Jia Yueting: A Year of Renewal and Promise

![]() 12/31 2024

12/31 2024

![]() 648

648

Share prices soared by nearly 80% overnight

Author | Liu Yajie

Editor | Qin Zhangyong

Jia Yueting's financial prowess is once again on full display.

Yesterday, Faraday Future's (FF) share price surged by 80%, triggering a circuit breaker. By the close of trading, FF's total market value had climbed to $142 million, equivalent to approximately RMB 1.036 billion.

Good news brings renewed spirits. As the new year approaches, Jia Yueting also released a year-end summary video, encapsulating his feelings in 2024 with the sentiment, "What makes you the strongest are those moments when life feels unbearable."

In this video, Jia Yueting addressed various negative evaluations. Regarding the ridicule of being a "wordsmith," Jia Yueting stated that new terms are not mere gimmicks but a concise and summarized representation of new thinking and concepts towards new things, reflecting deep contemplation on every matter.

He also shared some behind-the-scenes insights:

FF only narrowly escaped the control of a bankruptcy group led by several malicious independent directors from Wall Street last year. He was constantly seeking both people and funding.

Meanwhile, $1 billion was exhausted, yet vehicle deliveries were delayed, with bankruptcy looming just a vote and a second away.

Fortunately, as 2025 approaches, FF has gotten off to a promising start.

01 New Funding and New Car Launches

Behind the soaring share price are continuous positive developments from FF.

On December 30, FF announced that renowned entrepreneur Luke Hans will officially take delivery of his new FF 91 2.0 Futurist Alliance electric vehicle in mid-January 2025. A special delivery ceremony will be held in Los Angeles, attended by FF executives.

Faraday Future introduced that as an FF Developer Co-Creator, Hans will play a pivotal role in supporting FF's business development, product sales, and collaborative innovation.

As a leader in the Los Angeles Chinese community, Hans's collaboration with FF is expected to further expand the company's market reach and forge deeper connections with more influential communities.

This is the 16th vehicle delivered by FF. Frankly, after a decade in vehicle manufacturing, this delivery performance is unremarkable.

Fortunately, FF's financing capabilities remain robust. On December 23, FF completed a new round of $30 million (approximately RMB 219 million) in financing.

The company stated that the first tranche of $7.5 million in this $30 million financing was prepaid in the fourth quarter of this year, with the remaining $22.5 million representing new financing commitments.

While this amount may seem insignificant in the context of vehicle manufacturing, it is crucial for FF's 'Bridge Vehicle Manufacturing Model' featuring 'Four Lights, Four Fasts, and Five Empowerments.'

FF plans to further expand its FF ieFactory plant in California to prepare the FX production line, aiming to launch the first vehicle by the end of 2025.

Speaking of FX, Jia Yueting also unveiled new developments. From January 5 to January 8, FF will hold a strategic update communication meeting in Las Vegas, USA, where the first prototypes of the second brand, FX, will be exhibited.

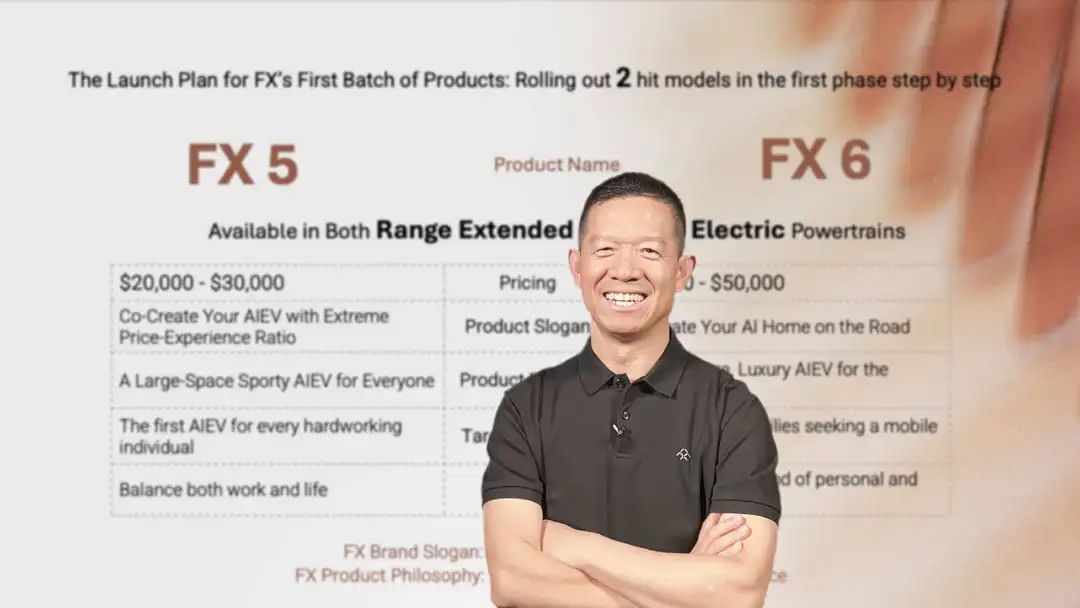

In September this year, Jia Yueting announced that FF was launching a second brand, "Faraday X" (FX), targeting the mass market with two models: FX 5 and FX 6.

The former is aimed at a price range of $20,000 to $30,000, while the latter is priced between $30,000 and $50,000. Both models are planned to offer two powertrain options: an extended-range AI EV and a pure electric AI EV, with the goal of launching by the end of 2025, pending the securing of necessary funding.

Regarding the market positioning of its two brands, Jia Yueting explained that the FF brand focuses on the premium market, characterized by its inability to achieve large-scale production. In contrast, the second brand, FX, targets the entry-level and mid-range markets, pursuing scale. "The FF and FX brands will empower each other, creating a comprehensive AIEV ecosystem that spans both the ultra-luxury and mass markets."

Matthias Aydt, FF's Global CEO, stated that the company's second brand is a crucial component of FF's overall growth strategy and part of its global automotive industry bridge strategy. FX aims to apply the technology from the $300,000 FF 91 to products priced at $30,000.

02 The Second Brand: A Crucial Leap Forward

A clear trend emerges: Jia Yueting is attempting to replicate the success of extended-range vehicles in the Chinese market within the US market.

FF positions FX as a high-volume model offering "double the performance, half the price," aiming to become the "Toyota" of the AI EV market.

In the domestic market, companies like Lixiang and Leapmotor have thrived on extended-range vehicles, while new forces such as XPeng, Zeekr, and Xiaomi are also beginning to focus on this technology.

Jia Yueting believes that, unlike the competitive Chinese market, extended-range vehicles represent an entirely untapped market in the US, where charging infrastructure is underdeveloped, and average daily driving distances far exceed those in China.

Moreover, in the US, ordinary consumers have limited options for new energy vehicles, typically choosing between Tesla and other plug-in hybrid models. Compared to these electric vehicle models, FX's advantages lie in being a new category, featuring 3rd aiSpace and ample space.

Jia Yueting has stated that AI cockpits, refrigerators, TVs, and large sofas are among the core reasons Chinese new energy vehicles have completely outpaced traditional fuel vehicles. However, there are almost no decent AI cockpits in the US, and the combination of refrigerators, TVs, and large sofas is even rarer, which is precisely where FX's strategy shines.

3rd aiSpace is the AI cockpit of FX models, bringing users' living, working, and other scenarios into the car, giving FX the confidence to compete with Tesla on the same stage.

It is worth mentioning that there are not many product options in the US market priced below $40,000. Coupled with the high cost of the domestic supply chain in the US, traditional fuel vehicle models like the RAV4 and Corolla dominate sales in this price range.

If large, intelligent models like FX 5 and FX 6 can successfully enter the market, they stand a good chance of competing.

Given the market gap, FF is quite optimistic about FX sales, expecting initial sales of tens of thousands of vehicles, with the potential to reach hundreds of thousands in the future.

To reduce production costs, the two FX brand models will be produced at FF's Hanford factory in California, USA, and the company has also signed cooperation agreements and memoranda of understanding with four domestic OEMs.

Compared to previous years, FF's financial situation has improved significantly this year. According to FF's Q3 2024 financial report, operating expenses were $3.8 million, a 92.6% decrease from the same period last year when they were $50.9 million. Operating losses also decreased from $66.4 million in the same period last year to $25.2 million.

As of September 30, 2024, the company's assets were $449 million, liabilities were $292.3 million, and book value was $156.7 million (approximately RMB 1.144 billion). Although FF still faces considerable financial pressure overall, it is at least moving in a positive direction.

In September, FF also successfully secured $30 million in financing. This funding came from investors in the Middle East, the US, and Asia, arriving in installments. It was precisely this $30 million in financing that allowed FF to regain Nasdaq compliance in the third quarter.

Previously, due to the closing price of FF shares being below $0.1 for ten consecutive trading days, failing to meet Nasdaq listing requirements, FF received a delisting opinion letter from Nasdaq on April 24 this year.

At that time, Jia Yueting stated that he would commercialize his personal IP to earn money for car manufacturing and that the company's management team would take all possible measures to maintain the company's compliance with listing requirements. Regaining compliance also attracted more funding and market opportunities for the development of FX.

Now, with $60 million in financing within three months, the market has witnessed increased possibilities.

Amidst this positive trend, an old question arises: When will Mr. Jia return to China?

Jia Yueting has also set a new deadline: two years.

Currently, Jia Yueting has approximately $2 billion in domestic debt. Whether Mr. Jia will be able to set foot on Chinese soil in two years depends on whether FX can make a significant impact.