Inspur Information Steers into the AI Abyss

![]() 12/05 2025

12/05 2025

![]() 715

715

Amid the escalating rivalry in the tech sector, the performance of two IT infrastructure behemoths, Sugon and Inspur Information, has consistently drawn the market's keen attention. The unveiling of the 2025 third-quarter financial reports has starkly contrasted the growth trajectories of these two firms.

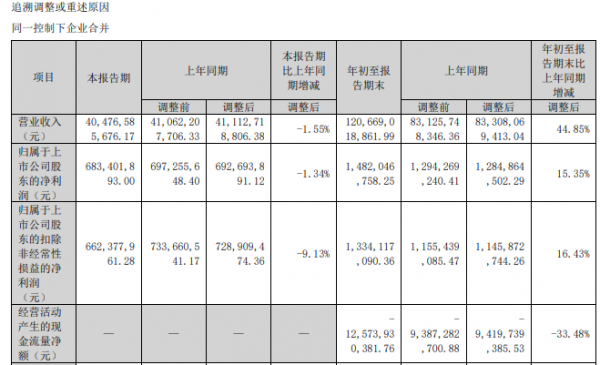

Financial report data reveals that Inspur Information's main business revenue for the first three quarters soared to 120.669 billion yuan, marking a 44.85% year-on-year surge. Net profit attributable to the parent company stood at 1.482 billion yuan, a 15.35% year-on-year increase. However, within these figures, the main business revenue for the third quarter dipped to 40.477 billion yuan, a 1.55% year-on-year decline. Net profit attributable to the parent company also fell to 683 million yuan, a 1.34% year-on-year decrease.

Financial report data further indicates that Sugon recorded revenue of 8.82 billion yuan in the first three quarters, a 9.68% year-on-year rise. Net profit attributable to the parent company reached 966 million yuan, a 25.55% year-on-year increase. Among these, revenue for the third quarter climbed to 2.97 billion yuan, a 27.51% year-on-year hike. Net profit attributable to shareholders of the listed company rose to 237 million yuan, a 15.07% year-on-year increase.

The simultaneous decline in both revenue and profit for Inspur Information in the third quarter starkly contrasts with its previous rapid growth. This signal not only mirrors fluctuations in the company's individual business cycle but may also hint at profound shifts in the competitive landscape of the IT infrastructure industry.

Internal and External Dynamics: Gross Margin Under Siege

The downturn in Inspur Information's third-quarter 2025 performance is an inevitable outcome of a confluence of internal and external factors. Currently, fluctuations in AI server market demand, an uneven customer base, and external supply chain pressures collectively pose challenges for the company.

On one front, server orders were concentrated in the first half of the year, leading to a cyclical rebalancing of supply and demand in the third quarter. This shift in market demand directly contributed to the decline in Inspur Information's revenue growth rate.

IDC data shows that the Chinese market for accelerated servers reached a staggering $16 billion in the first half of 2025, more than doubling compared to the first half of 2024. In terms of vendor sales, Inspur, New H3C, and Lenovo emerged as the top three, capturing nearly 50% of the market share.

In the first half of the year, major enterprises ramped up their capital expenditures to seize the initiative, actively deploying computing infrastructure to support large-scale model training and application deployment. This preemptive and concentrated procurement spree released part of the market demand early, leading to a subsequent slowdown in procurement pace in the short term.

On the other front, Inspur Information's gross margin continued to face pressure, becoming a key factor eroding its net profit space. Financial report data indicates that in the third quarter of 2025, Inspur's gross margin plummeted to only 4.91%, a 1.94 percentage point decrease from 6.85% in the same period last year, significantly below the industry average.

Behind the decline in gross margin lies a deeper issue of an uneven customer base. In the third quarter of 2025, orders from internet clients surged to 55% of the total, but these clients had a gross margin of only 2.8%. These clients, with their large procurement volumes and strong bargaining power, often demand extreme cost-effectiveness, squeezing profit margins.

From an external vantage point, as a hardware manufacturer heavily reliant on high-end chips, Inspur Information has long relied on GPUs such as NVIDIA's A100/H100 to build AI servers. US sanctions, chip supply disruptions, and uncertainties in the international market all potentially impact Inspur Information's core business, thereby affecting its revenue.

The 'golden age' of the AI server market persists, but the era of wild growth has ended. Amidst the backdrop of long-term growth in computing demand, Inspur Information needs to optimize its customer base and enhance its technological autonomy to secure sustained development in the new round of industry consolidation.

Far Ahead: Competition Intensifies

The relentless deepening of the global digitalization process has created vast development opportunities for the server market.

IDC forecasts that the global server market will reach a staggering $366 billion in 2025, a 44.6% year-on-year increase. Among this, the non-x86 server market will grow by 63.7% year-on-year to reach $82 billion, with Arm-based servers growing by 70.0% and accounting for 21.1% of total shipments.

In this thriving market, Inspur Information, China's leading and the world's second-largest server enterprise, is navigating a complex competitive environment brimming with both opportunities and challenges.

According to IDC data, in 2024, Inspur Information maintained its position as the world's second-largest player with an 11.3% global market share, capturing a 32.1% shipment share in the Chinese market, far outpacing competitors. However, behind this 'leadership' lies a complex competitive landscape, with a triple threat from an intensifying price war, rapid technological advancements, and increased competition.

Firstly, the rapid growth of the server market has not eased competition but instead attracted more participants, increasing competitive pressure on Inspur Information.

For instance, traditional international giants like Dell and HP maintain stable positions with their brand advantages and technological accumulation. Huawei continues to make strides in the government cloud market, securing numerous orders with its complete product line and robust technical service capabilities. New entrants like Super Micro Computer are rapidly seizing market share with flexible pricing strategies and localized services, backed by local governments.

Secondly, the price war has spread from traditional servers to the AI server market, which was once considered a high-margin blue ocean but now finds itself in fierce competition.

It is reported that AI server prices have plummeted from 140,000 yuan per unit in 2023 to 95,000 yuan per unit in 2024, a 32% decrease. This round of price cuts is not an isolated incident but a passive response from the entire industry. To retain clients and market share, manufacturers have had to sacrifice profits.

The essence of the price war is an ultimate test of supply chain efficiency, economies of scale, and customer loyalty. Inspur Information, with its high proportion of internet clients and weak bargaining power, faces greater pressure in price competition.

Thirdly, technological innovation has become the cornerstone of corporate competition. Inspur Information continues to ramp up R&D investment in core technologies such as AI acceleration chips to enhance its technological capabilities. However, building an ecosystem for self-developed chips takes time, and establishing technological leadership is not achieved overnight.

According to financial report data, in the first half of 2025, Inspur Information's R&D investment reached 1.532 billion yuan, a 7.38% year-on-year increase. Its self-developed new-generation AI acceleration chip has achieved dual breakthroughs in performance and power consumption, with a 30% increase in computing speed and a 20% reduction in power consumption.

Amidst diverse technological routes, geopolitical sensitivities, and differentiated customer needs, the core of competition in the server industry is shifting from scale expansion to value creation, testing Inspur Information's technological foundation, business model sustainability, and strategic foresight.

Diversified Breakthroughs: Inspur Information Urgently Seeks New Growth

The domestic server market in 2025 presents a paradoxical landscape.

On one hand, the development of emerging technologies such as the digital economy, artificial intelligence, and the metaverse continues to drive growth in the server market. On the other hand, geopolitical factors, supply chain security, and technological autonomy and controllability introduce uncertainties into industry development. Additionally, the intensifying price war narrows profit margins in the server business.

Faced with this structural dilemma of high growth but low margins, Inspur Information is accelerating the optimization of its business structure, fully tapping into three new growth engines: cloud computing services, industry solutions, and overseas markets.

In cloud computing services, Inspur Information has launched a cloud service platform, providing flexible and efficient cloud computing solutions to build a more stable service revenue model, enhance customer loyalty, and optimize its profit structure. In industry solutions, Inspur Information has introduced a series of deeply customized solutions for key industries such as finance, healthcare, and education, expanding its product boundaries and creating higher added value.

Notably, Inspur Information is seeking breakthroughs in overseas markets through strategies of localized R&D, production, and services. Currently, it has eight R&D centers, 14 manufacturing bases, and over 50 branch offices, providing crucial support for diversifying market risks and acquiring new growth drivers.

Inspur Information's transformation attempts reflect an inevitable trend in the server industry: shifting from hardware sales to comprehensive service providers and upgrading from scale competition to value creation. In this process, it needs to balance short-term market share with long-term profitability, building differentiated competitive barriers while maintaining its scale advantage.

In conclusion, amidst the continuous global digitalization wave, the long-term demand for the server market remains promising. For Inspur Information, successfully cultivating new growth points and optimizing its business structure will determine whether it can continue to lead in the future industry landscape. The path to breakthrough is fraught with challenges but also holds significant opportunities for transformation and upgrading.