Can Baidu's PSIG (Personal Super Intelligence Group) of Net Disk + Document Break Through Its 'Meng Huo' Dilemma in AI Access?

![]() 01/26 2026

01/26 2026

![]() 560

560

Baidu's Dream of a Super Access Point Might Require It to First Abandon Its Platform Aspirations

Baidu Undergoes Another Reorganization!

On January 23rd, financial reports revealed that Baidu Document and Baidu Net Disk have been merged into a new business entity—the Personal Super Intelligence Group (PSIG). This group is headed by Baidu Vice President Wang Ying, who also oversees the Document Business Unit and Net Disk Business Unit, reporting directly to Baidu Chairman and CEO Robin Li.

Several insiders at Baidu have indicated that Net Disk and Document are currently among Baidu's most AI-integrated businesses, with plans to introduce new AI applications and develop these sectors as new avenues for growth.

Beyond their superior potential for AI commercialization, the business logic of Document and Net Disk significantly differs from Baidu's historical mobile ecosystem advertising business, making them suitable candidates for separation and reorganization into an independent BG (Business Group).

Thus, the split and reorganization into a new BG became a logical step, particularly given the current pressures on Baidu's business. An entirely independent BG is better positioned to articulate the narrative of AI for Consumers (AI To C) to investors.

So, can Baidu's merger achieve its intended objectives? Will the new PSIG represent Baidu's final dignity or just one of its few competitive edges? Can Baidu AI truly stand alongside ByteDance and Alibaba in a 'three-kingdom' scenario, as envisioned?

01

Wang Ying: Baidu's 'General Revitalizing Its Consumer-Facing Operations'

Net Disk and Document are not only among Baidu's few businesses maintaining robust growth but also the clearest and most monetizable 'ace cards' in Baidu's AI commercialization journey. Their merger has been quietly in the works for years.

In February 2024, Baidu's MEG (Mobile Ecosystem Group) underwent a fresh round of organizational restructuring, with the Baidu Document Business Unit officially elevated to a BU (Business Unit), continuing under the leadership of Baidu Vice President Wang Ying.

This organizational shift is understandable. At the time, Baidu urgently needed a 'success story' to showcase the commercial value of its Wenxin large model to the outside world. Compared to search, where minor changes could impact core advertising revenue, the Document scenario was more vertical, less risky, and naturally aligned with generative AI.

Simultaneously, elevating Document to a BU provided Wang Ying's team with greater autonomy and resource support, encouraging this spirit of 'complete reconstruction' to permeate other departments within Baidu.

According to Qianzhan Reports, upon assuming her role, Wang Ying comprehensively transformed Baidu Document with AI, reconstructing it as a 'one-stop AI content acquisition and creation platform.' She boldly reduced paywalls from 60% to 20%, focusing on enhancing user experience to boost retention. This strategy yielded remarkable results: by June 2024, Baidu Document's paid subscription rate had surged by 60% year-on-year, with impressive profit margins.

Such outstanding performance also brought Wang Ying's capabilities to the forefront within Baidu.

Consequently, in September of the same year, Wang Ying's 'sphere of influence' expanded further. The consumer-end business of Net Disk, previously part of the Intelligent Cloud Business Group (ACG) with annual revenues exceeding 5 billion yuan, was transferred to the Ecosystem Business Group (MEG), also under Wang Ying's management, marking the beginning of deep integration between Document and Net Disk.

This adjustment aimed not only to place Wang Ying in charge but also to signify Baidu's 'rectification' in business synergy.

Transferring Net Disk from the ACG, primarily focused on B2B technologies, back to MEG resolved the previous coordination challenges between Net Disk and cloud technology infrastructure across different groups, akin to the 'Alibaba ecosystem.' It also represented Baidu's attempt, centered around Wang Ying, to deeply integrate Document's AI reconstruction experience with Net Disk's vast consumer-end traffic, creating an integrated moat from 'cloud storage' to 'AI productivity tools.'

This organizational change proved its correctness in the following year of 2025.

Since Document and Net Disk (consumer-end businesses) represent two sides of the same AI productivity coin, with Document's public knowledge base and Net Disk's private storage combining to form a consumer-oriented AI productivity foundation, they should perform well in terms of monthly active users and revenue.

Data corroborated this trend. During the Q3 2025 earnings call, Baidu management disclosed that Baidu Net Disk and Baidu Document had nearly 300 million monthly active users. In Q3, Baidu's AI applications (including Document, Net Disk, and digital employees) generated 2.6 billion yuan in revenue.

Among them, Baidu Document's AI DAU (Daily Active Users) increased by 230% year-on-year, with a 60% year-on-year increase in paid subscription rates. Baidu Net Disk's AI monthly active users also exceeded 80 million. According to media personality Pan Luan's podcast, after leveraging AI to drive value-added services, Baidu Document achieved annual revenues of over 2 billion yuan, similar to WPS, but with double the net profit of WPS.

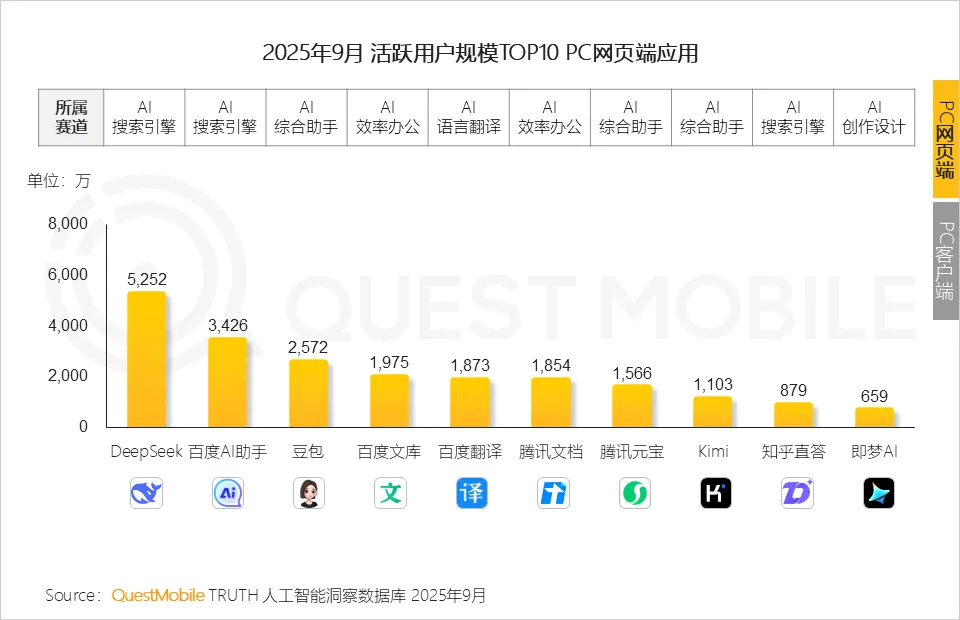

QuestMobile data shows that as of September 2025, Baidu Document's PC web version had approximately 19.75 million monthly active users, lower than DeepSeek's 52.52 million and Doubao's 25.72 million, but slightly higher than Tencent Yuanbao's 15.66 million.

The excellent performance of these businesses further propelled Wang Ying's rapid career advancement. In August 2025, Wang Ying was promoted from Baidu Vice President to Baidu Group Vice President. Her subsequent promotion to PSIG head, reporting directly to Robin Li, signifies a further increase in her influence within Baidu.

The next chapter in this story is the establishment of PSIG. Wang Ying's ascent and PSIG's independence send a clear signal: Baidu is attempting to build a pure commercial closed loop based entirely on 'AI + subscription,' distinct from its traditional 'search + advertising' model. The creation of PSIG allows Baidu to have a 'special zone' unencumbered by advertising revenue concerns or traditional structural constraints.

However, whether this 'competitive edge' can pierce through the current competitive fog faces dual challenges.

Internally, it's about the integration efficiency of a 'super app.' While Document's public content and Net Disk's private assets complement each other data-wise, the primary challenge for PSIG is to avoid clumsily stitching them together into a 'bloated toolbox' and instead evolve into a 'personal brain' capable of perceiving user intent and handling files in all formats.

Externally, it's about withstanding dimensional attacks from tech giants. ByteDance is charging ahead with Doubao's massive traffic, while Alibaba leverages DingTalk and Tongyi Qianwen to build a robust office ecosystem. PSIG must exploit its first-mover advantage in scalable profitability to quickly establish high migration costs and algorithmic barriers in the gap between 'storage tools' and 'intelligent assistants.'

Robin Li has repeatedly emphasized Baidu's commitment to 'going all-in on AI.'

Now, the convergence of Document and Net Disk has secured Baidu's final ticket to the AI To C finals. Whether PSIG represents Baidu's desperate transformation under business pressures or its strategic move as an AI veteran for a 'comeback,' 2026 will be the ultimate litmus test.

02

Vying for Access Points?

Baidu Must Avoid Becoming Its Own 'Meng Huo'

Looking outward from PSIG's 'lone deep penetration,' Baidu aims to sketch a grander blueprint for an 'AI super access point.' Unfortunately, for Baidu, which failed to secure essential access points during the mobile internet era, this remains an arduous task.

Recently, the Wall Street Journal, citing insiders, reported that Baidu's Wenxin Assistant has surpassed 200 million monthly active users.

Due to its application ecosystem partnerships with industry giants like JD.com, Meituan, and Ctrip, market analysts suggest that Wenxin Assistant has evolved beyond a mere chatbox into a 'super AI assistant' capable of booking flights, ordering takeout, and providing health and legal advice. This has even sparked discussions of a 'Wenxin, Doubao, Qianwen three-kingdom showdown.'

Industry insiders told Super Focus that despite seemingly prosperous data, Baidu's underlying logic as an 'AI access point' lacks confidence.

Objectively, Baidu still possesses formidable moats in infrastructure, applications, and Robotaxi capabilities.

By the end of 2025, the release of Kunlun Core M100 and its five-year roadmap signaled Baidu's ambition to become self-sufficient or even an exporter in the compute-constrained era. This vertical integration from chips to frameworks (PaddlePaddle) to models (Wenxin) and applications (Document, Net Disk) gives Baidu an edge over competitors relying on purchasing NVIDIA cards when facing compute hegemony.

The successful transformation of Baidu Document and Net Disk also demonstrates its high efficiency on the 'tool + AI' path. Even amid fierce external competition in 2025, Baidu managed to carve out a multi-billion yuan revenue pie in the consumer-paid market through PSIG, a scalability and user stickiness that many AI applications driven solely by traffic lack.

Furthermore, whether it's Luobo Kuaipao's regular operations in over 20 cities nationwide or the penetration of intelligent driving solutions into traditional automakers, Baidu remains at the forefront in physical-world AI implementation. This 'hard tech' accumulation gives Baidu far heavier cards to play in AI future discussions than mere chatbots.

However, these enviable technological assets cannot fill Baidu's inherent ecological lowland in the 'AI access point' competition.

In this so-called 'three-kingdom showdown,' ByteDance has begun diving into hardware ecosystems. From Doubao phones to upcoming AI glasses, ByteDance aims to forcibly intercept users at the physical terminal level, seeking system-level occupation.

Alibaba appears more seasoned, integrating Qianwen App into Taobao, Alipay, Fliggy, and Gaode, not merely stacking functions but truly settling AI into high-frequency, lucrative consumption scenarios like ordering takeout, shopping, and booking flights.

In contrast, this is Baidu's deepest anxiety.

In terms of ecosystem, Baidu still needs to strengthen its closed loop from transactions to payments: when users ask Qianwen to 'book me the cheapest flight to Shanghai,' Alibaba can complete the payment process seamlessly, whereas Wenxin's resource coordination can only provide solutions.

Regarding social connectivity, Baidu cannot compete with Tencent, which wields WeChat and is advancing AI mini-programs. Baidu's e-commerce and lifestyle services have lower visibility and lack a strong social platform, remaining highly dependent on 'information distribution' for access logic.

In the AI era, users seek direct services without redirects, but Baidu, lacking physical transactions and local life scenarios, faces an awkward situation of 'having traffic but no closed loop.'

If ByteDance represents the Wei Kingdom's cavalry, leveraging its powerful APP factory and algorithmic hardware to sweep through the central plains, and Alibaba embodies the Wu Kingdom's heavy naval forces, relying on its solid commercial ecosystem to dominate a region, then Baidu resembles the Shu Han, isolated in a corner, guarding the 'Jiange Pass' named Search. Despite possessing talents like Kunlun Core and technological accumulations, it struggles to conceal its decline in the all-encompassing national power competition.

Indeed, if Baidu insists on competing for access points in transaction and social scenarios where it lacks expertise, the outcome may not be a tripartite division but becoming the 'Meng Huo' subjected to 'seven captures and seven releases'—possessing brute strength and ambition yet repeatedly pulled apart by competitors within commercial closed loops.

However, Baidu is not entirely without retreat. Looking ahead, if Baidu can curb its obsession with 'super apps' and instead leverage Kunlun Core's foundational advantages to deepen compute services, or capitalize on Luobo Kuaipao's first-mover advantage to deeply cultivate autonomous driving, it could step out of the 'access point competition.'

In other words, Baidu's dignity does not necessarily hinge on competing with ByteDance in hardware or Alibaba in takeout. Becoming China's AI-era 'infrastructure provider' or 'autonomous driving operation giant' might offer Baidu an alternative narrative to lead as a tech giant post-2026.

However, this depends on whether Robin Li can let go of his decade-plus dedication to AI and the former BAT trio identity.

- END -