"AI Favorite" Swiftly Turns into a "Spendthrift Prodigal," Can Meta Still Bounce Back?

![]() 12/02 2025

12/02 2025

![]() 482

482

These days, Meta stands out as the sole trillion-dollar behemoth capable of experiencing daily fluctuations of 10% to 20%. From a rising star to a fallen one, Meta's descent took just a quarter. Following the release of its Q3 earnings report, investors appeared to have just digested their initial panic. Lately, with the resurgence of expectations for rate cuts, Meta has rebounded 11% from its lows.

Narratively, Meta was initially hailed as the "AI favorite," boasting the broadest range of application scenarios where AI investments would drive accelerating revenue growth. However, a Q3 guidance update, featuring a combination of increased investments and slowed revenue growth, directly transformed it into a spendthrift "AI prodigal son" asset.

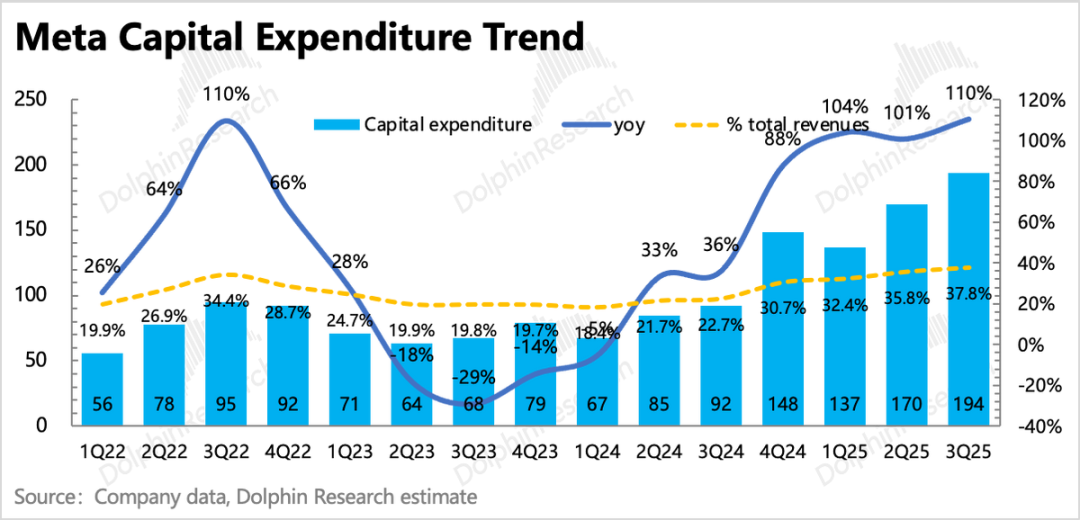

But can Meta truly bounce back with confidence? The capital expenditures, described as "notably larger than those projected for 2025," are no laughing matter. At a recent small gathering, the company reiterated that future depreciation expenses would surge significantly.

Thus, as we look ahead to 2026, how should we view the opportunities or risks facing Meta—a paradoxical entity with both a formidable social moat and reckless spending habits? Dolphin Research will commence our discussion by examining Meta's recent debt financings to offer our latest assessment of the company.

Here's a detailed analysis.

I. Cash Flow Impact: Significant but Not the Primary Factor in Valuation Suppression

Following the Q3 earnings report, Meta's two consecutive financing moves drew significant market attention: a $30 billion direct bond issuance and a long-anticipated $27.3 billion "off-balance-sheet financing." Clearly, Meta is grappling with short-term cash flow issues.

Dolphin Research roughly estimates that if the projected capital expenditures exceeding $120 billion in 2026 are to be fully supported by that year's operating cash flow, a multi-trillion-dollar market cap Meta would witness its operating cash flow nearly depleted in a single year.

Of course, industry giants like Meta won't wait for their cash flow to be exhausted; they have strategies to address such issues. Besides reducing shareholder returns—a move equivalent to implicit equity financing—both on- and off-balance-sheet bond financings are almost standard operating procedures.

1. Shareholder Returns: Not Worth the Anticipation

In our previous article, "Tencent: Starting from Stingy Repurchases, Is Super AI an Obvious Strategy?", we outlined the differences in cash flow management between Meta and Tencent. Meta adopts a "Cash Neutral" approach, where cash inflows stem from core business profits, while outflows are primarily allocated to business investments (including software, hardware, and fixed assets), shareholder returns (repurchases + dividends), external investments, and other expenses (such as tax withholdings).

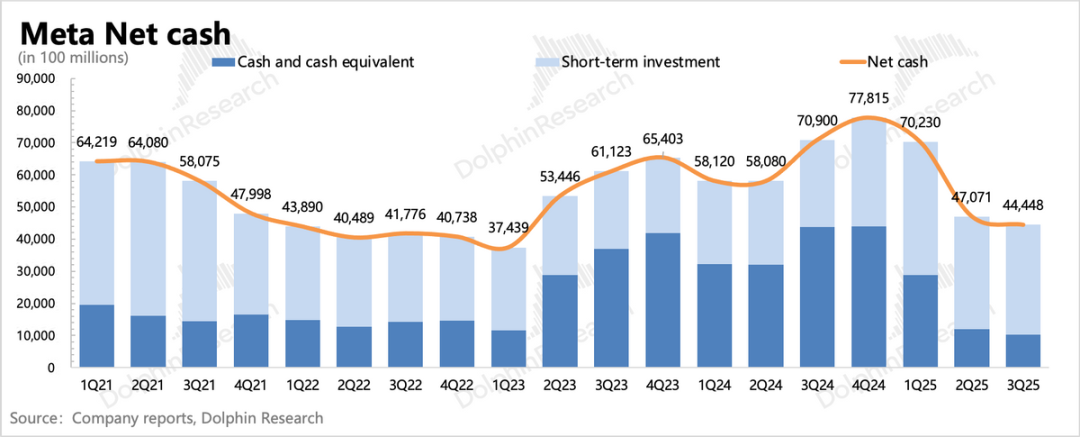

However, since the latter half of last year, the continuous rise in capital expenditures (Capex) has led to a sharp decline in Meta's cash reserves. By the end of Q3, cash plus short-term investments (mainly marketable securities) stood at $44 billion, down nearly 40% year-over-year.

In other words, this year's $70 billion in capital expenditures not only consumed newly generated operating cash flow but also tapped into over $30 billion in existing cash reserves (including Q4, the total will be even higher).

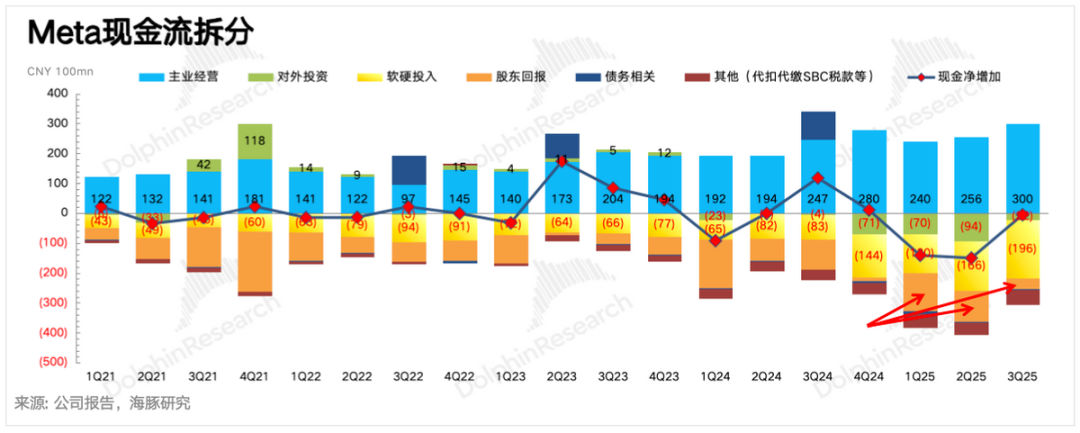

Examining the cash flow breakdown below, the negative net cash flow in Q1 and Q2 reflects the utilization of existing cash reserves. As "soft and hard investments" (including Capex) increase quarterly, the primary areas being compressed are shareholder returns and external investments. By Q3, these two areas had already dwindled significantly, leaving little room for further reduction.

Thus, if Capex increases by another $50 billion next year, on top of this year's $70 billion, how will the current cash reserves exceeding $40 billion suffice?

2. Off-Balance-Sheet Financing: Fully Backed by Meta

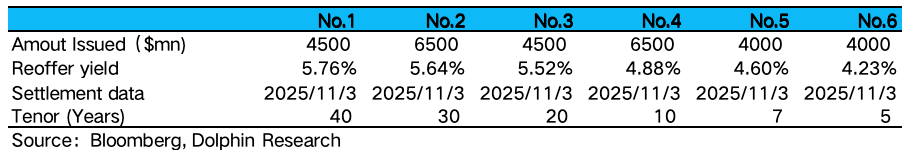

Following the Q3 earnings release, Meta immediately issued $30 billion in corporate bonds (in six tranches with interest rates ranging from 4.2% to 5.8%), three times the size of its Q3 2023 unsecured note issuance.

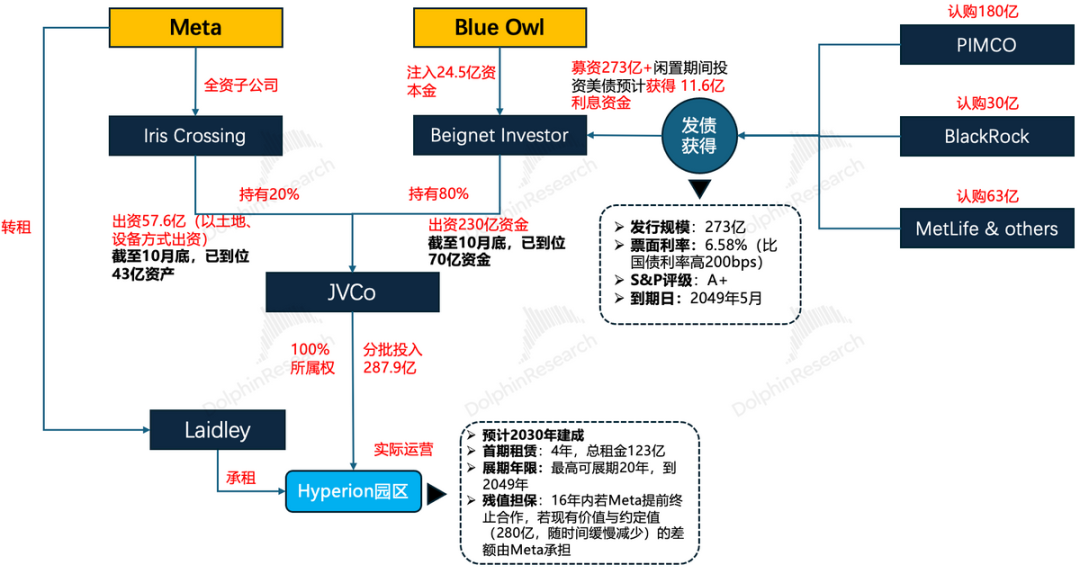

Besides direct bond issuances, before the Q3 earnings release, Meta conducted a unique financing maneuver: through a joint venture with financial institution Blue Owl, it established a project company to transfer the financing for data center infrastructure construction off-balance-sheet.

Moreover, in the joint venture's structure, Meta holds only a 20% stake, meaning it does not consolidate the joint venture's financials and instead records this stake as a "long-term equity investment."

However, essentially, Meta, as the "lessee," signs a lease agreement with a "sublessor" (Laidley first leases the data center campus and then subleases it to Meta).

While the lease ostensibly covers mainly server racks, it also encompasses subsequent chip deployments, campus property management, and long-term power operations—all handled by Meta. Blue Owl merely acts as an intermediary facilitating funding.

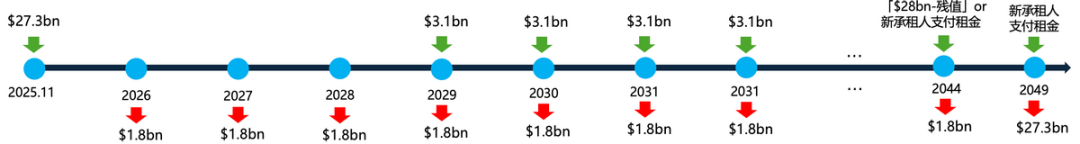

See the diagram below for details:

(1) Meta's Perspective: High Financing Costs = Off-Balance-Sheet Liabilities + Reduced Short-Term Cash Flow Pressure

On the surface, the data center's ownership does not belong to Meta, and the $27.3 billion note issuer is not Meta.

However, as the tenant, Meta provided residual value guarantees in this transaction—if Meta terminates the lease early within the first 16 years of operation, it must cover the difference between the data center's remaining value and the agreed-upon value (initially $28 billion).

Thus, this operation, while seemingly circuitous, is equivalent to:

Within the first 16 years, Meta has effectively issued a $28 billion corporate bond to Blue Owl for data center construction, paying interest annually as rent. For example, under the first four years' lease contract, the annual rent is about $3 billion, implying a coupon rate of approximately 10.7% (3/28).

While this coupon rate appears high, far exceeding Meta's corporate bond rates from half a month prior, Meta gains two advantages by sacrificing future cash flow:

1) Mismatched Rights and Obligations Timeline: Meta can immediately commence construction and delay the first $3.1 billion interest payment until 2029, four years later. Blue Owl covers the first four years' interest.

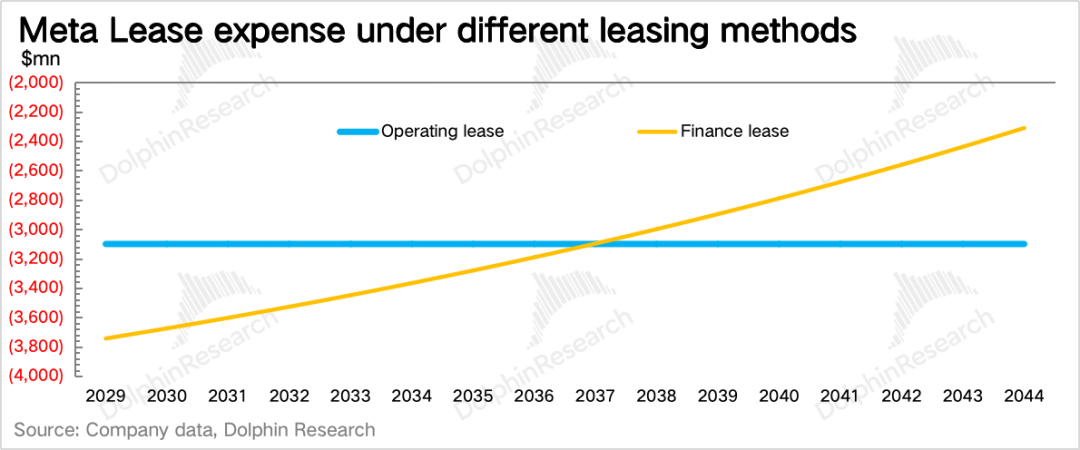

2) Reduced Short-Term Accounting Profit Pressure: Despite Meta being the primary operator, the unequal equity split and the absence of a provision for Meta to reclaim ownership ensure this remains an operating lease for accounting purposes, not a finance lease.

While finance leases also alleviate short-term cash flow pressure, under U.S. GAAP, finance leases recognize higher upfront interest expenses (including depreciation + interest) than actual rent payments.

As shown in our estimate below, assuming rent remains constant and discounted at 4.5%, from 2029 to 2036, operating lease recognition results in lower current operating expenses (Opex) than finance leases, potentially reducing Meta's short-term profit pressure.

(2) Blue Owl and Creditors' Perspective: A Risk-Free Profit

While Meta aims to polish its financials, Blue Owl, a pure financial institution, seeks effortless profits. In this partnership, Blue Owl avoids operational management responsibilities, bearing almost no risk or additional costs beyond covering $1.8 billion in annual interest for the first four years.

After 2029, Blue Owl collects $3.1 billion in rent from Meta while paying $1.8 billion in interest, netting a $1.3 billion "interest spread." If Meta terminates early, the $27.3 billion bond principal is guaranteed by Meta.

Assuming a 4.5% risk-free discount rate, for Blue Owl, if Meta ends the 16-year residual guarantee period in 2044 (which is irrational for Meta to do, but used here to calculate Blue Owl's investment return), Meta's $28 billion principal guarantee directly redeems the $27.3 billion bond. Over 19 years, the net interest spread, discounted, totals $7.1 billion, yielding a 1.4% annual net return (7.1/27.3/19)—essentially risk-free, as Blue Owl invests little of its own capital.

For PIMCO and BlackRock, this locks in a high annual yield of 6.58% for over 20 years, 1-2 percentage points higher than Meta's bonds, making it an attractive investment during a rate-cutting cycle.

II. Declining Profit Efficiency: The Real Culprit Behind Valuation Suppression

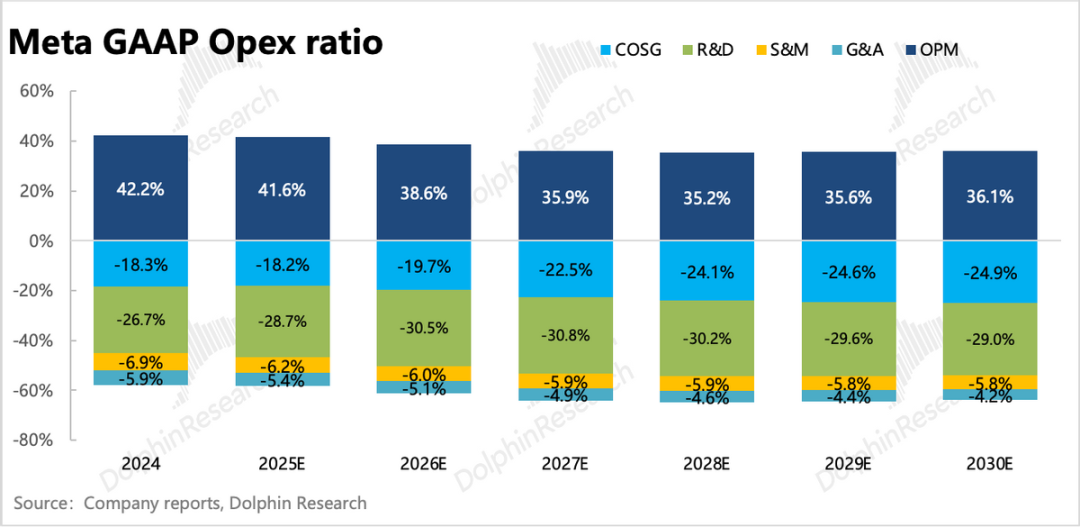

Besides cash flow, the difference between operating and finance leases reveals Meta's concern about the impact of AI investments on profits. Dolphin Research believes this is precisely the key factor suppressing Meta's 2026 valuation!

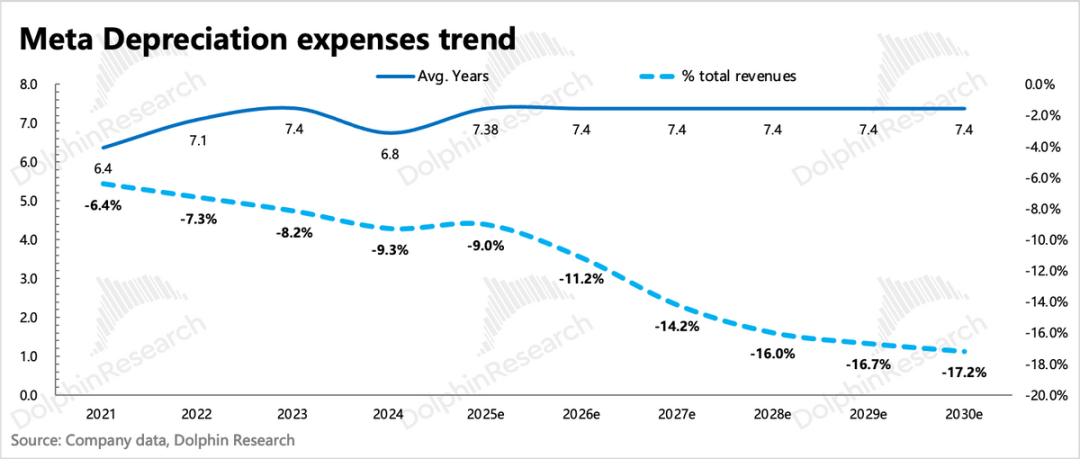

1. Accumulated Depreciation Cost Pressure

By Q3, Meta's capital expenditures accounted for 38% of current revenue, rising rapidly. Roughly, if this investment ratio (likely higher, with market expectations for Capex to reach 50% of revenue) is maintained next year, primarily for servers, and assuming a 5.5-year average server depreciation cycle, this implies a 7 percentage point annual profit margin pressure from this investment alone (38%/5.5, assuming revenue cannot effectively dilute depreciation).

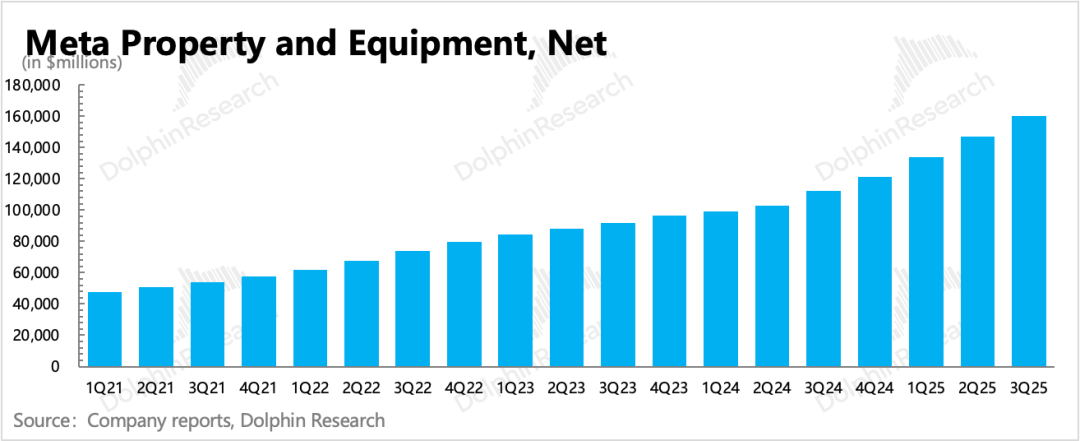

Even accounting for equipment replacements, compared to the previous investment scale of less than 20% of revenue, this still imposes at least an additional 3 percentage point profit margin impact. In reality, the value of replaced old servers pales in comparison to continuous new investments, with Meta's "Property and Equipment" book value steadily increasing over four years.

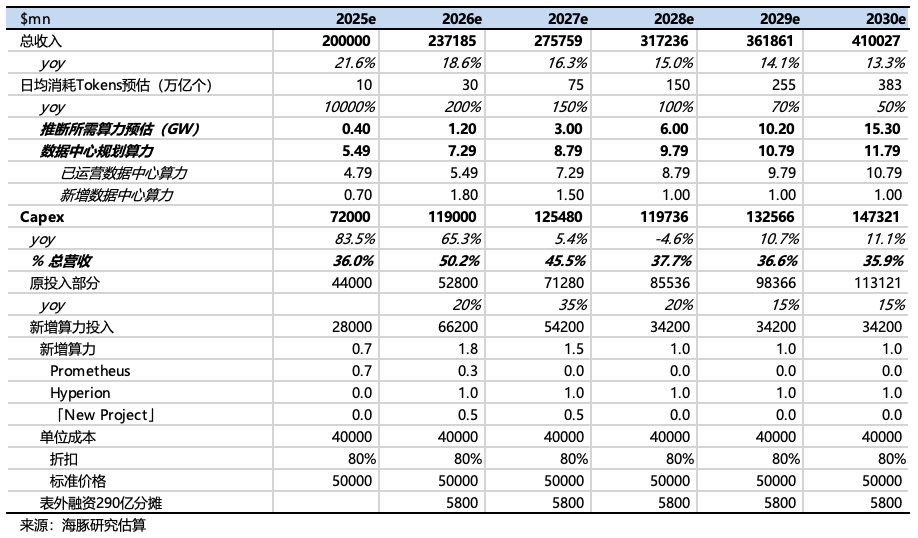

Moreover, each year's new investments bring accumulated depreciation costs. Combining market expectations, Dolphin Research offers the following simplified projection:

1) Assuming 18% revenue growth in 2026 and a 15% compound annual growth rate (CAGR) from 2025 to 2030 under AI empowerment;

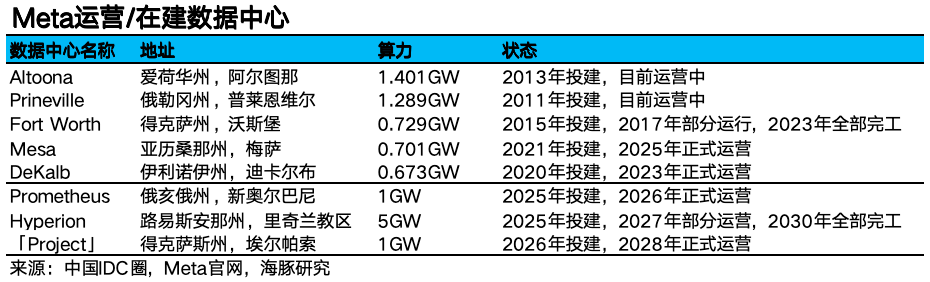

2) Based on current data center construction plans, Meta's investment cost pressure will peak in 2026—projecting 4GW of additional computing power by 2028, half from 2026. At NVIDIA's estimated $50 billion/GW deployment cost, this explicitly requires an extra $100 billion investment in 2026 alone.

However, given the current computing power competition, if Meta partially adopts TPUs, as rumors suggest—leasing Google's TPU cloud services in 2026 and directly deploying TPU chips in its data centers in 2027—this could cause significant short-term capital expenditure fluctuations.

Alternatively, if Meta negotiates an 80% discount with NVIDIA, reducing costs to $160 billion. Considering less information on TPU partnerships and technical compatibility issues, Dolphin Research will first use the discounted NVIDIA GPU cost for calculations.

After excluding the $29 billion from off-balance-sheet financing (Blue Owl), $130 billion is still needed, requiring an additional $50-60 billion in annual investments.

For other components, including leased computing power, land, and construction, assuming stable growth of 15-40% (based on data center deployment pace, slightly higher than the long-term revenue CAGR of 15%), the expected capital expenditure changes are as follows (note: this excludes any impromptu data center deployments by Meta, though computing power shortages may arise):

It can be seen from Dolphin Research's assumptions that regardless of how the planning after 2028 may change, the dual pressure on profits from AI investment will be very evident in at least 2026 and 2027. It is estimated that the proportion of Capex to total operating revenue will rise to 50% in 2026 before gradually declining.

The impact of the aforementioned depreciation expenses on the decline in profit margins will peak in 2027, with a drop of 3 percentage points in one year, and will gradually ease after 2028. The possibilities of exceeding expectations include a significant reduction in computing power costs or more concessions from Meta in operating expenses, such as staff optimization. This could lead to the profit margin decline bottoming out earlier than Dolphin Research's expectations, but obviously, the former approach would be more effective.

Conversely, if cost-cutting measures fail, the only hope lies in

Simultaneously, AI has dramatically broadened the scope of user interaction, leading to an exponential surge in the platform's operational costs. In the AI era, the internet's traditional diminishing marginal cost effect is almost negligible. Relying solely on the advertising model, it will be a formidable challenge for Meta to regain its former monetization efficiency.

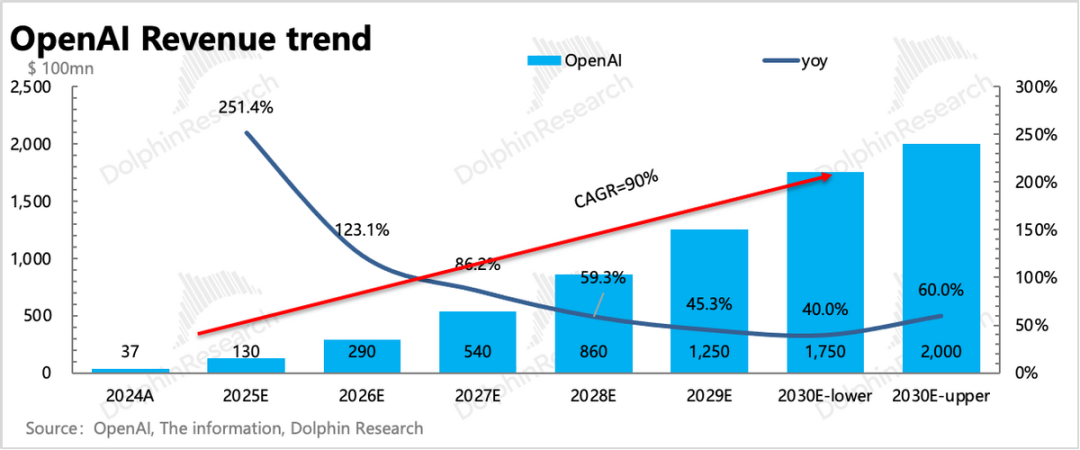

At least according to our model, the new computing power added to Meta's data centers by 2030 will only amount to 1GW. However, depreciation costs are projected to continue growing at a rate of 17%. To elevate the Operating Profit Margin (OPM) from 36% in 2027 back to over 40% by 2025, revenue in 2030 would need to soar to $436 billion. This figure is more than double the revenue level of less than $200 billion in 2025! Interestingly, this additional revenue of over $200 billion aligns precisely with OpenAI's revenue growth target for 2030.

III. Is Meta Squandering Its Resources? No Fatal Blow If Competition Remains Robust

Following a short-term collapse in profit margins, Meta swiftly descended from being a unanimous bullish favorite at the start of the year, an AI darling with the strongest social moat, to now ranking at the bottom of the 'Magnificent Seven,' reminiscent of its 2022 position. Meanwhile, Google, once dismissed with a modest 19x Price-to-Earnings (P/E) ratio, has supplanted the once-$900-billion-more-attractive Meta and NVIDIA (which had surged to become the world's largest company by market cap) to emerge as the current 'AI New King' with the most coherent logic.

In the ever-evolving AI landscape, where narrative logic can swing from one extreme to another, it precisely signals that more transformations are on the horizon. Let's observe the performances of the tech giants sequentially and refrain from jumping to premature conclusions.

For Meta, currently trading at a 21x P/E ratio—although below its historical valuation average—and with its stock price recently rebounding amid market expectations of interest rate cuts, as well as finding support near the 20x P/E level due to alleviated concerns about falling into a vicious AI investment bubble, thanks to its collaboration with Google TPU.

However, considering the profit collapse issue discussed earlier, Dolphin Research believes that it is premature to blindly sing Meta's praises, at least not in 2026. Looking back at history, Meta's absolute bottom was at a 7x P/E ratio in 2022. Although Dolphin Research's operating profit expectations for 2026 also indicate single-digit growth, as we mentioned in our Q3 earnings review, the current situation is by no means a 'repeat of the 2022 nightmare.' The crux lies in the fact that Meta's core competitive logic remains unscathed.

Although OpenAI appears to be gaining momentum, Google's search dominance underscores the importance and underlying value of ecosystems and user entry points. To establish a highly sticky consumer entry point, OpenAI still needs to lower barriers and foster competition.

However, the market has cooled down for some time, and the allure of unrealizable AI dreams has waned. Even if capital is willing to dream, industry leaders will not allow risks to be transferred to them. Among these, electricity and TSMC's production capacity are pivotal to AI's lifeline.

Without a stable cash flow, how can OpenAI secure the favor of industry leaders for production allocation? This makes finding a 'big leg' to provide unlimited support for the trillion-dollar Stargate project a more critical task for OpenAI at present.

Therefore, Meta still has time, but there are also risks associated with trial and error. A detailed value analysis has been published in the same-named article in the 'Dynamic - Investment Research' section of the Longbridge App.

Finally, Dolphin Research emphasizes once again that Meta's path to recovery requires more patience. In 2026, Meta's opportunity lies only in a rebound from a bottom value, rather than a breakthrough during an emotional peak.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. If you wish to reprint it, please obtain authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, aimed at users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report assumes their own risks. Dolphin Research shall not be held responsible for any direct or indirect liabilities or losses that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or views mentioned in this report shall not, under any jurisdiction, be regarded as or considered an offer to sell securities or an invitation to buy or sell securities, nor shall they constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for or proposed for distribution to jurisdictions where the distribution, publication, provision, or use of such information, tools, and data contradicts applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliated companies are required to comply with any registration or licensing requirements in such jurisdictions.

This report merely reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) produce, copy, duplicate, reproduce, forward, or distribute in any form whatsoever, any copies or replicas, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all related rights.