Growth slows, profits narrow, Airbnb still weathering the storm

![]() 11/11 2024

11/11 2024

![]() 609

609

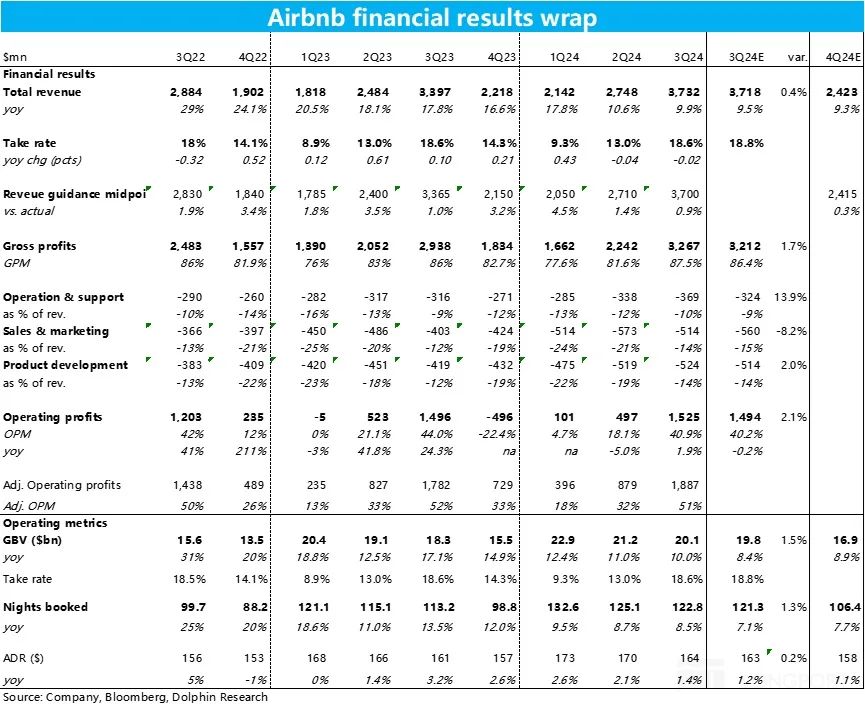

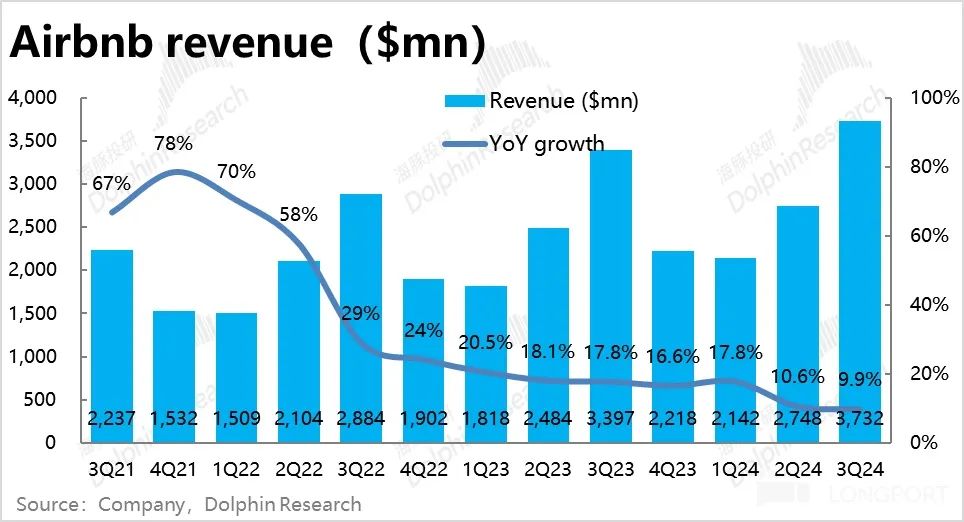

After the US market closed on November 8, Beijing time, Airbnb released its fiscal third-quarter 2024 earnings report. Overall, this quarter's performance metrics were generally slightly better than market expectations, but despite this, the slowdown in growth and decline in profit margins remained unresolved. Key points are as follows:

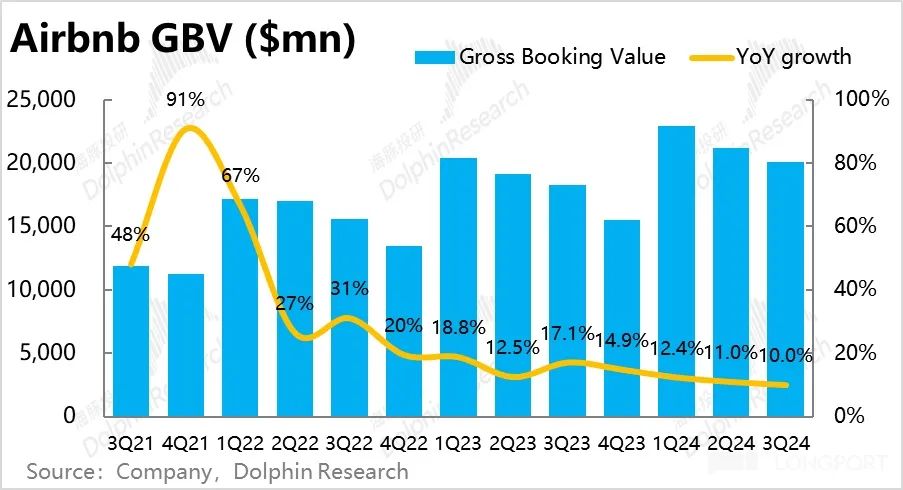

1. The most critical metric - Gross Booking Value (GBV) was approximately $20.1 billion this quarter, with year-over-year growth slowing by another 1% to 10%, hovering at the brink of single-digit growth. Although slightly better than more conservative expectations, the trend of slowing growth has not reversed.

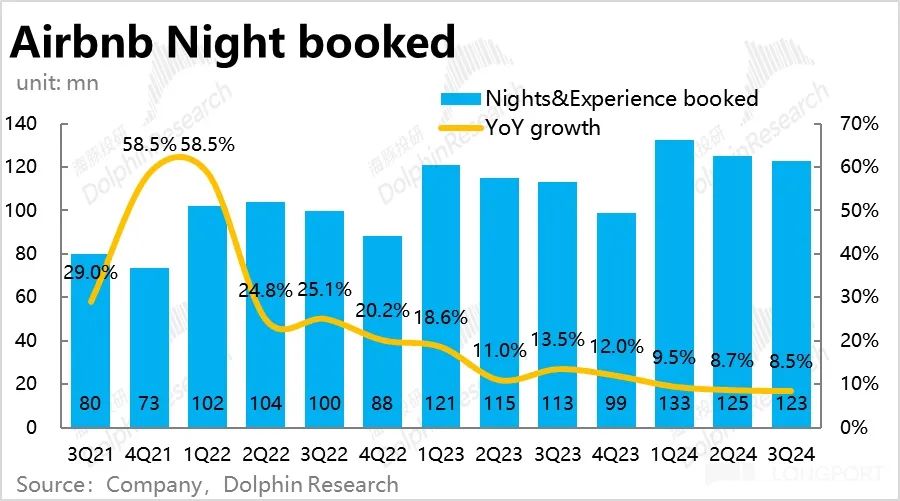

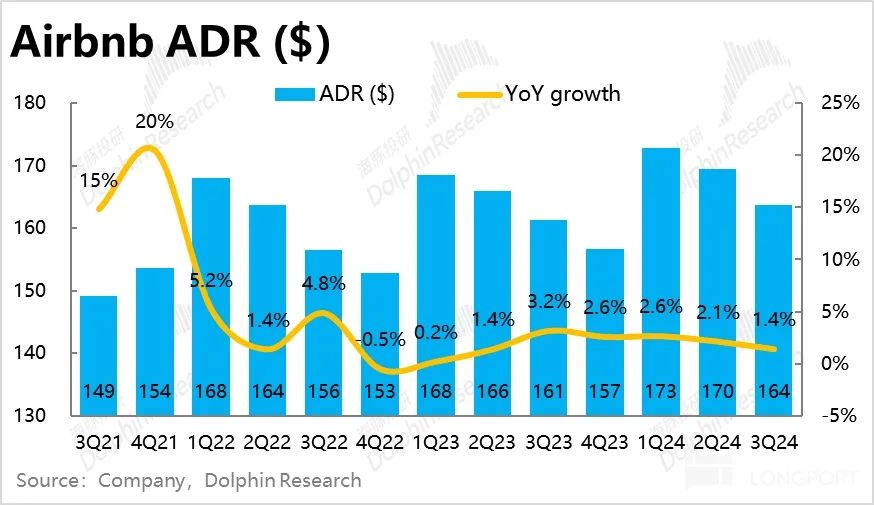

In terms of drivers of price and volume, Airbnb booked approximately 123 million nights this quarter, with year-over-year growth continuing to slow slightly by 0.2% to 8.5%. While this is significantly better than the market's more pessimistic expectation of 7.1%, it is still a slowdown. In terms of price, the average nightly rate reached $164, a year-over-year increase of 1.4% (compared to 2.1% in the previous quarter). As travel demand cools in Europe and the United States, hotels have less pricing power.

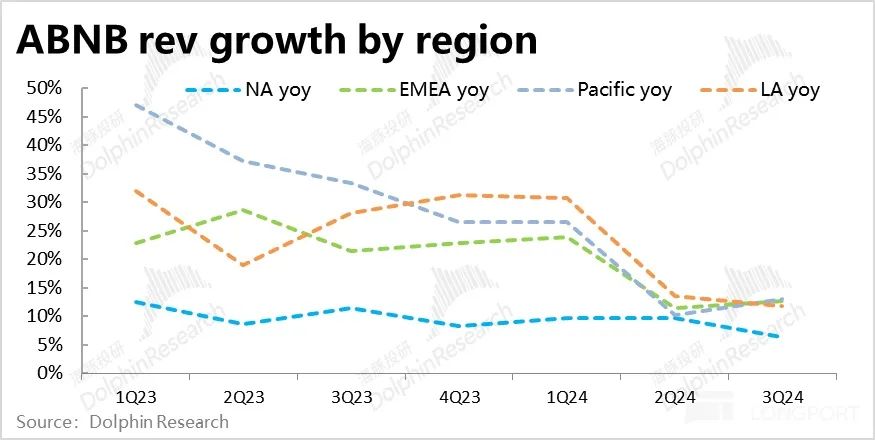

2. Regionally, revenue in North America grew by approximately 6%, significantly slower than the 9% growth in the previous quarter. Additionally, Average Daily Rate (ADR) in North America increased by 3% this quarter. Assuming the monetization rate remains largely unchanged, the growth rate of order volume in North America is likely to be only in the low single digits.

Europe benefited from the Olympics, with night bookings growing faster than the previous quarter, and revenue increasing by approximately 13%.

Emerging markets in South America and Asia-Pacific saw night booking growth rates of 15% and 19%, respectively, roughly in line with the previous quarter. However, revenue growth in these regions was 11.8% and 13%, respectively, lagging behind night booking growth, suggesting a decline in monetization rates in these regions.

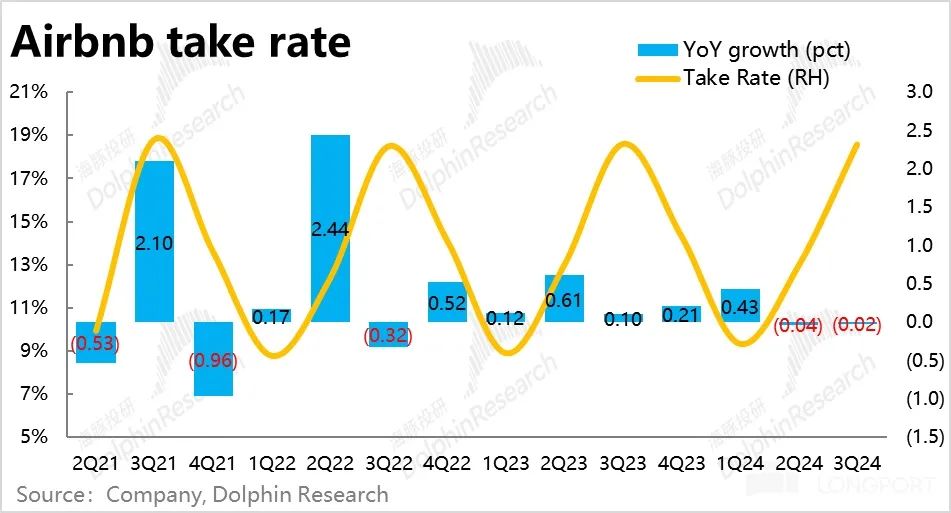

3. From a revenue perspective, due to a slight year-over-year decline of 2 basis points in the monetization rate this quarter, revenue grew at a year-over-year rate of 9.9%, a decrease of 0.7% quarter-over-quarter, lower than GBV growth and entering the single-digit range. According to the company, the slight decrease in the monetization rate was due to increased investment in user services, which partially offset revenue.

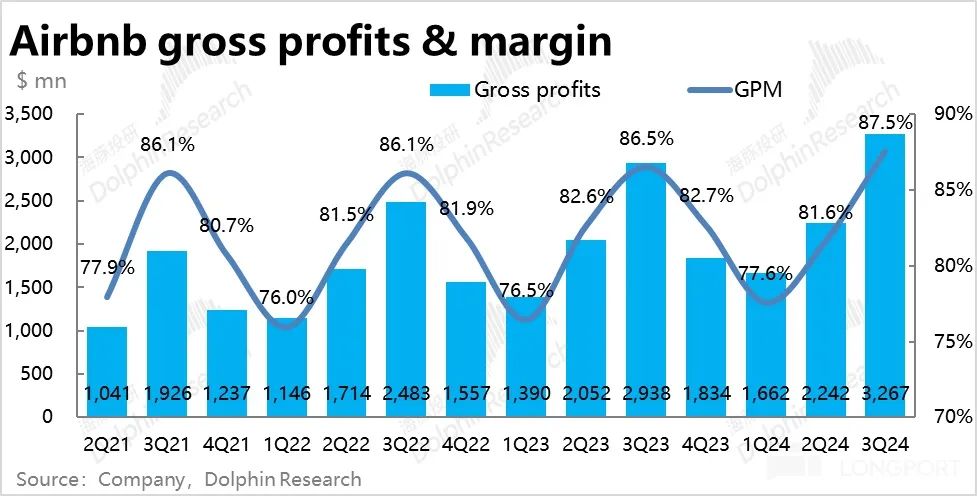

Surprisingly, gross margin increased by approximately 1% year-over-year, with gross profit of approximately $3.27 billion, slightly higher than market expectations by 1.7%.

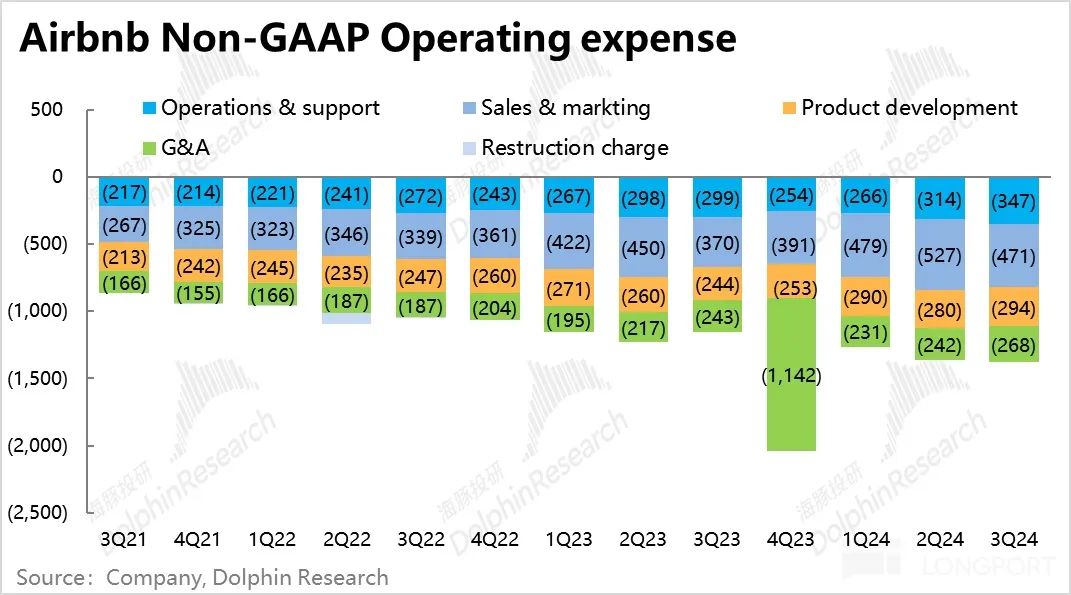

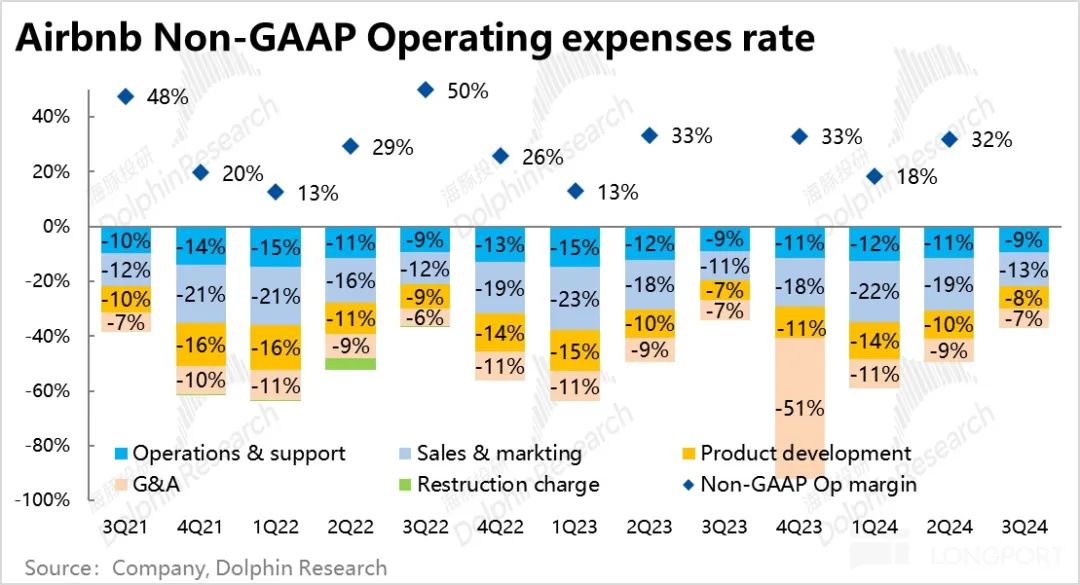

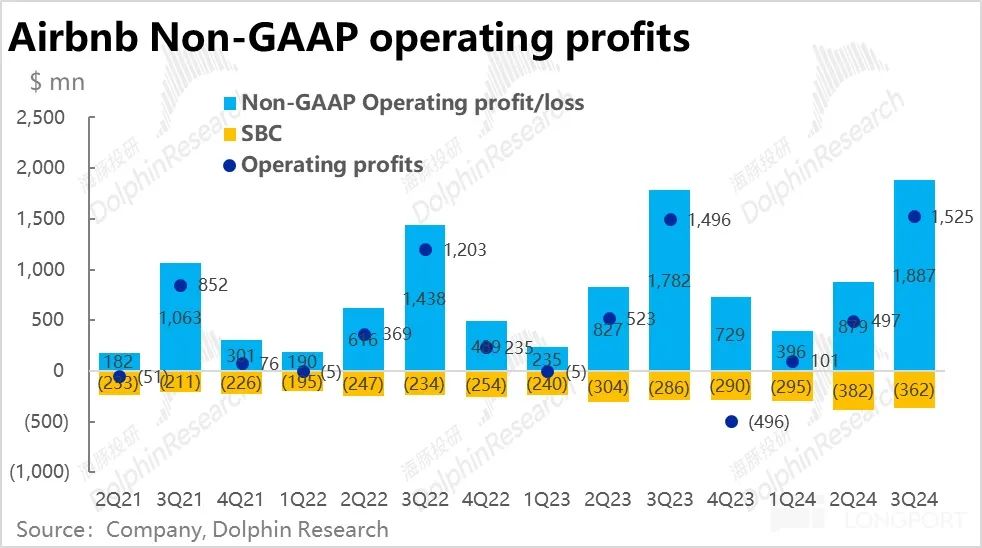

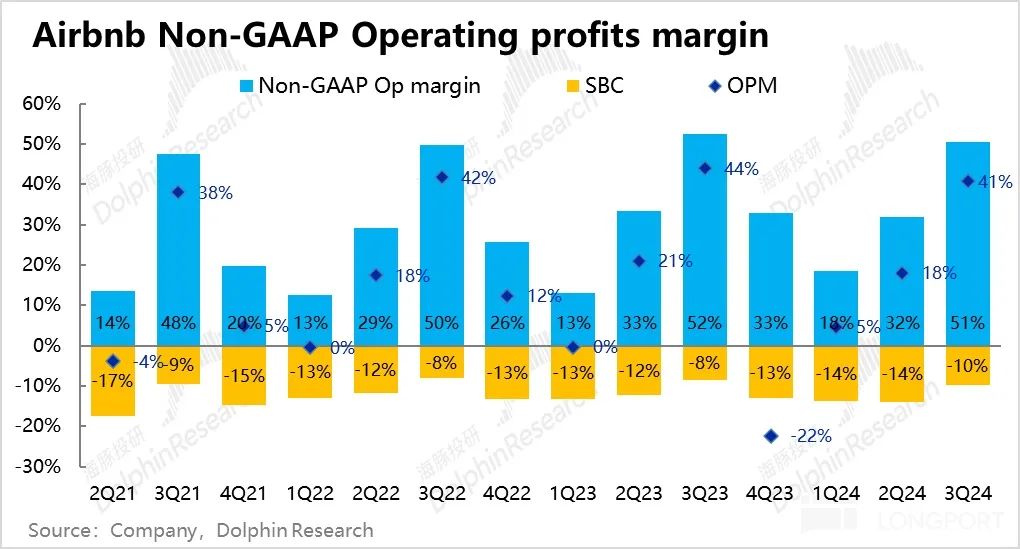

3. Since the company's management has repeatedly stated since 2024 that investments will increase, expense expansion compressing profit margins is one of the market's primary concerns. Excluding stock-based compensation, operating support, product development, and marketing expenses grew at year-over-year rates between 16% and 27%, with marketing expenses showing the most significant increase, while administrative expenses grew by approximately 10.3%, roughly in line with revenue growth.

After including stock-based compensation expenses, Airbnb's overall operating expense ratio for this quarter was 46.7%, an increase of 4.3% year-over-year, significantly compressing the company's profit margins. Ultimately, operating profit was $1.53 billion, a mere 2% increase year-over-year.

4. For the fourth quarter of 2024, the company's revenue guidance range is $2.39 to $2.44 billion, with the upper end slightly higher than market expectations of $2.42 billion, indicating a neutral outlook. For other key metrics, the company expects a slight acceleration in night booking growth compared to this quarter (8.5%), but it may still not reach double digits. Average nightly rate is expected to show slight year-over-year growth (but it is not clear whether this growth will increase or decrease quarter-over-quarter). On the profit side, adjusted EBITDA margins will continue to narrow year-over-year due to increased marketing and product investments.

5. From a shareholder return perspective, the company repurchased approximately $1.1 billion worth of shares this quarter, bringing the cumulative repurchases for the first three quarters of the year to approximately $2.6 billion, equivalent to an annualized shareholder return of 3.7%. Notably, the company's operating cash flow for this quarter was also $1.1 billion, suggesting potential pressure to further increase repurchases.

Dolphin Investment Research Perspective:

Based on the above analysis, Airbnb's performance this quarter was slightly better than more conservative market expectations, which cannot be denied. However, looking beyond these expectations, we can see from the trend of the performance itself that:

1) In terms of growth, the growth rates of order volume, average nightly rate, and total order value have continued to decline slightly, and the trend of slowing growth has not reversed. Regionally, North America has continued to deteriorate significantly, and revenue growth in other regions has only hovered slightly above 10%, with a narrow margin before falling into single-digit growth. This shows that the growth pressure faced by Airbnb is universal globally.

2) On the profit side, due to a significant increase in expenses, the monetization rate has decreased, expense ratios have risen, and profit margins have fallen, resulting in the company's operating profit growth hovering around zero for two quarters, with earnings pressure becoming more apparent. While increased investments are, on the one hand, a proactive choice by the company to promote new businesses and expand into new markets, they also likely reflect a forced choice due to growth pressures on the other hand.

Combining these two points, slowing growth and narrowing profits constitute a lose-lose situation. Although growth is expected to improve in the next quarter, profit margins will remain under pressure. The overall outlook remains negative.

From a valuation perspective, although Airbnb's current performance trends are not favorable, its EV/EBITDA valuation is still higher than peers Booking and Expedia. Based on a PE valuation, the corresponding 2025 GAAP net profit still has a valuation of approximately 30x. This shows that the valuation is not inexpensive, and Dolphin Investment Research finds it difficult to consider Airbnb as a comfortable investment target.

Detailed Analysis Below

I. Slightly better than expected performance, but core business metrics continue to slow

The most critical metric - Gross Booking Value (GBV) was approximately $20.1 billion this quarter, with year-over-year growth slowing by another 1% to 10%, hovering at the brink of single-digit growth. Although slightly better than more conservative expectations, the trend of slowing growth has not reversed.

In terms of price and volume, Airbnb booked approximately 123 million nights this quarter, with year-over-year growth continuing to slow slightly by 0.2% to 8.5%, but still better than the market's more pessimistic expectation of 7.1% growth.

In terms of price, the average nightly rate reached $164, a year-over-year increase of 1.4% (compared to 2.1% in the previous quarter). As travel demand cools in Europe and the United States, hotels have less pricing support and momentum.

Regionally, the company reported that revenue in North America grew by approximately 6%, while ADR increased by 3%. Assuming the monetization rate remains largely unchanged, the growth rate of order volume in North America is likely to be only in the low single digits. Airbnb also stated that most travel in the region currently consists of relatively inexpensive domestic travel.

Europe benefited from the Olympics, with night booking growth accelerating compared to the previous quarter. For the same reason, ADR also increased by 6% year-over-year. Combined with revenue growth of approximately 13% in Europe, the order volume growth rate should be in the mid-to-high single digits.

Emerging markets in South America and Asia-Pacific saw night booking growth rates of 15% and 19%, respectively, roughly in line with the previous quarter. However, revenue growth in these regions was 11.8% and 13%, respectively, indicating a decline in monetization rates in these regions.

II. Slight decline in monetization rate & revenue growth slips into single digits

From a revenue perspective, due to a slight year-over-year decline of 2 basis points in the monetization rate this quarter, revenue grew at a year-over-year rate of 9.9%, a decrease of 0.7% quarter-over-quarter, lower than GBV growth and officially entering the single-digit range. According to the company, the slight decrease in the monetization rate was due to increased investment in user services, partially offsetting revenue.

Although not below market expectations, under the combined effects of slowing GBV growth and consecutive quarterly declines in the monetization rate, the momentum of slowing revenue growth remains persistent.

Surprisingly, gross margin increased by approximately 1% year-over-year, with gross profit of approximately $3.27 billion, slightly higher than market expectations by 1.7%.

III. Profits continue to be compressed under high investments

In addition to the slowdown in revenue growth, another concern for the market is the company's management's repeated statements that investments will significantly increase in 2024.

In reality, excluding stock-based compensation, administrative expenses grew by approximately 10.3% year-over-year, roughly in line with revenue growth. However, operating support, product development, and marketing expenses grew at year-over-year rates between 16% and 27%, with marketing expenses showing the most significant increase, consistent with management's previous statements.

The increased investments reflect, on the one hand, the company's proactive choices to promote new businesses and expand into new markets, and on the other hand, they likely also reflect forced choices due to growth pressures.

After including stock-based compensation expenses, Airbnb's overall operating expense ratio for this quarter was 46.7%, an increase of 4.3% year-over-year, significantly compressing the company's profit margins. Ultimately, Airbnb's operating profit for this quarter was $1.53 billion, a mere 2% increase year-over-year. Excluding stock-based compensation, adjusted operating profit was $1.89 billion, a 5.9% year-over-year increase, slightly better performance.

Past Airbnb Research: Fiscal Quarter 2024 Earnings Reviews - May 9, 2024: "Airbnb: Blaming Weak Guidance Again?" - February 14, 2024 Earnings Review: "Growth Slows, Hidden Profit 'Bombs,' Will Airbnb's Turning Point Come?" - November 2, 2023 Earnings Review: "Airbnb: From 'Sweetheart' to 'Has-Been'?" - August 4, 2023 Earnings Review: "Airbnb: Small but Certain Success No Longer Captivates the Market" - February 15, 2023 Earnings Review: "Eating, Drinking, and Playing Non-Stop, Airbnb 'Skipping Grades' and Running" - November 2, 2022 Earnings Review: "No Good News is Bad News, How Much Appeal Does Airbnb Have Left?" - August 3, 2022 Earnings Review: "Is High Valuation the Original Sin? Even Good Results Can't Help Airbnb" - May 4, 2022 Earnings Review: "As COVID-19 Fades, Airbnb Returns as a King" - In-Depth Analysis: June 1, 2022: "After the Pandemic, 'Playing Crazy,' Airbnb and Disney Finally Made It" - April 6, 2022: "Airbnb: An Anomaly During the Pandemic, Why Does It Thrive While Others Suffer?" - April 7, 2022: "Airbnb: The Crown is Too Heavy, Valuation is Moving Too Fast"

- END -