Honor’s Robot Phone Vision Falters: Why Are Investors Cold on the ‘Next-Gen Revolution’?

![]() 11/12 2025

11/12 2025

![]() 560

560

The disconnect stems from a stark reality: Honor’s ambitious robotics-driven future clashes with the declining trajectory of its core smartphone business.

From foldable displays to AI integration, smartphone brands are pushing technological boundaries to redefine their categories. Yet, despite sporadic innovations, the industry remains mired in stagnation—data trends fluctuate, but true paradigm shifts remain elusive. To survive, manufacturers must transcend the limitations of traditional mobile devices.

Against this backdrop, Honor has positioned itself at the forefront of AI and robotics innovation.

On November 8, Honor CEO Li Jian unveiled plans for a groundbreaking “Robot Phone” set to launch in 2026. Combining AI-driven mobile capabilities, embodied intelligence, and professional-grade imaging, the device aims to redefine human-device interaction as a “warm, new intelligent life form.”

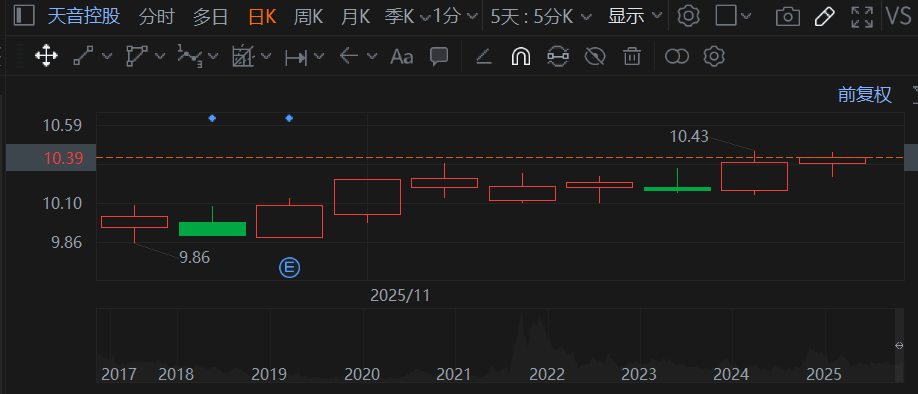

However, capital markets have greeted this vision with skepticism. While some concept stocks saw minor upticks post-announcement, shares of Telling Telecom—a key Honor partner—dipped, underscoring investor caution.

This raises a critical question: Why has Honor’s futuristic blueprint failed to ignite broader enthusiasm?

01

Robot Phone: Innovation or Hype?

Honor’s pivot to robotics is no coincidence. The global smartphone market is mired in a prolonged slump.

Omdia reports a 1% YoY decline in Q2 2025, marking the first contraction in six quarters. IDC further downgraded its annual growth forecast from 2.3% to 0.6%. In China, Honor fell into the “Others” category in Q3 2025, with Canalys data revealing a 3% YoY drop in 2024 shipments to 42.2 million units.

Facing saturation in its core market, Honor seeks a “second growth curve,” with robotics emerging as a strategic priority. IDC projects the global robotics market to exceed $30 billion by 2025, bolstered by Chinese policies favoring humanoid robot development.

Smartphone makers’ expertise in computer vision, AI algorithms, and supply chains aligns seamlessly with robotics’ core components—“eyes,” “brains,” and “bodies.” For instance, Vivo adapts its imaging tech for machine vision, while Huawei leverages HarmonyOS for cross-device ecosystems.

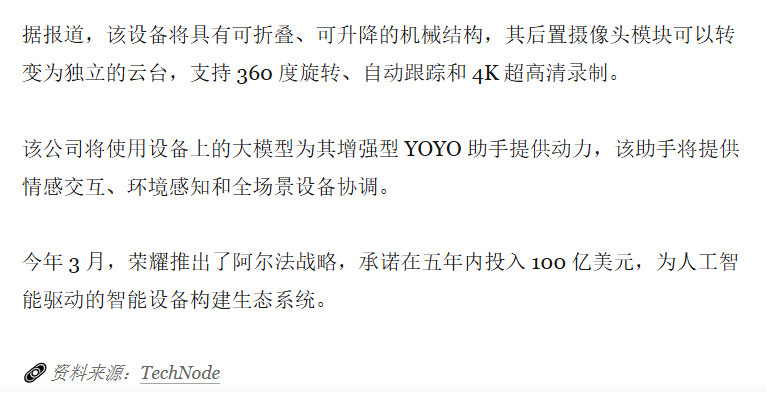

Honor’s Robot Phone takes a bold approach, eschewing minimalist design for mechanical complexity.

Its standout feature is a foldable, retractable camera module that transforms into an independent gimbal. Supporting 360° rotation, auto-tracking, and 4K recording, the system resembles a professional handheld stabilizer integrated into the phone. Powered by an on-device AI assistant (YOYO), it analyzes user emotions to deliver personalized content recommendations.

Yet, this “AI brain + robotic arm + gimbal camera” hybrid faces significant technical hurdles.

Durability tops the list. How will the heavy robotic arm and lens module withstand daily wear? Drop resistance remains unproven, especially when extended. Honor has yet to address these concerns convincingly.

Thermal management is another critical issue. 4K capture and on-device AI processing generate substantial heat, yet Honor has disclosed no cooling solutions.

For context, professional gimbal maker FeiyuTech equips its smartphone stabilizers with built-in fans for extended use.

Mechanical cameras are not new to Honor. Previous attempts, like OPPO N1’s rotating lens and Vivo NEX’s pop-up module, faced reliability issues and were eventually phased out. Innovation alone does not guarantee adoption.

In 2015, Honor released the Honor 7i, featuring a 13MP rotating camera that outperformed front-facing alternatives. However, the mechanism required a recessed body design, sacrificing battery capacity—a critical trade-off in compact devices.

02

Capital Market Caution

In the smartphone industry, major product launches often boost market confidence.

For example, Tecno’s August 2024 unveiling of a triple-fold concept phone drove its stock up nearly 5%. Similarly, Vivo’s AI-powered foldable launch triggered a surge in concept stocks, with Xinyin Electronics jumping over 10%.

However, Honor’s Robot Phone announcement met with mixed reactions.

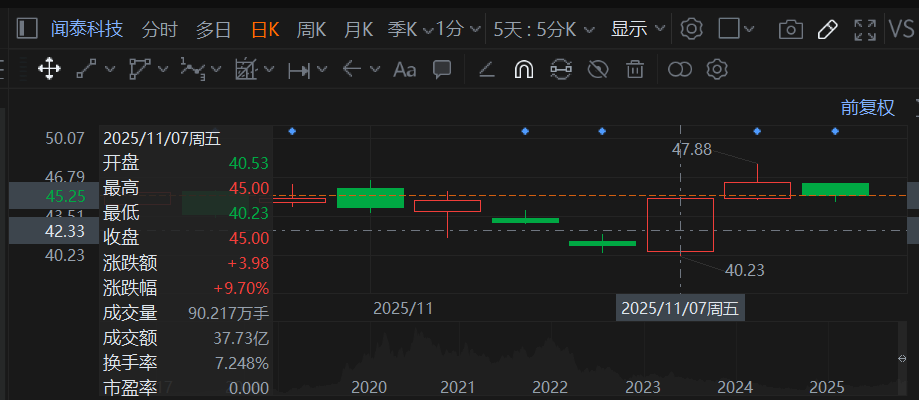

On November 8, Wingtech Technology—Honor’s ODM partner—saw shares rise 9.7%. Other concept stocks, like Flyrdar and Qiangrui Technology, posted modest gains around 4–5%, while Telling Telecom and F-R Electronics dipped slightly on November 7.

Telling Telecom’s financial woes deepened concerns. Its mid-2025 earnings forecast projected a net loss of 50–65 million yuan for H1 2025, versus a 9.78 million yuan profit the previous year. Revenue is expected to shrink 7.94–15.77% YoY to 43–47 billion yuan.

Investment bubbles in robotics further fuel skepticism.

Honor’s “Alpha Strategy” earmarks $10 billion for AI ecosystem development over five years. Yet, its smartphone business—its revenue backbone—stagnated, with 2024 shipments declining 3% YoY.

This “high-investment, slow-return” model mirrors the AI industry’s “burning money” trap, intensifying doubts about Honor’s ability to balance long-term vision with short-term profitability.

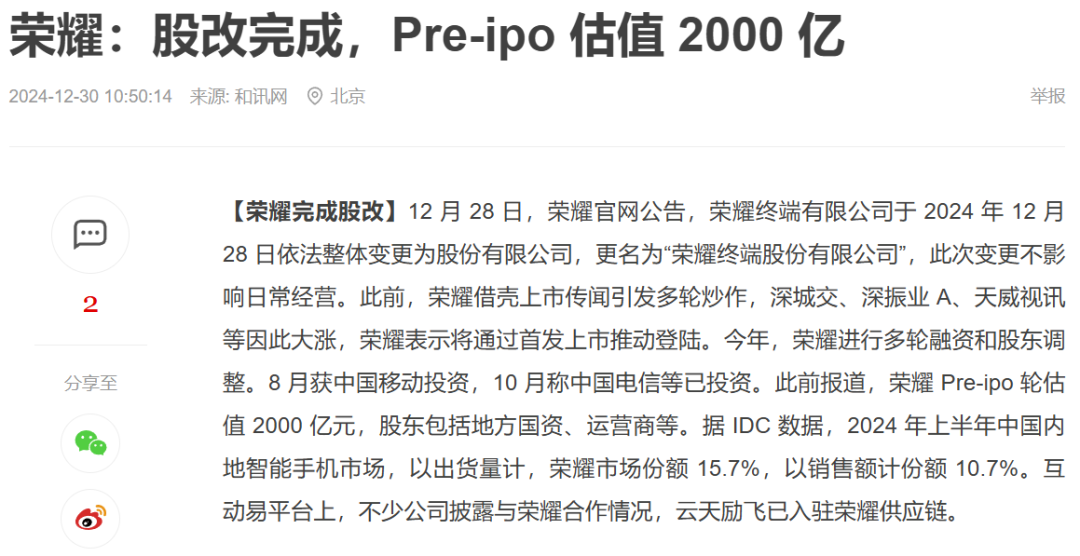

During its pre-IPO funding round, Honor’s valuation of ~200 billion yuan marked a 23% decline from its Huawei split valuation (260 billion yuan), reflecting investor caution.

In contrast, Apple’s conservative AI strategy has regained investor favor. Its fiscal 2026 capex is estimated at $14 billion, far below Microsoft’s $94 billion and Meta’s $70 billion.

03

Honor’s Rollercoaster Ride

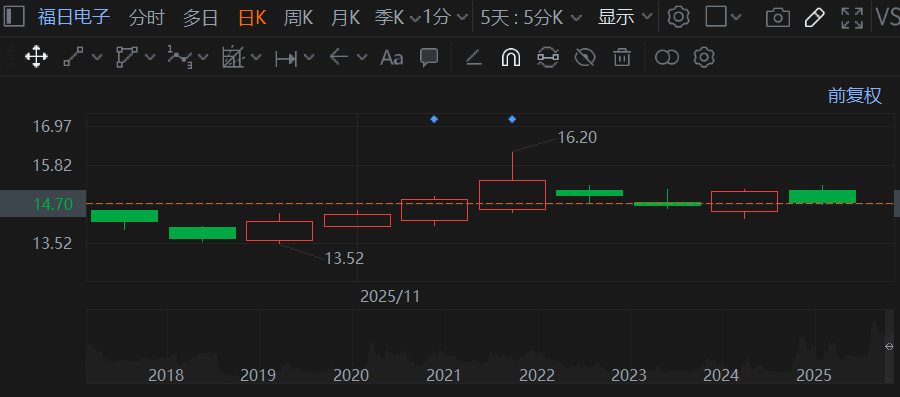

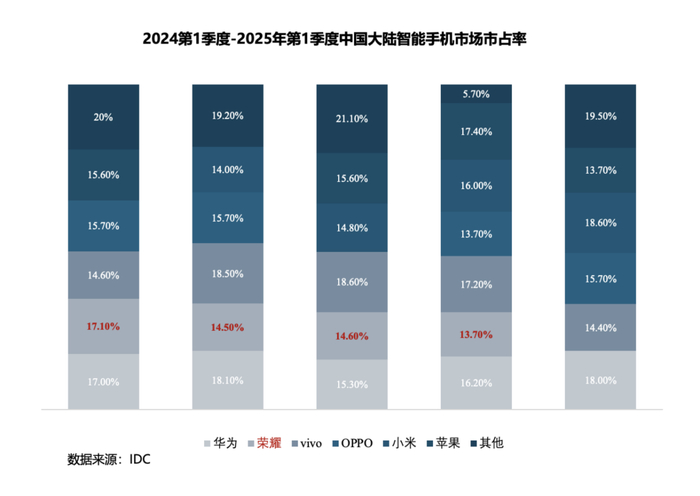

Since splitting from Huawei in November 2020, Honor has oscillated between crisis and resurgence. IDC data shows it tied with Huawei for China’s top spot in Q1 2024 (17.1% share, +13.2% YoY), only to slide to 13.7% in Q4 2024 (-14.9% YoY). By Q1 2025, it fell out of the top five.

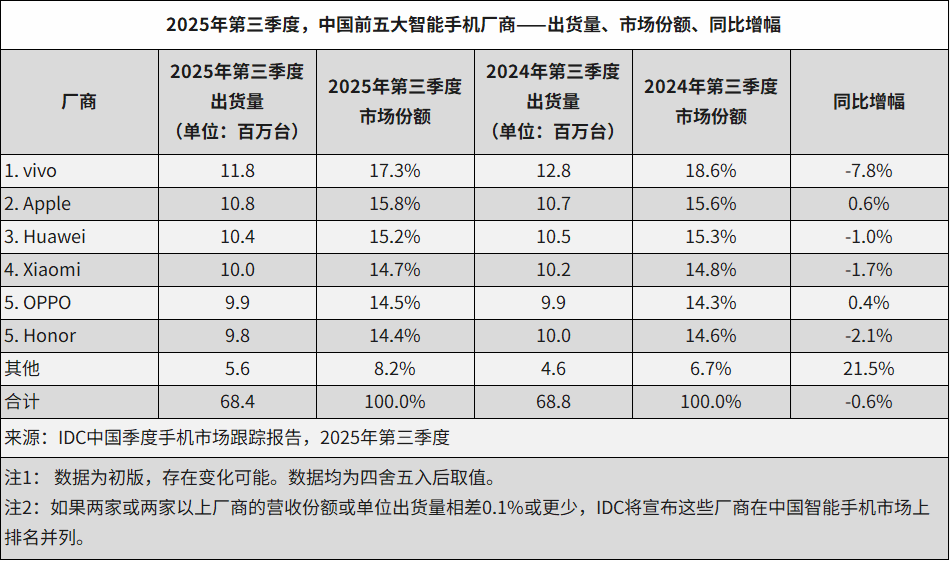

In Q3 2025, Honor’s China smartphone sales dropped 8.1% YoY—the steepest decline among mainstream brands (average: -2.1%).

The root cause lies in product innovation and brand positioning gaps amid fierce competition.

For instance, the April 2025 launch of the Honor GT Pro—intended to boost sales—backfired after AnTuTu benchmark disputes sparked “unethical marketing” backlash, tarnishing Honor’s “tech-forward” image.

Honor’s brand strategy has also lacked consistency. Initially positioned as a “Huawei alternative,” this perception weakened post-Huawei’s return. Under former CEO Zhao Ming, Honor targeted the premium segment, competing directly with Apple and Huawei. After Li Jian’s appointment, the focus shifted to mid-range and budget models (e.g., Honor Power, Honor X70) to reverse sales declines.

Rivals are also eroding Honor’s market influence.

IDC data for Q3 2025 shows Vivo leading China (17.3%), followed by Apple (15.8%) and Huawei (15.2%). Xiaomi, OPPO, and Honor trailed at 14.7%, 14.5%, and 14.4%, respectively.

Globally, Samsung, Apple, Xiaomi, Transsion, and Vivo dominate shipments, with “Others” accounting for ~31.4% of the market. For Honor, breaking through this crowded landscape remains an uphill battle.

04

Conclusion

Honor’s Robot Phone launch is a bold declaration of intent to redefine the stagnant smartphone market. Yet, the capital market’s cautious response underscores a broader dilemma: with declining core business market share, erratic brand positioning, and intense competition, even ambitious innovations struggle to alleviate short-term profitability concerns.

Honor’s path to breakthrough is fraught with challenges. The Robot Phone’s success hinges not only on technical execution and market adoption but also on stabilizing its smartphone business and achieving clarity in brand strategy and channel reforms. This tests Honor’s technological resilience and strategic focus—and poses a critical challenge for the entire industry in its quest for a “second growth curve.”

*Images sourced from the internet. For copyright issues, please contact for removal.