Staying in Tune with Huawei: Will BYD Abandon Low-Price Competition by 2025?

![]() 12/12 2024

12/12 2024

![]() 511

511

BYD's business strategy in 2025 will mark a significant departure from its 2020-2024 trajectory.

Internally, BYD's 2025 KPI for smart driving technology surpasses that for its second-generation Blade Battery. With the final wave of new vehicle launches in 2024, the intensifying competition in the automotive market for 2025 is already apparent. Despite the spotlight on brands like AITO 06 and Xiaomi YU7, BYD remains the focal point for understanding this escalating rivalry.

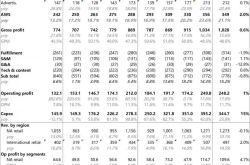

If 2024 could be summarized in three keywords for the automotive industry, they would be price reductions, smart driving, and plug-in hybrids. Any company excelling in two of these areas achieved remarkable results. BYD, for instance, sold 3.7573 million vehicles from January to November 2024, surpassing the 500,000-unit monthly sales mark in November. Starting in December, BYD further offered terminal discounts of RMB 3,000 on many models. Following the launch of Geely's Yinxing 7, BYD swiftly increased the terminal discount for the Song Pro Glory Edition by RMB 3,000 to RMB 10,000 and for the second-generation Song Pro by RMB 3,000 to RMB 7,000.

According to third-party data, BYD didn't slow down in December despite nearly achieving its 2024 sales target. Instead, it accelerated further. The number of locked orders frequently exceeded 120,000 per week. It is now speculated that if BYD maintains this momentum in December, its final annual sales volume could reach 4.3 million units.

This figure positions BYD to challenge for the title of the world's third-largest automaker, trailing Toyota and Volkswagen but surpassing Ford and Honda. According to the latest data, some institutions predict that BYD will aim for an annual sales volume of 5.5 million units in 2025. Regardless of whether this figure is accurate, BYD's intensified competition will significantly impact the Chinese automotive market's competitive landscape in 2025 and consumer purchasing decisions.

Will BYD prioritize something other than low prices in 2025?

Compared to its 2022-2024 strategies, BYD will undergo a noticeable transformation in 2025, most notably by expanding its premium market share. The latest key developments can be summarized in four points.

First, the entire group is all-in on smart driving technology. This includes a software team of over 4,000 people focused on algorithm and code breakthroughs, as well as collaboration with Huawei. Additionally, in early December, BYD acquired approximately 3.95% of DJI's Shenzhen Zhuoyu Technology, with a registered capital of RMB 2.8859 million. These moves indicate that smart driving technology will be rapidly integrated into vehicles in 2025.

Second, new vehicle plans are targeted at the high-end segment, including the Han L, Tang L, BYD Xia, and Yangwang U7. A higher-end positioning translates to higher premiums and profits.

Third, the second-generation Blade Battery, initially planned for release in the fourth quarter of 2024, will gradually be integrated into vehicles in 2025, becoming a competitive advantage and ultimately contributing to sales and profits.

Fourth, despite the new energy era, BYD is also secretly focusing on engine development. In the latest batch of application information, careful observation of the Yangwang U7 reveals that BYD has applied for a patent for its BYD4H20 2.0T horizontally opposed engine, which will gradually be used in BYD's low-center-of-gravity sports models.

In terms of overall priority, the second-generation Blade Battery ranks third in importance.

By leveraging new technologies to generate higher profits, BYD has, to a certain extent, entered a period of market harvest, according to conventional market definitions.

From a developmental perspective, BYD has outpaced similar competitors in the market through technological innovation and cost control in previous years.

In 2022, BYD reduced the prices of its mainstream A-segment sedans and SUVs by approximately RMB 20,000. Through enhancements in DM-i technology, it achieved price parity between gasoline and electric vehicles. In 2023, the launch of the Champion Edition, with the Qin PLUS DM-i priced at RMB 99,800, was a key milestone, marking a lower price for electric vehicles compared to gasoline ones. In 2024, with the introduction of the Glory Edition and the fifth-generation DM, these prices were further reduced by RMB 20,000.

Over the past three years, BYD's annual sales volume has increased by over 1 million units each year. In 2022, it sold 1.8025 million units, 3.0244 million units in 2023, and is expected to reach 4.2 million units in 2024. It is evident that, by reducing costs through technological innovation, BYD has, in three years, first gained pricing power in the market below RMB 200,000. When other companies launch new vehicles, they must benchmark against BYD. Furthermore, BYD has also gained the right to define the market below RMB 200,000, and other automakers must consider BYD's approach when defining new products.

In simple terms, it is clear that BYD is shifting gears to start a new round of competition. To date, the lower-end market has become overly competitive. Whether it's the launch of Geely's Yinxing 7 or the upcoming launch of Chery's Fengyun A8L, the competition among BYD, Geely, Changan, and Chery has turned into a cycle of price reductions under equivalent configurations and technological approaches.

The second-generation Blade Battery ranks third in importance?

The logic is clear, and more attention should be paid to specific areas, starting with technology and then products.

Considering the second-generation Blade Battery, at COP29, Wang Chuanfu publicly stated that a new generation of Blade Batteries would be launched in 2025. Key indicators include a driving range exceeding 1,000 kilometers per vehicle, improved battery life, and continued advantages of LFP lithium iron phosphate batteries in safety, stability, and low cost, while further approaching the performance of high-end ternary lithium batteries in energy density.

Further compiling credible information currently available, the second-generation Blade Battery's notable features also include a charging rate of 5.5C and a discharge rate of 14C. Regarding energy density, multiple sources indicate an increase from 150Wh/kg for the currently available first-generation Blade Battery to 190Wh/kg. For comparison, NIO's semi-solid-state battery has a cell energy density of 350Wh/kg and a pack energy density of 260Wh/kg, similar to that of IM Motors.

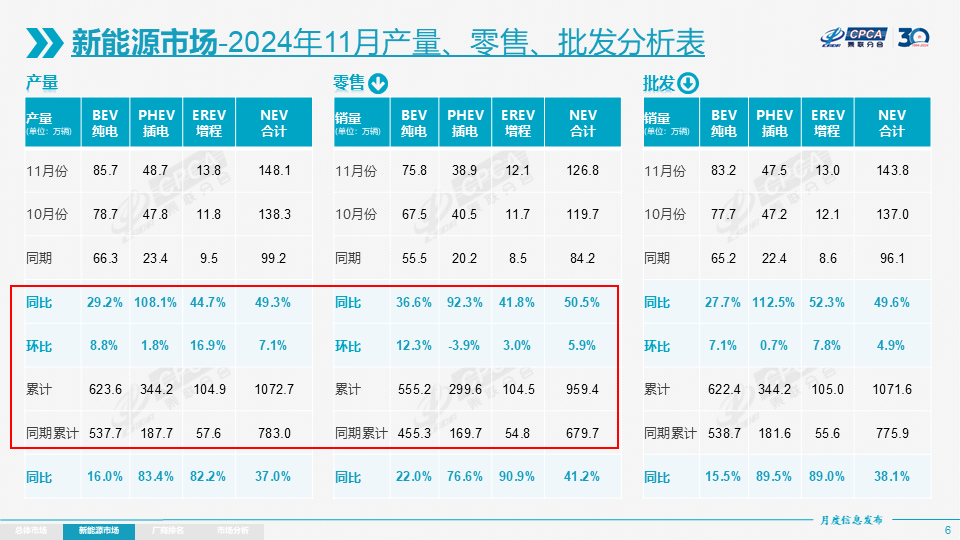

However, considering the current market competition, the urgency and importance of the second-generation Blade Battery are not as significant as BYD's all-in approach to smart driving. The reason is that the current growth in new energy vehicles primarily relies on plug-in hybrids and extended-range electric vehicles, while pure electric vehicle sales are sluggish. In terms of cumulative sales, both plug-in hybrids and extended-range electric vehicles have grown by over 80% in 2024, while the sales growth of pure electric vehicles has not exceeded 20%.

For automakers today, sales volume and cash flow are crucial for ensuring normal business development and future survival. Coupled with brands like Zeekr and XPeng successively shifting to extended-range electric vehicles, it is evident that increasing efforts on pure electric vehicles has diminishing returns in terms of cost-effectiveness.

The reason smart driving ranks first is closely related to the current market competition. This can be seen in the examples of three companies. First, Huawei's AITO M9, powered by HarmonyOS, has been the sales champion in the over-RMB-400,000 segment for multiple months. Supporting its sales performance is not the extended-range technology but Huawei's strength in digitizing products and its Qiankun Intelligent Driving ADS 3.0 system. The same applies to the newly launched AITO S800. In the global market, it is a fact that new energy vehicles cannot be sold at high prices. However, the AITO S800 can be priced above RMB 1 million and quickly attract over 2,000 orders because of consumer expectations for Level 3 autonomous driving.

Second, Li Auto's VLM+ end-to-end solution, which was the first in the Chinese market to offer parking lot-to-parking lot assisted driving, has seen sales growth of over 20% for its MAX version, which is fully equipped with LiDAR and intelligent driving hardware.

Third, XPeng, although ranked second in intelligent driving after Huawei, has been criticized as being on the brink of collapse due to product definition issues, internal management chaos, and a disorganized sales and manufacturing system. However, it has managed to climb to second or third place among new energy vehicle startups, primarily due to its intelligent driving capabilities and a business model that provides a competitive advantage.

From a financial perspective, Yu Chengdong officially announced within the year that the Vehicle BU is expected to turn a profit. Li Auto reported profits of RMB 1.3 billion in the first quarter, RMB 1.5 billion in the second quarter, and a significant increase to RMB 2.8 billion in the third quarter. Additionally, in XPeng's third-quarter financial report, although the average transaction price halved, the profit margin of the XPeng P7+ remained high. The core reason for this is the minimization of focus on vehicle functions and driving performance, with software being the primary source of profit.

Considering new vehicle plans, BYD's Tang L is likely to use the 2.0T fifth-generation DM technology in 2025, priced above RMB 200,000, competing with models like the Li Auto L6 and AITO M7. The BYD Han L is also expected to target the market above RMB 200,000, competing with models like the Xiaomi SU7 and Tesla Model 3. Furthermore, the BYD Xia, based on the latest application information for the Denza D9, is likely to have a starting price below RMB 300,000, offering essential MPV functions, while the Denza D9, equipped with LiDAR, will provide better intelligent driving capabilities, forming a complementary combination.

Another example is the upcoming Denza D9, expected to be priced at over RMB 400,000 and will compete with AITO M9 and Li Auto L9. Additionally, BYD's N brand model U7, with the introduction of a horizontally opposed engine, will emphasize sportiness, performance, and a low center of gravity, leading to a gradual transition in BYD's lineup. This brings the advantage of allowing the intake system to bypass the front axle's dual motors, enabling direct drive from the engine, effectively altering the previous electric-centric drive logic.

From this perspective, BYD's competitive strategy shifts. In the highly competitive entry-level market, it offers intelligent driving features to attract consumers and boost profits. In the more lucrative market above RMB 200,000, it competes with new-energy vehicle startups for market share.

Final Thoughts

Of course, this doesn't mean that the second-generation Blade Battery is not a powerful weapon in BYD's arsenal. According to our information, in addition to having an energy density close to that of ternary lithium batteries, a further 15% reduction in production costs is also a core objective. Moreover, there will be two versions: a long blade and a short blade. The short blade will focus more on plug-in hybrid and high-