"Japanese" Automobiles are Coming

![]() 12/24 2024

12/24 2024

![]() 512

512

Compiled by | Yang Yuke

Edited by | Li Guozheng

Produced by | Bangning Studio (gbngzs)

On the afternoon of December 23, local time in Japan, Honda, Nissan, and Mitsubishi Motors jointly announced that they had signed a memorandum of understanding (MOU).

According to the MOU, Nissan and Honda plan to form a joint holding company, with both companies becoming wholly-owned subsidiaries through a mutual share transfer. The goal is to finalize the agreement by June 2025 and list the new holding company on the Tokyo Stock Exchange by August 2025. Mitsubishi Motors will decide by the end of January 2025 whether to join the business integration of Nissan and Honda.

Honda and Nissan aim to coexist and develop their respective brands equally. Upon the listing of the joint holding company, Honda and Nissan will delist from the Tokyo Exchange in August 2025.

Nissan's President, CEO, and Representative Executive Officer, Makoto Uchida, stated, "Today marks a pivotal moment as we embark on discussions about business integration, which holds the potential to reshape our future. By integrating our strengths, I believe we can offer unparalleled value to customers worldwide who cherish our brands."

Honda's Director and Representative Executive Officer, Toshihiro Mibe, added, "Pooling Honda and Nissan's resources, including knowledge, talent, and technology, is crucial to overcoming the environmental challenges facing the auto industry. Both companies possess unique strengths."

To facilitate the integration, Nissan and Honda will establish a preparatory committee. By realizing timely synergies, they aim to become a world-class mobility company with sales revenue exceeding 30 trillion yen and operating profit surpassing 3 trillion yen.

Nissan outlined on its official website that the integration primarily aims to achieve synergies in seven areas: vehicle platform standardization, R&D function integration, manufacturing system optimization, procurement function integration, operational efficiency improvement, sales and financial function integration, and the establishment of an intelligent and electrified talent pool.

The potential merger of Honda, Nissan, and Mitsubishi represents a historic move.

If successful, the combined entity would become the third-largest automaker globally, trailing only Toyota and Volkswagen.

This deal would also reshape the Japanese auto industry, consolidating it into two major camps: one led by Toyota, which holds minority stakes in Subaru, Mazda, and Suzuki, and the other comprising Honda, Nissan, and Mitsubishi.

However, the merger could lead to significant overlaps in Japanese production facilities, key markets, management, and product lines. Additionally, cross-shareholdings might entangle Honda and Nissan in a complex shareholder network with their existing partners Renault and Mitsubishi.

Moreover, the scale of the merger might exacerbate existing problems.

On December 20, 2024, Carlos Ghosn, the former Chairman of Nissan, described the merger as a "desperate move" due to the difficulty in finding synergies between the two companies.

Nine months ago, Honda and Nissan shocked the industry by announcing their intention to explore cooperation in electric vehicles, automotive software, batteries, procurement, and other areas. This was surprising given their long-standing rivalry, with Honda known for its independent approach.

Size is Not a Panacea

The collaboration between Honda and Nissan could create a new Japanese giant in the global auto industry, rivaling automotive groups like Volkswagen and Hyundai.

However, it could also result in a formidable yet desperate duo, leaving both companies prone to the same issues. In this complex era, size alone is not a guarantee of success.

Regardless of the outcome, a tightly integrated partnership heralds a new era for Japan's historic auto industry. It underscores the immense pressure felt by traditional global automakers amid technological upheaval, fierce competition, and encroachment from China and the tech sector.

Part of the reason Honda and Nissan expedited the signing of the MOU was news that Foxconn, the world's largest Apple iPhone manufacturer and tech giant, was seeking a stake in Nissan amid declining share prices.

Regardless of whether it's beneficial or detrimental, both automakers will continue to be operated by Japanese entities. However, collaboration does not guarantee a robust defense or necessarily solve their problems.

"If they merge, it will be an alliance of the weak," commented Sanshiro Fukao, Executive Researcher at the ITOCHU Research Institute's Industrial Research Center.

Perhaps size is not the solution to Honda and Nissan's predicaments.

Nissan's global production capacity has surpassed 5 million vehicles, far exceeding sales. Honda also faces overcapacity issues, albeit less severe. James Hong, an analyst at Macquarie Securities, stated that the two companies should only integrate after "slimming down."

"A merger without capacity optimization will only exacerbate problems," said James. "We estimate Honda and Nissan have excess capacities of 500,000 and 1.3 million vehicles, respectively."

Some within Nissan believe that Honda cannot quickly address Nissan's fundamental issues. In the US and China, Nissan struggles with excess inventory and unremarkable products. Its US operations have suffered significantly due to the lack of hybrid models.

Honda, a global leader in hybrids, could assist Nissan in this regard. However, deploying hybrid systems across Nissan's product line could take years.

For Honda, Nissan could bring expertise in frame-bodied pickup trucks.

Both companies are developing their own solid-state batteries for electric vehicles. Concentrating resources on such costly technologies and automotive software is a natural fit for collaboration.

However, closer integration under a holding company is not a panacea. Honda and Nissan are known for their distinctly different corporate cultures, making integration challenging. Size alone cannot solve all problems. Sometimes, a vast empire comprising different brands, competing executive teams, and parallel corporate traditions only introduces new complexities, as evidenced by the trials and tribulations faced by Stellantis and its numerous brands.

Both Nissan and Honda need a quick start, but it's unclear where the synergies lie, how the companies can rationalize operations, and what sacrifices will be made.

Reshaping the Japanese Auto Industry

The Japanese government has expressed clear support for the merger.

Yoji Muto, Minister of Economy, Trade, and Industry, said, "When companies cooperate to enhance competitiveness, we should take a positive attitude." While he declined to discuss the Honda-Nissan merger plan specifically, he noted that such industry reorganization is "an effective method to promote innovation and enhance corporate value."

On the morning of December 23, before announcing the plan, the CEOs of Honda and Nissan visited the Japanese government department, symbolically showing respect for the regulators.

China's encroachment on areas once dominated by Japan, including automobiles and components like batteries, has raised concerns among Japanese officials. Last year, China surpassed Japan to become the world's largest auto exporter by vehicle volume.

According to the Japan Automobile Manufacturers Association, about 8% of Japan's working population is employed in the automotive and related industries. The association states that the entire automotive industry (including cars, trucks, motorcycles, and parts) accounted for more than a fifth of Japan's total exports last year.

The Japanese government is funding research projects that bring together competing automakers to develop technologies like next-generation batteries.

In March this year, Honda and Nissan began exploring a looser technical and procurement partnership, which will form the basis for a capital tie-up between the two companies. This will enable the automakers to achieve greater scale to reduce costs and share the R&D burden of developing new technologies.

Establishing a joint holding company can create a unified management structure at the top, with executives from both companies guiding overall corporate strategy. However, under this umbrella, the two companies will retain their respective brand identities, sales networks, presidents, and other senior management.

The biggest benefit of the merger between Honda, Japan's second-largest automaker, and Nissan, the third-largest, is scale. Despite downgraded expectations, Nissan projects sales of 3.4 million vehicles for the fiscal year ending March 31, 2025. Honda expects sales of 3.8 million vehicles.

The synergies generated by the approximately 7.2 million vehicles sold globally by these two companies annually will be significant. Due to Mitsubishi's existing capital partnership with Nissan, it is expected to participate in the future. Adding Mitsubishi's 895,000 vehicles brings the total scale to over 8 million.

In contrast, Toyota sold a record 11.09 million vehicles in the previous fiscal year, solidifying its position as the global leader. This figure does not include its capital cross-shareholding partners such as Subaru, Mazda, Suzuki, and Isuzu.

Nissan's weakened state makes it eager for a friendly partner but also vulnerable to hostile influences. Nissan's share price has fallen about 35% this year before news of negotiations with Honda emerged. Makoto Uchida has been preparing defensive measures to ward off unwanted suitors.

After Foxconn expressed interest in investing, some within Nissan anticipated interest from other tech companies. According to sources close to management, one idea was that Nissan needed a thorough overhaul with partners in software and AI rather than facing the same self-transformation issues as an old-school metal manufacturer.

"By merging two unhealthy traditional automakers, both heavily focused on the US market and not strong in software, can they really become champions?" questioned an insider. "I believe we can't achieve anything sustainable without a tech company."

Japanese media speculated that the powerful Ministry of Economy, Trade, and Industry pushed Honda and Nissan to establish a capital relationship to thwart takeovers by Foxconn or other foreign interests.

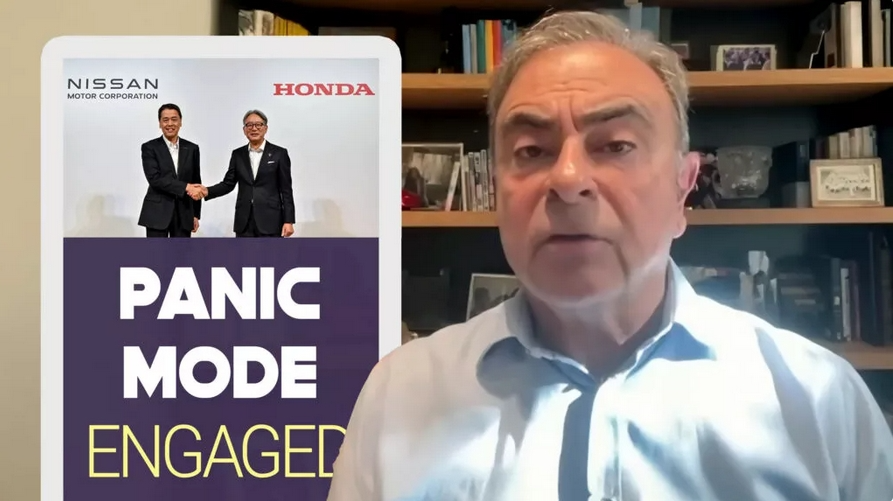

Ghosn: Nissan in "Panic Mode"

On December 23, Ghosn said the merger was "politically meaningful" because Japan's Ministry of Industry, Trade, and Industry wanted anyone rescuing Nissan to be Japanese.

"Do they force anyone? No, they won't force you, but they'll give you reasons you can't refuse," Ghosn said at a press event, interviewed by the Lebanese ambassador to Tokyo.

Ghosn noted that the negotiations for Nissan's merger with Honda indicated that Nissan was in "panic mode." "This is a desperate move," Ghosn said on Bloomberg Television on December 20. "It's not a rational deal because, frankly, it's hard to find synergies between the two companies."

Ghosn called the potential merger between Nissan and Honda a "desperate move." "These two companies have no real complementarity. They are in the same markets. They have the same products. The brands are very similar," Ghosn added.

Ghosn told Bloomberg Television that the Japanese government, particularly the Ministry of Economy, Trade, and Industry, was likely the driving force behind the Nissan-Honda merger talks. "So in the end, they are trying to find a way to combine Nissan's short-term problems with Honda's long-term vision," Ghosn said.

Foxconn is holding off on its acquisition interest in Nissan, waiting for signs of reasonable progress in the automakers' deal.

Ghosn, 70, has been living in Beirut since his daring escape from Japan five years ago. While on bail facing financial misconduct charges, he hired an American father-son duo to smuggle him in a music equipment case onto a private plane bound for Lebanon, which rarely extradites its citizens.

According to Ghosn, six years ago, some hardliners within Nissan, resistant to a merger with Renault, colluded with the Japanese government to arrest and oust him. Ghosn and Nissan continue to litigate against each other. Nissan claims its former chairman concealed income and misappropriated company assets for personal gain. Ghosn denies these allegations and accuses Nissan of damaging his finances and reputation.

Foxconn Halts Contact with Nissan

A source told Bloomberg that Foxconn, headquartered in Taiwan, China, has temporarily shelved its interest in acquiring Nissan Motors.

The source said Foxconn decided to pause its acquisition efforts after sending a delegation to meet with Renault in France. Renault owns a 35% stake in Nissan and would have a say in any partnership.

However, the source indicated that the smartphone manufacturer has not entirely abandoned its efforts but is inclined to adopt a wait-and-see approach, monitoring whether the two Japanese brands make legal progress towards a deal before deciding on their next steps.

Foxconn, officially known as Hon Hai Technology Group, hired Jun Seki, Nissan's former Chief Operating Officer (COO), last year as its Chief Strategy Officer for electric vehicles.

After Carlos Ghosn's arrest and dismissal, Seki assumed the role of second-in-command in Nissan's 2019 management team under CEO Makoto Uchida. Nonetheless, he left Nissan shortly after assuming his position to become the CEO of Nidec, a Japanese electric motor manufacturer.

Despite being well-respected during his tenure at Nissan, his abrupt departure at a critical juncture upset many of his colleagues.

Nissan is striving to reverse its declining profitability and shrinking market share. Honda and Nissan, which have been contemplating an alliance this year, appear to have accelerated their potential merger process following Foxconn's contact with Nissan.

It remains unclear whether Nissan has engaged in substantive discussions with Foxconn or has already rejected the latter's overtures. However, considering the close domestic ties between the two Japanese companies, it is plausible that Foxconn may struggle to outbid Honda in an acquisition battle.

Foxconn already has a diverse range of proposed electric vehicles, including a B-segment hatchback, a V-segment pickup truck, and an N-segment van. The company's five-seat crossover, the Model C, launched in 2021, is currently available in Taiwan. The Model C boasts a 172-kilowatt electric motor and offers a driving range of 313 miles under the New European Driving Cycle standard.

In the United States, Foxconn's plan to produce electric pickup trucks with Lordstown Motors at a factory in Ohio has encountered setbacks, sparking controversy.

Foxconn agreed in 2021 to acquire a $50 million stake in Lordstown, which in turn agreed to sell its Ohio factory to Foxconn for $230 million. However, last year, amid disputes with Foxconn over investments, Lordstown filed for bankruptcy. Lordstown stated that Foxconn had promised to invest in the company.

Since then, Lordstown has emerged from bankruptcy and filed a lawsuit against Foxconn, accusing it of fraud and failure to honor business and financial commitments within the partnership.

Nonetheless, Foxconn has prior experience in reviving struggling Japanese companies.

In 2016, Foxconn acquired a controlling stake in Sharp Corporation, an electronics giant that had struggled due to the emergence of cheaper Chinese displays, for which it had long been renowned for its televisions.

Just nine months ago, Honda and Nissan announced their intention to explore a broad, project-based, loose partnership—a deal that Foxconn may have been awaiting the outcome of.

(This article incorporates reports from Automotive News, Reuters, Bloomberg, and Nissan Global, with some images sourced from the internet)