Technological Leaps and Cost Efficiency: Dual-Arm Collaborative Robots Poised for Commercial Breakthrough

![]() 12/05 2025

12/05 2025

![]() 424

424

Produced by | Bullet Finance

Art Editor | Qianqian

Reviewed by | Songwen

Recently, a video showcasing a dual-arm robot adeptly folding clothes at WAIC 2025 stirred considerable excitement within the industry.

In the footage, the robot's two arms worked in seamless coordination with remarkable precision, enabling a single unit to efficiently carry out the entire "pick-fold-place" sequence for clothing. This robot is reportedly well-suited for automated folding and packing tasks in both domestic settings and garment workshops.

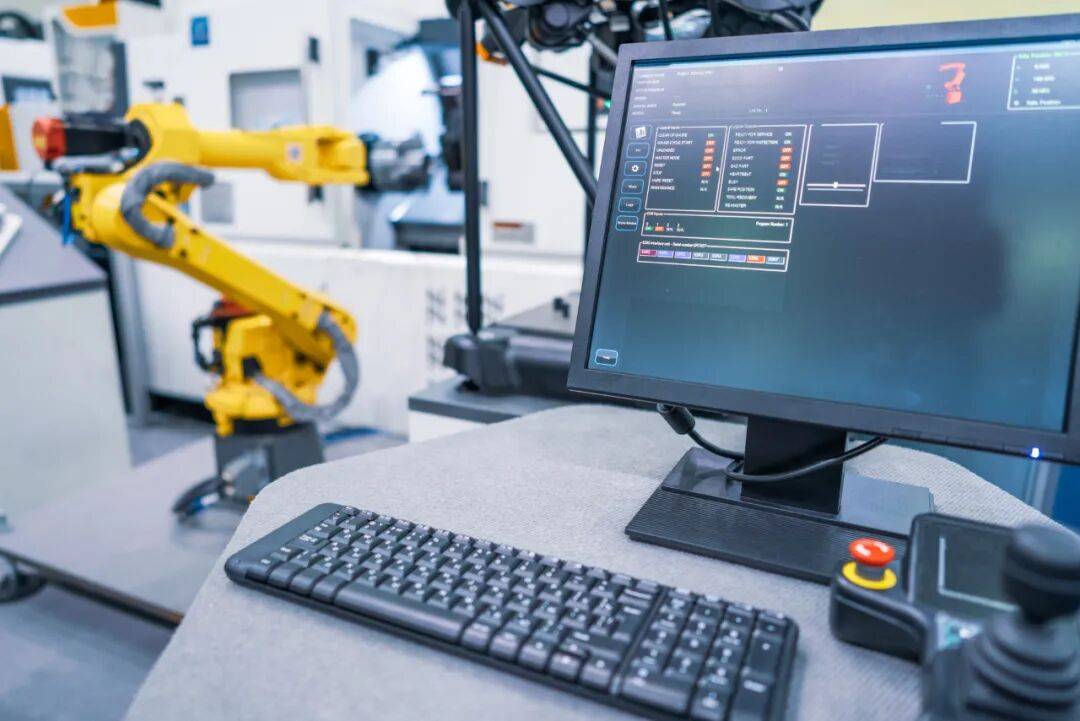

Behind the dazzling product displays at cutting-edge exhibitions, dual-arm collaborative robots have already demonstrated stable operational capabilities in industrial manufacturing, spanning from automotive production to electronic assembly.

Since the beginning of the year, the intelligent robot sector has witnessed a surge in activity, with market expectations for the industry steadily rising. Among these, dual-arm collaborative robots, though a niche segment, are on the cusp of market commercialization maturity, thanks to their increasing intelligence, flexibility, and technological sophistication. The future potential of dual-arm collaborative robots is vast across multiple market sectors.

1. Dual-Arm Collaboration: A Sector Experiencing Concentrated Growth

On the path to a smart society, enabling machines to collaborate with or even replace humans in work, thereby freeing people from arduous and repetitive tasks, stands as one of the ultimate goals of human societal development.

Dual-arm collaborative robots represent a phased outcome of this shared vision.

A dual-arm collaborative robot is an intelligent device specifically engineered for collaborative work with humans. It typically features two flexible robotic arms. Unlike traditional industrial robots, dual-arm collaborative robots are designed to safely interact with humans in shared workspaces and jointly accomplish complex tasks.

In 2014, industrial robot giant ABB unveiled the world's first human-robot collaborative robot, the "YuMi dual-arm robot," marking the emergence of collaborative robots as a new category and elevating human-machine collaboration to a new level.

Over the past decade, domestic collaborative robot manufacturers have transitioned from initial technology introduction and learning advanced experiences to developing independent research capabilities, mastering core technologies, and deeply integrating with cutting-edge technologies such as artificial intelligence.

Globally, the collaborative robot market is experiencing rapid growth, with the Chinese market emerging as a core growth region.

According to the "2025 Global Collaborative Robot Industry Development White Paper," global collaborative robot sales reached 68,000 units in 2024, a 25% year-on-year increase. Furthermore, the white paper forecasts that global sales of collaborative robots are expected to exceed 100,000 units in 2025, with a growth rate surpassing 40%. As the world's largest single market, China saw sales of approximately 30,000 units in 2024, a 28% year-on-year increase.

Since the beginning of this year, dual-arm collaborative robots have also undergone a wave of concentrated industry transformation.

From the evolutionary direction of global leading manufacturers, collaborative robots are continuously pushing the boundaries in terms of load capacity, speed, and precision. For instance, manufacturers such as Japan's Fanuc and Switzerland's ABB have begun adopting high-voltage drive solutions for their collaborative robot products, providing stronger power to achieve greater load capacities and higher precision.

Enhancing robot intelligence and user-friendliness is another core focus. For example, Germany's KUKA introduced the iiQWorks.Copilot programming assistant, which allows users to generate executable robot programs directly using natural language (e.g., "stack boxes from the conveyor belt onto the pallet"), significantly lowering the barrier to automation.

Investment and financing trends also indicate concentrated growth in related sectors. According to IT Juzi, in the third quarter of 2025 alone, three robotics companies—Zhongqing Robotics, Xingmai Innovation, and Autovariable Robotics—each secured financing exceeding 1 billion yuan. Additionally, companies such as Tashi Zhihang and Xinghaitu announced financing exceeding $100 million.

2025 marks the "year of domestic dominance" in the collaborative robot market, with domestic manufacturers not only leading in quantity but also demonstrating strong growth momentum. Companies such as Shenyang SIASUN, Estun Automation, and AUBO Robotics are showcasing increasing competitiveness in the Chinese market and even globally, leveraging localization advantages and policy support.

According to MIR DATABANK data, in 2025, the localization rate of industrial robots in China exceeded 55% for the first time, marking a historic milestone as the year of breakthrough for domestic robots.

Amid the continuous industrial upgrading and acceleration, a venture capital institution leader lamented that he almost spends every week evaluating and seeking projects to stay abreast of the latest trends, noting that "current robot innovations are advancing not by years but by days."

2. Growing Demand and Technological Advancement

Behind the surging popularity of the dual-arm collaborative robot sector lies tangible market demand.

First is the rigid demand for flexible manufacturing in industrial sectors.

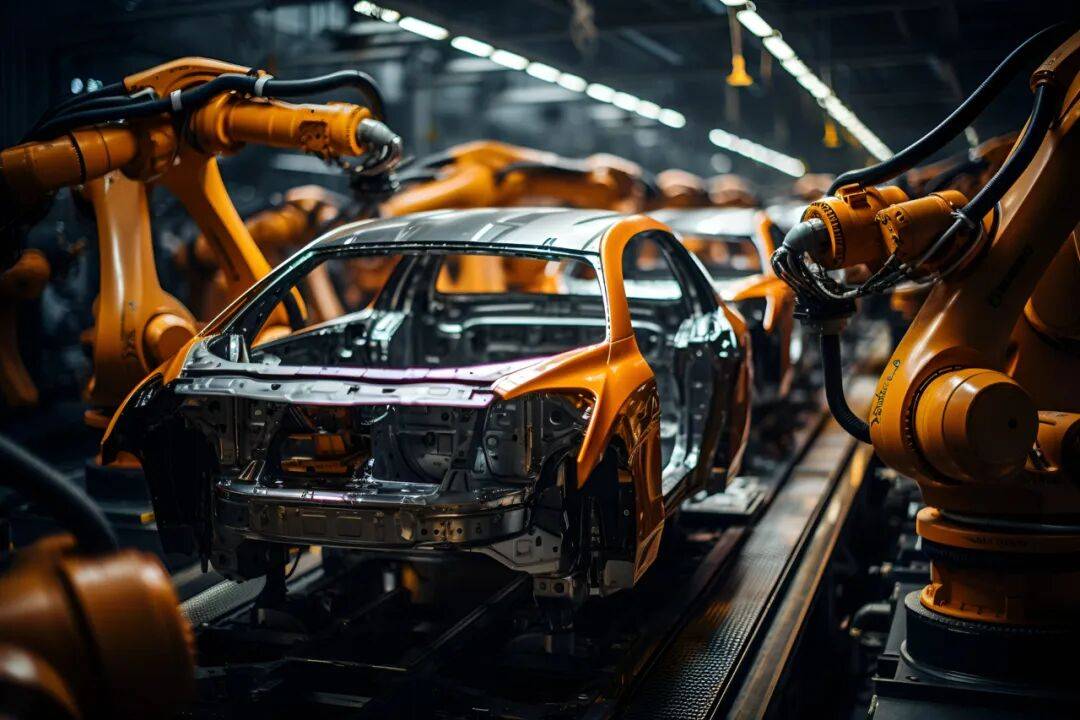

In industries such as automotive and 3C electronics, product iteration cycles are shortening, making small-batch, multi-variety flexible production the norm. Traditional large-scale automated production lines are too rigid and difficult to adjust. Dual-arm collaborative robots, with their rapid deployability and reprogrammability, perfectly fill the gap between large-scale automation and pure manual operations.

Changes in the labor force structure are another significant factor. With rising labor costs and an aging population globally, the challenge of "recruitment difficulties" has become increasingly prominent. Enterprises urgently need automation solutions to take over repetitive, strenuous, and even hazardous tasks, freeing human labor for higher-value work.

The rapid rise in demand is also evident from the global application of collaborative robots.

In Europe, collaborative robots are making their mark in the automotive industry. In German and French automotive component factories, collaborative robots already handle complex processes such as welding and inspection. In the North American market, Boeing uses collaborative robots for automatic aircraft fuselage inspections in the aerospace sector. In Southeast Asia, automotive factories in Thailand and electronics factories in Vietnam are accelerating the adoption of collaborative robots to address local shortages of skilled technicians.

On the other hand, overall technological advancements by collaborative robot manufacturers have laid a solid foundation for the industry's long-term development.

The dual-arm collaborative robot industry chain encompasses a complete ecosystem, from raw material supply and core component manufacturing to robot production, system integration, and final application.

The upstream of the industry chain is primarily composed of core component suppliers, including metal materials, electronic components, sensors, and transmission systems. The quality and supply stability of these suppliers directly impact robot performance and production costs.

The key core components of industrial robots—reducers, servo systems, and controllers—serve as the "joints," "muscles," and "cerebellum" of the robots.

In recent years, global manufacturers of key components have made significant technological advancements in these three core areas. These breakthroughs have not only enhanced the performance of the components themselves but also fundamentally propelled the entire robotics industry toward greater intelligence, precision, and collaboration.

These key technological advancements have driven morphological innovations in robots, enabling the design of more compact and higher power-density collaborative robots. Simultaneously, they have lowered the barriers to automation adoption, as intelligent controllers and easier-to-debug servo systems significantly reduce the programming and system integration complexity of robots, allowing emerging enterprises to adopt advanced automation solutions more easily.

Additionally, these technological innovations and design optimizations, along with synergies across the industry chain, have further reduced the manufacturing costs of dual-arm collaborative robots.

With growing demand for industrial automation on one side and continuous technological breakthroughs and cost optimizations in the collaborative robot industry chain on the other, the widespread adoption of dual-arm collaborative robots in industrial manufacturing and other scenarios as a collaborative production force may soon become a reality.

3. Infinite Potential: From Industrial Collaboration to Broader Life Services

According to Fortune Business Insights, the global industrial robot market reached $19.89 billion in 2024 and is expected to grow from $21.94 billion in 2025 to $55.55 billion by 2032, with a projected compound annual growth rate of 14.2%.

Amid the robotics industry boom, China continues to support and drive the sector's development at the policy level. From the 60 billion yuan National Artificial Intelligence Fund promoting "robotics+" supply-demand matching to the establishment of innovation hubs (such as the Beijing Humanoid Robot Innovation Center and Shanghai's "Model Speed Space") and other ecological communities, these initiatives are accelerating the transition of the robotics industry from laboratories to markets.

Currently, dual-arm collaborative robots have begun small-scale production applications in automotive manufacturing and 3C electronics.

For example, in the automotive industry, they are used for precision assembly, material handling, quality inspection, complex operations, and special process treatments. In the electronics industry, they are involved in assembling mobile phone and computer components, screw fastening, micro-component pressing, electronic component insertion, board testing, appearance defect detection, dimension measurement, and product packaging.

With advancements in artificial intelligence algorithms, sensor technologies, and core components, dual-arm robots are evolving toward greater intelligence, flexibility, and lower costs, with application scenarios expanding from current industrial sectors to commercial services.

The commercial service sector has emerged as a new growth area for dual-arm collaborative robots.

In retail, dining, hospitality, and other service scenarios, dual-arm collaborative robots can perform more complex tasks and provide more humanized services. In the medical field, they can assist in surgeries, rehabilitation training, and sample handling. In logistics and warehousing, dual-arm lifting robots demonstrate unique advantages. These robots integrate a dual-robotic-arm structure with a liftable work platform, enabling precise gripping, assembly, grabbing, and handling operations through two highly dexterous collaborative robotic arms while achieving flexible vertical movement through lifting mechanisms.

The continuous expansion of application scenarios provides long-term impetus for the industrial advancement of dual-arm collaborative robots. With further technological progress and cost reductions, it is foreseeable that dual-arm collaborative robots will find applications in even more fields and demonstrate their value.

More importantly, AI is empowering collaborative robots toward an intelligent revolution. Driven by concurrent advancements in artificial intelligence, cloud computing, and related technologies, the technological maturity of dual-arm collaborative robots is significantly improving. Against the backdrop of market dynamics, demand shifts, and societal structural changes, the application scenarios of dual-arm collaborative robots are gradually becoming more diversified.

Domestic manufacturers are expanding their footprint in the dual-arm collaborative robot niche segment, with their commercialization processes gradually accelerating through technological breakthroughs and diversified scenario expansions.

Over the past decade, Chinese dual-arm collaborative robots have transitioned from followers to paralleling global giants, building the most dynamic robotics industry ecosystem on this land. Amid this flourishing landscape, the industrial potential of collaborative robots holds great promise for the future.

*The images in the article are sourced from Shutu.com and are based on the VRF protocol.