"Double Champion" Insta360 Innovations Battles Persistent Overseas Challenges Amidst Intense Competition from DJI

![]() 03/19 2025

03/19 2025

![]() 979

979

[Abstract] On February 27, 2025, Insta360 Innovations, a persistent applicant on the STAR Market, successfully completed its IPO, bringing an end to its four-year journey.

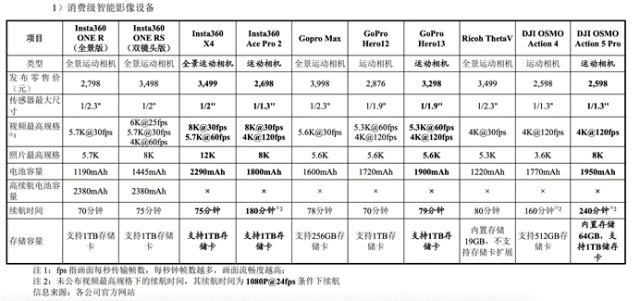

As a globally renowned provider of smart imaging equipment, Insta360 Innovations, a "double champion" in panoramic and action cameras, surpassed long-standing American manufacturer GoPro in revenue in the first half of 2024.

However, the company's revenue is heavily reliant on overseas markets, with overseas sales consistently accounting for a significant portion of total revenue. International trade frictions, including increased tariffs imposed by the US government and a 337 investigation initiated by GoPro, pose significant challenges for Insta360 Innovations.

In the domestic market, Insta360 Innovations faces fierce competition from DJI in the action camera sector. Amidst the dual pressures of price and technology, how will the "first global stock of smart imaging" navigate the intense competition?

Below is the main text:

The Long IPO Journey of a Persistent Applicant

On February 27, 2025, Insta360 Innovations' IPO registration application on the STAR Market officially received approval from the China Securities Regulatory Commission, marking the imminent debut of the "first global stock of smart imaging."

From its acceptance on the STAR Market on October 28, 2020, to the approval of this registration application, Insta360 Innovations, the "persistent applicant," is finally set to land.

Founded in July 2015, Insta360 Innovations is a globally renowned provider of smart imaging equipment based on panoramic technology. Deeply rooted in the fields of panoramic cameras and action cameras, it stands as a "double champion" in these domains.

According to Frost & Sullivan data, in 2022, Insta360 Innovations' market share in the global panoramic camera market exceeded 50%; by 2023, its sales revenue share in the global consumer-grade panoramic camera market reached as high as 67.2%, ranking first globally for six consecutive years.

Insta360 Innovations not only broke the long-standing monopoly of European, American, Japanese, and Korean brands in the panoramic camera field but also achieved impressive results in the global action camera market, becoming a Chinese brand that keeps pace with GoPro, consistently ranking among the top two globally.

In the first half of 2024, Insta360 Innovations' revenue even surpassed that of the established American manufacturer GoPro.

The prospectus reveals that Insta360 Innovations' revenue for each period from 2021 to the first half of 2024 has continued to grow, reaching 1.33 billion yuan, 2.04 billion yuan, 3.64 billion yuan, and 2.43 billion yuan, respectively, with a compound annual growth rate of 65.46% over the past three years.

Simultaneously, the company's net profit attributable to shareholders also increased, reaching 266 million yuan, 407 million yuan, 830 million yuan, and 518 million yuan, respectively. Behind the simultaneous growth of revenue and profit lies a relatively stable gross profit margin.

From 2021 to the first half of 2024, Insta360's gross profit margins were 50.41%, 51.49%, 55.95%, and 53.44%, respectively.

Despite its stable performance, the company's IPO journey has been tumultuous.

Since submitting its registration in 2022, the company has undergone multiple inquiries, and its listing process was stalled twice due to the expiration of financial data and the founder's self-disclosure that "all salaries were used to repay interest." Insta360 Innovations' path to success was arduous.

The key factor impeding the company's IPO lies in the special identity of an indirect shareholder.

Chen Bin, an indirect shareholder of Insta360 Innovations, once served as a senior manager at the Shenzhen Stock Exchange and was seconded to the Issuance Department of the China Securities Regulatory Commission. Through funds such as Shenzhen Maigao Holding and Xiamen Fukai, he indirectly holds approximately 5% of Insta360 Innovations' equity in a "non-review position."

The controlling shareholder of Shenzhen Maigao Holding is Chen Bin himself, and among the contributors to Xiamen Fukai, Depu Investment, controlled by his spouse Wang Rong, holds a 99% stake.

The surge in valuation and the confusing operations of special shareholders have forced Insta360 Innovations to spend considerable time and energy responding to detailed regulatory inquiries from the capital market, significantly slowing down the company's IPO process.

At the same time, the authenticity of the company's financial data has also been questioned by the capital market.

According to past prospectuses, from 2018 to 2020, Insta360 Innovations' total revenue was 257 million yuan, 585 million yuan, and 837 million yuan, respectively, showing a trend of equal increments; the direct labor costs of its different product categories were exactly the same during the same period, and some product cost data were deemed abnormal.

Among them, seven of Insta360 Innovations' nine wholly-owned subsidiaries were loss-making in 2020, with a cumulative loss of nearly 16 million yuan, while Insta360 Innovations achieved a net profit of 120 million yuan, with a gross profit margin as high as 50.74%.

It should be noted that the technology industry often has strong cyclicality, and both equally increasing revenue and high-margin profitability are extremely rare; the existence of identical labor costs also raises the possibility of accounting manipulation.

Now, the approval of Insta360 Innovations' registration application may indicate that the company's shareholder and financial issues have been properly resolved; however, after successfully landing in the capital market, the company still faces numerous challenges.

Persistent Troubles in Overseas Markets

Since its inception, Insta360 Innovations has actively expanded into overseas markets, collaborating with renowned international brands such as Leica, Google, and Apple. Since entering the global Apple Store in 2018, the company has launched 11 products.

However, the deeply penetrated overseas market seems to have become a burden post-listing.

Prospectus data shows that from 2021 to the first half of 2024, Insta360 Innovations' overseas sales revenue was 934 million yuan, 1.596 billion yuan, 2.9 billion yuan, and 1.842 billion yuan, respectively, accounting for 71.17%, 79.43%, 80.83%, and 76.52% of total revenue, respectively, remaining consistently high.

The excessive reliance on overseas markets has compelled Insta360 Innovations to bear the brunt of geopolitical tensions and trade frictions. If foreign countries continue to intensify trade and tariff policies detrimental to the company's exports, Insta360 faces the risk of failing to maintain high-speed growth in overseas sales and even the risk of performance decline.

Under substantially compressed profit margins and soaring operating costs, the construction of overseas after-sales service networks will further increase its operating expenses.

In fact, besides tariff impacts, Insta360 also faces fierce competition from the "local bully" GoPro in the North American market.

In the North American market, GoPro dominates approximately 62% of the action camera market share through deep bundling sales with telecommunications operators.

In contrast, Insta360 Innovations still primarily relies on the Amazon platform, lagging behind its competitors in sales channels and brand awareness. Although it surpassed GoPro in revenue in the first half of 2024, the ultimate competition in the market comes down to market share.

Simultaneously, Insta360 Innovations also encounters international intellectual property challenges.

In March 2024, GoPro filed a 337 investigation application with the US International Trade Commission under Section 337 of the US Tariff Act of 1930, accusing Insta360 Innovations and its US subsidiary Insta360 USA of infringing its patents related to specific cameras, camera systems, and accessories exported to, imported into, or sold in the US.

If the final 337 investigation results are unfavorable to Insta360, its reputation will be tarnished, and related products may no longer be sold in the US, undoubtedly dealing a significant blow to Insta360's overseas market. Although the company is confident in its own patents, this lawsuit undoubtedly impacted the company's financing progress.

Insta360 Innovations' hidden concerns continue to emerge. Whether Insta360 Innovations can maintain its leading position in the global smart panoramic imaging market in the future remains uncertain.

Who Will Win the Domestic Market Battle: Insta360 or DJI?

Data released by SinoMarketIntelligence shows that the global retail market size of handheld smart imaging equipment grew from 16.43 billion yuan in 2017 to 36.47 billion yuan in 2023, with a compound annual growth rate (CAGR) of 14.2%.

Among them, action cameras dominate, accounting for more than 85% of the retail market size in 2023.

Currently, in the domestic market, DJI is also a leader in the action camera field, forming fierce competition with Insta360.

In 2016, the second year after Insta360 Innovations was established, the company launched the Insta360 Nano, addressing the pain points of slow transmission and stitching in panoramic cameras at that time and quickly gaining market traction.

In 2019, DJI, as a "latecomer," also entered the action camera arena.

In May of that year, the company released its first action camera, the DJI Osmo Action, which, due to its excellent performance and affordable price, once forced GoPro to conduct price reductions and promotions.

Subsequently, DJI launched new action cameras at a rate of almost one per year. As of September 2024, DJI has introduced its fifth-generation action camera, swiftly capturing a 15% market share of action cameras by leveraging the synergistic advantages of its drone ecosystem.

In terms of price, DJI's Osmo Action 5 is 100 yuan cheaper than Insta360's Ace Pro, and Wired even evaluated DJI's Osmo Action 5 as the best overall action camera.

In addition to DJI, competitors such as Senna AKASO, Ricoh (Japan), and GoPro are also constantly making strides, significantly squeezing Insta360 Innovations' market share.

It should be noted that Insta360 Innovations itself grapples with the issue of a single business structure.

The prospectus reveals that Insta360 Innovations' two primary businesses, action cameras and panoramic cameras, collectively contributed 87.3% of its revenue, with the panoramic camera business accounting for as high as 58.2%, while accessories and other businesses only accounted for 12.7% of revenue.

Under the pressure of market share erosion, the company's revenue may struggle to maintain high growth in the long run.

Technologically speaking, the smart imaging industry is characterized by extremely rapid technological iteration, necessitating sufficient R&D investment from companies.

Data disclosed in the prospectus shows that the company's R&D investments during the reporting period were 150 million yuan, 256 million yuan, 448 million yuan, and 280 million yuan, respectively; there were 1031 R&D technicians, accounting for 55.94% of the total workforce.

Insta360 faces considerable pressure from technological iteration and financial constraints.

In the future, if Insta360 Innovations aims to overcome market difficulties, it may need to focus on diversifying its business structure and shifting its business focus.

Epilogue

The approval of Insta360 Innovations' IPO does not signify the end of the battle; a new round of competition is about to commence.

Insta360 Innovations still needs to establish its market position and gain a competitive edge in the fierce market competition and niche segments.

Facing the patent siege of international giants and local suppression from DJI, only by taking proactive measures can it secure a glimmer of hope for survival.