Kunlunxin's Journey to the Hong Kong Stock Exchange: Baidu's Final Gamble or a Breakthrough for China's AI?

![]() 12/08 2025

12/08 2025

![]() 397

397

Introduction: As the search giant cuts ties with its advertising revenue lifeline, a new surge, powered by computing prowess and a bet on chips, is quietly making waves in Hong Kong's stock market.

In 2025, Baidu's lifeblood is transitioning from traffic-driven advertising to silicon-based computing power. The tech behemoth, once synonymous with Chinese internet dominance through 'keywords,' now stakes its future on an AI chip—Kunlunxin—that is yet to be fully embraced by the market. This isn't just another spin-off; it's a 'strategic amputation.' By propelling Kunlunxin towards a Hong Kong IPO, Baidu aims to shed its 'outdated traffic company' tag and carve out a central role in the narrative of 'domestic computing power infrastructure.'

Yet, behind this high-stakes gamble lies a triple threat: dwindling advertising revenue, falling behind in the race for large AI models, and sluggish growth in its cloud business. More crucially, it underscores China's anxieties and aspirations for 'computing power autonomy' in the global AI race. The success or failure of Kunlunxin will determine whether Baidu can regain investor confidence and may well serve as a litmus test for its ability to construct a truly independent AI infrastructure ecosystem.

Baidu's Strategic Blueprint

Kunlunxin's choice of the Hong Kong stock market isn't a hasty adaptation but a calculated move driven by Baidu's intertwined strategic objectives. This decision reflects Baidu's astute assessment of its business structure, capital efficiency, and market perception.

Firstly, Kunlunxin's business nature necessitates an independent valuation logic distinct from Baidu's parent entity. As an AI chip and computing power infrastructure platform, Kunlunxin faces lengthy R&D cycles, substantial capital expenditures, and a challenging path to profitability. If indefinitely tied to Baidu's financial reports, its high investments would be perceived by the market as a 'drag,' exacerbating investor concerns about Baidu's 'reckless spending.'

Through a Hong Kong IPO, Kunlunxin can establish an independent financial disclosure system and valuation benchmark. Capital markets can then evaluate its technological progress, customer acquisition, and commercialization strategies without interference from Baidu's advertising business fluctuations. More importantly, once Kunlunxin secures external market recognition—such as orders from telecom giants, government bodies, or state-owned enterprises—its valuation surge will bolster Baidu's overall market capitalization, creating a 'dual-wheel drive' dynamic between parent and subsidiary.

Secondly, the Hong Kong stock market aligns better with Kunlunxin's customer and capital structure. While backed by Baidu, Kunlunxin's future growth hinges on external clients. Key customers like China Mobile and China Telecom are either listed on the Hong Kong stock exchange or closely tied to international capital. A Hong Kong listing would enhance Kunlunxin's credibility as a 'trusted supplier meeting international disclosure standards' for these clients. Additionally, Hong Kong attracts long-term Asian and Middle Eastern capital that is patient about long-cycle returns and willing to pay a premium for the 'national strategy + technological barrier' combination rather than chasing short-term profits.

Thirdly, the spin-off is crucial for Baidu to redefine its AI narrative. Over the past few years, Baidu's AI investments have often been reduced by the market to 'just another large model company,' lacking differentiation. Kunlunxin's independence allows Baidu to reposition itself as a 'full-stack AI platform spanning from foundational computing power to upper-layer applications.' This narrative shift is pivotal—it elevates Baidu's strategic value in the eyes of government and industrial clients while paving the way for future ecosystem collaborations, such as opening Kunlunxin's computing power to third-party cloud providers.

By opting for the Hong Kong stock market for Kunlunxin, Baidu is essentially undergoing a 'strategic weaning': it no longer attempts to indefinitely support a capital-intensive tech project with internal resources but instead pushes it into the market to face real-world commercial scrutiny. This isn't a retreat but an upgrade of Baidu's AI bet from 'self-bloodletting' to 'ecosystem co-investment.' For Baidu, this is both risk isolation and trust empowerment—it believes Kunlunxin's value deserves recognition by a broader world.

The $3 Billion Valuation: Capital Mirage or Domestic Computing Power's True Anchor?

The $3 billion valuation—a figure poised to spark polarizing debates in the 2025 AI chip landscape. Some dismiss it as inflated, given Kunlunxin's lack of large-scale profitability; others see it as justified, representing a scarce asset in China's AI infrastructure.

To assess its reasonableness, we must step outside traditional chip company valuation frameworks and re-examine Kunlunxin through an 'ecosystem platform' lens rather than a 'single product' one.

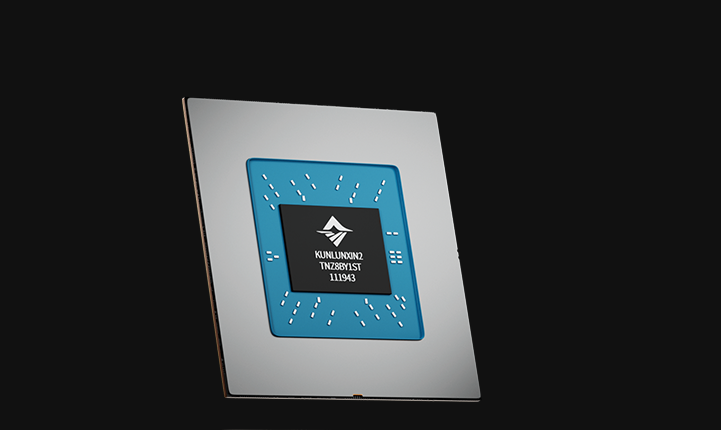

Firstly, Kunlunxin's value extends far beyond a single chip. It serves as the 'silicon heart' of Baidu's AI strategy: powering the trillion-parameter training of Baidu's Wenxin large models, driving inference clusters for Baidu Smart Cloud, and embedding into AI deployment solutions for finance, government, telecom, and other critical industries. While its latest M100/M300 series chips haven't publicly released benchmark comparison data, internal tests show their large model inference energy efficiency nearing that of the A10 level, with deep synergy with Baidu's PaddlePaddle framework significantly reducing developer migration costs. This 'chip + framework + model + cloud service' full-stack capability is nearly unique in China.

Secondly, commercialization signals are accelerating. In Q3 2025, Kunlunxin secured China Mobile's AI server procurement project, marking its first entry as an independent supplier into a national-level computing power procurement system. As the largest buyer of domestic computing power, telecom operators' orders represent not just revenue but industry credibility. Once China Mobile opens the door, orders from China Unicom, China Telecom, and even the National Supercomputing Center may follow. More critically, Kunlunxin is negotiating with multiple state-owned cloud providers to integrate its computing units into the government-led 'National Integrated Computing Power Network'—success here would secure long-term, stable, policy-driven order guarantees.

Thirdly, U.S. export controls on high-end GPUs to China have expanded from A100/H100 to 'special edition' H20/L20 models, exposing China's AI industry to systemic risks. Against this backdrop, national-level AI computing power security has become a strategic priority, with policies like 'East Data, West Computing' and the 'High-Quality Development Action Plan for Computing Power Infrastructure' rolling out intensively. State-owned funds now show unprecedented willingness to invest in domestic chips. As one of the few targets with 'real deployment + ecosystem closure + major client validation,' Kunlunxin naturally becomes a favorite under the dual logic of capital risk aversion and industrial security.

Of course, risks loom large. The $3 billion valuation rests on 'future realization,' and the commercialization path for AI chips is fraught with pitfalls: Will performance withstand third-party evaluations? Can the software ecosystem attract independent developers? Will clients abandon migration due to compatibility issues? More dauntingly, over a dozen domestic AI chip companies—including Cambricon, Hygon, Moore Threads, and Muxi—are already competing, with some listed and others securing billion-dollar funding. The sector is already a red ocean.

Kunlunxin's valuation is ultimately a 'trust-based' pricing—whether capital markets believe Baidu can translate technological advantages into commercial barriers and whether China can achieve true autonomy at the AI computing power base.

The $3 billion figure is both a validation of past investments and an advance on future ecosystems. If Kunlunxin doubles revenue, turns gross margins positive, and attracts over 10,000 ecosystem developers within two years, this valuation will prove 'undervalued.' If it remains trapped in internal dependency, ecosystem isolation, and performance bottlenecks, it could become another 'story collapse' case study. This valuation gamble is not about chips but China AI's industrial confidence.

From 'Forgotten Giant' to 'Gatekeeper of the Computing Power Era'?

The true protagonist of Kunlunxin's IPO is not the chip itself but Baidu behind it.

Q3 2025 financials reveal a harsh reality: Baidu's advertising revenue declined year-over-year, while AI business growth exceeded 50% but still accounted for less than 30% of total revenue, with high costs. More critically, in the AI large model race, Baidu has fallen from 'leader' to 'also-ran'—Alibaba's Tongyi leverages e-commerce scenes, Tencent's Hunyuan embeds deeply in social ecosystems, Huawei's Pangu benefits from a hardware + cloud closed loop, while Baidu's Wenxin, though technically solid, lacks strong scene traction and risks marginalization.

In this desperation, Kunlunxin becomes Baidu's only narrative pivot. By positioning it as the 'domestic AI computing power base,' Baidu attempts an identity revolution:

From 'search + advertising' company → full-stack AI infrastructure platform

From 'algorithm provider' → foundational computing power + ecosystem + service builder

From 'commercial company' → key participant in national science and technology strategy

If successful, Baidu will shed its image as a legacy internet giant reliant on traffic and become an indispensable 'gatekeeper' in China's AI industrial chain—controlling the entire chain from silicon-based computing power to large model deployment and potentially revaluing itself as a platform infrastructure company with far higher PE multiples than application-layer AI firms.

But the cost of this transformation is steep. Kunlunxin requires sustained massive investments, while Baidu's own cash flow is under pressure. Kunlunxin needs an open ecosystem, yet Baidu has historically struggled with 'platformization.' Kunlunxin must win external clients, but market doubts linger about its 'Baidu-affiliated' identity. A rupture in any link could collapse the entire strategy.

The industry quip, 'Without Kunlunxin, Baidu would be forgotten,' encapsulates its AI-era predicament.

Epilogue

Kunlunxin's Hong Kong IPO is a mirror reflecting a giant's self-redemption amid technological upheaval; it is a spark igniting hopes for domestic AI computing power autonomy; it is a do-or-die card determining whether Baidu can secure a place in the new AI era.

Over the next three years, Kunlunxin must achieve three leaps: from 'internal project' to 'industry public good,' from 'policy beneficiary' to 'market choice,' and from 'tech demo' to 'commercial closed loop.' Every step is fraught with challenges.

This gamble is not just about Baidu's future but a pivotal battle for whether China AI can truly 'stand on its feet.'