Tesla Q2 2025 Earnings Call Recap: Latest Developments in FSD, Robotaxi, Optimus Humanoid Robot, and Chips

![]() 08/04 2025

08/04 2025

![]() 470

470

During Tesla's recent Q2 2025 earnings call, Elon Musk revealed that competitors meticulously benchmark Tesla's AI Day presentations down to the pixel level before attempting to replicate them. As a result, Tesla now shares more insights into its product technology and development strategies during earnings calls and investor meetings.

When we hosted our AI Day, we discovered that some suppliers scrutinized our slides meticulously, including every word, and subsequently replicated them.

This prompts the question: What is the advantage of such an approach? Does it really aid in recruitment? Nonetheless, competitors scrutinize us meticulously and mimic our strategies.

Musk - Q2 2025 Call: Indeed, Tesla is now more guarded about details concerning FSD algorithms, chips, and affordable car models. Drawing from verbal updates from Musk and other Tesla executives during the Q2 2025 investor call, this article summarizes the latest developments in FSD, Robotaxi, the humanoid robot, and chips, aiming to provide valuable information and inspiration.

Regarding Tesla's Q2 2025 financial report, it presents a challenging landscape, with intensifying competition in China and unfavorable policies in Europe and the United States. Automotive revenue stood at $16.7 billion, a decline of 16% from $19.9 billion in the corresponding period last year.

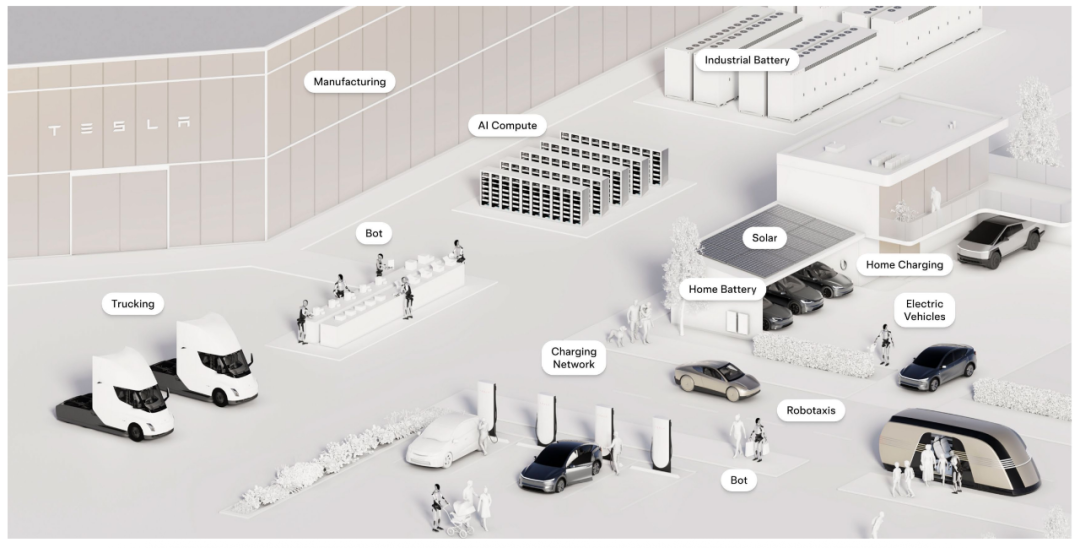

1. Robotaxi

Tesla has launched its first commercial Robotaxi service for paying customers in Austin, Texas. For more detailed insights, refer to our previous article, "Can Tesla's Robotaxi Continue the Growth Myth of Model Y?" Furthermore, the service area in Austin is poised to expand over tenfold.

Robotaxi Launch and Expansion Plans:

As of Q2 2025, Tesla's expansion into markets such as the San Francisco Bay Area, Nevada, Arizona, and Florida awaits regulatory approval.

During the call, Musk mentioned that with regulatory approval, Tesla could technically extend its Robotaxi service to cover half of the US population by the end of 2025.

Once approved and proven safe, we will deploy the autonomous ride-hailing service across most parts of the US. I believe that by the end of this year, we could potentially serve half of the US population. This is our objective, contingent on regulatory approval. Technically, we are capable of achieving this. Assuming we obtain regulatory clearance, we could serve half of the US population by the end of this year. We proceed with caution and do not wish to take any risks. However, the service area and the number of operating vehicles will grow at a super-exponential rate.

Musk - Q2 2025 Call

During the meeting, Tesla's Vice President of Software, Ashok Elluswamy, revealed the mileage and safety metrics of Tesla's Robotaxi:

As of Q2 2025, Robotaxi taxis in Austin have traveled over 7,000 miles without any significant safety interventions.

Currently, Tesla operates conservatively in Austin, with remote monitoring of vehicle travel areas and a speed limit of 40 miles per hour. This information was disclosed when investors inquired about the takeover rate of Tesla's Robotaxi. Evidently, this suggests that Tesla's Robotaxi is not yet commercially viable like Waymo.

Regarding Robotaxi operating costs, Musk stated that the future goal for the CyberCab, optimized for Robotaxi, is to achieve a fuel economy of less than 30 cents per mile, or even 25 cents per mile.

Regarding previous rumors that all Tesla vehicles would be integrated into the Robotaxi network, Musk clarified that this issue has not been seriously considered yet.

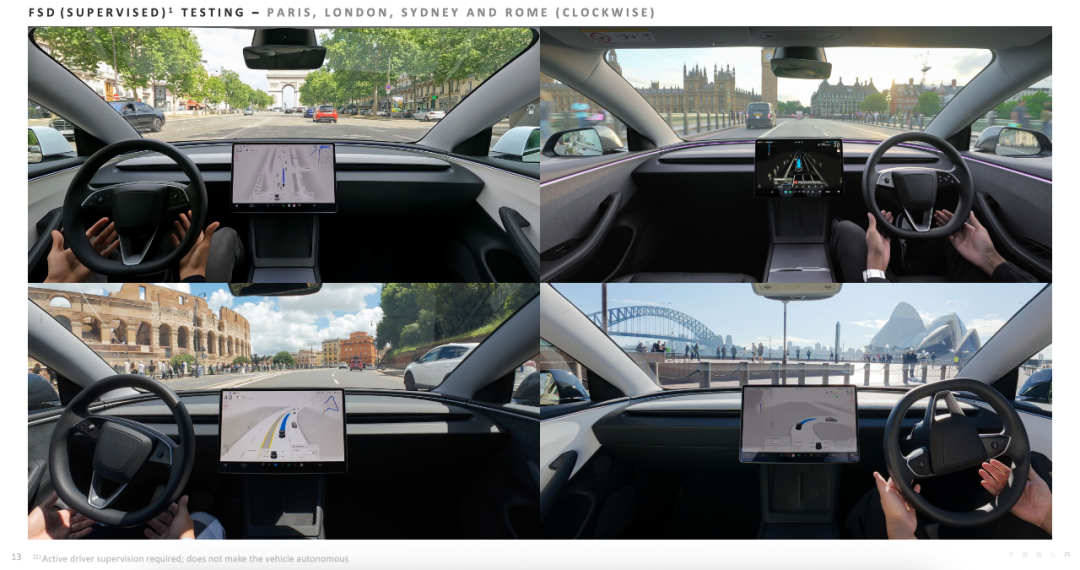

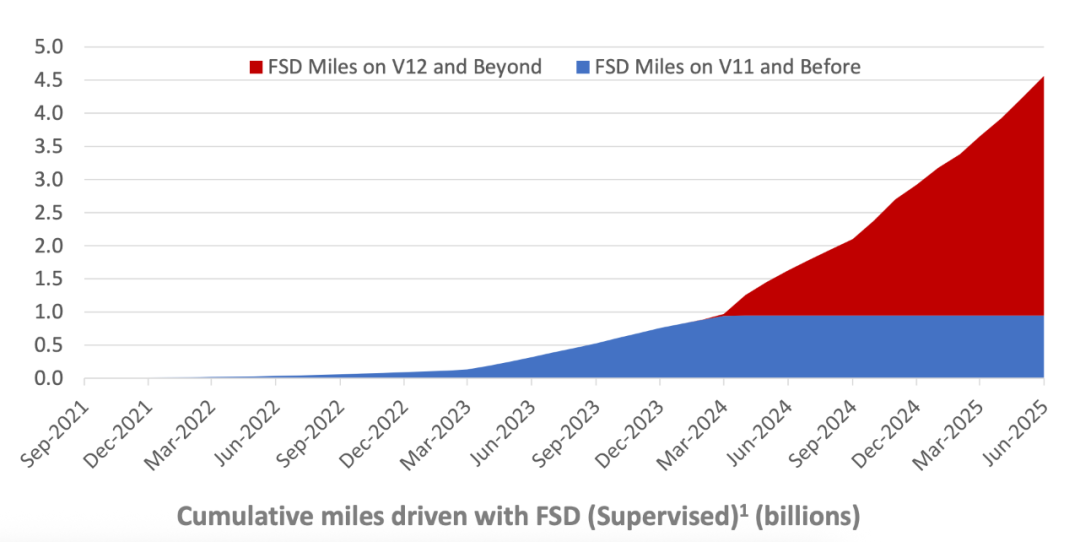

2. Full Self-Driving (FSD)

The new mass-production version of FSD, presumably FSD V14, will be launched after several months of Robotaxi operation in Austin, estimated to be at the end of Q3 2025.

The new FSD algorithm will have 10 times the number of parameters compared to the current FSD V13. Musk also noted that as the number of algorithm parameters increases, storage bandwidth will become a limitation, indicating that the next-generation FSD HW5 hardware chip, AI 5, will undergo upgrades in computing power and storage bandwidth.

However, based on the chip information available, it is anticipated that Tesla will continue to run FSD V14 on the current HW 4 AI 4 chip.

Musk expressed confidence that by the end of this year, in certain regions of the US (West and Bay Area), newly purchased Tesla vehicles can be autonomously delivered to customers through FSD. He also stated that Tesla vehicles are already driving autonomously within its factories and shipping terminals, and delivering vehicles to customers involves only an OTA software update.

Since the launch of FSD V12 in North America, FSD subscription revenue has increased by 45%, and the subscription rate has risen by 25%.

FSD has not yet received certification in Europe, but Musk mentioned that the Netherlands might be the first to obtain road use certification.

3. Optimus Robot

The humanoid robot Optimus will unveil the Optimus 3 prototype in the third quarter, with mass production anticipated to commence early next year, aiming for an annual production capacity of 1 million units by 2030.

The design of Optimus 3 is robust, devoid of significant flaws. We will enhance it in numerous aspects. The Optimus 3 prototype may be available by the end of this year, with mass production achievable next year. We will expedite Optimus production to achieve the goal of 1 million units per year. We believe we can accomplish this within less than five years. This is a realistic target. In summary, 2025 has been an exhilarating year marked by several significant milestones thus far.

Musk - Q2 2025 Call

The Optimus humanoid robot will be utilized in Tesla's enterprise-level applications, such as factory screwdriving and Robotaxi operation and maintenance services.

4. FSD Chip and Dojo Computing Chip

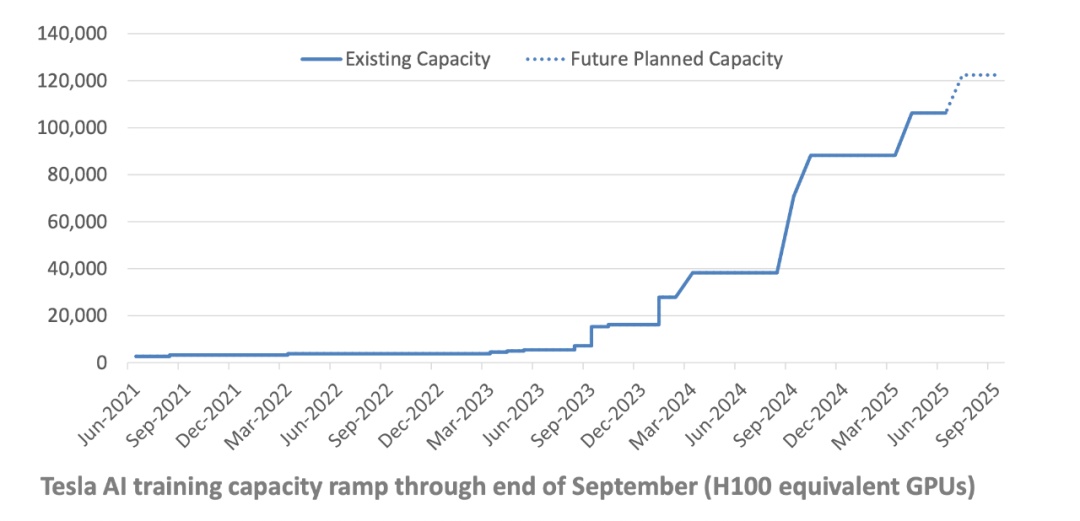

Tesla anticipates its AI training chip platform, Dojo 2, to achieve large-scale operations by 2026, with a capacity equivalent to approximately 100,000 GPUs. By then, the AI factory will be fully operational. Notably, by the end of 2024, Tesla had only 85,000 NVIDIA H100 GPUs.

According to Musk, the FSD HW5 chip, AI 5, will be launched after the Dojo 2 AI training factory becomes operational. It is estimated that both the algorithm and computing power will be revamped at that time. However, it can be inferred that both the algorithm model and computing power will reach advanced levels, and the trend towards more sophisticated driving vehicle-end models and algorithms will continue to grow.

Regarding future Dojo 3 and AI 6, their computing chips may be similar or share a common platform, such as utilizing 2 AI 6 chips for cars and robots. The computing platform might then employ 5-12 AI 6 chips interconnected through high-speed bandwidth.

5. Automotive Vehicles

During the meeting, someone inquired about Tesla's new low-cost vehicle model, attempting to elicit details from Musk through specific questions. However, they were rebuffed by Tesla CFO DevOps Ninja. Musk and other executives remained tight-lipped about the new low-cost vehicle model.

Will Stein: Thank you for answering my question. First, I would like to know more about the low-cost vehicle model you mentioned earlier, which you said entered production in the first half of the year but will gradually scale up later. I recall you discussing aspects like reducing silicon carbide use by two-thirds or three-quarters, eliminating rare earth elements in motors, and other cost-cutting measures during the last Analyst Day. You also mentioned a non-encapsulated architecture, which I believe you said would not be included in this transitional plan. Can you provide an overview of the actual expectations for this product?

DevOps Ninja: We won't delve into specifics. Your focus should be on Model Y.

Elon Musk: Yes. I'll discuss the car after it.

Tesla Q2 2025 Call

It is certain that the low-cost vehicle model, originally scheduled for mass production next quarter, has been postponed. Musk stated during the meeting that it has been delayed to the end of the fourth quarter.

Regarding CyberCab, Musk revealed that the maximum speed has been reduced, and the design emphasizes smoother driving. This allows Tesla to forego the need for high acceleration and braking, enabling the use of more efficient tires. It also aligns with product positioning and demand, pushing cost reduction to its limits.

The distinction between XAI and Tesla is that XAI focuses on super AI in the digital world, with models at the terabyte level, whereas Tesla focuses on Physical AI in the real world, with models 100 times smaller than XAI's.

6. Final Thoughts

Tesla is facing numerous challenges. From a business perspective, there are several adverse factors, particularly in the automotive industry in China.

However, from a product technology standpoint, although Musk often exaggerates, his overall strategy and technical roadmap are accurate, and Tesla has achieved numerous impressive milestones.

This article interprets the information from Q2 2025, striving to objectively present facts and valuable core information. For those interested in interpreting it themselves, I recommend reading the original 20,000-word transcript.

Reference Articles and Images

Tesla Q2 2025 Call Original Transcript in Chinese and English

Tesla Q2 2025 PPT

*Reproduction and excerpt are strictly prohibited without permission