Reducing Losses While Making Major Investments in AI Chip Manufacturers: When Will Fourth Paradigm Reach the Commercial Inflection Point?

![]() 12/08 2025

12/08 2025

![]() 579

579

【Abstract】Recently, Fourth Paradigm released its Q3 2025 report, showcasing a remarkable performance with revenue reaching RMB 4.402 billion, a year-on-year increase of 36.8%.

This technology company, specializing in enterprise-level AI, has positioned its Prophet AI Platform, Shift Intelligent Solutions, and ShiShuo AIGS Services to leverage product performance and continuously narrow losses, standing at a commercial inflection point.

Furthermore, Fourth Paradigm's strategic investments in AI chip companies have sparked industry discussions. What is the deeper intention behind its layout (positioning) amidst its own losses? Where lies the ultimate battleground for enterprise-level AI?

The following is the main text:

As Bank of Communications achieves a leap in decision-making efficiency through its bank-wide AI platform and Yonghui Supermarket significantly reduces operational costs through intelligent systems, Fourth Paradigm, an AI company established in 2014, is transitioning from a technology service provider to an industry value reconstructor. The Q3 2025 report shows that the company's revenue reached RMB 4.402 billion, a year-on-year increase of 36.8%. Whether analyzed from a business layout (positioning) perspective or based on financial fundamentals, everything indicates that Fourth Paradigm, a decade-old AI veteran, has reached a critical commercial inflection point.

Full-Stack Business: Underlying Technology + Platform Products + Industry Solutions

Fourth Paradigm is a technology company specializing in enterprise-level AI services. With 'AI Decision-Making' as its core, it has built a full-stack business system comprising 'Underlying Technology + Platform Products + Industry Solutions.' Currently, the company's commercialization capabilities have been validated in key sectors such as finance, retail, and energy.

The company's business consists of three main modules: Prophet AI Platform (4Paradigm Sage), Shift Intelligent Solutions (4Paradigm Shift), and ShiShuo AIGS Services (4Paradigm AIGS).

The Prophet AI Platform is the company's core product, providing enterprises with a one-stop AI development and deployment platform. It integrates functions such as machine learning, model training, and automated toolchains, supporting rapid AI application development and deployment across multiple industries, including finance, retail, manufacturing, and healthcare.

On September 22, 2025, the company launched ModelHubXC and the AI Engine EngineX, focusing on model architecture adaptation to achieve efficient compatibility with domestic computing power. Currently, the platform supports trusted computing power from Huawei Ascend, Cambricon, Iluvatar CoreX, Kunlun Core, MetaX, and XiWang. The company explicitly stated that over the next six months, the number of adapted and certified models will gradually increase to the thousands; within a year, it will reach the tens of thousands; and subsequently, it will maintain this update pace, covering all mainstream trusted computing power in the market.

In the first three quarters of 2025, the Prophet AI Platform achieved revenue of RMB 3.692 billion, a year-on-year increase of 70.1%, accounting for 83.9% of the group's total revenue.

Shift Intelligent Solutions is an extension of the Prophet Platform in the solutions domain, providing standardized AI solutions for specific industry scenarios to help enterprises address business pain points and accelerate digital transformation.

For example, it has created an 'all-customer, all-channel, all-product' ecological operating model for the financial industry, achieving a balance between extreme security and revenue growth in risk control scenarios. For retail enterprises, it offers end-to-end optimization tools from intelligent pricing to supply chain collaboration. Yonghui Cai Shi Xian achieved an operational transformation of 'system-driven decision-making replacing manual decisions' through this solution, significantly reducing management costs.

ShiShuo AIGS Services provide the AI technology foundation for the Prophet Platform. Based on generative AI technology, it offers one-stop services for the entire enterprise R&D process, including code continuation, comment generation, code correction, code refactoring, and unit test generation, assisting enterprises in building AI applications.

In the first three quarters of 2025, Shift Intelligent Solutions and ShiShuo AIGS Services achieved revenues of RMB 602 million and RMB 108 million, respectively, accounting for 13.7% and 2.4% of the group's total revenue.

Additionally, the company has recently expanded into the consumer electronics sector (Phancy brand), launching AI Agent + hardware integrated products such as smart mice and conference systems, extending AI capabilities to the C-end market.

Overall, the three major businesses are closely integrated, forming a virtuous cycle where technology serves as the platform foundation, the platform empowers solutions, and solutions feed back into the platform, enabling the company to leverage product strength to drive a leap in financial fundamentals.

Financial Fundamentals: Rapid Revenue Growth, Continuously Narrowing Losses

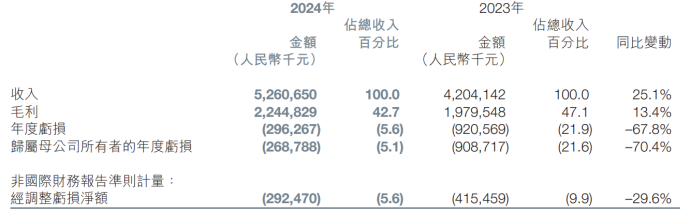

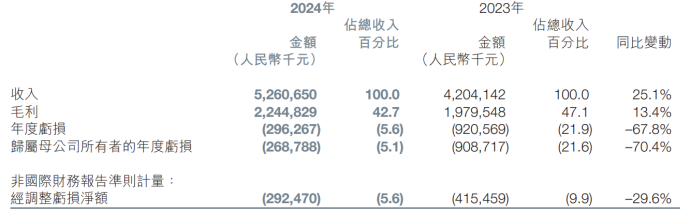

The company's revenue has grown rapidly. Financial reports show that in 2024, the company's revenue was RMB 5.261 billion, a year-on-year increase of 25.1%. In the first three quarters of 2025, revenue reached RMB 4.402 billion, a year-on-year increase of 36.8%.

On the one hand, the core driver of revenue growth comes from the Prophet AI Platform. By product, from 2023 to the first three quarters of 2025, the revenue proportion of the Prophet AI Platform was 59.6%, 69.87%, and 83.9%, respectively, showing a clear upward trend. In the first three quarters of 2025, the platform achieved revenue of RMB 3.692 billion, a year-on-year increase of 70.1%, with an average revenue per benchmark customer of RMB 25 million, a year-on-year increase of 71.4%.

On the other hand, revenue growth is not dependent on low-price expansion but is built on a healthy gross margin structure. In the first three quarters of 2025, the company achieved a gross profit of RMB 1.621 billion, a year-on-year increase of 20.1%, with a further accelerated growth rate. In 2024, the company's gross margin was 42.7%, significantly higher than the average level in the AI services industry, reflecting the technical added value of its products and customer willingness to pay.

Notably, in 2024, the net loss attributable to the parent company was RMB 269 million, a year-on-year narrowing of 70.4%, marking the third consecutive year of loss reduction since 2022. The narrowing of losses is mainly attributed to two factors: first, the expansion of revenue scale diluting fixed costs, and second, the increase in the revenue proportion of high-margin industry solutions, effectively optimizing the revenue structure.

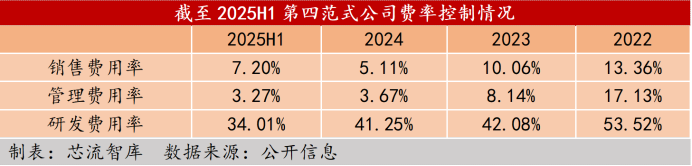

Furthermore, the narrowing of losses is also due to the optimization of expense ratio control. In 2024, the company's sales expense ratio was 5.11%, a year-on-year decrease of 4.95%. This is partly due to the reduction in personnel costs from the sale of subsidiaries and partly because the large B-end model relies more on technology and reputation rather than high-cost promotion. During the same period, the company's administrative expense ratio was 3.67%, a year-on-year decrease of 4.47%, mainly due to the reduction in listing-related expenses and improved internal operational efficiency.

In terms of solvency, as of the first half of 2025, the company's current assets reached RMB 5.893 billion, with total assets of RMB 7.759 billion, while current liabilities were RMB 1.483 billion, and total liabilities were only RMB 1.497 billion. The current ratio was 3.97, and the asset-liability ratio was 19.29%, far below the industry average. Abundant cash flow and a low-debt structure provide solid support for its continuous R&D investment, market expansion, and strategic investments, laying the foundation for the subsequent arrival of a profit inflection point.

Positioning in AI Chips: Strategic Positioning for Software-Hardware Synergy

According to the Q3 2025 performance announcement, Fourth Paradigm's strategic positioning in the AI chip sector is evident. It not only directly holds over 9% of the shares in Hangzhou XiWang CoreX Intelligent Technology Co., Ltd., a leading domestic GPU manufacturer, but also strategically invests in another domestic GPU leader, Shanghai Iluvatar CoreX Semiconductor Co., Ltd., through its subsidiary fund.

Fourth Paradigm's positioning in chips has a long history, having initiated strategic investments in the AI chip sector as early as 2020. Essentially, it is a strategic positioning for software-hardware synergy, with the core logic summarized in the following three points:

First, to meet the emerging needs of privatized deployment. With the rise of the enterprise-level AI market, the demand for privatized AI deployment has surged, and the shortcomings of general-purpose chips have become increasingly apparent. Applications such as real-time risk control in the financial industry and equipment quality inspection in industrial scenarios have rigid requirements for data privacy protection and low-latency response. The traditional cloud-based GPU deployment model cannot meet data security needs and suffers from computing power losses. Moreover, the procurement and maintenance costs of general-purpose chips from manufacturers like NVIDIA are exorbitant. In this context, the company must seek alternatives.

The AI chips invested in by Fourth Paradigm, XiWang CoreX and Iluvatar CoreX, both focus on customized AI computing power chips. XiWang CoreX specializes in high-cost-performance inference chips, with unit power consumption performance exceeding that of general-purpose GPUs by over 40%. Iluvatar CoreX's high-performance training chips have been adapted to meet the large model training needs in scenarios such as financial risk control and industrial quality inspection.

Second, to build technical barriers for a software-hardware collaborative ecosystem. Currently, Fourth Paradigm's self-developed Sage AIOS operating system has achieved deep adaptation with the GPUs of XiWang CoreX and Iluvatar CoreX. By directly calling chip instruction sets, it achieves end-to-end optimization from algorithm development to hardware deployment, improving AI model operation efficiency by 35%-50% compared to general-purpose GPU platforms.

This synergy not only enhances the company's product strength but also significantly increases customer switching costs through the 'Sage AIOS + customized chip' bundling model. If a customer wants to switch hardware suppliers, they would need to re-adapt the entire AI platform, thereby building a solid customer stickiness barrier.

Finally, to achieve autonomous control over the supply chain. With the increasing uncertainty of the global chip supply chain, technological autonomy and controllability have become the survival bottom line (changed to 'bottom line' in English, but kept as ' bottom line ' in the Chinese original for this JSON structure) for enterprise-level AI service providers.

Previously, Fourth Paradigm relied on external manufacturers like NVIDIA for hardware, lacking risk resistance in the face of chip sales bans and supply chain fluctuations. By investing in AI chip companies such as XiWang CoreX and Iluvatar CoreX, it not only pre-secures core computing power resources but also achieves a domestic GPU + self-developed AI platform localization substitution (changed to 'domestic substitution' in English, but kept as ' localization substitution ' in the Chinese original for this JSON structure) solution through joint optimization, ensuring stable solution delivery under extreme conditions.

Epilogue

Fourth Paradigm has reached its commercial inflection point, not only reflected in the financial fundamentals of revenue growth and loss narrowing but also in the construction of an AI ecosystem and the enhancement of platform stickiness.

The ultimate battleground for enterprise-level AI has never been a competition of algorithm model parameters but an all-round competition of 'computing power foundation + software platform + industry ecosystem + scenario implementation.' Fourth Paradigm has crack (changed to 'addressed' in English, but kept as ' crack ' in the Chinese original for this JSON structure) computing power bottlenecks with customized GPUs, bound customer ecosystems with AIOS, and solidified its commercial foundation with industry solutions, establishing a 'hard technology + real scenarios' survival rule for domestic AI.

It provides a crucial reference for Chinese AI companies struggling on the path to commercialization: true barriers stem from a profound understanding of core industry needs and the construction of closed-loop capabilities. Only by creating real value for customers can sustainable commercial success be achieved.

However, after the inflection point, the real challenges begin. The full-stack model, while building high barriers, also implies heavier resource investment and more complex collaborative management. How to balance the long cycle of chip investments with the urgency of commercial returns? How to balance platform openness with ecosystem control? Whether Fourth Paradigm can translate its first-mover advantage into sustained scalable growth ultimately tests its operational depth and strategic patience as a 'platform-type organization.'

- XINLIU -