The Leading Domestic Welding Robot Giant Accelerates Towards IPO! Steps into the Realm of Embodied Intelligent Robots with a 50% Gross Margin

![]() 12/01 2025

12/01 2025

![]() 624

624

The largest domestic welding robot enterprise is in full throttle (or actively) on its path to going public.

Recently, Canrobot officially filed its prospectus with the Hong Kong Stock Exchange.

In contrast to the highly publicized humanoid robots of recent times, industrial robots boast more mature technology and wider applications. Nevertheless, they have not drawn as much attention due to their limited intelligence.

However, Canrobot's prospectus hints at an exploratory direction: evolving from traditional industrial robots to developing embodied intelligent robots.

Established in 2012, Canrobot initially concentrated on manufacturing industrial robot controllers and swiftly emerged as a leader in its niche market. In 2018, the company made a strategic shift into the industrial robot complete machine market, rapidly achieving commercialization. Since then, it has risen to prominence in the domestic industrial robot sector, particularly in welding robots, leading domestic companies in revenue from this product in 2024. In the robotics sector for metal and mechanical processing industries, Canrobot ranks third among domestic enterprises.

From 2022 to 2024, Canrobot's revenue reached 197 million yuan, 222 million yuan, and 234 million yuan, respectively, indicating a slight upward trend. However, its net profit fluctuated from profit to loss during this period.

Currently, Canrobot offers a fully self-developed product lineup consisting of three major categories: industrial robots, collaborative robots, and embodied intelligent robots. Compared to the first two categories, embodied intelligent robots boast a higher gross margin and greater profit potential.

Today, let's delve into the transformations within this leading domestic welding robot company's traditional industrial robots and its new business ventures.

/ 01 /

Over 600 Small and Medium-sized Clients Propel a Welding Robot Business

According to the prospectus, Canrobot's product range encompasses industrial robots, collaborative robots, and embodied intelligent robots.

Among these, six-axis robots within the industrial robot category are the primary revenue generators, contributing over 80% of the total. Within the six-axis robots, six-axis welding robots are the main sales drivers, accounting for approximately 50% of the company's overall revenue.

Specifically, Canrobot's six-axis welding robots include the RH series, PRO series, Lingweld series, laser welding series, and spot welding series, catering to various application scenarios such as heavy-duty welding (primarily used in automotive manufacturing), light and medium-duty welding, high-precision welding, and spot welding.

According to the prospectus, Canrobot's recent revenue growth has primarily stemmed from product diversification, expanding from its core six-axis welding robots to fully self-developed products like six-axis multifunctional robots, four-axis industrial robots, collaborative robots, and embodied intelligent robots.

These new product lines have generally exhibited revenue growth during past reporting periods. However, except for six-axis multifunctional robots, which account for roughly 30% of revenue, the other three robot series still contribute relatively little, with their revenue shares all below 5% of the total from 2022 to 2024.

In terms of sales model, like most B2B companies, Canrobot's revenue growth heavily relies on acquiring clients, particularly small and medium-sized ones.

Over 90% of Canrobot's revenue comes from direct sales, with clients including end-users and system integrators.

From 2022 to 2024, the number of Canrobot's direct sales clients increased from 527 to 644, becoming the primary driver of revenue growth.

However, these clients are predominantly small and medium-sized. From 2022 to 2024, except for revenue from the largest client, which was 19.074 million yuan, 23.108 million yuan, and 17.318 million yuan, respectively, accounting for 7-10% of revenue, the revenue contributed by the 2nd to 5th largest clients was all below 10 million yuan, with their shares in total revenue also below 4%.

In terms of average price, the average value of Canrobot's direct sales clients ranges from 300,000 to 400,000 yuan. Possibly affected by the general price reductions in the industrial robot industry, this figure has consistently declined from 365,000 yuan to 329,500 yuan between 2022 and 2024.

It should be noted that Canrobot's client retention rate is not particularly high, hovering around 50%. This implies that Canrobot needs to continuously acquire new clients to sustain revenue growth.

From a production capacity perspective, Canrobot has been actively expanding in recent years. Its designed production capacity was 4,000 units in 2022 and then increased by 500 units annually, reaching 5,000 units in 2024. The expansion was even more significant in the first half of this year, with the designed production capacity reaching 4,000 units, a 60% increase compared to the same period in 2024.

Despite the capacity expansion, although Canrobot's production volume has continuously risen from 3,300 units in 2022 to 3,800 units in 2024, its capacity utilization rate has consistently declined from 82.5% to 76.0%. In the first half of this year, its production volume reached 3,000 units, a 50% year-on-year increase, but the capacity utilization rate slipped to 75.0%.

Although production volume has maintained growth (continuously increased) and revenue has steadily risen, Canrobot's net profit has exhibited significant fluctuations in recent years.

Canrobot's net profit was 28.265 million yuan, 1.688 million yuan, and -12.944 million yuan from 2022 to 2024, respectively, showing a clear decline and shifting from profit to loss.

In the first half of this year, Canrobot's performance improved, with revenue of 156 million yuan, a 36.35% year-on-year increase. Net profit was 8.438 million yuan, compared to a loss of 9.68 million yuan in the same period in 2024.

From a business and financial standpoint, Canrobot may seem like an ordinary industrial robot company, but its growth story extends beyond that.

/ 02 /

Under Competitive Pressure, Ventures into Embodied Intelligent Robots

Although Canrobot is the domestic leader in welding robots, its market share in the entire Chinese welding robot market is less than 1.63%. Meanwhile, this leader has not established a significant gap with other domestic competitors.

The prospectus reveals that Canrobot's revenue from welding robots was 137 million yuan in 2024, ranking first among domestic companies. However, the revenue from corresponding products of the 2nd to 5th ranked companies in the industry was approximately 128 million yuan, 120 million yuan, 108 million yuan, and 83 million yuan, respectively.

Under intense competition, Canrobot's traditional businesses and products face significant development pressure. However, its embodied intelligent robot products, launched since 2022, are worth paying close attention to.

When we mention embodied intelligence, we often directly associate it with humanoid robots. But in reality, humanoid robots are just one type of embodied intelligent robot. Any robot with a physical carrier, a certain level of intelligence, and capable of performing complex and flexible operations can be called an embodied intelligent robot.

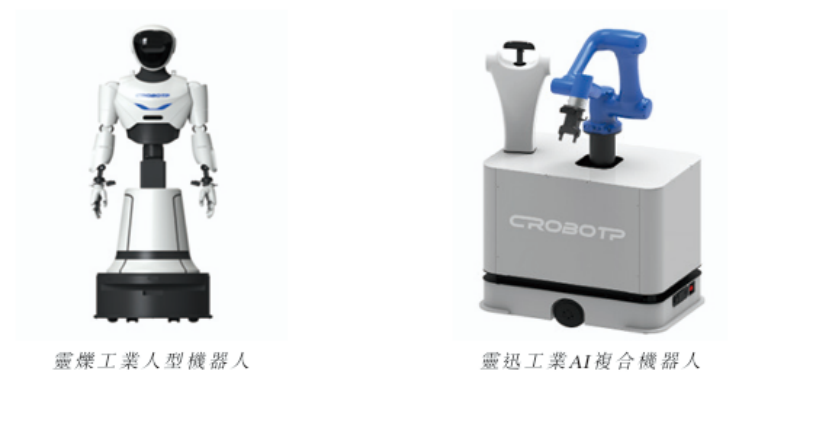

Canrobot's embodied intelligent robots include the Lingshuo industrial humanoid robot, Lingxun industrial AI composite robot, cold welding series, and industrial embodied intelligent robots.

The Lingshuo industrial humanoid robot adopts a human-like design but without bipedal locomotion. It consists of a wheeled chassis and dual arms, with 21 degrees of freedom (excluding the dexterous hands) in the body. Each arm is equipped with a dexterous hand featuring 11 motion joints and 7 active degrees of freedom.

Meanwhile, the robot is also equipped with a "brain" boasting a computing power of 275 TOPS and multiple binocular vision cameras. According to the introduction, the Lingshuo industrial humanoid robot can independently or collaboratively perform precision tasks such as handling, sorting, assembly, grinding, and quality inspection.

The Lingxun industrial AI composite robot adopts a composite design of AGV (Automated Guided Vehicle) + collaborative robotic arm + end effector + wrist vision + global vision. It is equipped with a VLA (Vision-Language-Action) large model, possessing intelligent decision-making and execution capabilities, enabling multi-trade collaboration.

Due to its special structural design, the Lingxun industrial AI composite robot can reduce production costs by two-thirds compared to traditional humanoid robots. It can perform precision welding, incoming material sorting, and tooling fixture loading and unloading. The equipped VLA model allows it to learn and master key links in the welding process through training.

Compared to traditional industrial robots and collaborative robots, embodied intelligent robots exhibit greater potential. In terms of gross margin, Canrobot's main sales product, the six-axis welding robot, has had a gross margin of 30%-35% in recent years. The gross margins of six-axis multifunctional robots, four-axis industrial robots, and collaborative robots are all below 30%, while the embodied intelligent robots have a gross margin of around 50%.

However, in terms of revenue, the business scale of Canrobot's embodied intelligent robot products is still relatively small.

From 2022 to 2024, their revenue was 6.113 million yuan, 8.255 million yuan, and 9.881 million yuan, respectively. In the first half of this year, the revenue from this product was 6.73 million yuan, a 40.41% year-on-year increase. However, this high growth may be related to price reductions. In the first half of this year, the gross margin of Canrobot's embodied intelligent robots was 42.7%, a nearly 10 percentage point year-on-year decrease.

Simply looking at the revenue level, Canrobot's embodied intelligent robot business still needs to expand. However, its profit potential has far surpassed that of Canrobot's other businesses.

Currently, Canrobot continues to invest in R&D, focusing on cutting-edge fields such as embodied intelligence. In recent years, Canrobot's R&D expense ratio has been above 15%, a relatively high level. In the first half of this year, its R&D investment remained roughly the same as the same period last year. However, due to the significant revenue increase, the R&D expense ratio dropped to 11.6%.

One of the fund allocations in this IPO is to purchase equipment and software such as AI training servers and embodied intelligent teleoperation systems.

Strictly speaking, the competitive issues faced by Canrobot are common in the machinery manufacturing industry. However, its launch of embodied intelligent robot products points out a potential breakthrough direction for companies represented by Canrobot: To overcome development challenges, continuous innovation is the only way forward.

By Dong Wuying