Not copying Huawei's "four boundaries", GAC can't lower its status

![]() 12/10 2024

12/10 2024

![]() 674

674

"After the threat theory of Huawei's soul fades away, another essential issue truly needs to be addressed: Should large automakers use Huawei's name to make money?"

@TechNews Original

GAC Motor also knocks on the door, expanding Huawei's circle of friends.

At the end of 2024, the automotive industry underwent dramatic changes. On November 30, GAC Group signed a deepened cooperation agreement with Huawei. It was revealed that GAC Group will launch a brand-new high-end smart new energy vehicle brand in addition to Trumpchi, Aion, and Enverge.

Driven by positive news, GAC Group's Hong Kong stocks closed up 25.17% on December 2, demonstrating the "money-making ability" of Huawei-related stocks.

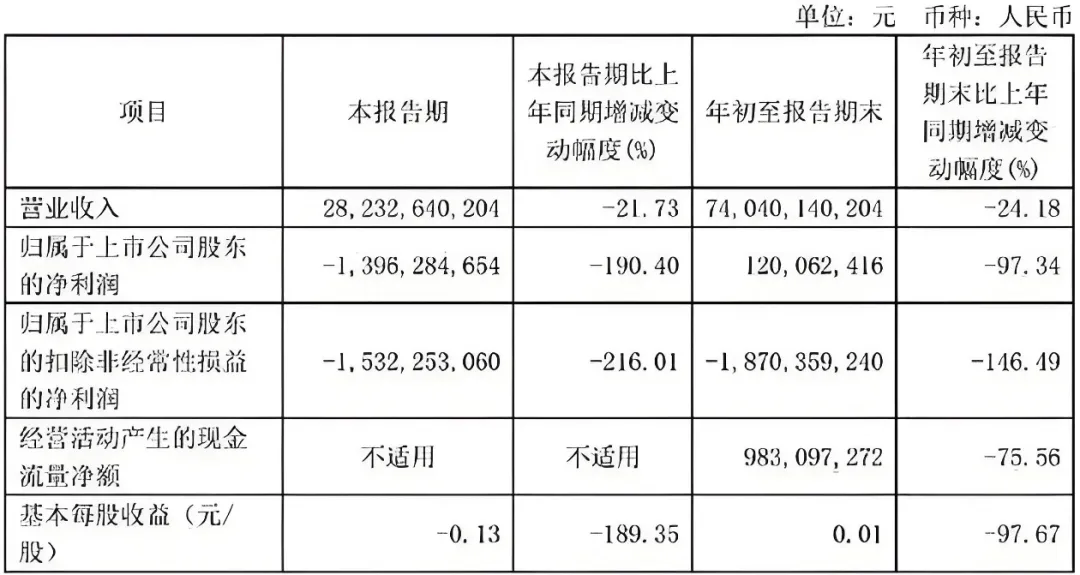

GAC's significant move is actually related to its current market situation. According to data, GAC Group achieved operating revenue of RMB 28.233 billion in the third quarter of this year, a year-on-year decrease of 21.73%; net profit attributable to shareholders of listed companies was -RMB 1.396 billion, a year-on-year decrease of 190.40%; and net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was -RMB 1.532 billion, a year-on-year decrease of 216.01%.

For the first three quarters, GAC Group achieved revenue of RMB 74.04 billion, a year-on-year decrease of 24.18%; net profit attributable to shareholders of listed companies was RMB 120 million, a year-on-year decrease of 97.34%; and net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was -RMB 1.87 billion, a year-on-year decrease of 146.49%.

Obviously, after setting a new record for the worst net profit performance since listing, GAC faces a bigger issue: how to break the deadlock.

01

Join if you can't compete

In fact, GAC Motor and Huawei have a long history of cooperation.

GAC Motor and Huawei have cooperated in the field of intelligent connectivity since 2017. In 2021, GAC Aion selected the AH8 model to pilot Huawei's HI mode, combining GAC's GEP 3.0 chassis platform with Huawei's full-stack intelligent vehicle technology. On July 9, 2022, GAC Group issued an announcement stating that it agreed to cooperate with Huawei on the AH8 model project through its holding subsidiary GAC Aion.

This is a powerful alliance. GAC provides an advanced GEP 3.0 chassis platform, while Huawei contributes a new-generation intelligent vehicle digital platform and full-stack intelligent vehicle solutions. The two parties jointly define and create future-oriented intelligent vehicles. At that time, GAC and Huawei, one a leader in the automotive industry and the other a giant in the communications field, naturally attracted much attention for their in-depth cooperation.

However, things unexpectedly changed soon, and the cooperation ultimately failed to materialize.

On March 27, 2023, GAC Group issued another announcement stating that the GAC Aion AH8 project had been changed from joint development with Huawei to independent development, with Huawei participating as a supplier.

This shift is akin to partners who were once fighting side by side suddenly beginning to fight alone. What exactly caused this downgrade in cooperation?

At a financial report briefing a few days later, GAC Group Chairman Zeng Qinghong stated that GAC had already launched Aion and Hyper and did not need to create a new brand with Huawei. GAC Group General Manager Feng Xingya added that, first, once cooperation is finalized, a certain degree of flexibility is lost, and independent development allows for greater flexibility and faster R&D speeds. Second, GAC mainly considers profitability in its core areas and can temporarily forgo others. Third, considering overall cost competitiveness, switching to a supplier model allows both parties to maximize their respective advantages.

Obviously, GAC's reasons are relatively credible, but they reflect an awkward issue: Who is really in charge of this cooperation? At that time, Huawei was a newcomer to the automotive industry, and its giant status made traditional players wary. Lacking an industry foundation, Huawei could only choose to cooperate with smaller automakers. GAC, on the other hand, was in a growth trend in terms of sales and revenue quality, especially in the joint venture gasoline vehicle sector, where GAC relied on "two fields" (Honda and Toyota) and had a high market share.

Comparing these situations reveals an issue: When GAC cooperates with Huawei, the distinction between primary and secondary roles in technology leadership and project control becomes blurred. Essentially, GAC is wary of Huawei due to considerations of interests and core technologies.

As early as 2022, Zeng Qinghong publicly criticized the high cost of batteries, with all profits going to CATL, leaving automakers as mere "workers." Maintaining dominance is crucial for him. At that time, GAC was still riding high. Before 2023, GAC's two joint venture brands helped achieve annual sales of over 1.5 million vehicles. Aion emerged as a leader among new forces with a valuation of nearly RMB 100 billion and monthly sales exceeding 50,000 vehicles.

However, the automotive market has undergone tremendous changes since then. As the new energy vehicle market continues to develop, competition among new force automakers has become increasingly fierce.

Despite experiencing a sales downturn in the first three quarters, GAC Aion achieved sales of over 40,000 vehicles consecutively in October and November. In November, global sales reached 42,000 vehicles, an increase of 1.8% year-on-year and 10.9% month-on-month. However, from January to October this year, GAC Group's cumulative sales were 1.52 million vehicles, a year-on-year decrease of 24.66%. Moreover, the decline was not limited to joint venture brands; sales of independent brands also fell by about two digits year-on-year. Even Aion, a star performer among new forces, is losing its charm.

GAC's other core business, joint venture gasoline vehicles, is also performing worse than before. From 2020 to 2022, the combined annual sales of GAC Honda and GAC Toyota remained between 1.5 million and 1.7 million vehicles, accounting for approximately 70% of GAC's total automotive sales. In 2023, this proportion dropped to around 60%.

What makes GAC even more behind is the lack of a presence in the premium car market. Over the past year, first-tier luxury brands have undergone a major reshuffle in the Chinese market. In the first three quarters of this year, Mercedes-Benz, BMW, and Audi sold 170,700, 147,800, and 157,500 new vehicles in China, respectively, with year-on-year decreases of 29.8%, 12.9%, and 19.63%, respectively.

In contrast, models like the AITO M9 have been highly successful in the RMB 300,000 to RMB 500,000 market segment, selling 180,000 vehicles in 11 months since its launch. The AITO M7 series delivered 12,573 vehicles in November, with a cumulative delivery of 183,096 new vehicles in 2024. However, in this fierce competition, GAC Enverge, which is in the same class as the AITO M9, appears to be struggling, with sales of only 3,161 vehicles in November 2024.

The latest financial report sounded the alarm. GAC Group's revenue in the third quarter was RMB 28.233 billion, a year-on-year decrease of 21.73%; net loss was RMB 1.396 billion, compared to a net profit of RMB 1.545 billion in the same period last year. From January to September, GAC Group's cumulative sales were 1.335 million vehicles, a year-on-year decrease of 25.59%.

This comparison makes one sigh that fortunes change over time for both GAC and Huawei. Previously, GAC only regarded Huawei as a component supplier, but now, automakers that cooperated deeply with Huawei in the early stages, such as Thalys, BAIC, Chery, and JAC, have made a name for themselves. Even AITO and HORIZON have gained significant attention through their association with Huawei.

Huawei is like a "super cheat code" for automakers, and sales data is the best proof of this.

Since it is impossible to compete with Huawei's partners, joining them may be a viable option. But can GAC's partnership with Huawei change the game at this point?

02

Huawei's circle of friends expands

Huawei has been very busy.

A review of Huawei's automotive activities this year: In January, it established the Yinwang company to spin off the vehicle BU; in May, it transferred the "Xiangjie" trademark to Beijing Electric Vehicle Co., Ltd.; in July, it transferred trademarks such as "AITO" to Thalys. The Deep Blue S07 was officially launched, with the high-end model equipped with Huawei's Kunlun Intelligent Driving ADS SE system, touted as the "only high-end intelligent driving system from Huawei under RMB 200,000." At the end of August, BYD signed a cooperation agreement with Huawei, and the FANGCHENGBAO flagship model BAO 8 will be equipped with Huawei's Kunlun Intelligent Driving ADS 3.0, becoming the first BYD model to feature Huawei's intelligent driving system. In September, the all-new VOYAH Dreamer MPV, equipped with Huawei's Kunlun Intelligent Driving and HarmonyOS cabin system, was launched.

Among the latest models to cooperate deeply with Huawei are the Audi A5L, GAC Trumpchi 1 Concept, VOYAH Dreamer, BYD FANGCHENGBAO BAO 8, CHANGAN Deep Blue S07, and DFM Motors.

Clearly, Huawei has found a suitable role in the automotive industry, and this path is helping it reshape its intelligent driving landscape.

According to data released by HarmonyOS Drive, 272,136 vehicles from the entire HarmonyOS Drive lineup were delivered from January to August this year, with 33,699 vehicles delivered in August alone, excluding non-smart selection models. At this development rate, Yu Chengdong's boast of selling 300,000 vehicles annually is about to become a reality again.

Meanwhile, in the current highly competitive domestic new energy vehicle market, automakers that cooperate with Huawei have generally seen improvements in sales performance to varying degrees.

For example, Chery, which cooperated with Huawei to launch the Zhijie automobile, delivered 8,983 new vehicles in November, showing a promising situation. JAC Motors, which recently cooperated with Huawei, saw its third-quarter profits soar by 1028%. Thalys successfully turned a profit thanks to AITO, with profits increasing by more than five times and its market value temporarily surpassing that of SAIC. The VOYAH Dreamer, equipped with Huawei's high-end intelligent driving system, delivered 10,856 vehicles in November, a year-on-year increase of 55% and the third consecutive month with sales exceeding 10,000 vehicles. It even won the monthly sales championship for new energy MPVs in October.

This is why Huawei is surging ahead: empowering automakers. With its value recognized, Huawei's circle of friends is becoming increasingly crowded. Even SAIC, which initially voiced the "soul theory," has been reported to be on the verge of cooperating with Huawei.

In November, market rumors circulated that SAIC Motor was in close contact with Huawei and preparing for in-depth cooperation.

As everyone knows, Huawei offers automakers three cooperation modes: supplier mode, HI mode, and smart selection car mode. The latter two are more popular among automakers. However, like GAC, super giants are still avoiding the risk of losing dominance when cooperating with Huawei.

In this cooperation, SAIC may become the third investor in Shenzhen Yinwang, and the cooperation between the two parties will focus on the Feifan brand, adopting intelligent solutions provided by Huawei. However, this cooperation will not follow Huawei's "HI" mode.

If SAIC successfully cooperates with Huawei, there will undoubtedly be less market space left for GAC. The reason is simple: As super automakers, SAIC and GAC compete across the board and have simultaneously bet on Huawei's intelligent driving system. For both, it is a single choice, but for Huawei, it is a relationship of homogeneous services to multiple parties with equal status, making it difficult to prioritize.

It seems that GAC still has a long way to go to break through.

03

No intention to replicate the "four boundaries" model

In this cooperation with Huawei, GAC is signaling its intention to maintain dominance in its own development.

Regarding this, Gu Huinan, General Manager of GAC Aion, made a vivid comparison: "We still insist that the underlying electronic and electrical architecture must be our own. It's like building a house; the land is mine, so I won't lose everything just because the house above it is gone."

This statement shares a similar context with SAIC's previous soul theory. However, times have changed, and GAC's engagement with Huawei seems to have a new interpretation. Feng Xingya, General Manager of GAC Group, has expressed the view that autonomous driving is not the soul, reasoning that "when a technology matures and can be widely supplied by society, it certainly is not the soul."

It seems that GAC, which is no longer threatened by the soul theory, should have embraced Huawei earlier. In reality, it was not until February of this year, when Trumpchi upgraded its cooperation with Huawei, that GAC's determination to integrate with Huawei became apparent. At that time, Trumpchi announced the launch of the Trumpchi M8 Master Vanguard Edition, which uses Huawei's in-vehicle infotainment system. Then, in March, Trumpchi and Huawei held a HarmonyOS cooperation signing ceremony, and Trumpchi officially became one of the first automotive brands to join the HarmonyOS ecosystem. At that time, GAC even stated that its cooperation with Huawei would not be limited to the HarmonyOS ecosystem.

However, how to cooperate has become a major issue for GAC. In fact, after the threat theory of Huawei's soul fades away, another essential issue truly needs to be addressed: Should large automakers use Huawei's name to make money?

Initially, it seemed that Huawei had many cooperative brands, but only Thalys was deeply involved. Thalys' performance improved from worrying sales to becoming one of the top three in its vertical market, a transformation achieved in just a few years. Nowadays, large automakers that have lowered their status to sign cooperation frameworks with Huawei include Changan, Chery, JAC, and Dongfeng. So many OEMs want to cooperate with Huawei. The demand for intelligent driving is a business consideration, but more importantly, it is to use Huawei's golden signboard to boost sales.

Huawei has three modes of cooperation with automakers: component supply mode, HI mode, and Smart Selection mode, with increasing tightness in that order. Among them, the 'Four Realms' under the Smart Selection mode are currently the most popular: they are AITO, EnjoyAuto, SmartAuto, and ZenithAuto, which are Huawei's collaborations with Thalys, BAIC, Chery, and JAC, respectively.

However, despite the popularity of the Four Realms, GAC seems uninterested in replicating this model. At the signing ceremony, Huawei was represented by Rotating Chairman Xu Zhijun and CEO of Intelligent Automobile Solutions BU Jin Yuzhi, who advocate the HI mode, suggesting that this cooperation will likely also adopt the HI mode.

The main promoter of the Smart Selection mode is Yu Chengdong from Huawei's automotive sector. There have been multiple clashes between Huawei's two automotive strategies this year, with Xu Zhijun representing the company and repeatedly reiterating the bottom line of not manufacturing cars. Before the establishment of the Yinwang company, Yu Chengdong even voiced his grievances on Huawei's internal network.

Thus, the cooperation between GAC and Huawei is actually moving beyond the Four Realms. However, time seems to be running out for GAC.

Zhang Xiang, a researcher at the Automotive Industry Innovation Research Center of Northern Polytechnic University, analyzed for the Economic Observer that GAC's independent brands currently contribute relatively little in sales and profits to the group, and are in the initial stage of new energy vehicle development, falling short of the substantial earnings previously generated by GAC Toyota and GAC Honda. To successfully transform, GAC needs drastic reforms.

In September this year, the third-party consulting firm Hurun Research Institute released the 2024 Hurun China New Energy Industry Cluster City Rankings, showing that Guangzhou ranked fifth on the list, behind Shanghai, Shenzhen, Changzhou, and Suzhou. In the era of gasoline vehicles, Guangzhou, with GAC, has long ranked first in terms of automotive supply chain concentration.

This is another footnote to GAC's lag in the new energy race. Over the past two years, the "14th Five-Year Plan" for the Innovative Development of Smart and New Energy Vehicles in Guangzhou and the Medium and Long-term Development Plan for the Automotive Industry in Guangzhou (2023-2035) have been successively implemented, clearly stating that the development of Guangzhou's automotive industry faces new challenges and opportunities, and will promote the development of new energy vehicles, intelligent and connected vehicles, and elevate the level of automotive exports to a new stage.

Although Guangzhou also has new forces like XPeng leading the industry, it is more natural for core state-owned enterprises like GAC to shoulder the responsibility of urban new energy development.

An elephant never turns around quickly. GAC, aiming to move beyond the Four Realms, actually has more to change.