The Most Noteworthy Robots: Beyond Humanoid Forms

![]() 12/05 2025

12/05 2025

![]() 483

483

In 2025, the entire robotics sector is witnessing sustained and robust growth.

From Unitree at the start of the year, to Tesla's subsequent innovations, and XPENG Motors' recent advancements, groundbreaking products are frequently taking center stage and captivating audiences.

However, many are unaware that the robots truly deserving of attention now are not the popular humanoid robots or traditional industrial robots, but rather a field that some may not even be familiar with:

Collaborative robots.

[Maximum Certainty and Strongest Explosive Potential]

Collaborative robots can be viewed as an advanced alternative to industrial robots.

Traditional industrial robots typically operate solely in structured environments, relying on pre-programmed fixed trajectories and rigid control logic. They struggle to respond in real-time to dynamic changes, rendering them "inert."

In contrast, collaborative robots inherently prioritize human-machine interaction and environmental feedback mechanisms, offering greater flexibility and adaptability across various scenarios. They can adjust themselves as needed at any moment, making them "dynamic."

For an extended period, the application scenarios of collaborative robots have been relatively constrained, primarily centered around material handling. However, beginning in 2023, with the rapid evolution of underlying AI technologies, the capabilities of collaborative robots have expanded significantly, breaking through into numerous complex industrial scenarios such as assembly, welding, and palletizing.

Moreover, collaborative robots are gradually gaining economic advantages. For instance, their power consumption is roughly only one-third that of industrial robots.

More critically, the trend towards flexible production and intelligent manufacturing across the entire manufacturing sector is becoming increasingly pronounced, further underscoring and amplifying the value of collaborative robots' flexible responsiveness.

The convergence of these factors has positioned collaborative robots as nearly the most certain and explosive branch within the robotics field.

After years of rapid growth, industrial robots have now reached a bottleneck. According to GGII's statistics on the sales volume and growth of industrial robots in China, from 2021 to 2024, the growth rate of industrial robot sales in China has declined from 54% to -4.5%.

Although humanoid robots are generating significant buzz, they are still some distance away from large-scale commercialization.

According to Musk's plan, under optimistic conditions, Tesla aims to produce 1 million humanoid robots over the next five years, indicating that the industry's true explosion will not occur until at least after 2030.

In contrast, collaborative robots are already poised for takeoff.

According to CIC's estimates, with the explosion of demand in emerging scenarios such as commerce, healthcare, and scientific research education, the global market size for collaborative robots is expected to surge from $1 billion in 2023 to $5 billion in 2028, a fivefold increase in five years, with China serving as the absolute core market.

As the world's largest manufacturing country, China is experiencing the gradual disappearance of its demographic dividend, making the replacement of human labor with machines an inevitable trend.

Data from the Ministry of Industry and Information Technology reveals that China's industrial robot inventory has grown from 960,000 units in 2020 to 2.03 million units in 2024, more than doubling in four years, with the current inventory size ranking first globally.

The upgrading and replacement of over 2 million existing industrial robots will itself bring a significant incremental market for collaborative robots.

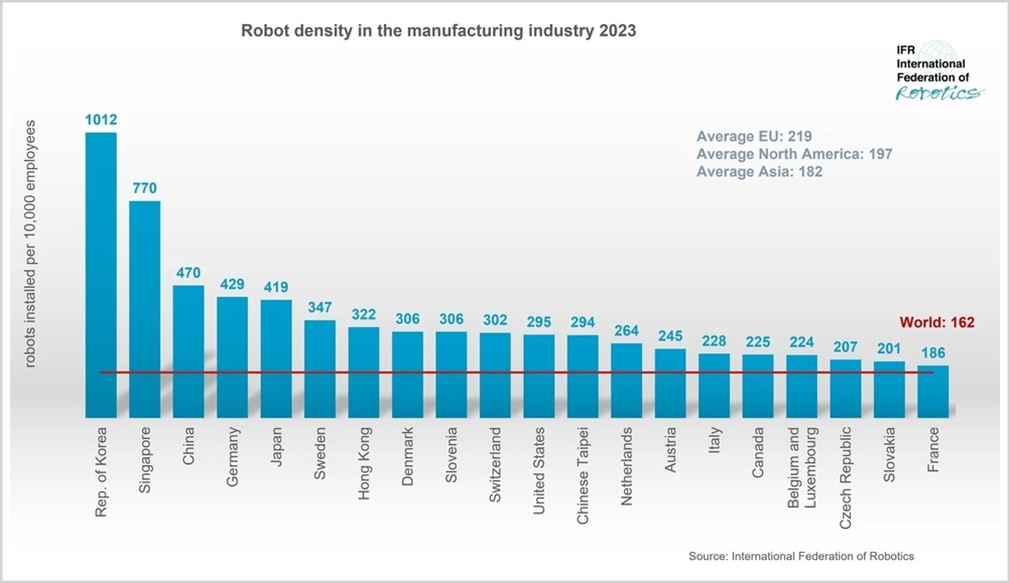

Moreover, in the long run, there is still substantial room for improvement in China's robot density.

According to a previous report by the International Federation of Robotics (IFR), China has approximately 470 robots per 10,000 employees, far below South Korea's 1,012 and Singapore's 770.

Some time ago, the State Council has already made significant deployments for the "AI Plus" initiative and recently issued the "Implementation Opinions on Accelerating Scenario Cultivation and Opening Up to Promote Large-Scale Application of New Scenarios."

Guided by top-level design, the entire embodied intelligence industry is poised to initiate a new wave of expansion in the coming years, with collaborative robots likely becoming the new protagonists.

[Overtaking on Curves and Reshaping the Global Landscape]

The transition from industrial robots to collaborative robots represents not only an industrial upgrade for China but also a strategic opportunity to surpass its competitors.

For an extended period, the global industrial robot industry has been dominated by Japan's Fanuc, Japan's Yaskawa Electric, Germany's KUKA (acquired by Midea Group), and Switzerland's ABB—the "Big Four"—with a combined market share once reaching as high as 70%.

However, the landscape for collaborative robots is entirely different, as no absolute leader has emerged in this field yet.

From an industry competition perspective, Denmark's Universal Robots holds approximately a 30%-40% market share in the global collaborative robot sector, making it the leader in this niche. Although Chinese companies have not yet taken the lead in market share, they have demonstrated clear competitive advantages.

Firstly, collaborative robots are characterized by their lightweight and flexibility. Many orders from downstream industries such as electronics, light industry, and consumer goods involve small-batch and diverse product needs. Compared to foreign companies, domestic firms offer greater research and development flexibility and strong customization capabilities, enabling them to quickly integrate resources and respond to market demands. For instance, while foreign brands typically require a 3–4 week supply cycle, Chinese companies can deliver from order placement to delivery in as fast as 7 days.

Secondly, collaborative robots are primarily used in non-critical, non-continuous production lines with higher error tolerance. As a result, downstream customers are relatively more accepting of domestic brands, facilitating the penetration of local companies into application markets—a situation entirely different from that of industrial robots.

Most critically, China's collaborative robot industry is already supported by a complete and mature local supply chain, with the localization rate of core components such as servo motors, sensors, and controllers continuously increasing. Currently, some manufacturers have achieved complete independent research and development of the entire technology chain, including hardware platforms, software platforms, core algorithms, and intelligent operations for collaborative robots, with a localization rate of key components reaching as high as 100%. This not only reduces costs but also effectively enhances supply chain security.

From a development prospect perspective, in addition to traditional collaborative robot companies deserving attention, another category of players warrants significant focus: companies crossing over from the automotive industry chain into the robotics sector.

In the past, robots were primarily service-oriented, essentially consisting of a chassis plus applications, without involving joint control and operation. Therefore, the "brain" and "cerebellum" could be separated, with the brain responsible for perception and decision-making, and the cerebellum for planning and control. Humanoid robots are entirely different, integrating perception, decision-making, planning, and control into one, requiring a high degree of coupling between the brain and cerebellum; otherwise, consciousness and actions would become disjointed.

In this context, a main controller capable of information processing and functional coordination becomes paramount.

Domestic leading intelligent driving companies possess extensive experience in delivering large-scale automotive-grade domain controllers, along with substantial accumulations and matured capabilities in underlying technology reserves, engineering capabilities, and large-scale mass production. Given that the complexity of automobiles is highly similar to that of robots, the capabilities accumulated in the field of autonomous driving domain controllers can largely be directly transferred to robot main controllers.

If these intelligent driving companies can achieve technological breakthroughs and closures first, they may realize industrialization and commercialization faster than existing players in the industry, potentially completely reshaping the global competitive landscape of collaborative robots.

According to ITjuzi's statistical data, in the first eight months of this year, the total financing in the domestic robotics sector at the primary market reached 38.624 billion yuan, far exceeding the 21.254 billion yuan for the entire year of 2024.

Capital's role in fueling the robotics sector has given rise to a large number of high-profile companies, garnering significant social attention and popularity.

However, from an investment and commercial realization perspective, the truly valuable entities now may actually be some enterprises that have not received widespread attention.

The former have "face," while the latter earn "substance."

Disclaimer

The content of this article concerning listed companies is based on the author's personal analysis and judgment of information publicly disclosed by the listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions in the article do not constitute any investment or other business advice. Market Value Observer does not assume any responsibility for any actions taken as a result of this article.

——END——