Weekly Stock Review | "Two New" Policies Bolster A-Shares, NVIDIA Encounters Another Hurdle

![]() 12/15 2025

12/15 2025

![]() 537

537

This week's review of automotive stocks highlights the varied trends within the automotive market.

After dropping consecutively below the 4,000-point and 3,900-point levels, the A-share market finally saw a ray of hope on the final trading day of the week, with a rebounding trend injecting optimism into the market.

Following the Central Economic Work Conference, a series of positive signals emerged, marking a turning point for the downward-trending market. Notably, fiscal policy support has enabled consumption—the most critical driver among the economy's three engines—to continue growing.

By the close of trading on Friday, activity surged on both exchanges. The Shanghai Composite Index edged up by 0.41% to 3,889.35 points, while the Shenzhen Component Index rose by 0.84% to 13,258.33 points. The ChiNext Index jumped by 0.97% to 3,194.36 points. Total trading volume across both exchanges reached 2,092.2 billion yuan, up 13% from the previous day, returning to the 2,000 billion yuan trading range and signaling active market participation.

Fueled by the overall market rebound, signs of warmth emerged in the stock landscape. A total of 2,686 stocks advanced, with 84 hitting their daily limits. The outflow of main funds diminished, with a single-day net outflow narrowing to 3.818 billion yuan, a reduction of over 80 billion yuan from the previous day.

The semiconductor sector, in particular, remained a focal point. Driven by artificial intelligence, the semiconductor industry continued to dominate stock market attention. Both cutting-edge concepts and established technologies, such as assisted driving and intelligent robots, accelerated the expansion of the industry's scale.

As the saying goes, "In turbulent waters, fortunes are made." The rapid expansion of the AI industry has created new opportunities. Last Friday, just five years after its inception, domestic chipmaker Moore Threads made a successful debut on the Science and Technology Innovation Board, soaring by 425.46% on its first day and setting a new historical record.

This week, Moore Threads' surge continued unabated, reaching a high of 941.08 yuan per share, an eightfold increase from its issue price of 114.28 yuan. Prior to its listing, Moore Threads was already touted as the wealth code for this year's A-shares, with subscriptions in high demand during fundraising. Indeed, the high demand was justified by the high returns, as on its debut day alone, the floating profit from one subscription (500 shares) of Moore Threads exceeded 250,000 yuan.

Beyond its astonishing surge, Moore Threads also set multiple A-share records. From submitting its IPO application on June 30 to receiving regulatory approval on October 30, it took only 122 days, setting a new record for the Science and Technology Innovation Board.

The high regard for Moore Threads stems from its demonstrated ability to substitute domestic GPUs. Currently, the global GPU market is nearly monopolized by NVIDIA, with even its software ecosystem dominated by NVIDIA's CUDA. To achieve independent control in AI, source control is essential.

Unlike Huawei Ascend and Cambricon, Moore Threads' products span various markets, including consumer-grade graphics cards (e.g., MTT S80), AI training cards (S4000/S5000), intelligent computing clusters ("Kua'e"), and edge SoCs ("Changjiang"), showcasing its versatile product development capabilities for substitution.

Its chips already support over 300 AI models, covering scenarios such as large-scale model training/inference, intelligent driving simulation, industrial digital twins, and medical imaging, enabling domestic users to reduce their reliance on NVIDIA's computing power.

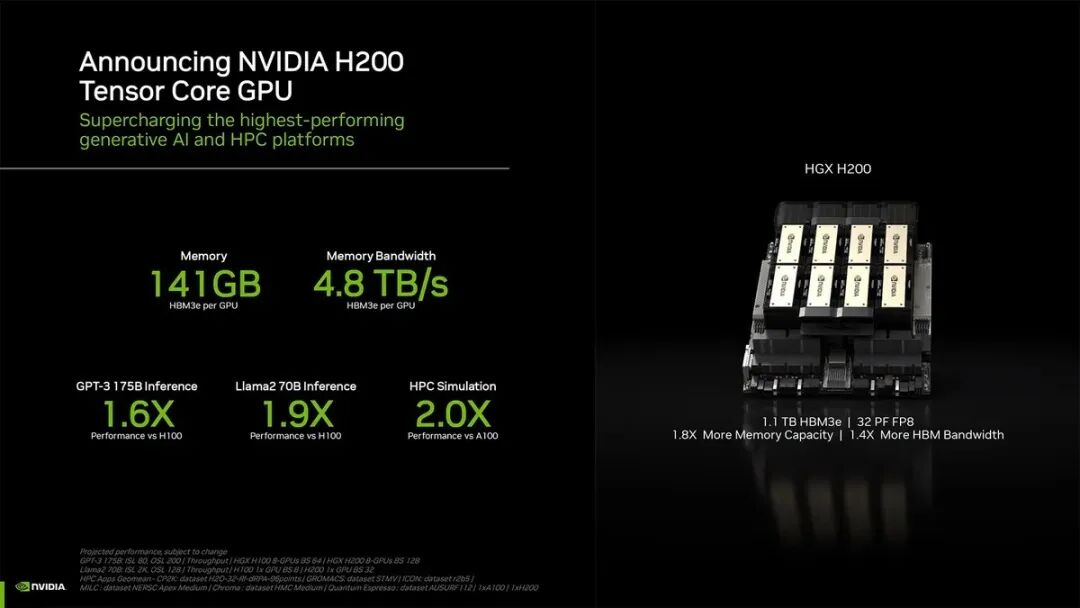

Coincidentally, shortly after Moore Threads' listing, NVIDIA announced that the U.S. government had granted it a special license to export H200 chips to the Chinese market, with the condition that they can only be sold to "Chinese clients approved by the U.S. government" and that 25% of the sales revenue must be paid to the U.S. Treasury as a "technology licensing fee" or "national security compensation."

Even so, NVIDIA's H200 can still impact the domestic market. In terms of computing power, a single H200 chip offers over six times the computing power of the previous H20, with a price tag of only 200,000 yuan, making it economically viable and one of the mainstream high-performance AI training chips globally.

Besides general-purpose chipmakers like Moore Threads, the automotive industry is also experiencing a wave of domestic substitution. This week, Horizon Robotics held a technology ecosystem conference in Shenzhen, primarily attended by the automotive industry, with almost all domestic automakers participating.

Wu Borui, CTO of Volkswagen China, and Yang Dongsheng, President of BYD's New Technology Research Institute, delivered keynote speeches. During the two-day conference, numerous automotive technology leaders and executives from assisted driving technology companies shared their insights.

This reflects Horizon Robotics' years of deep cultivation in automotive chips, culminating in a concentrated breakthrough in 2025. The "intelligent driving equality" initiative proposed by BYD at the beginning of the year spurred a year-long technological competition. Among BYD's most shipped solutions, the "God's Eye C" scheme, Horizon Robotics and NVIDIA were both suppliers, demonstrating domestic substitution's technological prowess and market recognition.

In the second half of the year, Horizon Robotics released its high-level assisted driving system, HSD, while accelerating the mass production of high-level assisted driving solutions equipped with its Journey 6 chip. Horizon Robotics swept through the assisted driving industry with thunderous momentum, with the Journey 6 chip becoming the best alternative to Orin chips.

Under this influence, Horizon Robotics' stock price maintained an upward trend for the week. By Friday's close, it reported at 9.010 Hong Kong dollars, up 3.8%, with a weekly increase of 7.26%. Multiple institutions maintained a "buy" rating for Horizon Robotics.

Besides the highly sought-after cutting-edge industries like artificial intelligence, the "new three" sector of power batteries also demonstrates strong industrial capabilities.

Following the release of third-quarter financial reports, CATL and Zijin Mining ranked first and second among several heavily invested funds. Over 2,000 funds heavily invested in CATL, with a holding market value of approximately 200 billion yuan, while over 1,500 funds heavily invested in Zijin Mining.

From a stock market perspective, CATL has become the most profitable power battery enterprise. Particularly driven by the fourth-quarter delivery surge from automakers, CATL's industry influence has been further amplified. With its large-scale production capacity, CATL has become a must-have for new energy automakers. No matter how good the secondary supplier is, it cannot compare to CATL's ability to deliver.

Moreover, although CATL does not manufacture vehicles, its industrial layout continues to expand into the automotive industry. From its Ningjia service in the automotive aftermarket to its collaboration with JD.com and GAC Group on the Aion UT super model, CATL's business segments continue to grow.

Of course, regardless of artificial intelligence, AI chips, or power batteries, the most crucial platform currently remains new energy vehicles. Although the industrial potential of embodied intelligence is vast, from the current industrial scale perspective, the new energy vehicle industry is still the only product capable of achieving large-scale applications.

The most significant news this week came from the Central Economic Work Conference, where it was stated during the deployment of next year's economic work, "Adhering to domestic demand-led growth and building a strong domestic market," that the implementation of the "two new" policies would be optimized.

This policy is interpreted as the continuation of the two-year large-scale equipment renewal and consumer goods trade-in policies, which will continue to drive the steady development of the new energy vehicle industry.

According to Ministry of Commerce data, over 11.2 million vehicles were traded in during the first 11 months of this year, driving steady growth in the domestic automotive industry. Previously, under uncertain policy conditions, domestic new energy vehicle growth slowed in November, falling below the annual growth rate of 19%.

With clear policies in place, the new energy vehicle market in December may witness a rebound, demonstrating strong consumer demand.

Meanwhile, several experts stated that the "national subsidy" amount for 2026 may moderately increase from the 2025 level, also benefiting new energy vehicle sales and mitigating the impact of the purchase tax subsidy phase-out.

Under the influence of policies, the stock prices of several A-share automakers rebounded on Friday. Great Wall Motors surged by 2.95%, while SAIC Motor, BYD, BAIC BluePark, Changan Automobile, and Seres all achieved gains.

It can be said that with the gradual implementation of policies in 2026, the domestic new energy vehicle market will continue to lead globally with high-speed growth. Meanwhile, the competition among automakers is far from over, and no one dares to claim they have secured their ticket to the finals.

Note: Image sources are from the internet. If there is any infringement, please contact us for deletion.

-END-