Why Are There No Losers in the 2025 Search Sector War?

![]() 12/05 2025

12/05 2025

![]() 564

564

From Fierce Clashes to Shared Prosperity

Written by / Chen Dengxin

Edited by / Li Jinlin

Formatted by / Annalee

The search domain has long been a fiercely competitive battleground.

In the era of AI, well - known global internet behemoths are harnessing AI to pursue opportunities for transitioning from traditional to new growth drivers, with search emerging as a critical battlefield.

In 2025, major companies have placed even greater emphasis on search. From the early - year launches of Doubao, Yuanbao, and DeepSeek to the year - end releases of Qianwen and Lingguang, an AI access war centered around search has erupted.

The puzzle lies in the fact that after a year of intense competition, new search entrants continue to make significant strides, while 'Google and its contemporaries' remain robust, with their core businesses as solid as ever.

AI has disrupted the fundamental logic of search, yet why has it failed to shake up the competitive landscape of search?

AI Deals a Devastating Blow to Traditional Search

Since ChatGPT sparked the AI revolution, 'Google and its contemporaries' have found themselves at the epicenter of the storm.

A widely - held belief is that traditional search relies on keyword matching to determine the presence or absence of answers, whereas AI - powered search can match full - chain needs, enhancing the accuracy of answers.

In simple terms, traditional search is like having the raw ingredients for a cream cake; users have to manually transform them into the final product. In contrast, AI skips the intermediate steps and directly provides a complete cream cake.

'Xinmou' bluntly states, 'In the AI era, personal AI assistants are highly likely to become the next 'super access'. They can serve as the primary channel for users to obtain information, replacing some search functions; act as the core carrier for intelligent interaction, connecting various hardware devices; and function as a convergence platform for life services, covering shopping, travel, healthcare, education, and more.'

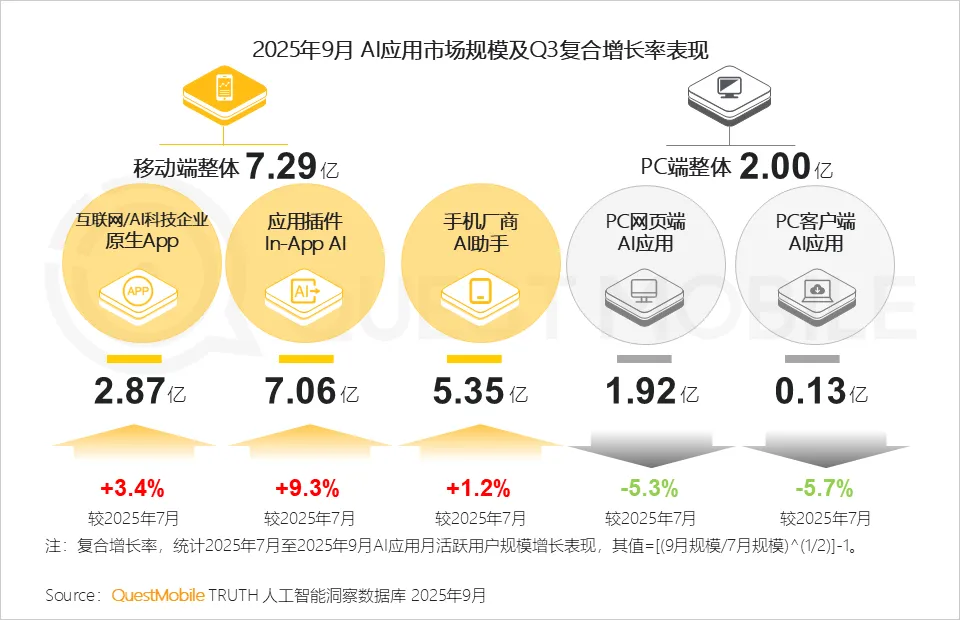

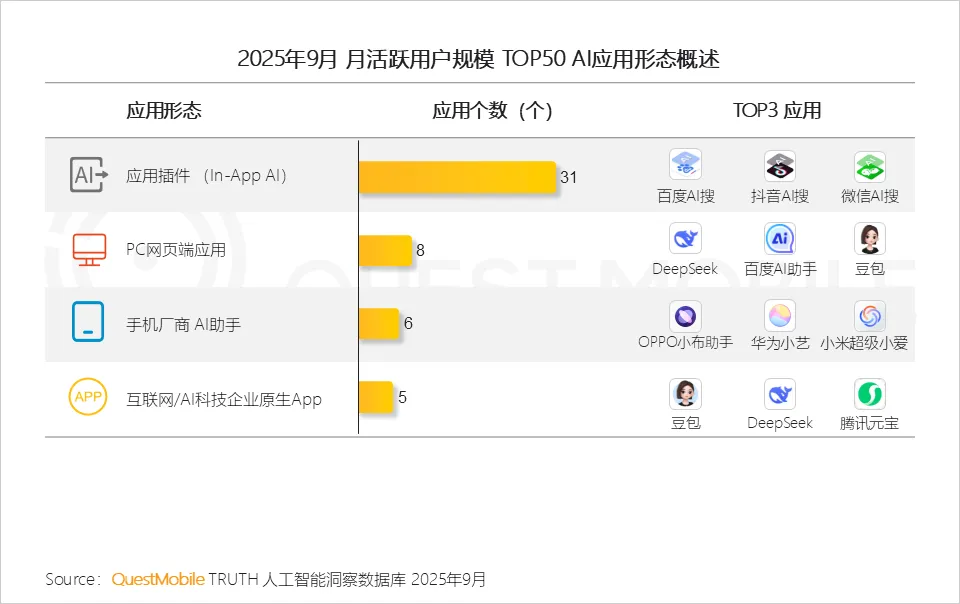

Image Source: QuestMobile

It is clear that AI has dealt a devastating blow to traditional search.

Consequently, internet giants are flocking to the search arena, aiming to redefine the relationship between users and information, unlock growth opportunities for AI implementation, and seek rapid advancement.

Abroad, Microsoft has taken the lead by renaming Bing to Microsoft Bing, no longer viewing it as a mere search engine but as an AI search service based on Microsoft's ecosystem.

Domestically, the competition is intense and ongoing.

Doubao, under ByteDance, has maintained steady growth, reaching 172 million monthly active users in the third quarter of 2025, surpassing DeepSeek's 145 million. Tencent Yuanbao, under Tencent, saw its monthly active users grow by 55.2% year - on - year in the first half of 2025, ranking second on the AI native app surge list and becoming the most notable 'dark horse' among AI native mobile applications. Alibaba's Qianwen and Lingguang both became phenomenal products in November 2025, surpassing ChatGPT, Sora, and DeepSeek to become the fastest - growing AI applications with tens of millions of users in history...

In short, AI applications with a 'conversation + search' foundation are gaining widespread popularity.

Against this backdrop, concerns naturally arise about 'Google and its contemporaries', as search is their core business, hailed as a 'cash cow', and 'search + information feed' forms the cornerstone of their ecosystem, making its significance self - evident.

However, reality tells a different story.

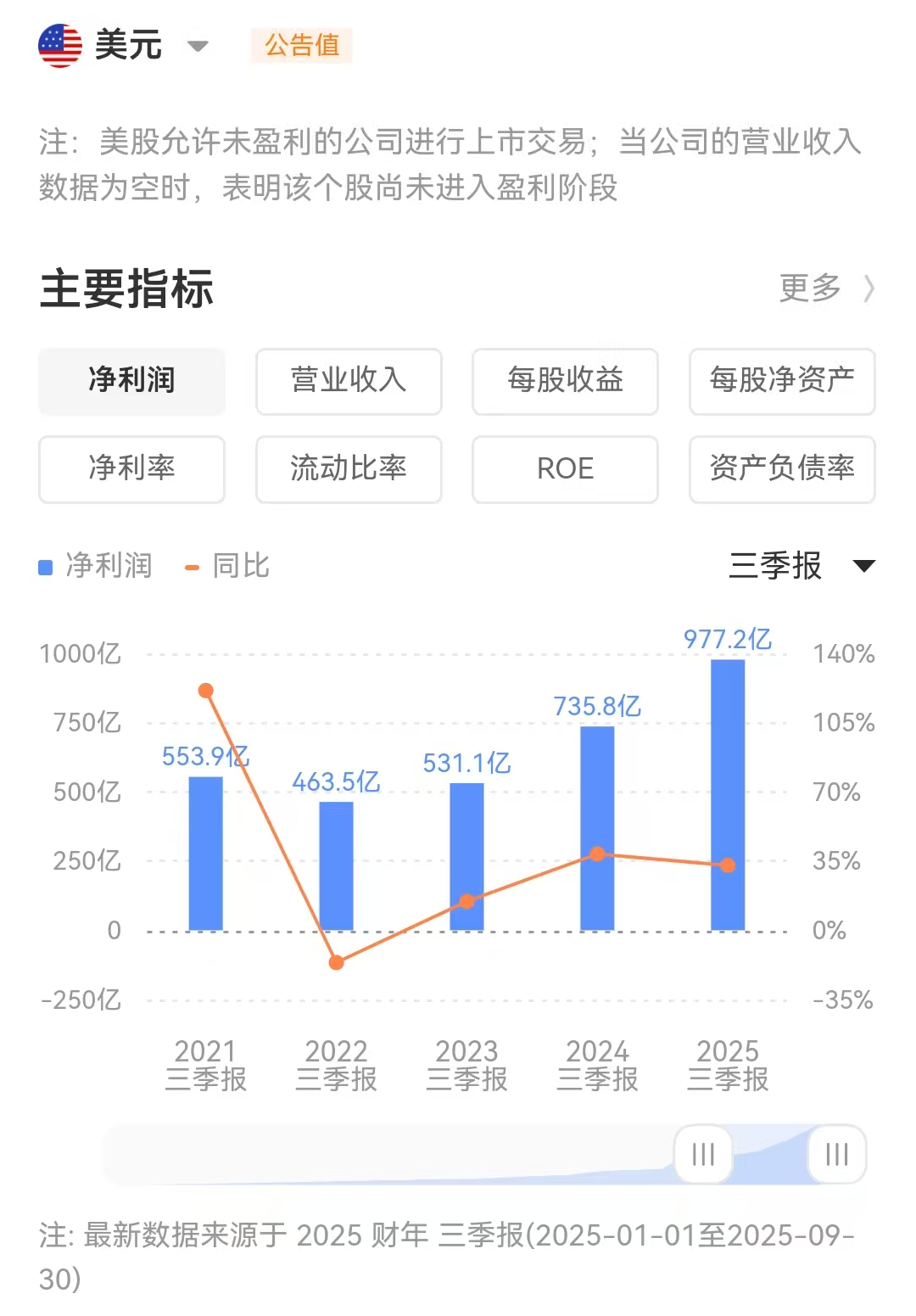

In the third quarter of 2025, Google's revenue reached $102.346 billion, a 16% year - on - year increase, surpassing the $100 billion mark for the first time in history, with AI - related revenue reaching billions of dollars.

Google's Performance Soars

During the same period, Baidu disclosed its AI business revenue for the first time, approximately RMB 10 billion, a more than 50% year - on - year increase, with AI native marketing service revenue reaching RMB 2.8 billion, a 262% year - on - year surge.

In other words, new search entrants are advancing alongside 'Google and its contemporaries'.

The Expanding Market Welcomes More Players

'Google and its contemporaries' have not only avoided becoming victims of AI but have also reaped its benefits, for three reasons.

Firstly, the expanding market is more inclusive.

Previously, the internet suffered from information silos: most content platforms tended to prohibit third - party scraping, confining relationships, interactions, and content within their ecosystem's product matrix, with sharing limited to partners.

As a result, traditional search often functioned as ecosystem search.

For instance, ByteDance launched Toutiao Search in 2019, primarily focusing on matrix products under ByteDance, such as Douyin and Toutiao, playing a pivotal role within the ecosystem by leveraging its vast content pool.

Similarly, WeChat and Alipay have also integrated search functions, serving as crucial entry points for their respective ecosystems and significant markers of ecosystem search.

Nowadays, although information silos still exist, under the dominance of AI, boundaries are gradually blurring, transforming search from a mature market to an expanding one.

As is well - known, a shrinking market breeds disillusionment, a mature market fosters cut - throat competition, and an expanding market teems with vitality. Thus, it is unsurprising that players advance together in an expanding market.

Secondly, established players are not standing still.

Upon review, although AI assistant applications have sprung up like mushrooms, their user churn rate in the first month exceeds 80%, with only a handful truly standing out.

'Dolphin Research' states, 'OpenAI's recently launched AI browser exemplifies inadequate product disruption. If it merely attempts to mimic existing products by encapsulating ChatGPT, the access value will remain in the hands of traditional giants that currently control the scenarios.'

This implies that the expanding market is not yet solidified, and 'Google and its contemporaries' have opportunities to reshape search and attract user migration.

Taking Baidu as an example, it has restructured its search, evolving the search box into a 'smart box' that supports multi - modal capabilities such as input exceeding a thousand characters, as well as photo, voice, and video.

Li Yanhong states, 'We have restructured the search results page with AI, not simply inserting AI summaries into search results but transforming search from an internet application primarily based on text content and links into an AI application mainly featuring rich media content like images and videos.'

As a result, 'Google and its contemporaries' now possess the capital to fearlessly compete across boundaries.

Public data reveals that Google's search business, driven by the AI model, has surpassed 75 million daily active users in the U.S., with query volumes doubling. Currently, 70% of Baidu's search results pages contain AI - generated content, and users exposed to AI search results exhibit higher retention rates, with query volumes increasing by 6% year - on - year.

Advancing Side by Side

Thirdly, first - mover advantages cannot be overlooked.

First - mover advantage is a crucial barrier in business competition, serving to buy time for companies to build their moats. Once solidified through user habits, cost advantages, and brand appeal, it becomes difficult for latecomers to dislodge the first movers.

The same holds true in the search arena, where 'Google and its contemporaries' remain the dominant players in the search market.

Taking Google as an example, it currently holds over 90% of the global search market share, firmly suppressing Microsoft's Microsoft Bing. To put it bluntly, the latter, even with AI enhancements, has not posed a substantial threat to Google.

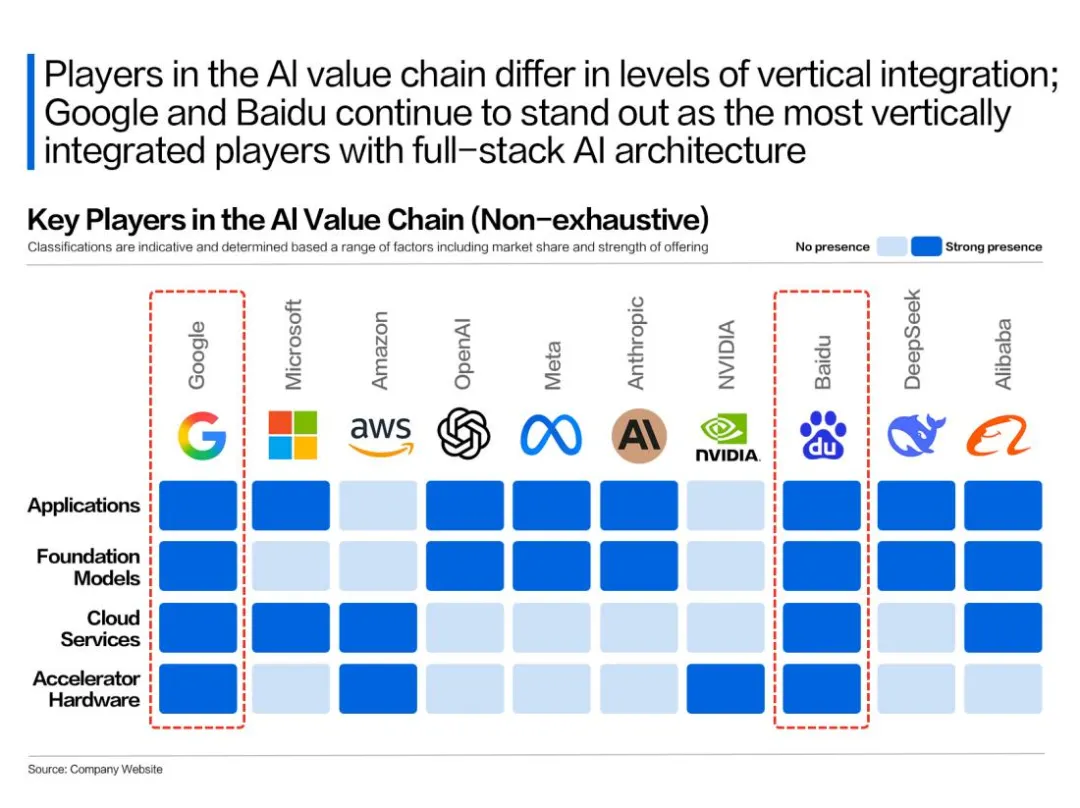

Moreover, when it comes to AI technology, 'Google and its contemporaries' are not flustered.

As early as 2016, 'AI First' became Google's core strategy, the same year Baidu proclaimed 'solidifying the mobile ecosystem and winning in the AI era', with both companies inadvertently stepping into the same river.

Based on this, 'Google and its contemporaries' possess full - stack AI capabilities spanning chips, models, frameworks, and applications, thereby occupying a relatively advantageous position in the search competition.

'Huxiu' states, 'Full - stack capabilities are transitioning from a technological option three years ago to a competitive necessity today. It represents the inevitable stage of the AI industry's commercial maturity and foreshadows a future competitive landscape that places greater emphasis on systemicity and sustainability.'

Established Search Players Have Full - Stack AI Capabilities

As seen above, although the search war is raging fiercely, the access has not changed hands.

For this reason, the capital market is reevaluating 'Google and its contemporaries': Warren Buffett made his first purchase of Google in the third quarter of 2025, with 17.84 million shares propelling it to become his tenth - largest holding. Google is poised to become the third tech company with a market capitalization exceeding $4 trillion, while Hillhouse Capital, Citigroup, and others increased their stakes in Baidu in the third quarter of 2025.

In conclusion, as internet giants continue to intensify their efforts, the war centered around the crucial access of search is escalating, presenting a flourishing landscape in the short term. How the future competitive landscape will evolve remains to be seen.

The only certainty is that, regardless of the strategies employed, users are the true winners.