Surge of 20 Billion: Can ByteDance Help the Market Understand ZTE's AI Story?

![]() 12/04 2025

12/04 2025

![]() 409

409

Baker Street Detective

ZTE's Fate Was Sealed Long Ago

On December 1, a Weibo post from Nubia caused ZTE, a company with a market capitalization of 200 billion yuan, to hit its daily limit, surging by 20 billion yuan in value.

ByteDance's Doubao team released a technical preview version of the Doubao Mobile Assistant, which deeply integrates the Doubao large model into the operating system. Users can activate Doubao via voice commands, side buttons, or Doubao Ola Friend earphones. The engineering prototype of the nubia M153, a collaborative product between Doubao and ZTE, is priced at 3,499 yuan. By partnering with mobile phone manufacturers, Doubao aims to achieve product implementation and sales through smartphones as the core platform, opening up the broadest application scenarios and commercialization paths for large models.

On December 1, ByteDance publicly stated that Doubao is currently negotiating assistant collaborations with multiple smartphone manufacturers and has no plans to develop its own smartphones. To date, ZTE is the only officially disclosed smartphone partner.

ZTE, once a representative of domestic smartphone brands that faced supply disruptions from the U.S. before Huawei, ranked 16th globally in smartphone shipments for the first three quarters of 2025, according to data from IDC, Omdia, and other institutions. Whether ZTE can leverage ByteDance's system-level on-device AI to stage a comeback has become a highly anticipated question in the market.

01 Why Did ByteDance Choose ZTE, the 16th-Ranked Player?

Opinions vary on social media platforms regarding the reasons behind the collaboration between ByteDance and ZTE. Some jokingly suggest that ZTE's expansion into overseas markets through the NBA around 2015 and ByteDance's current increased cooperation with the NBA, coupled with the 16th overall pick of Chinese player Yang Hanshen in this year's draft and ZTE's 16th global sales ranking, create too many 'coincidences' for the two companies not to collaborate.

However, a closer look at the businesses of ZTE and ByteDance reveals a high degree of complementarity in their core operations.

Taking ByteDance's Doubao as an example, public data shows that the Doubao app successfully surpassed 160 million cumulative users in 2024, becoming the second-ranked AI application globally and the top-ranked AI application in China. It has also driven significant stock price increases for related A-share companies.

Analysts at Minsheng Securities believe that considering only the 'Doubao' text large model and referencing ChatGPT's 600 million monthly active users, its inference demands would require approximately 350,000 A100 GPUs, with training demands around 120,000 A100 GPUs.

Since 2022, ZTE has focused on 'computing power' as its second growth curve. The company has now established a full-stack computing power layout encompassing chips, servers, storage, switches, data centers (including power supplies and liquid cooling), and software platforms. It is one of only two domestic companies to achieve a full-industry-chain computing power layout.

ZTE's server business has grown rapidly. In the first half of 2025, ZTE's server and storage revenue increased by over 200% year-on-year. In August, it secured the top share in China Mobile's 2025-2026 AI inference server centralized procurement. Huatai Securities believes that starting in the second half of 2025, uncertainties will persist in overseas GPU supplies, while domestic computing power is gradually breaking through at various levels. As a full-stack computing power service provider, ZTE is expected to benefit significantly.

Indeed, current results confirm Huatai Securities' predictions. Computing power chips from the ByteDance-ZTE collaboration have entered the supply chains of leading internet companies. ByteDance has completed customized verification, Alibaba Cloud is in a deep collaboration phase, and Tencent Cloud is conducting compatibility tests. Starting in the first quarter of 2026, ByteDance will receive 30,000 ASIC chips in batches.

According to IDC's 'China Large Model Inference Computing Power Market Analysis Report 2025' released in August 2025, ZTE's full-stack open intelligent computing platform achieved remarkable results, scoring full marks in key indicators such as computing power architecture, network and storage enhancements, and security and compliance.

Relying on its long-term technological accumulation, ZTE has deeply deployed research and development as well as integration of intelligent computing hardware and software, covering the entire process from underlying hardware to upper-layer applications. Notably, it has developed 'in-machine high-speed interconnection chips' (Scale-up) and inter-machine interconnection switching chips (Scale-out).

From the perspective of practical application results, ZTE has proposed a high-speed interconnection open architecture for AI accelerators based on its self-developed AI high-capacity switching chip 'Lingyun.' This architecture enables large-scale high-speed interconnection of domestically produced GPU cards, constructs the Nebula Intelligent Computing Hypernode, and creates a software-hardware collaborative, network-enhanced, open-decoupled, and highly efficient and stable super-large-scale intelligent computing cluster capable of supporting the training of sovereign large models with trillions of parameters, significantly enhancing AI computing performance and efficiency.

With NVIDIA's high-end graphics cards fully exiting the Chinese market, domestic GPU companies have undoubtedly become the first choice for domestic computing power demanders. The proportion of domestic GPUs will continue to increase. However, related companies may be constrained by their cluster network construction capabilities, making it difficult to fully unleash the performance of computing chips.

ZTE currently possesses outstanding network interconnection capabilities. Coupled with its GPU and DPU products, it has the subsequent capability to assist related manufacturers in performance optimization. Therefore, it is not difficult to understand why ByteDance, a major computing power demander, chose to collaborate with ZTE Communications.

02 What Is the Use of ByteDance's On-Device AI?

ZTE's computing power capabilities cannot be fully demonstrated by merely supporting the Doubao app, nor can ZTE continuously expand its influence among consumers (C-end) through the Doubao app. Directly integrating Doubao's on-device AI technical capabilities into ZTE's systems may lead to a win-win situation for both parties.

The technical preview version of the Doubao Mobile Assistant released by ByteDance this time deeply integrates the Doubao large model into the operating system. Based on the capabilities of the Doubao large model and the authorization of smartphone manufacturers, the Doubao Mobile Assistant can provide users with more convenient interactions and richer experiences.

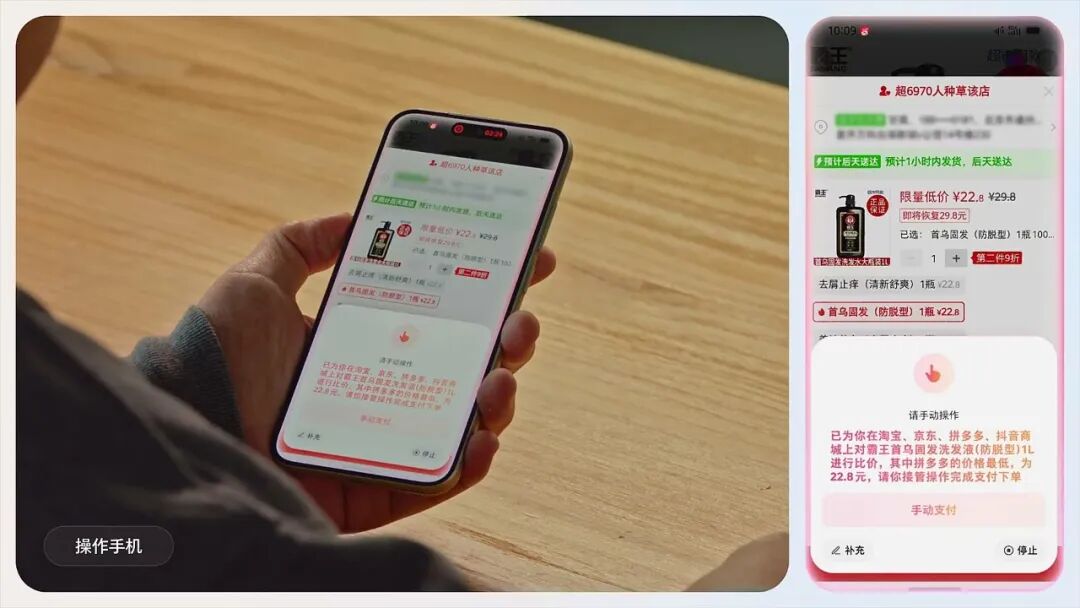

From the perspective of the Doubao app experience, the Doubao large model boasts comprehensive capabilities. Its performance in reasoning, visual understanding, image creation, video generation, and voice aspects is sufficient to handle daily usage scenarios. Its graphical user interface operation capabilities have even achieved the best results in the industry in multiple authoritative evaluations. With system-level operating permissions, by recognizing UI elements on the smartphone screen, Doubao can understand user needs and then simulate actions such as clicking, sliding, and inputting to operate applications on the smartphone like a human, completing various complex tasks. For example, after identifying a product image, it can compare prices across multiple platforms and directly place an order for the cheapest option.

After the Doubao large model is fully integrated into the operating system, it can transform into an Agent to perform complex operations across applications. Users can activate Doubao directly via voice commands, side buttons, or Doubao Ola Friend earphones, enabling more convenient interactions. In terms of multimodality, the Doubao Mobile Assistant connects to the system's native photo gallery, allowing users to directly issue photo editing instructions via voice within the gallery, such as removing people or clearing clutter.

Its AI smartphone operation capabilities can automatically navigate among multiple applications based on user instructions, helping users complete tasks like ticket searches and bookings, product orders, batch file downloads, and one-click multi-software logistics tracking. Based on memory, the Doubao Mobile Assistant has also launched a Pro mode for smartphone operations. In addition to invoking the GUI Agent (simulated clicking), this mode can directly invoke system tools, combining memory data with stronger reasoning capabilities to help users complete complex tasks.

During the demonstration, operators used the Doubao Mobile Assistant loaded on an engineering prototype to mark favorite restaurants on a map, find out which museum had an exhibition they liked on the second day of their trip, book a 10 AM ticket on a travel platform, and organize the relevant information into a memo, all in just 8 minutes and 4 seconds, demonstrating remarkable efficiency.

From an industry perspective, smartphones, as the core platform, open up the broadest application scenarios and commercialization paths for large models. Currently, developers and tech enthusiasts can experience the technical preview version of the Doubao Mobile Assistant on the engineering prototype of the nubia M153, a collaborative product between Doubao and ZTE. This version is currently available in limited quantities to developers and tech enthusiasts at a price of 3,499 yuan.

However, it is worth noting that on the path to implementing the mobile assistant, Doubao has explicitly stated that it has no plans to develop its own smartphones. Instead, it is negotiating with multiple smartphone manufacturers to integrate the Doubao Mobile Assistant into different brand models through 'ecosystem cooperation.' Therefore, ZTE needs to seize this window of opportunity, as the market will only remember the first and the rest, especially in the tech sector.

03 ZTE's Strategic Resolve or Industry-Leading R&D Capabilities

When it comes to being the first, ZTE Communications derives its confidence from its industry-leading R&D investment. In March 2025, the company focused on expanding and transforming from its original connectivity foundation to 'connectivity + computing power.' Its confidence in this transformation stems from its sustained and stable R&D capabilities.

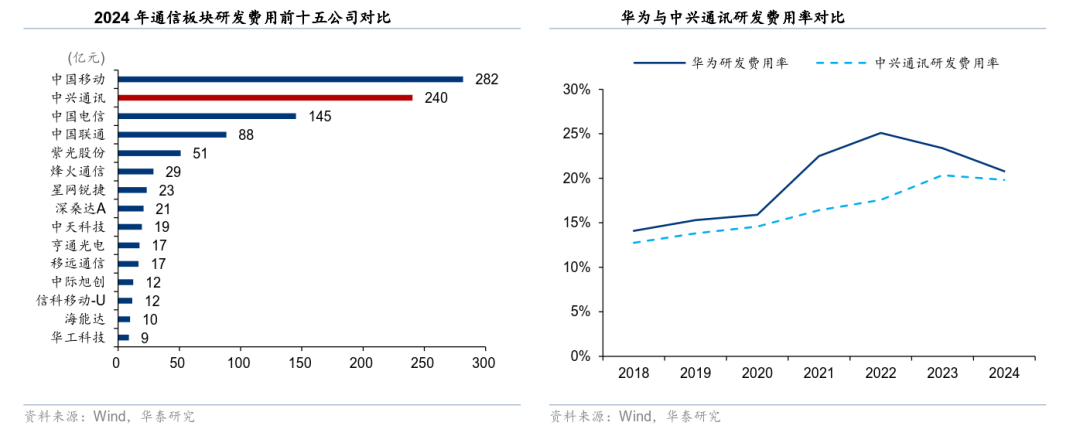

Compared to listed companies in the communications sector, ZTE's R&D expenses are significantly higher than those of its peers. In 2024, among the top 15 domestic communications listed companies in terms of R&D expenses, ZTE ranked second with an investment of 24 billion yuan, second only to China Mobile, the leader in the communications sector. Compared to Huawei, which is also known for its high-level R&D investment, ZTE maintained a similar R&D expense ratio to Huawei from 2018 to 2024.

As of June 30, 2025, ZTE held approximately 94,000 global patent applications and had accumulated over 50,000 globally authorized patents. In the AI field, it had nearly 5,500 patent applications, with nearly half of them authorized. In the chip field, it had approximately 5,700 patent applications and had accumulated over 3,700 authorized patents.

From a product R&D perspective, in the connectivity field, the company has initiated new business formats such as low-altitude economies, 10Gbps experiences, and deterministic services through 5G-A. It is actively laying out 6G technology evolution and providing key network capabilities such as ultra-large bandwidth, low latency, and high reliability through all-optical networks.

In the computing power infrastructure field, the company is fully promoting the R&D of intelligent computing products. Through fully domestically produced intelligent computing products such as self-developed chips, intelligent computing servers, super-large-scale clusters, intelligent computing all-in-one machines, as well as software solutions including resource management platforms, training and inference platforms, the Nebula large model, and intelligent agent factories, it aims to create an open and inclusive intelligent computing foundation.

Focusing on the company's self-developed chips, about 30 years ago, ZTE began its chip research. Today, it is one of the few domestic companies capable of mass-producing 7nm chips and introducing 5nm chips, providing one-stop design services from chip design to mass production. Currently, the company possesses self-developed 5nm process CPU chips and is planning next-generation switching chips. Through years of accumulated network interconnection technologies, it has formed competitive data center hypernode solutions, adapting to different GPU/ASIC chips.

At the Alibaba Cloud Town Hall in September this year, ZTE Communications showcased its next-generation planned 51.2T switching chip. Simultaneously, it exhibited a hypernode server supporting 64 GPUs in a single machine, which supports dual expansion modes of Scale-Up and Scale-Out, boasting industry-leading integration and expansion capabilities to support the creation of software-hardware collaborative, network-enhanced, open-decoupled, and highly efficient and stable super-large-scale intelligent computing clusters with tens of thousands of cards.

Based on its self-developed platform, ZTE Communications has introduced a '3+2+3' intelligent computing server solution to fully meet the AI full-scenario application needs of various customers across industries. ZTE Communications has launched intelligent computing servers in different forms for three major CPU platforms to meet customers' diverse CPU selection needs, including the mainstream foreign X86 architecture CPU platform, the domestic X86 architecture CPU platform, and ZTE Communications' self-developed ZFX CPU platform.

In 2025, ZTE Communications will continue to adhere to R&D investment, consolidating its foundation in network connectivity business while seizing the opportunities brought by the artificial intelligence wave and deeply participating in the construction of intelligent computing infrastructure. It is committed to 'becoming a leader in network connectivity and intelligent computing power.' As 2025 draws to a close, whether ZTE can achieve its goals is about to reach its conclusion.

For enterprises, short-term market fluctuations are inevitably influenced by various news. However, when the timeline is extended, excellent enterprises usually share a common trait: they possess stable and powerful R&D capabilities, product iteration capabilities, market grasp capabilities, and a stable management team. ZTE currently embodies these capabilities, making its future development worthy of market anticipation.

© THE END

All materials are sourced from officially disclosed information.

This article does not constitute any investment advice.

This article is originally written by Baker Street Detective and may not be reproduced without permission.

Images are sourced from publicly disclosed materials. Please contact us for removal if there is any infringement.