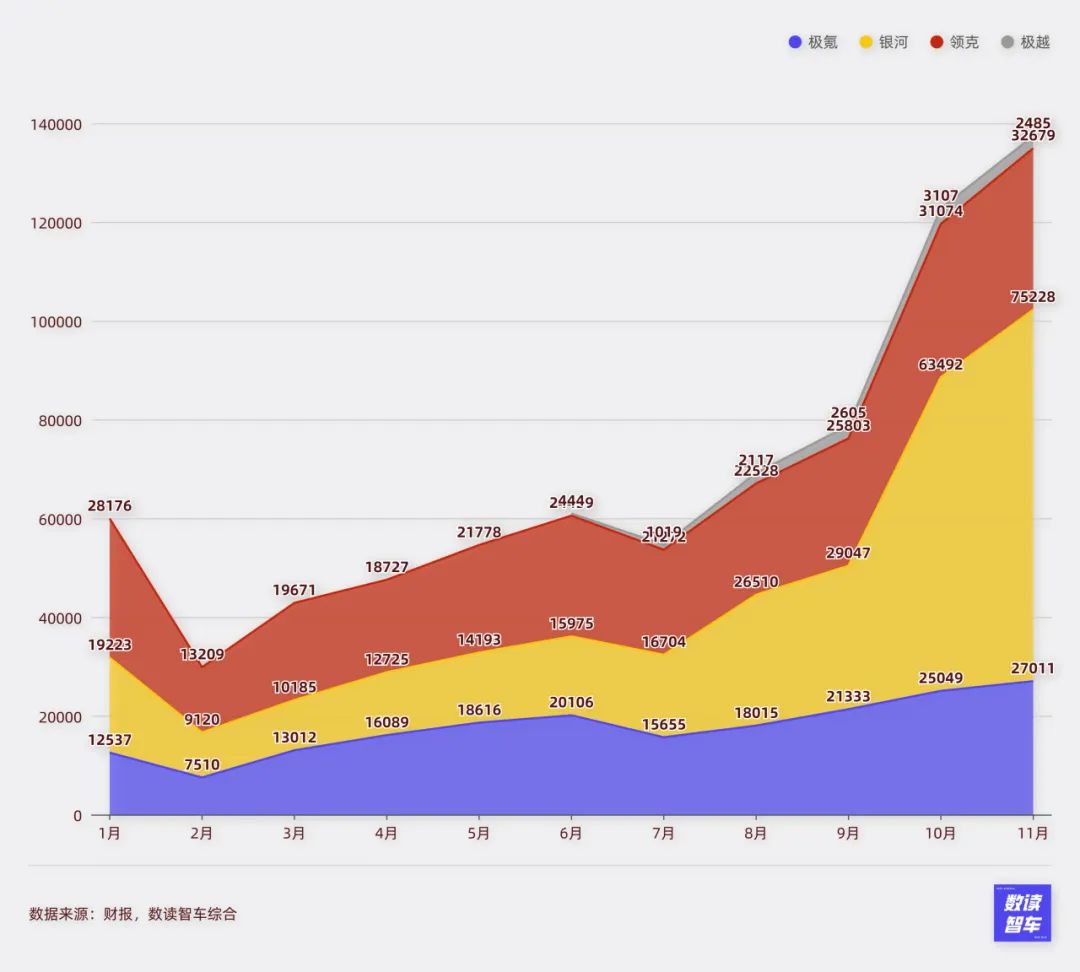

Apart from BYD, Geely has successfully entered the ranks of automakers with monthly sales of over 100,000 units.

Several brands under Geely are constantly setting new records. The Galaxy series sold 75,228 units this month, a new high after selling over 60,000 units last month.

ZEEKR sold 27,011 units in November, nearing the 30,000-unit mark. The biggest news for Geely this month is the acquisition of Lynk & Co. by ZEEKR. According to Geely's announcement, ZEEKR will hold a 51% stake in Lynk & Co. CEO An Conghui stated that the merged Lynk & Co. will continue with its dealership model, while ZEEKR will maintain its direct sales model.

Together, ZEEKR and Lynk & Co. sold nearly 60,000 units in November. Based on this, Geely's Galaxy and ZEEKR brands are starting to resemble BYD's Dynasty and Ocean series. Geely is showing signs of replicating BYD's success.

#

GAC Motor and Changan Automobile: Leveraging Trends to Enrich Product Lines

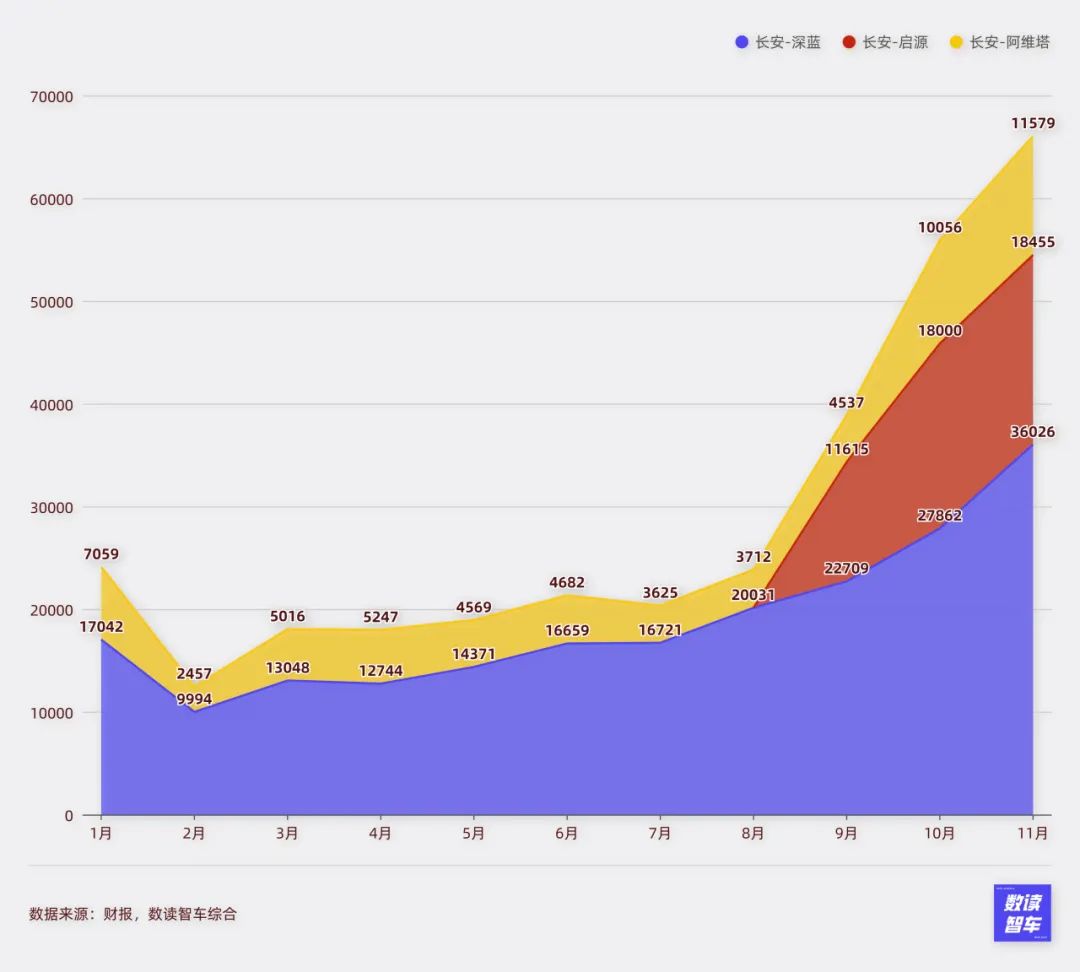

Beyond BYD and Geely, Changan Automobile is also showing signs of growth.

In November, Changan's Deep Blue series sold 36,026 units, setting a new record. Qiyuan surpassed 18,000 units, also setting a new record, while Avita sold over 10,000 units, also a new high. Combined sales of these three models exceeded 66,000 units.

Changan has ambitious plans. The company plans to invest over 50 billion yuan in the next five years to develop land, sea, and air transportation solutions and humanoid robots, with the aim of launching a flying car by 2026.

For its flagship model Avita, Changan plans to introduce extended-range electric vehicles, mid-to-large 5-seater and 6-seater SUVs, and is also planning sports cars and MPVs.

Unlike Changan, GAC Motor's breakthroughs are mainly in specific markets and technological advancements.

In November, Aion stabilized sales at around 40,000 units per month but did not set a new record. GAC Motor signed a deepened cooperation agreement with Huawei, sparking speculation about a joint project called "The Fifth Realm," which was denied by GAC Motor.

GAC Motor's plans for new energy vehicles extend beyond passenger cars to commercial vehicles. The company's commercial vehicle strategy aims to achieve a revenue of 30 billion yuan by 2030 and accelerate the transition to intelligent new energy commercial vehicles.

Additionally, GAC Motor's research and development in solid-state batteries is promising. The company has reportedly made breakthroughs in the full production process of solid-state batteries and achieved key technological advancements, with plans to install them in Aion models by 2026.

In November, amid fierce competition, some automakers like Nezha and Hopon, which were once in the running, have largely fallen behind. Currently, there are about 10-11 mainstream automakers competing. As competition intensifies, Chinese automakers are continuously improving their product quality, management standards, and technological capabilities. The fewer players remaining, the higher their bargaining power in the industry chain. As long as this competition continues, dealers will inevitably be dragged into price wars.