From Microsoft to Alibaba: AI's Plan B Hits Its "Ceiling"

![]() 12/12 2025

12/12 2025

![]() 575

575

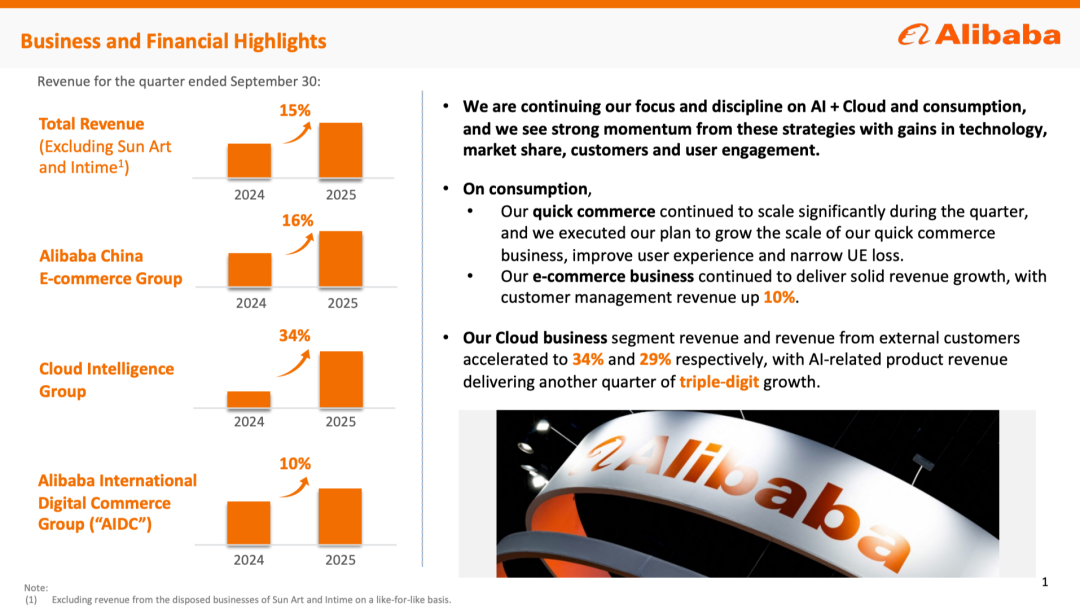

During Alibaba's recent earnings call, a "ceasefire" was declared in the food delivery sector war. However, a significant AI investment was also unveiled: a staggering 380 billion yuan over the next three years. From a financial standpoint, this move is quite understandable. The food delivery battle led to a 34 billion yuan year-on-year decrease in Alibaba's adjusted EBITA for Chinese e-commerce. Meanwhile, Alibaba Cloud's growth rate soared to 34.5%. With these two figures laid out, Wu Yongming likely didn't have to do much persuading at decision-making meetings.

Alibaba's Q3 2025 Earnings

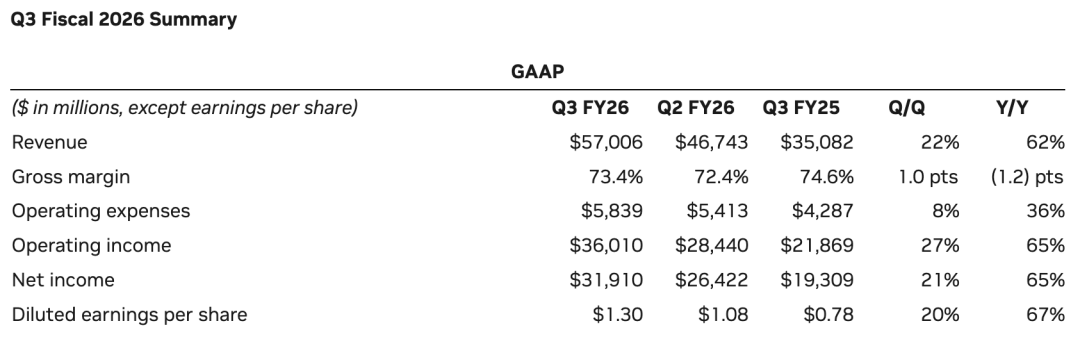

Across the Pacific in Silicon Valley, AI cloud has also yielded tangible results for major tech firms. In the latest quarter, Google Cloud witnessed a 33% year-on-year growth, with a backlog of 155 billion USD. Microsoft's Azure cloud (excluding exchange rate impacts) also saw a 39% year-on-year increase...

Despite Microsoft's latest earnings report showing substantial Azure cloud growth, its stock still dropped nearly 3% on that day, as investors grew increasingly skeptical.

Recently, it was reported that Microsoft lowered internal sales targets for multiple AI products, including Foundry. While Microsoft denied altering its overall AI sales targets, this didn't prevent a 12/3 stock price decline.

On December 9, Microsoft announced its largest-ever Asian investment: a 17.5 billion USD data center in India. However, a day later, Oracle—a deep-seated partner of Microsoft and OpenAI—saw its stock plummet over 10% after earnings, casting a shadow over these industry behemoths and the entire sector.

Microsoft Official Website Screenshot

In reality, cloud infrastructure is akin to another "gold rush shovel," similar to GPUs. If the AI narrative falters and the "gold rush" subsides, these "shovel sellers" could see their revenues plummet. An AI bubble seems to be a widely accepted notion, even acknowledged publicly by the CEOs of Microsoft and Google. The suspense (uncertainty) now revolves around two questions: how long the short-term bubble will persist and whether the industry can rebound after it bursts.

"B2C" or "C2B"?

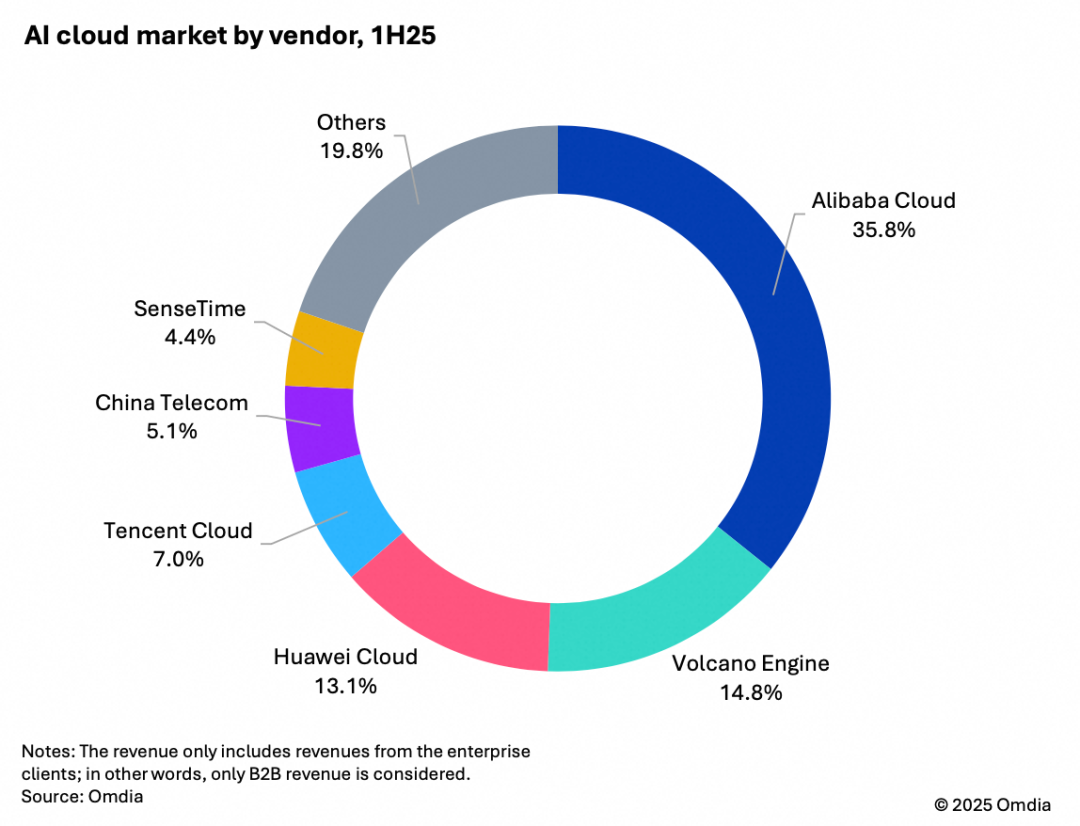

Regarding the first question, Alibaba's Wu Yongming believes, "An AI bubble is unlikely for at least the next three years." Hence, he decided to double down over the next three years. According to Omdia, Alibaba dominated China's AI cloud market in the first half of the year, holding a 35.8% share, far ahead of competitors. Its market share even surpassed the combined total of the second- to fourth-place firms. Who was the runner-up? ByteDance, a company Alibaba struggles to compete with in consumer markets. ByteDance's Volcano Engine holds a 14.8% market share, making it Alibaba's top rival.

Omdia, "China AI Cloud Market, 1H25"

Thus, Alibaba hasn't given up on consumer markets. While B2B decision-making differs, if enterprise leaders become ByteDance's C-end users (e.g., using Doubao), Alibaba Cloud's AI adoption will face significant hurdles. Volcano Engine President Tan Dai revealed that many clients approach them with Doubao chat records—a classic "high-frequency beats low-frequency" or "rural surrounds urban" strategy in the large model industry. Perhaps for this reason, Alibaba has elevated the strategic importance of its AI "C Plan," continuously upgrading products like Kuake and Qianwen, along with substantial budget allocations, signaling a shift in its AI strategy.

Alibaba Kuake AI Glasses

AI is a massive financial drain. Other internet giants either find it financially unviable and opt for stability (e.g., Tencent, whose capital expenditures last year matched Alibaba's but lacks the urgency to expand further) or lack the scale to go all-in (e.g., Baidu, whose 2024 capital expenditures totaled just 8.134 billion yuan, roughly a tenth of Alibaba's or Tencent's). In terms of business models, if Alibaba Cloud follows Amazon's AWS, then Alibaba's AI strategy borrows from Google's current momentum. Both are among the world's only full-stack AI tech companies, with in-house development spanning AI chips and infrastructure to large models and applications. Alibaba chose this path partly due to its corporate culture. Building ecosystems is Tencent's forte; Alibaba's past acquisitions aimed at integration, with Jiang Fan and Zhang Xuhao serving as contrasting examples.

Alibaba Cloud's NBA Partnership

Additionally, Alibaba Cloud was once China's leader and the world's third-largest, but it fell out of the top three last year due to Google Cloud's AI-driven surge. Learning from this, Alibaba chose to "join the winners." However, significant gaps remain between Alibaba and Google. For instance, Google's TPU has attracted clients with its lower power consumption compared to NVIDIA's chips, while Alibaba's self-developed chips are still in the development phase. Alibaba's models are strong, but its AI applications haven't created C-end urgency for ByteDance like Google's did for OpenAI. Thus, Alibaba's most realistic path is to enable its existing Alibaba Cloud customers to adopt AI, while ByteDance aims to make enterprise leaders adopt Doubao. With ByteDance unlikely to halt its efforts, Alibaba must counterattack. Neither will cede ground in the short term.

Volcano Engine's Partner Companies

ByteDance plans to invest 150 billion yuan in 2025, making it Alibaba's sole rival in scale. Both are betting on the future, but does AI have one?

Large Model Unicorns as Leading Indicators

The answer hinges on whether AI genuinely boosts productivity at the application level. The AI value chain becomes increasingly detached from reality at higher levels. NVIDIA's success stems from massive investments by Google, Microsoft, Alibaba, and ByteDance, whose performance depends on broader enterprise adoption, which ultimately hinges on AI's productivity gains.

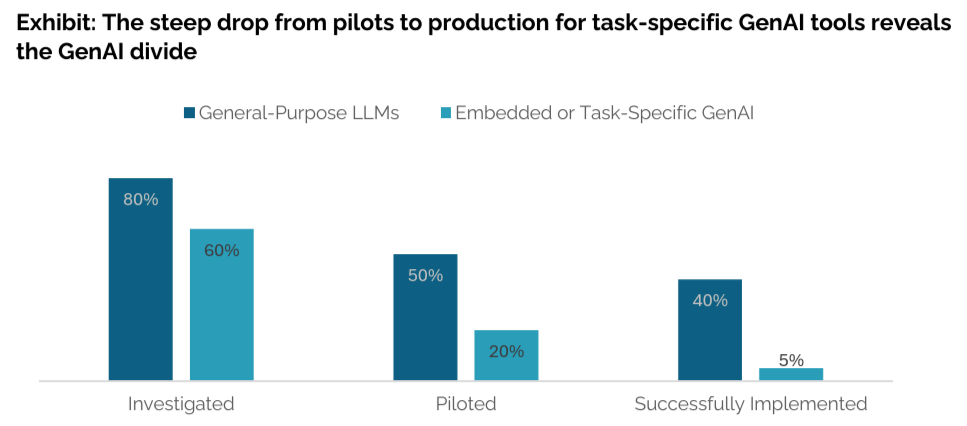

NVIDIA's Q3 FY2026 Earnings

As Microsoft CEO Satya Nadella stated, "AI must genuinely enhance overall economic productivity and drive broad GDP growth; otherwise, it's a bubble." Nobel laureate Daron Acemoglu estimated in a May 2024 paper, "Simple AI Macroeconomics," that only a quarter of current AI tasks may be cost-effective over the next decade, accounting for just 5% of total work tasks. Thus, AI could boost U.S. productivity by only 0.5% and cumulative GDP by 1% over ten years. An MIT report in August noted that only 5% of firms successfully leveraged AI tools to boost productivity, while the remaining 95% saw their AI investments yield no returns.

MIT, "The Generative AI Divide: The State of Business AI in 2025"

Generative AI has improved the tech and media/telecom industries but failed to optimize key workflows in professional services, healthcare, consumer retail, financial services, advanced manufacturing, or energy/materials. A simple litmus test: When large model and application firms like OpenAI, Anthropic, Kimi, and Zhipu become profitable, generative AI's business model will be validated. If not, what happens when the bubble bursts? Consider the robotics rental market. Early in 2025, coinciding with the DeepSeek-fueled large model hype and robot performances at the Spring Festival Gala, humanoid robot rentals soared to 10,000 yuan per day, while robot dogs cost 2,000 yuan. Now, those prices have plummeted to 2,000 yuan and 500 yuan, respectively. This is no laughing matter. For the 95% of firms, large models that don't boost productivity are like Spring Festival Gala robots—entertaining but useless. The AI narrative's shift from AGI to cost-effectiveness will accelerate the bubble's collapse, an inevitable industry trend. Expanding markets accommodate many players, but mature markets devolve into price wars. This holds true for instant retail and AI large models alike. However, AI's energy costs and token pricing are predicated on promises of "productivity gains" or AGI visions. If these fail, businesses might hire more graduates or buy employee subscriptions instead.

For CEOs of firms in the AI arms race, the hope isn't that the bubble never bursts but that AI becomes infrastructure like early 21st-century fiber optics, early 20th-century power grids, or 19th-century railways—all of which survived bubbles to fuel industrial revolutions. In the short term, everyone is acting as a "patchwork fixer." Wu Yongming still pitched ASI at September's Cloud Town Conference. But if U.S. executives reject AGI, will Chinese ones embrace ASI?