Putting an End to the PPT Financing Era: Capital Places Bets on the 'Certainty' of the Low-Altitude Economy

![]() 12/05 2025

12/05 2025

![]() 546

546

By Su Cheng

In stark contrast to the frenetic pace of financing announcements last year, the funding rhythm in the low-altitude economy sector this year has adopted a more cautious stance. The market now exhibits distinct characteristics, marked by 'overall high enthusiasm, concentration among top players, and a shift in underlying logic'.

Recently, Aerofugia unveiled its latest round of Series C financing, securing hundreds of millions of yuan. A notable departure from previous funding rounds, the lead investors were not early-stage venture capitals chasing high risks, but rather strategic capitals boasting both industrial resources and a global vision. These included Hangzhou Industrial Investment Group, Prosperity7 Ventures (P7), and Songhe Capital. This shift sent a clear signal:

The investment logic in the low-altitude economy has undergone a profound transformation. The capital market is abandoning speculative bets on distant technological visions and, instead, is using real money to support companies that have clearly delineated commercial closed loops and verifiable paths to profitability.

1. Investment Logic: From 'Starry-Eyed Dreams' to 'Pragmatic Accounting'

'Investing in the low-altitude sector transcends funding a single aircraft; it's about betting on the future mobility ecosystem of a city or region,' remarked an industry insider. This sentiment aptly captures the current shift in capital's perspective on the low-altitude economy. Investment is no longer about underwriting technological fantasies but about funding a definable and actionable commercialization blueprint.

For Aerofugia, this certainty is built upon four key pillars:

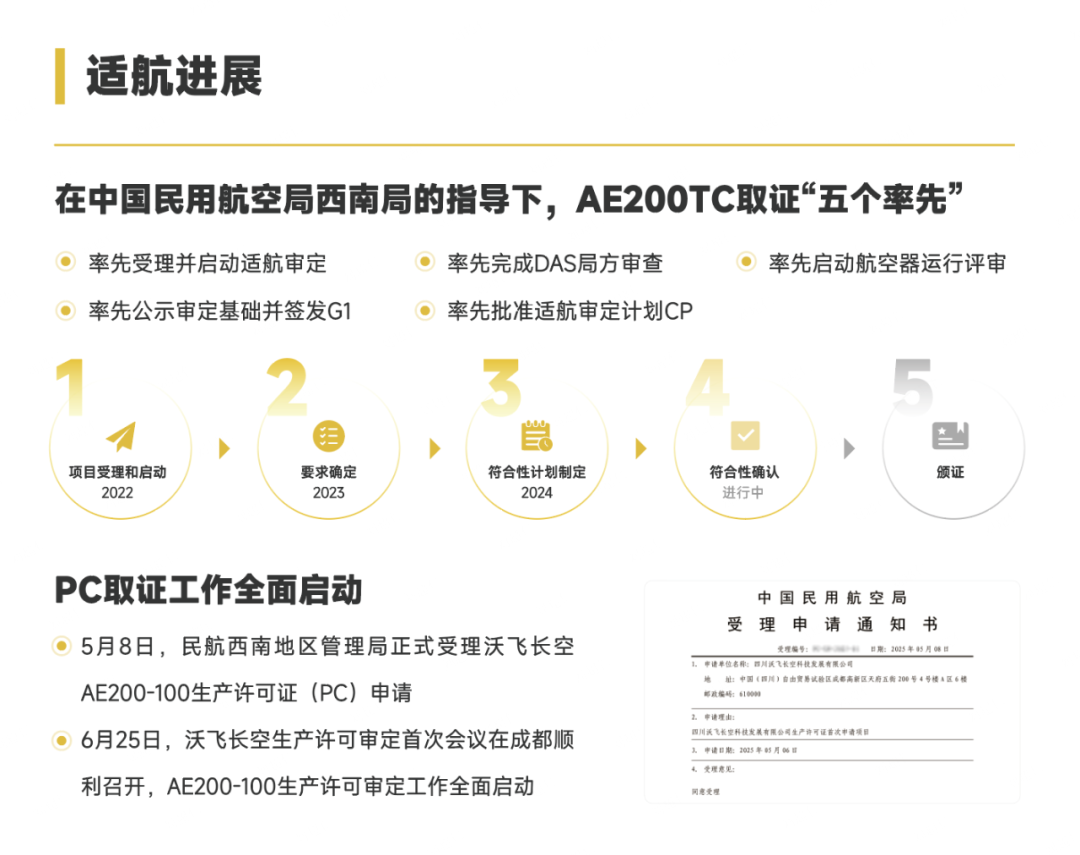

Firstly, anticipated regulatory approval. The AE200 has entered the fourth and final stage of certification by the Civil Aviation Administration of China (CAAC) for its Type Certificate (TC) - the manned compliance flight verification stage. This signifies that its greatest regulatory hurdle (whether it can be approved for manned operations) is nearing resolution, with a relatively predictable timeline. Moreover, it has secured CCAR-135 operational certification, laying a solid foundation for its compliance in operations.

Secondly, calculable future revenue. The future cash flow, a paramount concern for capital, is being bolstered by a growing number of purchase agreements. From the confirmatory purchase agreement inked with Shendu Airspace in July to recent confirmed orders with companies like Huilong Aviation, Shenzhen Transport Group, and Konglian Jiexing at the Asian General Aviation Expo, even conservative assumptions regarding price and delivery provide a robust revenue base for financial models.

Thirdly, visualizable capacity and cost projections. The first phase of the global headquarters base in Chengdu has reached completion, with production slated to commence in 2026. This indicates that the peak of capital expenditure has passed, and the output stage is on the horizon. More critically, by forging a joint venture with Wolong Electric Drive and collaborating with Fuwei Group on smart cockpits, Aerofugia has either internalized or deeply integrated key links in its core supply chain. This translates to a far clearer path to scaling cost reductions compared to its peers, directly influencing future gross margins.

Fourthly, replicable operational and profit models. Merely selling aircraft adheres to traditional manufacturing logic. However, the test flight of the Sichuan-Chongqing low-altitude cultural tourism corridor validates a more sophisticated commercial narrative. It has proven not just the feasibility of flight but the entire process encompassing airspace coordination, route approval, ground connections, and market operations. This validated model can be swiftly replicated in other tourist destinations, minimizing exploration risks and costs for each new scenario.

2. Capital Structure: The Formation of the Tripartite Golden Triangle

The investor structure in this Series C financing round exemplifies a classic risk hedging and value-enhancing combination. The three capital entities are not merely stacked financial investments; each plays a distinct role, forming a golden triangle that caters to short-, medium-, and long-term development needs.

Hangzhou Industrial Investment Group embodies the most tangible local certainty. As a Fortune 500 state-owned enterprise, it brings to the table the industrial and scenario resources of Hangzhou and, by extension, the Yangtze River Delta region. Its involvement is tantamount to rolling out a red carpet for Aerofugia's commercialization in one of China's most mature and high-consuming markets.

The P7 fund, on the other hand, opens up global avenues. As an investment arm of Saudi Aramco, Prosperity7 not only injects capital but also provides a fast track to the Middle Eastern market and global capital networks. It elevates Aerofugia's valuation benchmark from domestic comparisons to alignment with global leading eVTOL companies like Archer and Joby, serving as a resounding endorsement of its long-term growth potential.

Songhe Capital, meanwhile, focuses on the manufacturing foundations. As a seasoned hard technology investment institution, it possesses a deep understanding of the full value chain from laboratory to factory. Its extensive industrial resources in the Greater Bay Area can effectively assist Aerofugia in overcoming core manufacturing challenges such as yield, cost, and supply chain resilience during mass production, directly impacting the company's future profitability.

Comparative Reflection—

Low-Altitude Economy Investment Enters the 'Era of Accountability'

The success of Aerofugia's Series C financing serves as a reflective mirror, highlighting the differentiation among companies in the low-altitude economy sector. A few years ago, many entrepreneurs could lure investment merely by showcasing sleek aircraft animations and grand narratives about reshaping urban transportation. Today, this 'PPT financing' approach has lost its allure.

The capital market is no longer swayed by cool concepts; instead, it seeks solid orders, clear certification timelines, controllable manufacturing costs, and validated business models. This differentiation and logical shift are particularly pronounced when examining the situations of other companies in the same industry.

According to the 21st Century Business Herald, the performance forecasts for the first half of 2025 also paint a mixed picture for low-altitude economy companies. Among the 24 constituent stocks of the Wind Low-Altitude Economy Index, exactly half (12) reported losses, underscoring common industry challenges: the sector is in its nascent '0 to 1' stage, necessitating massive investment and long cycles for technological validation, airworthiness certification, infrastructure construction, and operational model exploration; eVTOLs and other products are essentially aircraft with stringent safety and reliability requirements, where any technical setback or safety hazard could plunge a company into crisis; despite these challenges, a plethora of companies continue to enter the fray, making the track highly competitive.

It is anticipated that capital will further concentrate at the top, intensifying the Matthew effect. Order fulfillment capabilities will be rigorously scrutinized, with timely delivery and operational realization becoming pivotal for the next stage of financing for companies. Simultaneously, investment opportunities in the supply chain will emerge, with significant prospects arising in upstream areas like aviation-grade batteries, motors, flight control systems, and composite materials, as well as downstream operational services and infrastructure (landing sites, air traffic management systems) as OEMs transition to mass production.

3. Future Game—What Else Should Investors Focus On?

Securing financing marks the commencement of a new competition, not the culmination. For Aerofugia and its peers, capital infusion acts as both an accelerator and a pressure valve.

Following substantial capital injection, every certainty promised to the capital market will be subjected to relentless scrutiny: Can the final timeline for TC certification be adhered to as scheduled? Can thousands of orders, especially the initial deliveries, be fulfilled on time and with the requisite quality? Can the global headquarters base, commencing production in 2026, achieve the anticipated capacity ramp-up speeds and unit costs? Can the 'Sichuan-Chongqing Model' maintain its efficiency and capability when replicated in other regions?

The answers to these questions will form the bedrock for the capital market to dynamically price assets across the entire low-altitude economy sector. This secondary evolution from 'capital darling' to 'commercial winner' may prove to be no less arduous or challenging than initially constructing the first flyable prototype.