Striving to Be the 'Chinese NVIDIA': Is Baidu Letting Its 'Crown Jewel' Kunlunxin Fly Solo?

![]() 12/10 2025

12/10 2025

![]() 472

472

Reported by Cao Anxun, a journalist from Sing Tao Daily, in Guangzhou

"When the Qin Empire lost its symbolic deer, the world scrambled for it, with the swift and the talented seizing the prize first."

NVIDIA was once deeply entrenched at the heart of China's AI industry chain, crafting a stock market legend that saw its shares soar 25-fold over five years. Today, amidst U.S. export restrictions on China and a reshaping of the global computing power landscape, domestic Chinese chip companies are seizing the moment to vie for the title of the 'Chinese NVIDIA.'

Recently, whispers have surfaced that Baidu's subsidiary, Kunlunxin, is planning to spin off and go public. In response, Baidu's stocks in both Hong Kong and the U.S. have surged, with Baidu Group—SW (09888.HK) jumping 5% and its U.S. stock (BIDU.NAS) climbing approximately 5.85% on December 5.

On December 7, Baidu confirmed that it is evaluating the spin-off and listing of Kunlunxin. If implemented, the move will undergo relevant regulatory approval procedures, though no guarantees have been made.

However, Baidu's announcement did little to dampen investor enthusiasm. On December 9, Baidu's U.S. stock continued its upward trajectory, rising by 3.5%.

Capital Darling

Since the beginning of the year, Kunlunxin has made repeated breakthroughs in technology R&D and commercialization. Given this backdrop, capitalizing on the spin-off of a subsidiary can further unlock its core business value, making Baidu's consideration a logical step.

The prevailing market sentiment is that spinning off Kunlunxin is an inevitable move for Baidu to seize the window of opportunity for domestic AI chips, break free from valuation constraints, expand its business boundaries, and secure more resources to compete in the computing power arena.

Especially in the capital markets, domestic AI chips are gaining significant traction.

Although Baidu has not disclosed Kunlunxin's revenue figures, since its independent financing in 2021, Kunlunxin has secured 14 venture capital financing rounds. As of July 2025, Kunlunxin's financing has reached Series D, raising $283 million, with investors including the Beijing Municipal Government Guidance Fund, Southern Power Grid Fund, BYD, BOC International, and CICC Capital. Its post-investment valuation has also risen from 13 billion yuan in 2021 to approximately 21 billion yuan.

In the past, the market often viewed Baidu as an advertising and marketing company, leading to an undervaluation of its AI technology assets. According to CMB International, although Baidu currently relies on its advertising business, as its cloud services, autonomous taxi services, and AI-related new businesses make more progress, it is expected to drive a revaluation of the company.

This will also broaden Kunlunxin's business horizons. BOC International released a research report as early as September this year, predicting that the separate spin-off of Kunlunxin is inevitable. This will not only help avoid U.S. sanctions risks but also facilitate its adoption by other internet companies, secure a more reasonable valuation in the capital markets, attract more capital injections, and accelerate its development.

However, as the 'most valuable department' in the eyes of many investors, Kunlunxin's billion-yuan valuation can no longer meet market expectations.

BOC International predicts that Cambricon's A-share market capitalization will reach $80 billion, while other domestic GPU companies' expected valuations upon listing in Hong Kong range between 30 billion and 100 billion Hong Kong dollars. Kunlunxin's valuation should be at the forefront of this range.

The confidence that has capital markets excited stems from the better-than-expected stock price growth of leading domestic AI chip companies after their listings, as evidenced by Cambricon and Moore Threads. For instance, on their debut days, Cambricon and Moore Threads' stock prices soared by 290% and 425%, respectively, becoming the focus of attention.

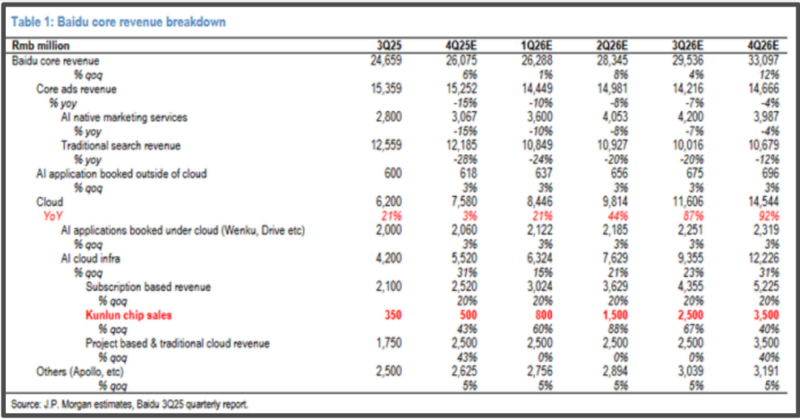

Financial data underpins corporate valuations. In a November research report, JP Morgan predicted that Kunlunxin's sales could grow sixfold to 8.3 billion yuan by 2026, significantly boosting Baidu Cloud's revenue.

It should be noted that there is little public disclosure of Kunlunxin's financial data. Rumors suggest its 2024 revenue has surpassed that of Cambricon and Moore Threads. In response, Baidu told Sing Tao Daily that official revenue data has not been released.

Nevertheless, in the eyes of the tech community and investors, Kunlunxin's position as a leading domestic AI chip manufacturer is undeniable, with its technological prowess in high-end AI chips and value in large-scale commercial applications widely recognized.

On the Brink of Explosion

According to Qichacha, Kunlunxin was established in 2011, formerly known as Baidu's Chip and Architecture Department, with Baidu's Chief Chip R&D Architect, Ouyang Jian, serving as CEO. The 2024 annual report of Kunlunxin (Beijing) Technology Co., Ltd. reveals that it provided social security for 187 employees.

After more than a decade of internal incubation and technological accumulation, Kunlunxin has experienced explosive growth this year, including the release of new-generation AI chips, the Kunlunxin M100 and M300, and the unveiling of two new super-node products.

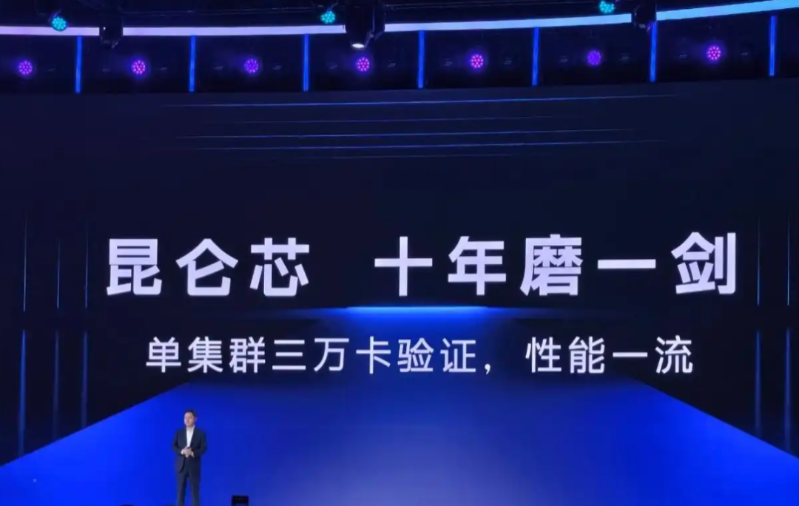

In the first half of 2025, Baidu lit up a 30,000-card cluster of the Kunlunxin P800 (launched in 2024), the first domestic 10,000-card cluster to receive a five-star rating from the China Academy of Information and Communications Technology, providing a solid foundation for large-scale model training and inference.

As its stable and efficient computing power continues to be validated, Kunlunxin has also achieved multiple breakthroughs in commercialization.

In March, the Kunlunxin P800 server won the bid for China Merchants Bank's AI chip resources project; in August, Kunlunxin secured a 1 billion yuan order in China Mobile's 2025-2026 AI centralized procurement project, showcasing Baidu's AI chip prowess.

Relevant data shows that China Mobile's procurement focused on AI general-purpose computing devices within the 'CUDA-like ecosystem' and 'CANN ecosystem.' Kunlunxin not only won the bids but also secured the largest shares in three key procurement packages.

As the computing power foundation for Li Yanhong's 'All in AI' strategy, Kunlunxin also took center stage at Baidu World, receiving extensive introduction and outlook. Baidu founder Li Yanhong once again attempted to stand at the forefront of the tech circle.

Information released at Baidu World revealed that the Kunlunxin M100 is optimized for large-scale inference scenarios, emphasizing cost-effectiveness, and will be launched in 2026; the Kunlunxin M300 caters to the training and inference needs of ultra-large-scale multimodal models, offering extreme performance, and will be launched in 2027.

Shen Dou, Executive Vice President of Baidu Group, introduced at the conference that Kunlunxin will launch new products annually over the next five years: 'Infrastructure is a long-term investment. We will firmly make long-term layouts and continuously climb the peak of computing power.'

Currently, alongside Kunlunxin, Chinese AI chip companies such as Huawei Ascend, Cambricon, Moore Threads, MetaX, and Enflame Technology are rising strongly against the backdrop of the world's largest AI application market, launching a global counteroffensive in AI chips. This is not just a commercial competition but also a crucial battle for China to master core technological sovereignty in the AI era and ensure the security of its development in the AI era.