When Jensen Huang Praises China's AI: How Should Investors Position Themselves in This Intelligence Surge?

![]() 11/14 2025

11/14 2025

![]() 476

476

Source | Shenlan Finance

Author | Wang Xin

Recently, AI has once again captured the tech world's attention. First, a female humanoid robot from XPeng Motors took the internet by storm with its graceful and natural 'catwalk.' Subsequently, NVIDIA CEO Jensen Huang publicly acknowledged that 'China's AI technology is truly exceptional, with roughly half of the world's AI researchers hailing from China.'

These two events—one showcasing technological sophistication through a tangible product, the other highlighting talent concentration from a global standpoint—signal that the era of Chinese AI is racing toward us at an unprecedented pace.

Amid this intelligence surge, humanoid robots have transcended science fiction and are widely recognized by the industry as the 'third computer,' poised to revolutionize our lives after personal computers and smartphones.

1

Historical Echoes: Where Does the Current AI Boom Stand?

To foresee the future, the best strategy is to revisit the past. Over the past 15 years in China's A-share market, every major tech rally has aligned with the launch and proliferation of 'game-changing' products.

In 2010, the iPhone 4's debut ignited the first tech frenzy in A-share's mobile internet sector. Later, the 3G-to-4G communication transition fueled a second wave led by mobile gaming and social media. The third wave was driven by new energy vehicles and Huawei's smartphone supply chain.

Data Source: Wind, as of October 17, 2025

Today, we stand amid a fourth tech rally, with 'AI' boldly inscribed on the banner of breakthroughs in foundational technologies.

Remarkably similar to past cycles, the current macroenvironment—characterized by a sluggish economic recovery, abundant liquidity, and robust policy support from the national 'AI+' action plan—aligns with the explosive traits of previous booms.

However, a critical distinction lies in valuations: current valuations remain significantly below their 2015 peaks, while volatility and leverage are healthier. This suggests that unlike past speculative bubbles, the current AI-driven tech wave rests on firmer ground, offering investors a potentially longer window for rational positioning.

2

Triple Convergence: Why AI Holds the Greatest Imagination?

AI is seen as the most logically sound and imaginative technological theme because it uniquely converges 'timing, geography, and human factors.'

Timing: AI is not merely a single-product innovation but a true industrial revolution, empowering countless sectors. Its story of rising penetration has just begun.

Geography: Policy support for hard tech is unprecedented. In August 2025, the State Council issued the 'AI+' action plan, addressing not only national security concerns ('neck-breaking' technologies) but also a global industrial upgrade battle with the U.S.

Human Factors: From DeepSeek's emergence to continuous improvements in domestic computing chips, China has demonstrated the hard power to rival the U.S. in AI. As Huang noted, China boasts the world's largest and highest-quality talent pool, making it feasible to overtake competitors in this marathon.

Along this vast AI supply chain, investment opportunities center on two cores: upstream computing infrastructure (chips, optical modules) and downstream disruptive applications (humanoid robots). These three segments form the indispensable 'Three Musketeers of AI.'

3

The Ultimate Race: Humanity's 'Third Computer'

If chips are the 'heart' and optical modules the 'nervous system' of the AI era, then humanoid robots represent the 'third computer' set to transform our lives and production. Their disruptiveness lies in three dimensions:

They are no longer 'iron clumps' but 'soulful' companions. Breakthroughs in AI large models have equipped robots with smarter, cheaper brains. Model optimization reduces reliance on expensive specialized chips, drastically lowering costs and making robots affordable for households. More importantly, they can now converse, read emotions, and interpret tones, shattering their 'iron clump' stereotype.

Economically driven necessity. Striking data: The average U.S. labor cost is $31.25 per hour, while a humanoid robot's equivalent hourly cost is just $1.7—a 95% reduction. Even in China, costs drop by over 62%. Robots operate 24/7, with a lifespan of 43,800 working hours and fixed maintenance costs. Amid aging populations and rising labor costs, robots offer the ultimate solution to break the 'wage-inflation' spiral in manufacturing and services. (Of course, solutions for human employment and welfare will emerge in the robotic age.)

'Three-Stage Leap' in Applications. The commercialization path for humanoid robots is clear:

1.0 Phase (2024-2025): Replace repetitive labor in manufacturing as true 'new quality productivity' tools.

2.0 Phase (2029-2030): Enter restaurants, malls, and other commercial/service sectors to address labor shortages.

3.0 Phase (2035+): Enter households for chores, education, security, and emotional companionship.

By 2025, UBTECH's Walker series humanoid robots have secured over 800 million yuan in annual orders, primarily from production-line bulk purchases ('factory work') by automakers, local investment platforms, and listed tech firms—not just 'research procurement' or 'demonstration projects.'

Tesla's vision is even bolder: a 1 million-unit Optimus 3 production line by 2026, scaling to 10 million and 50 million units for household adoption. This scale underscores its status as the 'third computer.'

4

Conclusion: How Can Ordinary Investors Join the AI Feast?

Year-to-date, leading chip and optical module firms driven by AI have far exceeded earnings expectations, with analysts projecting sustained high growth. As humanoid robots commercialize, related supply chain firms will see explosive growth.

For investors, betting on a single technology or company is risky, as stock prices often decouple from earnings and valuations swing wildly. A safer approach is to focus on index groups representing AI's core strengths. Southern Fund's 'Three Musketeers of AI' strategy cleverly integrates the supply chain:

CS Sci-Tech Chip ETF Southern (588890): Targets AI's 'heart'—computing chips—benefiting from domestic substitution momentum.

ChiNext AI ETF Southern (159382): Covers AI's 'nervous system'—optical modules—where Chinese firms lead globally and directly benefit from overseas computing arms races.

Robot ETF Southern (159258): Positions in AI's 'ultimate form'—humanoid robots—the most disruptive and imaginative application.

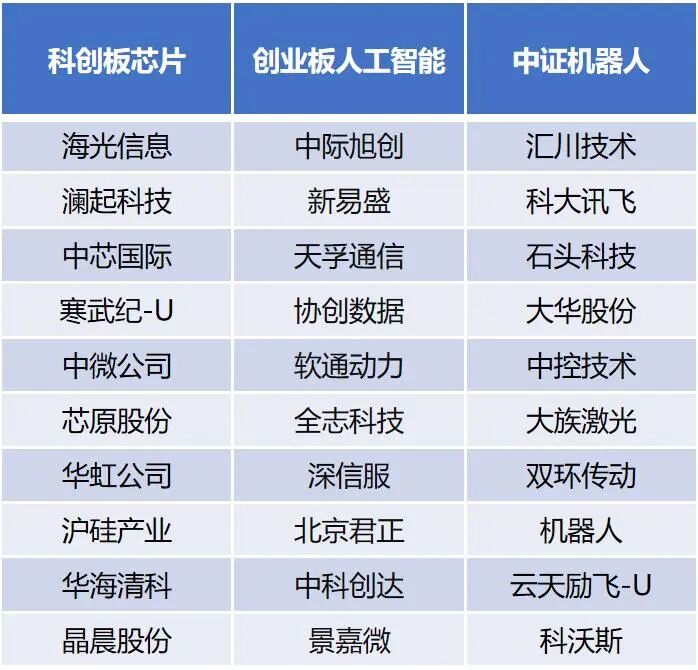

These three ETFs track the SSE Sci-Tech Innovation Board Chip Index, ChiNext AI Index, and CSI Robot Index, respectively, with no overlap in their top 10 holdings. Investors can allocate 33% to each for a balanced 'Three Musketeers' portfolio.

Top 10 Holdings of the Three Index Funds

As a major ETF provider, how robust is Southern Fund's 'Three Musketeers' portfolio?

Backtesting shows that as of October 2025, the portfolio exhibited lower volatility than the CSI AI Index over nearly six years while delivering a 7.63% annualized excess return. For ordinary investors seeking AI exposure with controlled volatility, this offers a diversified, high-performing option.

Data Source: Southern Fund, CSI Index, Wind

Period: January 1, 2020–October 20, 2025

Investors unable to trade ETFs on exchanges can opt for feeder funds: Southern SSE Sci-Tech Chip ETF Link (A: 021607, C: 021608), Southern ChiNext AI ETF Link (A: 024725, C: 024726), and Southern CSI Robot ETF Link (A: 020607, C: 020608) to efficiently access the 'Three Musketeers' portfolio.

History shows that great tech revolutions spawn immense investment opportunities. As AI's clarion call resounds and humanoid robots march from labs to production lines, we may stand at the dawn of a new era. Seizing this 'determinism' track could capture the next decade's tech dividends.

*Disclaimer: This article is an industry observation based on public data and does not constitute investment advice.

Shenlan Finance Media Group, originating from the Shenlan Finance Journalist Community, has a 15-year history as a leading Chinese financial media outlet. Its accounts focus on China's most valuable companies, cutting-edge industries, and emerging regional economies, providing valuable content for investors, corporate executives, and the middle class. Welcome to follow us.

***