The Turning Point in the New Wave of AI Market Trends

![]() 07/18 2025

07/18 2025

![]() 534

534

Recently, two significant developments in the artificial intelligence (AI) industry chain have emerged, poised to inject robust momentum into the sector's recovery.

Sunrise Technologies, a leading optical module company, released its semi-annual report, showcasing a year-on-year net profit increase of 328%-385%, marking its best performance since listing. This milestone underscores the explosive potential of the AI computing power industry chain.

Concurrently, NVIDIA announced its resumption of H20 chip sales to the Chinese market, addressing the fundamental needs of domestic large-scale model training and alleviating market concerns about limited computing power supply.

These two events have resonated powerfully: Sunrise Technologies' remarkable performance highlights the thriving upstream hardware segment of the AI industry chain, while NVIDIA's chip supply news removes a critical bottleneck impeding industry growth. Consequently, E Fund AI ETF (159819) surged by nearly 4% today. Despite a year-to-date gain of less than 10%, the ETF remains below its February level.

Sunrise Technologies' performance leap is no coincidence; the global AI large model arms race is driving exponential growth in demand for computing infrastructure, with the company emblematic of this trend.

Following a brief setback due to tariff disruptions in April, the AI sector has vigorously regained lost ground. With the performance verification period and industrial progress accelerating, now presents an opportune moment to position for industry recovery.

Concerns surrounding AI are gradually dissipating.

Retrospecting the AI sector's adjustment over the past six months, three major concerns dominated market sentiment. However, recent industry developments have progressively validated these concerns as overblown.

First, doubts about technological breakthrough stagnation persisted. The market feared that large models would encounter bottlenecks in core capabilities like multimodality and logical reasoning. Nevertheless, recently, new versions of large models have been密集released globally: Musk's AI company xAI officially launched Grok 4, GPT-5 is anticipated to arrive as early as summer, Alibaba's Tongyi Qianwen underwent a substantial upgrade in China, and ByteDance introduced the multi-agent-controlled image generation model XVerse.

More crucially, the accelerated commercialization of large models attests to technological progress translating into tangible productivity.

Second, there were apprehensions about computing power demand falling short of expectations. Early in the year, the market worried that the slow commercialization of large models would stifle computing power demand growth. However, in the first half of the year, domestic leading vendors like Alibaba Cloud and Tencent Cloud witnessed significant year-on-year increases in AI computing power expenditure. Recently, Meta announced plans to invest tens of billions of dollars in constructing several large AI data centers for 'super intelligence' development, and Amazon is considering additional billions of dollars in investment in AI company Anthropic.

From another perspective, not only NVIDIA GPUs but also self-developed chips like AWS are in high demand. The concurrent prosperity of GPUs and ASICs reflects that AI demand has entered a full-fledged stage. The explosive performance of optical module companies such as Sunrise Technologies and Zhongji Xuchuang directly evidences the sustained high growth in computing power demand.

Third, there was the impact of international technology restrictions. US export restrictions on chips to China initially sparked market panic about computing power supply disruptions. However, the domestic industry chain's substitution capability far surpassed expectations. Under the trend of domestic computing power autonomy and controllability, Cambricon's orders across various sectors, including government, are accelerating. Earlier, rumors also circulated about Huawei's Ascend chips being mass-produced and delivered.

Moreover, NVIDIA's resumption of H20 sales to China further demonstrates that a complete supply cutoff is unrealistic, and the industry's external development environment is improving.

It can be concluded that recent data and news have comprehensively disproved the market's earlier concerns about AI, and the industry is transitioning from an adjustment period to a new growth cycle.

Capturing the Growth Potential of the Global AI Market

Top international institutions' recent reports have consistently been optimistic about the long-term prospects of the AI industry, with particular emphasis on the growth potential of the Chinese market.

For instance, in a recent report, Goldman Sachs noted that despite growth slowing, AI infrastructure investment will remain sustainable over the next 2-3 years. The market's excessive focus on 'slow returns' may have overlooked the fact that cost dividends are already being realized, and share prices have yet to reflect this structural change.

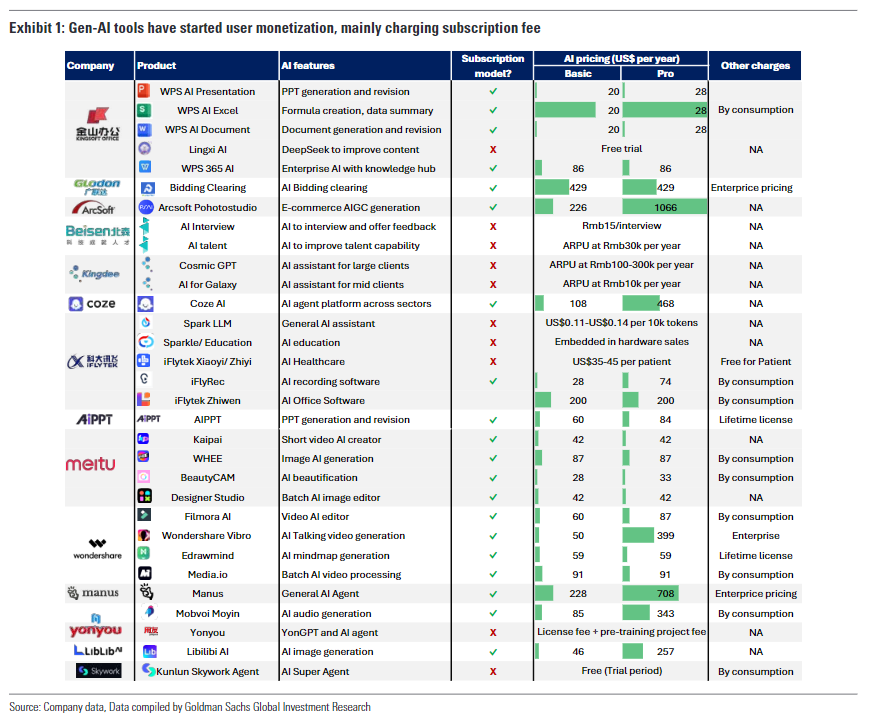

Simultaneously, China's software market maintained the robust development momentum of AI-native applications in the second quarter of 2025. Goldman Sachs believes that China's generative AI applications have entered the early stages of commercialization, with AI Agents, multimodal AI models, and model deployment emerging as the industry's three core growth engines.

Furthermore, according to Morgan Stanley's Global Technology Blue Book 'China - Artificial Intelligence: The Awakening of the Sleeping Giant,' by 2030, China's core AI industry's potential market size will reach RMB 1 trillion, with a related industry size of RMB 10 trillion.

However, with the consistent high growth in computing power demand, the continuous landing of application scenarios, and the escalating policy funding, the industry's beta market trend has become evident. Yet, for ordinary investors, issues like large stock fluctuations, high technical barriers, and the difficulty in selecting the right target often pose obstacles to seizing opportunities.

Therefore, instead of grappling with difficult choices among hundreds of AI concept stocks, deploying the entire industry chain through ETFs, such as E Fund AI ETF (159819), might be a more prudent approach, addressing these pain points.

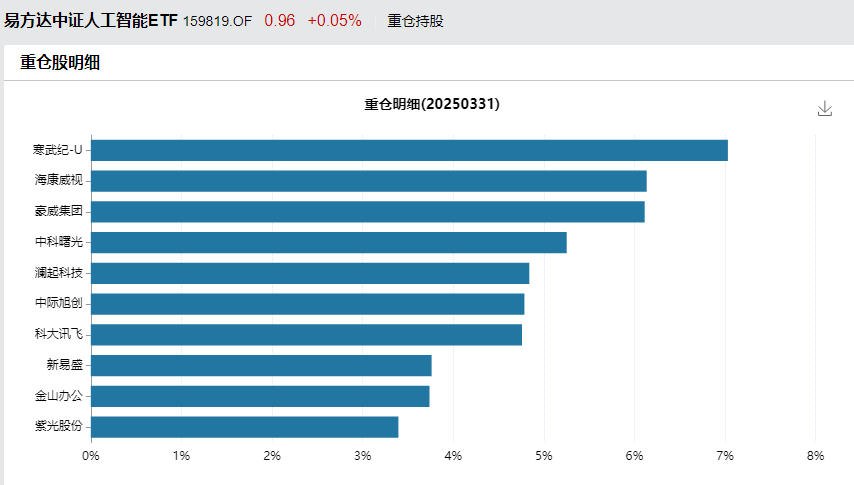

This ETF's top ten holdings encompass both upstream hardware leaders like Sunrise Technologies and Zhongji Xuchuang and downstream application scenario companies such as iFLYTEK and Hikvision. It also includes representatives of the domestic substitution trend, like Cambricon.

This configuration allows for capturing the growth dividends of overseas hardware while sharing the explosion opportunities in the domestic application layer, mitigating investment risks arising from fluctuations in a single link or region.

Additionally, E Fund AI ETF's fund shares have surged from 6 billion shares at the beginning of 2024 to over 17 billion shares currently, an increase of over 180%, with a circulation scale exceeding RMB 16 billion. This scale growth is not fortuitous but the outcome of institutional and retail funds' shared optimism about the AI industry's prospects, reflecting investors' preference for ETFs as a tool-type product.

Hence, in this wave of technological revolution, rather than getting entangled in individual stocks' fluctuations, grasping the industry's beta through ETFs might be more prudent. This approach avoids 'stepping on landmines by choosing the wrong company' and fully enjoys the industry's growth dividends, potentially the optimal solution for ordinary investors to participate in AI market trends.