["Industry In-depth Research"] Li Xiang: Building electric cars is work, buying fuel cars is life

![]() 12/03 2024

12/03 2024

![]() 492

492

Author | You Li

Learn more financial information | BT Finance Data Hub

The main text consists of 4,118 words, estimated reading time is 11 minutes

"Among the new forces in car manufacturing, Li Xiang's Lixiang One is perhaps the most visible."

According to media reports, only a few years have passed, and the list of the first batch of new car manufacturing forces has been reduced to "4+1". The '4' refers to NIO, Xpeng, Lixiang One, and ZERUN, while the '1' refers to Nezha. NIO, Xpeng, Lixiang One, and ZERUN are currently operating healthily with good sales, but Nezha... From this perspective, Lixiang One is fortunate.

The founder is deeply tied to the enterprise. Every word and action of the former affects the latter's share price, and the latter's reputation is always reflected in the former's public perception. In a sense, Li Xiang is both Lixiang One's greatest product manager and its greatest salesperson. According to ifeng.com, Li Xiang was recently spotted by netizens purchasing a Ferrari, specifically the Ferrari 296 GTS priced at nearly 3.5 million yuan, a standard luxury fuel vehicle. Netizens' comments were sharp: "Building electric cars is work, driving fuel cars is life." "Don't misunderstand, Li always orders Ferraris with a critical mindset." "Lixiang One is making money, so the CEO rewarded himself with a Ferrari."

In 2021, Li Xiang publicly commented on fuel vehicles again, saying that they only had the smell of gasoline to recommend them, "I really don't understand why anyone still likes to buy fuel vehicles now? Nostalgia? Or do they like the smell of gasoline...?" In the years since, Li Xiang has been known for his "pessimistic" view of fuel vehicles, and in the past two years, he even made the famous remark that "Lixiang One L9 is the best choice within 5 million yuan." In contrast, Li Xiang's purchase of a Ferrari appears particularly interesting.

Considering the current situation where multiple forces are jointly driving the new energy vehicle market towards the mainstream, how should we understand Lixiang One's next strategy?

1. Lixiang One Brings a "Sense of Ease"

Li Xiang is certainly not the only one opposing fuel vehicles. As fellow new energy vehicle manufacturers, Wang Chuanfu of BYD and Zeng Yuqun of CATL have also called for a ban on the sale of fuel vehicles; Li Bin of NIO has described buying fuel vehicles as "nostalgia" and compared fuel vehicles to electric vehicles as mechanical watches to digital watches; Shen Hui, founder of WM Motor, also tweeted that "traditional fuel vehicles can't go back," later changing it to "intelligent vehicles can't go back once used" due to backlash from netizens, but the internet, which does not forget, has already marked this moment... Regardless of whether it is a traditional automaker or a new energy automaker, there are many who raise the profile of new energy vehicles by disparaging fuel vehicles. Why is Li Xiang still attracting attention this time? The matter needs to be viewed from two perspectives. On the one hand, it is, of course, because Lixiang One's financial reports have proven itself, demonstrated the potential of new energy vehicles, and the monetization ability of the "dad car" niche market segment to bring tangible returns to the enterprise. The latest third-quarter financial report shows that Lixiang One achieved revenue of 42.874 billion yuan in the three months from July to September, with a net profit of 2.814 billion yuan for the quarter. Compared horizontally with the other two companies, Lixiang One is the only one that is profitable. During the same period, NIO had a net loss of 5.06 billion yuan with revenue of 18.674 billion yuan; Xpeng recorded revenue of 10.1 billion yuan with a loss of 1.81 billion yuan. Looking at sales volume, Lv Zhenning, a passenger car industry researcher, said that benefiting from the product sinking strategy launched this year, the sales volume of the three automakers has continued to grow. However, analyzing the data reveals that Lixiang One's delivery volume and growth rate also exceeded those of NIO and Xpeng by an order of magnitude. During this quarter, Lixiang One delivered a total of 153,000 vehicles, representing a year-on-year increase of 45.4%, making it the 30th consecutive week that Lixiang One has topped the sales chart of new forces in the Chinese market. Also in the third quarter, NIO delivered approximately 62,000 vehicles, a year-on-year increase of 11.6%; Xpeng delivered 47,000 vehicles, a year-on-year increase of 16.3%. Insiders close to Lixiang One also revealed that the cumulative delivery volume of Lixiang One L9 has exceeded 139,000 units but is still in short supply. During the Spring Festival in 2025, Lixiang One will initiate a factory expansion plan. Lixiang One, which is thriving, is the focus of all attention. Li Xiang's every move will be infinitely magnified and analyzed. The contradictory behavior of denouncing fuel vehicles while purchasing one belongs to the beloved "moment of breaking a promise" for people. For professionals, the signals released by the vanguard point to the future, which also leads to another reason for the controversy caused by Li Xiang's outright purchase of a Ferrari: Lixiang One may have a strategic adjustment. The day after the financial report was released, Lixiang One's Hong Kong shares fell by up to 11.55%. Despite impressive performance, the share price slumped, indicating that most forces in the capital market maintained a wait-and-see attitude. Logically, this is precisely the time for executives to come out and boost morale. However, instead of adopting any means of sharing profits with shareholders such as repurchases or dividends, Li Xiang first rewarded himself with a bonus worth 593 million yuan. During the post-earnings conference call, Li Tie, CFO of Lixiang One, stated that this was a rule set by Lixiang One in 2021, stipulating that if the delivery volume exceeds 500,000 units for 12 consecutive months, the CEO will receive equity incentives. He mentioned that the third quarter was just the first installment, and an additional 42 million yuan is expected in the fourth quarter. Obviously, investors are not fond of the story of "generals eating meat while soldiers drink soup," but ultimately, there is evidence to support it. Brokerage analysts believe that the core reason for the share price decline is still the management's conservative guidance for the fourth quarter. This issue had already emerged earlier. Although NIO's second-quarter report in August showed good growth momentum, the adjustment of the pure electric vehicle model release cycle to next year and management's expectation of delivering over 500,000 vehicles (later revised upwards to 560,000) still impacted the stock market, with NIO's U.S. shares falling by more than 17% intraday. Lixiang One now resembles a "Yesterday Once More" situation, with the current fourth-quarter sales guidance being 160,000 to 170,000 units, and the year-on-year growth rate is even lower than that of the third quarter. Based on these calculations, Lixiang One's full-year sales target is approximately 500,000 units, a gradual downward adjustment from the initial target of 800,000 units. The capital market demands new developments and sexy growth curves, and undoubtedly, Lixiang One has not met these expectations.

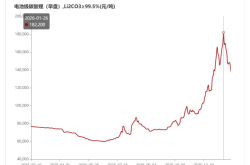

2. What Crisis Is Li Xiang Anticipating?

Although there is much ridicule online, there are always those who hold an optimistic attitude. Under any article related to Lixiang One's purchase of a Ferrari, there are comments like, "Is Lixiang One planning to become 'Ferrari One'? Finally, we will have a new energy sports car?" Another group of skeptics believes that Lixiang One has encountered a bottleneck, one piece of evidence being that while revenue has grown significantly, net profit performance has not kept pace. As mentioned earlier, in the third quarter of 2024, both revenue and net profit increased, but revenue increased by 23.6% year-on-year, while net profit only increased by 0.3%. The main factor affecting profitability is cost, and it is various costs. The financial report shows that Lixiang One's sales cost in the third quarter increased by 24.5% year-on-year, and operating expenses increased by 9.2% year-on-year. The vehicle gross margin of 20.9% may seem high but has actually decreased from 21.2% in the third quarter of 2023. Pang Yufeng, an analyst who has long focused on TMT and new car manufacturing forces, said that from the perspective of a single product line, Lixiang One's recent performance has offset its achievements and shortcomings. "The L6 is indeed a huge hit, but in the market above 300,000 yuan, the sales of the L7, L8, and L9 are all declining. Especially the L9, whose current sales volume is less than half of that of the AITO Askey M9, and this gap is likely to widen further." This point of view is similar to that of Lv Zhenning, who mentioned that if a product focuses on cost-effectiveness, it prioritizes quantity over price. It requires both a low selling price and competitive product configurations, which will sacrifice gross margin and put pressure on production capacity or the supply chain. Of course, Lixiang One has maintained a good performance in this regard. A report from BloombergNEF shows that Lixiang One's supplier payment terms fell back in 2023, giving it an advantage over BYD, NIO, and Xpeng, which are the only two companies among them to shorten their payment terms; the other is Tesla. Returning to Lixiang One's product line, there is also a theory that Lixiang One has now confined itself to the positioning of extended-range hybrids and high-end family cars. Holders of this theory analyze that Lixiang One's current four SUV models, the L6, L7, L8, and L9, are essentially the same car with slight differences in size and configuration. The underperformance of the Mega earlier this year revealed that Li Xiang's heavy investment in large extended-range MPVs was a strategic misstep, and the next direction must be reconsidered. Although the above viewpoints differ, there is consistency when carding them, which is that Lixiang One has reached a point where it must establish new growth points. After all, competition in the new energy vehicle industry is becoming increasingly fierce. In the high-end market, AITO, backed by Huawei, sold 182,000 vehicles in the first half of the year, which is comparable to Lixiang One's 189,000 vehicles. In the lower-end market, Xiaomi's SU7 has catapulted Lei Jun to the status of a new-generation "god," and ZERUN, known as the "half-price Lixiang One," has reduced its starting price to 150,000 yuan. There are countless county-level supergiants such as Nezha, Wuling, and Chery. The latest data released on December 1 showed that Lixiang One's delivery volume returned to below 50,000 units, a decrease of 5.3% from the previous month's delivery volume, which had already declined by 4.22% month-on-month. It is understandable that Li Xiang is eager to draw inspiration from his Ferrari purchase.

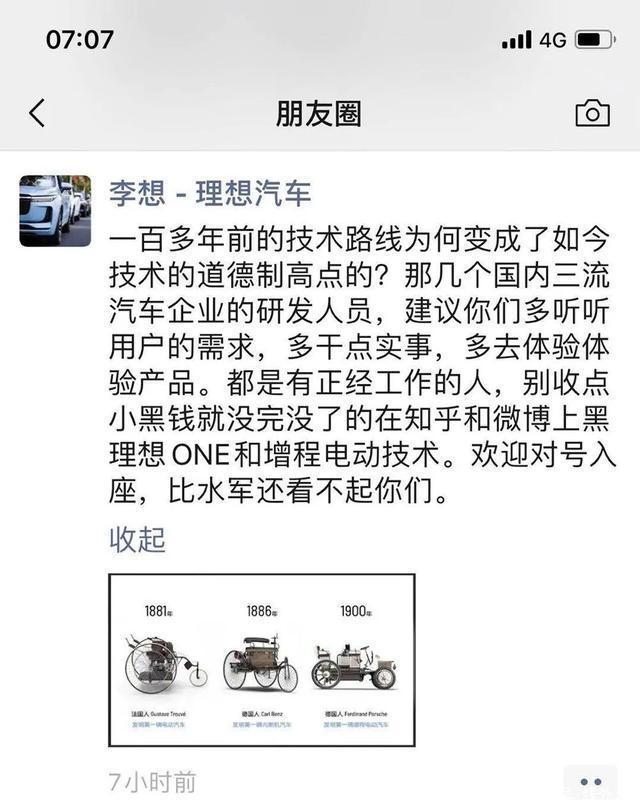

3. The "Red and Black Duality" of Entrepreneur IP

More than a year ago, Li Xiang retweeted a post on Weibo, predicting that the market share of new energy vehicles could be divided into three stages. The first stage involves the erosion of market share from second-tier independent brands, joint venture brands, and luxury brands; the second stage sees gradual replacement of first-tier joint venture brands; and the third stage involves either active transformation or territorial contraction by first-tier luxury brands. "Independent first-tier brands will complete the self-substitution of new energy, and ultra-luxury brands and supercar brands will not be affected." He predicted that in 2023, Lixiang One would occupy 20% of the SUV market, and by the end of 2025, new energy passenger vehicles would account for more than 70%. Although there is no authoritative data to verify the former performance, according to predictions from the China Passenger Car Association, the penetration rate of new energy vehicles in November will reach 53.5%, with both year-on-year and month-on-month retail sales expected to increase. Li Xiang's words were once regarded as gospel in the market, but rather than focusing on right or wrong, arrogant or sincere, it is more worthwhile to explore the reasons behind Li Xiang's insistence on "governing the enterprise through Weibo." From Lei Jun joining Douyin to Zhou Hongyi producing dramas, Chinese entrepreneurs in 2024 seem to have unanimously embarked on the path of becoming internet celebrities. Compared to the new media predecessors who love to make short videos and live streams, Li Xiang, who still insists on using text on Weibo, even seems a bit retro. The reason for the influx of these tycoons is simple: to sell products. After all, in an era of a stock economy, traffic is equivalent to money. The Xiaomi matrix formed by Lei Jun, Lu Weibing, Xu Fei, and others constantly voices their opinions, bringing a lot of attention to Xiaomi phones, Xiaomi cars, and even the Mi Ecosystem Chain. Li Xiang is following the same path. Excluding the "crazy" Elon Musk and Zhou Hongyi, who produces web dramas, netizens have mixed feelings towards most internet celebrity entrepreneurs, embodying the "red and black duality" of entrepreneur IP. Traffic is like water; it can carry a boat but also sink it. Internet celebrity CEOs can increase consumer trust in the brand to help sales but may also backfire on the company if one wrong move is made. Yu Minhong's dispute with Dong Yuhui led to a sharp drop in Eastbuy's share price, and Dong Mingzhu's remark that "if you want to rest, I suggest you quit directly" led consumers to directly boycott Gree. In high-value commodity fields such as automobiles, the attitudes of brand founders and executives are even more important. They carry consumers' perceptions of brand values and product capabilities. Li Xiang's previous statements about the disadvantages of fuel vehicles, followed by his outright purchase of a Ferrari, create a sense of disconnection. However, in the long run, no matter what entrepreneurs do, it will only have a temporary impact. Consumers' wallets and market choices are honest, and tangible quality and differentiated competitiveness will help brands gain a foothold. Brands like Chanel, LV, and Facebook have proven that the founder's outrageous statements will not destroy the brand. From this perspective, Lixiang One's public relations department's laissez-faire attitude towards Li Xiang is understandable. A flesh-and-blood "persona" is more popular with consumers. The trend of black-red popularity loved by the entertainment industry may have blown into the new energy sector. As long as there is traffic, it's not all bad. But this brings us back to a good question that all concerned netizens want to know the answer to: Why did Li Xiang, who has always looked down on fuel vehicles and insisted on only making new energy vehicles, buy a gasoline-powered Ferrari?