Qingdao’s Semiconductor Firms Secure Major Investments from National and Provincial Funds

![]() 12/09 2025

12/09 2025

![]() 629

629

Qingdao’s semiconductor enterprises have seen a surge in investments from national and provincial capital sources.

According to a November 27th post on Chengtong Fund’s official WeChat account, the State-Owned Assets Adjustment Fund, managed by Chengtong Fund, has completed a strategic investment in Qingdao Sirius Intelligent Technology Co., Ltd. (hereinafter referred to as “Sirius Intelligence”).

A week earlier, on November 21st, the Provincial Green, Low-Carbon, and High-Quality Development Pilot Zone Construction Major Special Fund—established and managed by Shandong Province’s New Kinetic Energy Fund Management Co., Ltd. (hereinafter referred to as “New Kinetic Energy Fund Company”)—made an additional equity investment in Wuyuan Semiconductor Technology (Qingdao) Co., Ltd. (hereinafter referred to as “Wuyuan Semiconductor”).

Going back even further, on October 16th, Xi’an (Qingdao) Integrated Circuit Co., Ltd. (hereinafter referred to as “Qingdao Xi’an”) issued tender announcements for the “2025 Proposed Capital Increase Special Evaluation Procurement Project” and the “2025 Proposed Capital Increase Special Audit Procurement Project,” signaling that Qingdao’s chip giant, Xi’an, is set to embark on a new round of capital expansion.

Behind these strategic moves, Qingdao has constructed a comprehensive industrial cluster centered on wafer fabrication, encompassing cutting-edge fields such as 3D packaging and testing, as well as key semiconductor equipment.

This also signifies Qingdao’s secured position within the national semiconductor industry’s strategic landscape.

1

The strategic investment by the State-Owned Assets Adjustment Fund Phase II in Sirius Intelligence extends far beyond mere capital infusion.

On the one hand, as a national-level fund with a total scale of 350 billion yuan, the State-Owned Assets Adjustment Fund was established to promote the reform of state-owned assets and enterprises, as well as optimize the layout and structural adjustment of central enterprises. Sirius Intelligence itself carries distinct central enterprise heritage.

The largest shareholder of Sirius Intelligence is CRRC Sifang Co., Ltd., holding approximately 19.48% of the shares, closely followed by Huayu Guohua (Qingdao) Equity Investment Partnership (Limited Partnership) with around 18.46%. Equity penetration analysis reveals that the “CRRC Group” collectively holds approximately 52% of Sirius Intelligence’s shares.

On the other hand, the State-Owned Assets Adjustment Fund has long been dedicated to investment布局 (replace with “in”) forward-looking technology fields and strategic emerging industries. This investment in Sirius Intelligence directly aims to “accelerate the resolution of bottleneck issues in semiconductor core equipment.”

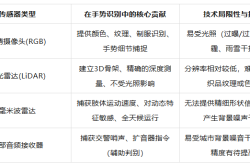

As a key enterprise in the field of core equipment for semiconductor front-end processes, Sirius Intelligence’s products include Atomic Layer Deposition (ALD) equipment and Ion Implantation (IMP) equipment, widely utilized in high-tech fields such as integrated circuits, third-generation semiconductors, and new energy.

According to its official website, Sirius Intelligence has established a serialized and platform-based product line of ion implanters, centered on high-energy and large beam current ion implanters, and continuously expanding into the power semiconductor field, including silicon carbide (SiC).

From a market performance perspective, Sirius Intelligence’s ALD equipment has entered renowned manufacturers in Europe, North America, Japan, and mainland China and Taiwan, securing repeat orders.

The IMP equipment has achieved industrial-scale production and passed mass production verification from multiple clients. In September 2023, China’s first and most challenging high-energy ion implanter with an energy level of 8MeV (megaelectron volts) was delivered to a leading domestic client.

In June this year, the Sirius Intelligence Semiconductor Advanced Equipment R&D and Manufacturing Center, located in the Qingdao Free Trade Zone · Qingdao Integrated Circuit Industrial Park, was completed and operational, focusing on the R&D and mass production of ALD and IMP—the two core semiconductor front-end equipment.

In reality, Sirius Intelligence is still in a critical stage of transitioning from technological breakthroughs to market scale, necessitating large-scale market verification.

A key indicator is that as early as last January, the State-Owned Assets Adjustment Fund strategically invested in Shanghai Jita Semiconductor Co., Ltd. (hereinafter referred to as “Jita Semiconductor”), a wafer fabrication enterprise specializing in specialty processes.

Jita Semiconductor’s business covers core chips such as power devices, analog circuits, digital logic, sensors, and third-generation semiconductors. It is one of the earliest domestic enterprises capable of manufacturing SiC power devices and has already embarked on research and development in cutting-edge process technologies such as ALD. This precisely serves as a natural downstream application platform and key verification scenario for Sirius Intelligence.

From this perspective, the State-Owned Assets Adjustment Fund’s strategic layout not only provides Sirius Intelligence with greater room for growth but also connects upstream and downstream links of the industrial chain through capital, “further promoting the localization process of semiconductor equipment and strengthening the security of the industrial and supply chains.”

2

Almost simultaneously with the State-Owned Assets Adjustment Fund, Shandong Province’s New Kinetic Energy Fund Company completed an equity investment in Wuyuan Semiconductor.

Currently, the global semiconductor industry landscape is undergoing a major transformation, with 3D integration technology centered around hybrid bonding processes widely recognized as the primary path for the global semiconductor industry to break through physical limits. Major global wafer fabs, including TSMC and Intel, are actively pursuing this technology. Its development not only concerns technological route competition but also involves the struggle for (replace with “entails a”) control over the industrial chain, with the potential to reshape the global semiconductor industry landscape.

Simply put, to remain competitive in the future artificial intelligence revolution, it is necessary not only to overcome advanced process nodes but also to achieve breakthroughs in 3D integration technology.

Headquartered in Qingdao and dedicated to wafer-level advanced packaging technology, Wuyuan Semiconductor is one of the few domestic enterprises that have taken the lead in entering the high-value track of 3D integration technology.

Wuyuan Semiconductor has built three technological innovation platforms: a computing chip platform, a memory chip platform, and a customized chip platform, utilizing Hybrid Bonding as its technological foundation. It has developed mid-process technologies such as Wafer-on-Wafer (WoW), Chip-on-Wafer (CoW), and Chiplet heterogeneous integration, and has researched, developed, and promoted a series of 3D-IC and customized IC products and technological solutions. Its products can be widely applied in fields such as AI computing power, memory chips, and automotive electronics.

Among them, the computing chips developed by Wuyuan Semiconductor using the WoW process platform have already received bulk commercial orders from leading domestic computing chip clients.

Currently, Wuyuan Semiconductor has established China’s first dedicated 12-inch wafer-level advanced packaging line, developed more than ten core products, and commenced commercial delivery. Line 2 completed the topping out of its main factory building in May 2024. In August this year, the first photolithography machine was installed in the Wuyuan Semiconductor project. According to the plan, the project will commence mass production in the fourth quarter of 2025.

According to the New Kinetic Energy Fund Company, this investment will assist Wuyuan Semiconductor in accelerating production line construction and technological upgrades, further enhancing Shandong’s self-sufficiency capabilities in the semiconductor mid-process field.

3

Earlier still, Xi’an’s new round of capital increase attracted significant attention.

As China’s first collaborative integrated circuit manufacturing project, Qingdao Xi’an’s last capital increase occurred in 2023, when its registered capital increased from 7.283 billion yuan to 10.068 billion yuan, an increase of 2.785 billion yuan.

The shareholder introduced at that time, Qingdao Qinluhongchuang Technology Partnership (Limited Partnership), included several Qingdao municipal state-owned enterprises and Shandong provincial state-owned enterprises, such as Haifa Group, Qingdao Urban Investment, Huatong Group, Qingdao Metro, Qingdao Science and Technology Investment, Qingdao Caitong Group, Shandong Hi-Speed Group, Shandong Heavy Industry, Qingdao State Investment, and Shandong State Investment.

The new round of capital increase after two and a half years also indicates breakthroughs by Qingdao Xi’an in mature process nodes, with the next step of development requiring greater financial support.

Since its establishment, Qingdao Xi’an has set its product line to clearly target three major application fields: automotive electronics, smart home, and IDT industrial electronics. Specific products include MEMS/MOSFET/IGBT, RF/Wireless IC, power management IC, MCU, embedded logic IC, and analog IC.

This also aligns with the explicit requirement in Qingdao’s “10+1” innovative industrial system to achieve breakthroughs in automotive-grade chips.

In reality, compared to the requirements for advanced process nodes in the consumer electronics field, automotive-grade chips generally require a broader range of mature process nodes (mature process nodes above 40nm still account for 70% of the market). However, due to the special application environment of automotive-grade chips, such as the need to withstand extreme temperatures ranging from -40°C to 125°C, resist vibration interference, and other harsh tests, the design of redundant circuits and protective modules increases costs by 20%-30%. The yield rate of dedicated production lines is only 70%-80%, and the testing time is 3-5 times that of consumer-grade chips, resulting in higher full-lifecycle costs.

At a time when new energy vehicles are rapidly developing towards intelligent connectivity, the market space for automotive-grade chips is also growing rapidly, presenting a greater opportunity for both Qingdao and Xi’an.