Alibaba Fully Embraces the AI Era | TrendWave

![]() 12/02 2025

12/02 2025

![]() 505

505

Editor | Yang Xuran

As major internet companies unveil their third-quarter financial results, the already volatile market becomes even more jittery.

In Q3 alone, Alibaba reported revenue of 247.795 billion yuan and a net profit of 21.02 billion yuan. JD.com posted revenue of 299.059 billion yuan and a net profit of 5.276 billion yuan. Meituan, meanwhile, recorded revenue of 95.488 billion yuan but a net loss of 18.632 billion yuan. Clearly, in 2025, amid fierce food delivery battles, e-commerce platforms have been impacted to varying degrees.

Investors are hotly debating whether food delivery subsidies will persist, whether Meituan has a competitive moat, whether Alibaba's strategy of using food delivery to drive e-commerce traffic is valid, what JD.com—which disrupted the market but saw its performance deeply affected—will do next, and whether now is the right time to buy the dip...

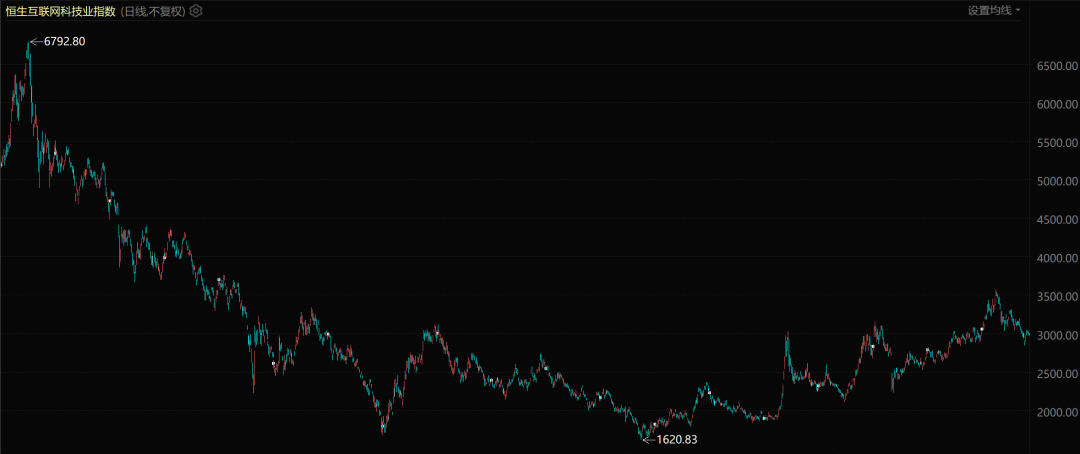

Hang Seng Internet Technology Industry Index (2021-Present)

For investors, the bustling food delivery sector is not the main focus; even e-commerce may not be. The capital market now seeks stories not of narrowing losses or rebounding performance. What giants fear most is not losing some market share to rivals but missing out on the next era.

Thus, we see that e-commerce platforms like Alibaba are downplaying their e-commerce identities and striving to craft a comprehensive AI narrative.

If successful, in an ideal scenario, whether for instant food delivery or e-commerce, these would merely be AI application scenarios. Their benchmark would no longer be domestic peers but international tech giants like Google and Meta.

This article is a deep-dive piece from the TrendWave content team. Follow us on multiple platforms.

Core Market Foundations

Burning money on subsidies, seizing market share, achieving monopoly, and driving stock prices upward used to be the signature moves of internet giants. However, these tactics have faltered in this year's food delivery wars.

After burning 80 billion yuan over two quarters, Alibaba, Meituan, and JD.com find themselves in a no-win situation, amplifying concerns about the next move for Hong Kong stocks.

The growth story of the "post-internet era" is indeed challenging to tell. Giants are desperately encroaching on each other's core markets, yet investors remain unimpressed.

While food delivery is considered a small business with a ceiling of 30-40 billion yuan, the fierce competition among Alibaba, JD.com, and Meituan suggests deeper strategic intentions.

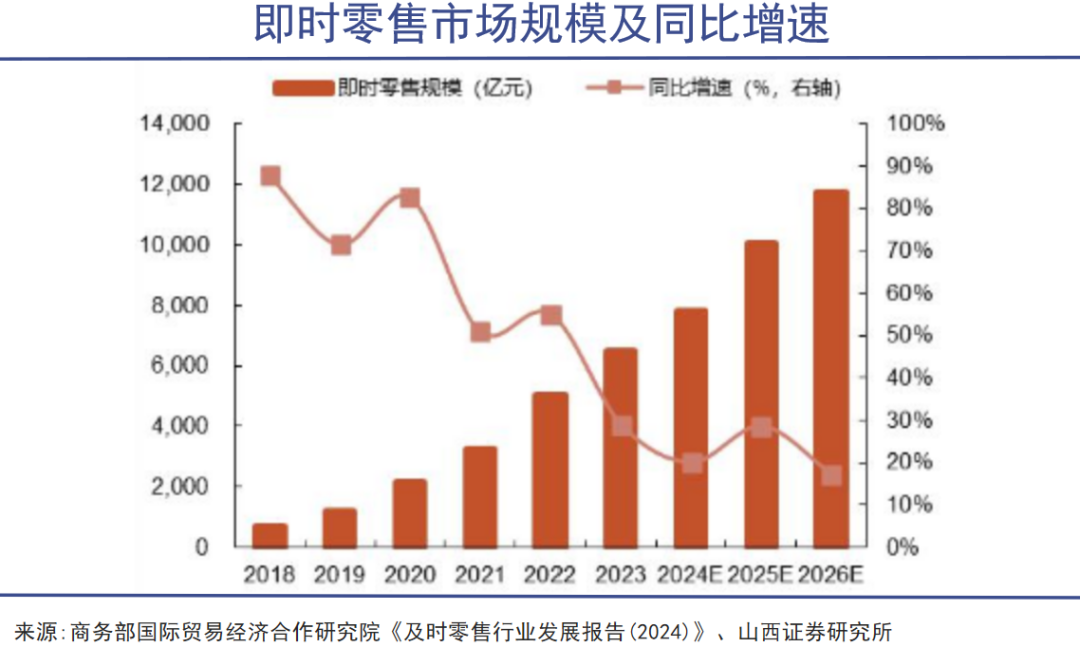

Instant retail is seen as the next growth engine for e-commerce. Last year, China's instant retail market reached 781 billion yuan, growing 20.15% year-on-year, outpacing the national online retail growth rate by 12.95% and the total retail sales of consumer goods by 16.65%. Clearly, no company wants to miss this hot sector.

Moreover, instant retail is growing even faster among the young consumer groups that merchants most want to reach. Meituan Flash Purchase data shows that as of March 2025, over two-thirds of its instant retail users are post-90s. Taobao Flash Purchase data indicates that as of July 2025, over 60% of its instant retail users are aged 25-40.

To some extent, Meituan initially had the upper hand in the instant retail race. Preparing since 2018, by the first quarter of this year, it had accumulated over 500 million transaction users, with non-dining instant retail daily orders exceeding 18 million. It also formed partnerships with brands like Huawei, Xiaomi, and Moutai.

During this year's 618 promotion, Meituan Flash Purchase saw a 200% increase in overall transaction volume for high-priced items like smartphones, liquor, and home appliances, demonstrating strong growth momentum in non-dining categories and triggering JD.com's sensitive nerves. After all, 3C and home appliances are JD.com's most critical e-commerce segments.

Thus, JD.com's aggressive entry and Alibaba's follow-up led Meituan to divert resources from technology R&D and supply chain construction for instant retail, depleting its arsenal.

With operating cash flow down by 10 billion yuan year-on-year, Meituan's conditions for developing instant retail have deteriorated. When it comes to cash flow and resilience, few Chinese companies can outmatch Alibaba.

However, Alibaba's unique situation is that even if it wins the food delivery and instant retail battles, the incremental gains may merely cannibalize its existing e-commerce business.

Cross-border e-commerce is another battlefield where internet giants have high hopes.

Alibaba's International Digital Commerce Group (AIDC) reported revenue of 132.3 billion yuan in FY2025, up 29% year-on-year. Pinduoduo's Temu achieved explosive growth this year, with Q3 transaction commission revenue exceeding 50 billion yuan and GMV reaching 168 billion yuan, accounting for nearly half of Pinduoduo's total revenue.

However, the scale growth in cross-border e-commerce has not yet translated into profitability, and the burning of cash is no less intense than in the food delivery wars. Moreover, the specter of deglobalization looms, keeping investors cautious.

So, where is the real growth driver for e-commerce platforms—or internet companies—in the future? Alibaba's current stance is clear: not local services or cross-border e-commerce, but artificial intelligence.

Large-Scale Models

This is not the first time China's capital market has heard an "all-in AI" story. However, the current consensus is that to excel in AI, one cannot rely solely on AI.

Before officially joining the large-scale model fray, Alibaba had already accumulated several strong assets. For instance, Alibaba Cloud operates 86 availability zones across 28 geographic regions, serving over 200 countries and regions, with a computing power scale that is a behemoth in the industry. Alibaba DAMO Academy has also been at the forefront of AI research compared to many peers.

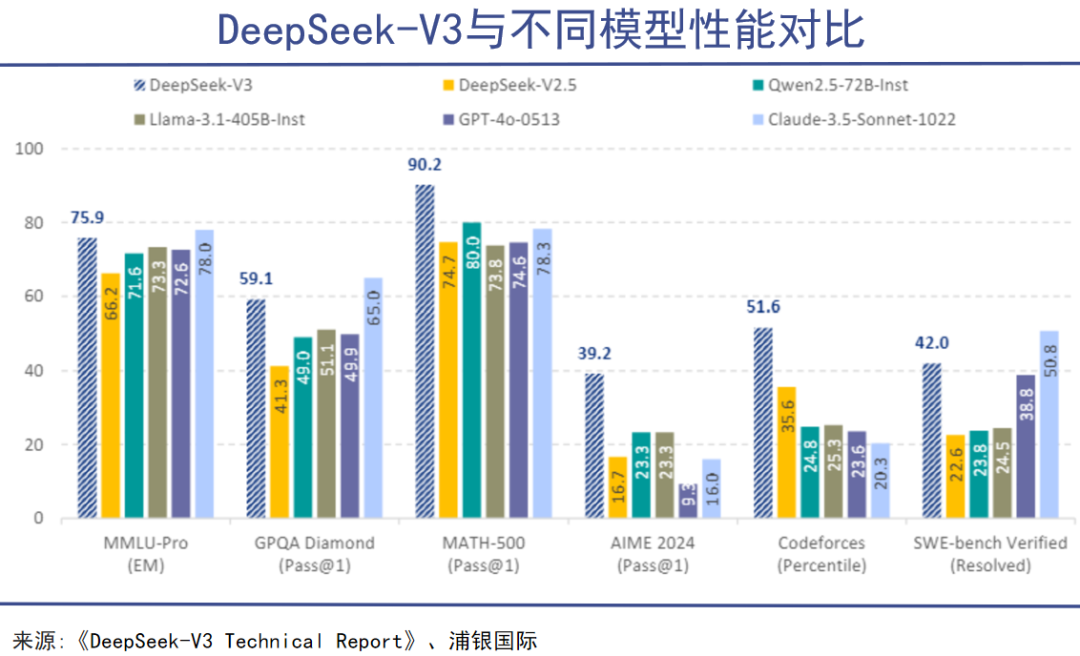

However, with ChatGPT, DeepSeek, and Doubao having already established strong C-end user recognition, Alibaba faces a reality: technological advantages do not directly translate into market perception.

From the "Tongyi" large-scale model series to "Tongyi Qianwen" and "Tongyi Wanxiang," Alibaba has launched multiple brands in a short time, making it difficult for C-end users to distinguish them clearly or understand their unique features. Alibaba AI's image in consumers' minds remains somewhat vague.

Meanwhile, DeepSeek maintains a stable C-end foundation, while ByteDance's Doubao leverages Douyin's traffic advantage to rapidly climb to 172 million monthly active users.

To break out of this predicament, the Qianwen APP began public beta testing last month as a standalone application, striving to catch up in a fiercely competitive and homogenized market. In Alibaba's vision, AI should assist C-end users in work and business, not just for chatting.

Indeed, in e-commerce—Alibaba's core domain—AI has become a vital tool for users to enhance business efficiency. For example, during the recent Tmall Double 11 promotion, over 5 million merchants used AI tools like "Business Butler" provided by Alibaba, achieving notable efficiency gains in store operations, customer service, and marketing.

AI is also being used to help Alibaba Cloud expand its enterprise client base. For instance, China Merchants Bank has established extensive cooperation with Alibaba Cloud in the foundational large-scale model domain, launching approximately 110 applications based on the Tongyi Qianwen model internally, covering intelligent customer service, meeting minute generation, risk management, and knowledge base retrieval.

However, these breakthroughs in single-point applications are not yet sufficient to support Alibaba's ambitions in the AI era. What Alibaba desires more is for Qianwen to become the C-end gateway and neural hub that connects its vast ecosystem.

The ideal scenario is that C-end users can simply say, "Help me plan a weekend trip to Hangzhou," in the APP, and Qianwen automatically coordinates and invokes services like Gaode Maps for route planning, Fliggy for hotel and ticket bookings, Taobao for travel supplies, and Alipay for payments, creating a seamless closed-loop experience.

Compared to coverage in specific domains, this broad and comprehensive AI positioning is distinctly Alibaba.

New Entry Points

Another example that reflects Alibaba's continued emphasis on a broad and comprehensive AI strategy is AI glasses.

It is difficult to imagine internet giants directly venturing into hardware device manufacturing—and succeeding—in the internet era. It is equally hard to fathom hardware manufacturers like JBD, Luxshare Precision, Qualcomm, and Bolon Optics willingly partnering with internet giants.

However, to compete for AI glasses—the next-generation hardware entry point for human-machine interaction—these industry giants have come together, proclaiming, "Every pair of glasses will be an AI glasses in the future."

Currently, the global consumer AI glasses market is showing steady growth. According to IDC data, global smart glasses shipments reached 4.065 million units in the first half of 2025, up 64.2% year-on-year.

IDC also projects that global smart glasses shipments will exceed 40 million units by 2029, with China expected to have the highest growth rate globally.

Among AI glasses manufacturers, Meta currently stands out the most. Its collaboration with Ray-Ban on the Ray-Ban Meta smart glasses became the world's first hit product, validating the feasibility of display-less AI glasses (pure audio + camera). Last year's sales reached 2.24 million units, accounting for 95% of total AI glasses sales.

Google is attempting to bring its Android ecosystem and Gemini large-scale model into the AR domain through its Project Aura collaboration with XREAL. In fact, the latest version of Gemini has received no less favorable review content than Alibaba's Qianwen in terms of reviews, tutorials, and marketing, earning high praise like "Gemini makes creativity ordinary."

Due to the isolation of foreign manufacturers' social apps from the domestic market, their ability to provide localized services is limited. Thus, the Chinese AI glasses market cake will likely be contested more by domestic tech companies.

In this landscape, domestic manufacturers have been intensively releasing new AI glasses products. In October alone, Baidu launched the Xiaodu AI Glasses Pro, Rokid partnered with BOLON Glasses to release the BOLON AI Glasses, and Alibaba unveiled six Quark AI glasses models across two series, S1 and G1.

However, no domestic manufacturer has yet created a blockbuster product. Consumers are most concerned about the AI functionality, first-person video recording capabilities, and interactive experience of AI glasses. Without the support of a content or social ecosystem, even advanced large-scale models cannot fully satisfy the true needs of AI glasses consumers.

Content and social have always been Alibaba's weaknesses. Even if it keeps Meta at bay, Alibaba still struggles to compete against strong content rivals like Baidu, ByteDance, and Tencent. Therefore, for Alibaba, attempting to challenge and build its own traffic entry point through AI glasses is worth a try.

Data shows that Quark AI Search users currently average 65 monthly uses, nearly six times higher than Baidu's 10.7. Moreover, Quark is more popular among young users, with over half of its users under 25. Many are beginning to sense that a battle for search entry dominance between Quark and Baidu is inevitable.

In the era of general artificial intelligence, once Alibaba secures the major traffic entry point that eluded it during the mobile internet era, its existing e-commerce, local services, entertainment, and health businesses will all gain clear paths to benefit.

For example, traditional e-commerce requires users to actively open the app and search, but AI glasses can enable "what you see is what you get." When people spot a piece of clothing they like on the street, the glasses can directly identify it and recommend similar items on Taobao. When discussing dinner plans, they can recommend restaurants based on individual tastes and directly jump to reservations.

This is definitely a more attractive story for the capital market than using food delivery as a new traffic entry point for the e-commerce business. It is also the new round of business story that Alibaba has been continuously trying to convey to the market recently.