The Shadow Fed Steps In: Is a 3% U.S. GDP Growth in 2026 the Baseline for the AI Era?

![]() 12/09 2025

12/09 2025

![]() 584

584

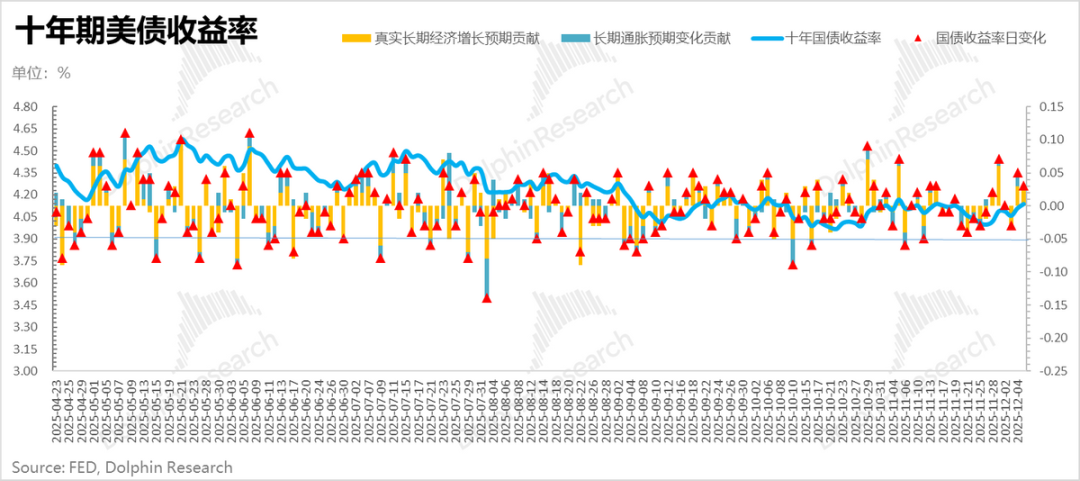

As 2025 draws to a close after a year of volatile market trends, the current macroeconomic focus is on the appointment of the new Federal Reserve Chair in 2026, along with a series of macroeconomic data releases. How will these factors shape the interest rate cut path for 2026?

Additionally, with a surge in corporate long-term bond issuance under AI capital expenditures (Capex), coupled with the Beautiful Big Act and a more dovish Federal Reserve stance, how will long-term bond yields evolve in 2026? Can they be effectively managed?

Next, let's delve into these questions one by one:

I. Does the Current Economy Support Interest Rate Cuts?

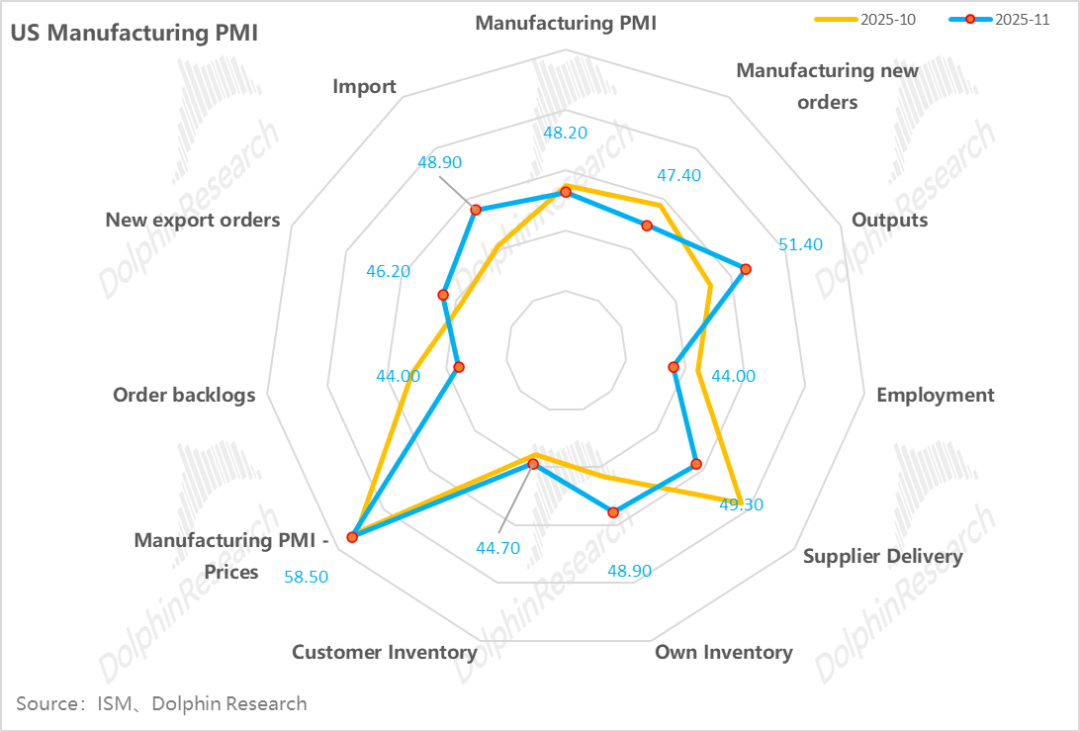

Recent economic data indicates a weakening in the U.S. manufacturing PMI following government shutdowns, with the critical new orders component remaining below the 50-mark in November and continuing to deteriorate.

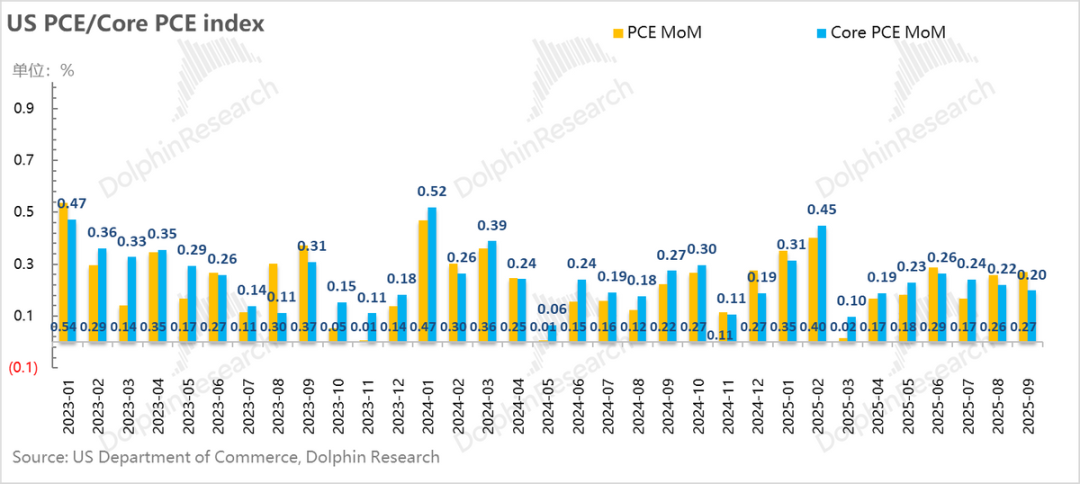

Furthermore, while the September PCE data, though somewhat outdated, shows a month-over-month core PCE price increase of 0.2%, translating to an annualized rate of 2.4%, this remains supportive of further rate cuts given the current interest rate range of 3.75-4%.

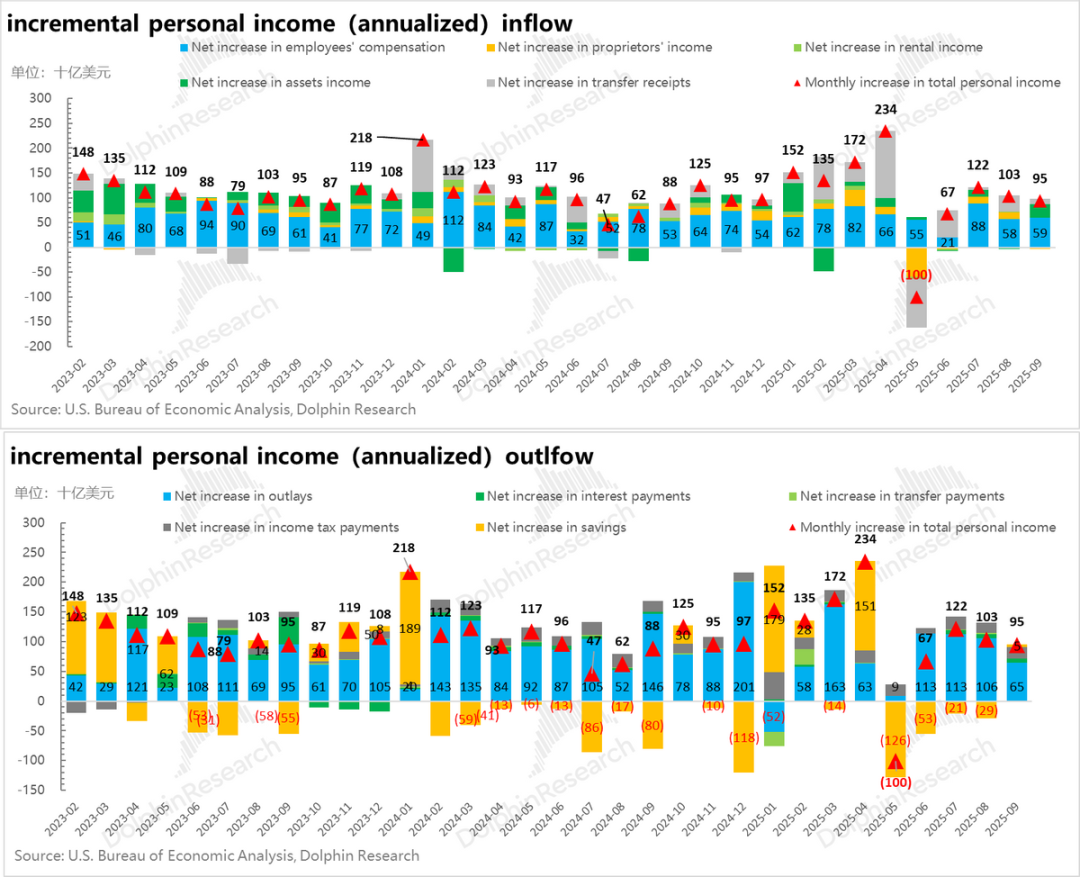

In terms of household spending and income trends, September saw U.S. households largely living within their means, with consumption no longer squeezing savings, leading to a decline in nominal consumption growth from 0.5% to 0.3% month-over-month.

Despite fluctuations in other income components, stable wage income and high asset income (interest + dividends) kept overall household income growth steady in September.

Overall, these data points suggest a steady but slowing economic pace. September inflation, despite tariff-related disruptions, saw core PCE return to a 0.2% growth rate, while consumption data remained stable but weakened slightly, and the November PMI contracted modestly.

Regardless of Powell's perspective, following the logic of the 'Shadow Federal Reserve Chair' Hassett (explained in detail below), actual price levels have eased, inflation risks are low, and economic data, driven by AI investments, remains weak. Interest rates are overly restrictive, and 2026 should fully unleash AI's potential to drive economic growth. Any growth below his preset (presumed) potential would justify further rate cuts.

II. The Arrival of the Shadow Fed: How Should We Interpret Friday's Rate Cut?

After a period of mixed expectations, the market now assigns a 95% probability to a Federal Reserve rate cut this week. With one of the Fed's current goals being to avoid surprising the market, a 25 basis point cut is widely expected.

Given the consensus on a 25 basis point cut, Powell's post-cut rhetoric will be the true marginal incremental information. With growing internal disputes over rate cuts, Powell may adopt a 'hawkish cut' stance, issuing stern warnings such as, 'The future path is uncertain, and one should not presume the Fed will cut rates further.'

However, Dolphin Research believes that if the market retreats due to such 'hawkish' rhetoric, there is no need for excessive fear, as the Shadow Fed is now taking shape. While the market will heed Powell's guidance, at this juncture of power transition, it will also closely watch statements from the 'prospective Federal Reserve Chair.'

Hassett's recent remarks suggest he has set an excessively high bar for next year's economic performance. If this threshold is not met, it will likely be attributed to excessively high interest rates impeding AI productivity's impact on the economy.

In other words, Powell's authority in guiding market expectations will be significantly diminished going forward.

III. Hassett vs. Powell: Is a Fiscal-Dominated Federal Reserve Era Approaching?

As discussed in our previous strategic weekly report, facing the 2026 midterm elections, the Republican Party needs to regain the narrative of 'Making America Affordable Again' to avoid a sweeping defeat by the Democratic Party.

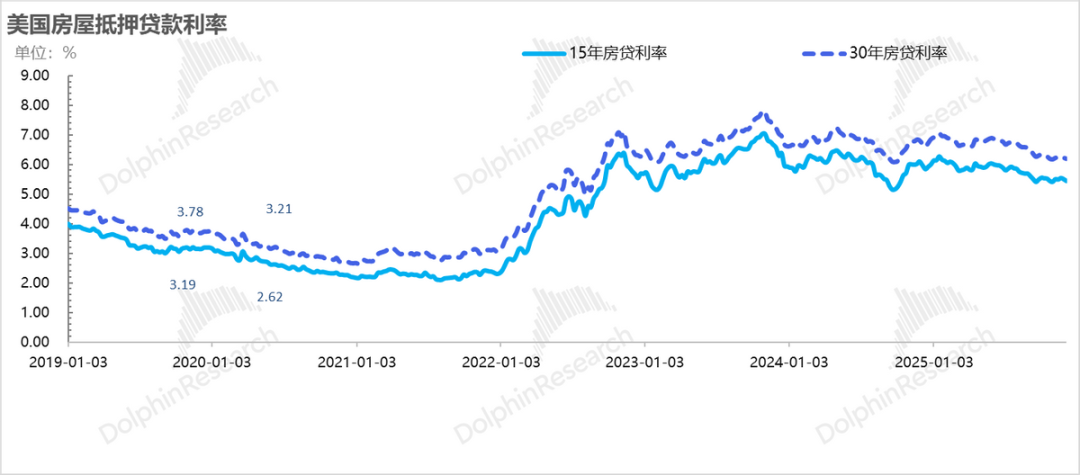

A crucial aspect of this narrative is ensuring affordable rent, which is closely tied to mortgage rates. Thus, Trump will likely pressure the new Federal Reserve Chair to advance rate cuts.

Currently, Hassett is the leading candidate for Federal Reserve Chair. As the Director of the National Economic Council, a top-tier White House economic advisory role, he is a key spokesperson for Trump's economic policies.

In a recent interview, Dolphin Research noted several critical preliminary forecasts Hassett made for 2026:

a: AI advancements could boost U.S. productivity to 3-4% next year;

b: A 3-4% productivity increase should correspond to similar economic growth rates, with even 3% growth being 'disappointing' to him;

c: He cited an example from the 1990s, during Greenspan's Fed tenure (1987-2006), when computers enhanced productivity. Some Fed members wanted to raise rates due to low unemployment, but Greenspan refused, believing productivity gains would naturally suppress inflation, leading to subsequent years of economic prosperity.

Hassett argues that AI's efficiency gains will be even faster and more pronounced than those from computers. The Fed should not suppress such 'supply-side shocks.'

Together, these points outline a highly optimistic baseline for U.S. economic growth starting next year—above 3%. Anything below this threshold would suggest policies have failed to unlock AI-driven productivity improvements.

Currently, the mainstream market expectation for U.S. economic growth in 2026 hovers around 2%, significantly lower than Hassett's forecast. He also highlights several upward drivers in the first quarter, such as U.S. companies beginning factory construction, AI capital deployment, implementation of the Beautiful Big Act, and tax cuts for households, suggesting a strong start to 2026.

Once this narrative is established and market expectations are 'reset,' any failure to achieve high growth around 4% in early 2026 would pave the way for rate cuts under his Fed leadership.

However, the actual path of rate cuts in 2026 is unlikely to be dictated solely by the Federal Reserve Chair, as the Fed's decision-making mechanism is inherently 'collective':

a. Seven members of the Federal Reserve Board of Governors (nominated by the President and confirmed by the Senate);

b. The President of the Federal Reserve Bank of New York, with permanent voting rights;

c. Four of the remaining 11 regional Federal Reserve Bank Presidents, serving on a rotating basis (one-year terms).

The duration of this collective decision-making structure remains uncertain, as Bessent has called for Federal Reserve institutional reforms, including requiring at least three years of local residency for candidates nominated by the 11 regional banks.

The extent to which this collective decision-making system will be retained amid institutional reforms remains to be seen.

IV. Can Long-Term Bond Yields Be Contained Amid Fiscal and Monetary Expansion and a Flood of Corporate Debt in 2026?

Dolphin Research notes that given the recent tightness in U.S. dollar liquidity and frequent use of the Fed's Standing Repo Facility (SRF), markets anticipate potential balance sheet expansion by the Fed.

One approach would be for the Fed to purchase short-term bonds to replenish bank reserves, ensuring reasonable bank reserve adequacy, which does not constitute genuine quantitative easing (QE).

If the Fed can manage short-term rates, could it also control long-term rates? Might the new Fed begin to manage both ends of the yield curve, implementing long-term rate controls through purchases of benchmark long-term bonds to serve the goals of the AI infrastructure era?

After all, Dolphin Research observes that high-quality corporate debt, such as that guaranteed by Meta, already carries a 6.58% interest rate (24-year term). Financing the AI infrastructure boom at such high rates imposes excessively stringent long-term internal rate of return requirements on projects.

In summary, for 2026, Trump's likely approach remains to aggressively suppress prices in People's wellbeing (people's livelihood) sectors (e.g., healthcare through drug procurement reforms akin to China's, swiftly concluding the Russia-Ukraine war to lower oil prices, ramping up domestic traditional energy including nuclear, and pressuring interest rates to decline to lower housing costs), creating an administratively suppressed 'price-controlled' environment.

Simultaneously, through fiscal and monetary measures such as AI infrastructure spending, the Beautiful Big Act, and tax cuts, he aims to foster economic prosperity, ensuring victory in the 2026 midterm elections while balancing short-term price objectives with medium-term AI strategic goals. The U.S. economy in 2026 faces no significant risks.

V. Portfolio Returns

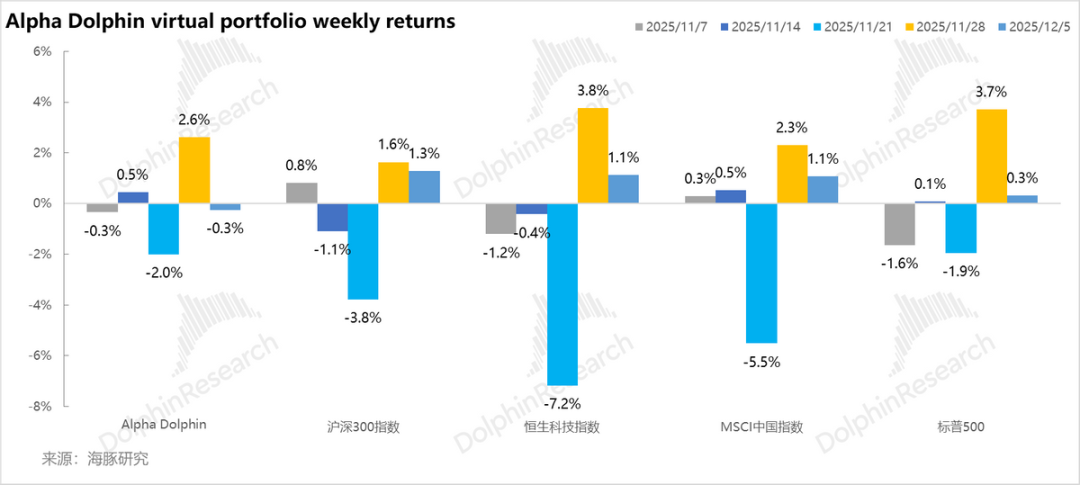

Last week, Dolphin Research's virtual portfolio, Alpha Dolphin, made no adjustments. It declined by 0.3%, underperforming the CSI 300 (+1.3%), MSCI China Index (+1.1%), Hang Seng Tech Index (+1.1%), and the S&P 500 (+0.3%).

This underperformance was primarily driven by drag from gold and U.S. Treasuries in our portfolio, compounded by weakness in consumer stocks among our equity holdings.

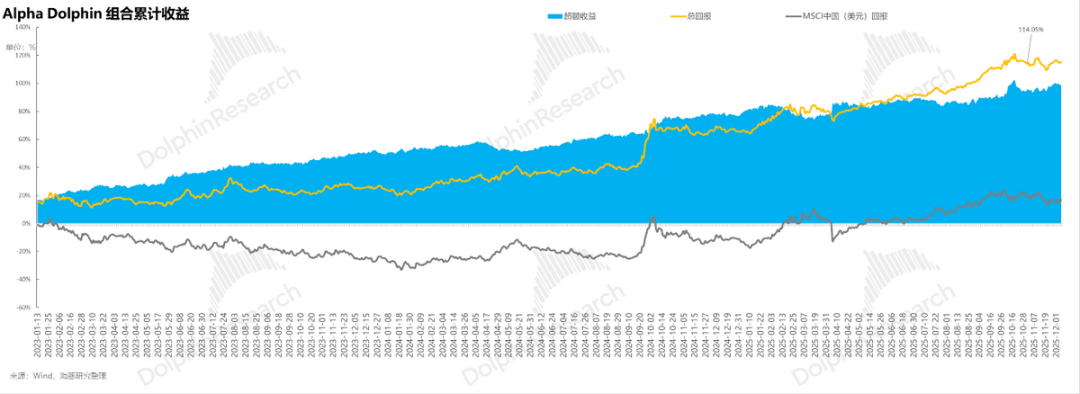

Since the portfolio's inception (March 25, 2022) through last weekend, it has delivered an absolute return of 115%, outperforming the MSCI China Index by 98%. From a net asset value perspective, our initial virtual portfolio of $100 million has grown to over $217 million as of last weekend.

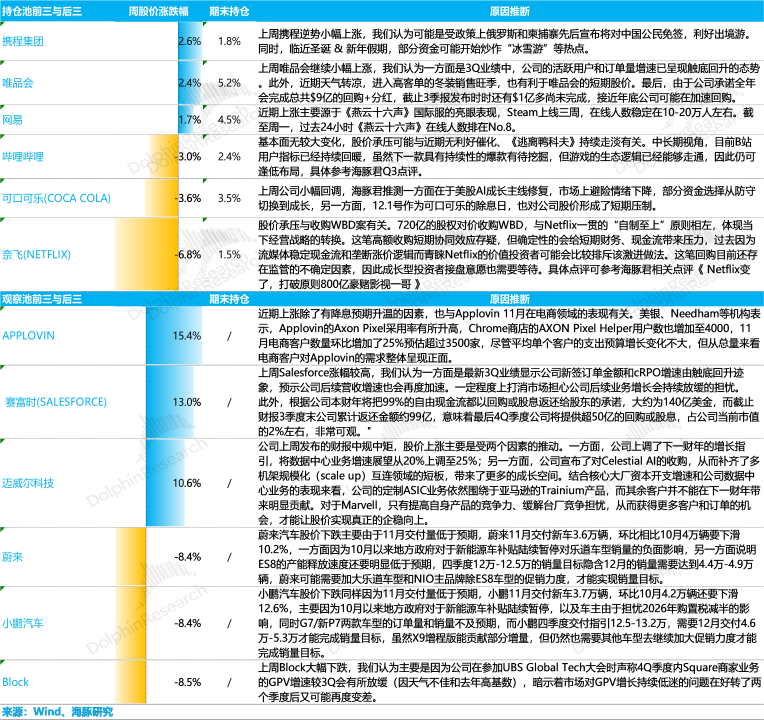

VI. Individual Stock Contributions to Gains and Losses

Last week, Alpha Dolphin underperformed the indices primarily because, as rate cuts approached, the market favored small, high-growth stocks, a segment where our portfolio is underweight, leading to underperformance relative to market indices. Key individual stock movements are explained below:

VII. Portfolio Asset Allocation

The Alpha Dolphin virtual portfolio currently holds 18 individual stocks and equity ETFs, with 7 at benchmark weight and the remainder underweight. Non-equity assets are primarily distributed among gold, U.S. Treasuries, and U.S. dollar cash, with the current allocation roughly 55% equities to 45% defensive assets (gold/U.S. Treasuries/cash).

As of last weekend, the asset allocation and equity holdings weights of the Alpha Dolphin portfolio have been published in the Longbridge App under the 'Dynamic - Research' section in an article with the same title. Additionally, Dolphin Research's timely hot topic comments and updates on major corporate events are prioritized on the Longbridge App rather than on public platforms.

VIII. Key Events Next Week

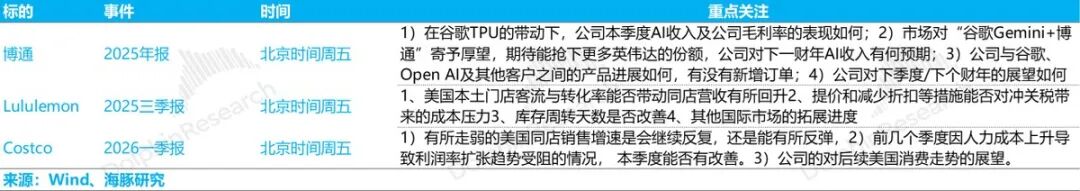

As the U.S. earnings season winds down this week, only Broadcom remains among AI stocks to report, offering insights into order progress for affordable AI computing ASICs. Additionally, two relatively weak consumer stocks, Lululemon and Costco, will release earnings, with key areas of focus as follows:

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Reproduction requires authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data reference, catering to users of Dolphin Research and its affiliated entities for general reading and data reference purposes. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or unique needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any investment decisions made using or referencing the content or information in this report are undertaken at the investor's own risk. Dolphin Research shall not be held liable for any direct or indirect responsibilities or losses that may arise from the use of data contained in this report. The information and data in this report are based on publicly available sources and are intended for reference only. Dolphin Research strives to ensure, but does not guarantee, the reliability, accuracy, and completeness of the information and data provided.

The information or viewpoints expressed in this report shall not be construed as, or deemed to be, an offer to sell or a solicitation to buy securities in any jurisdiction, nor shall they constitute recommendations, inquiries, or endorsements regarding relevant securities or financial instruments. The information, tools, and materials in this report are not intended for, or directed at, individuals or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, or materials conflicts with applicable laws or regulations or subjects Dolphin Research and/or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, insights, and analytical methods of the relevant creators, and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) make, copy, reproduce, duplicate, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Research will reserve all related rights.