Behind the $4.5 Billion Valuation: Why Is Sequoia Backing This "Stealth" AI Company for the Third Time?

![]() 12/19 2025

12/19 2025

![]() 514

514

As AI models gradually take on a role as indispensable as "utilities," the key determinant of value no longer lies in who constructs superior models but in who holds sway over the control valves of the supply network. Within a mere three months, the valuation of Fal.ai has tripled. In its latest Series D funding round, which was led by Sequoia and also saw participation from Kleiner Perkins and NVIDIA, Fal.ai's valuation soared to $4.5 billion. Beyond the sheer funding amount, the continuity of investment is remarkable—this represents Sequoia's third investment in Fal.ai this year.

This isn't merely an investment in a product; rather, it's an investment in a standard. The locus of pricing power in the AI landscape is shifting from the model layer to the operational layer.

01

┃ Why Sequoia Invested Three Times in a Row: From Inference Optimization to an Operational Platform

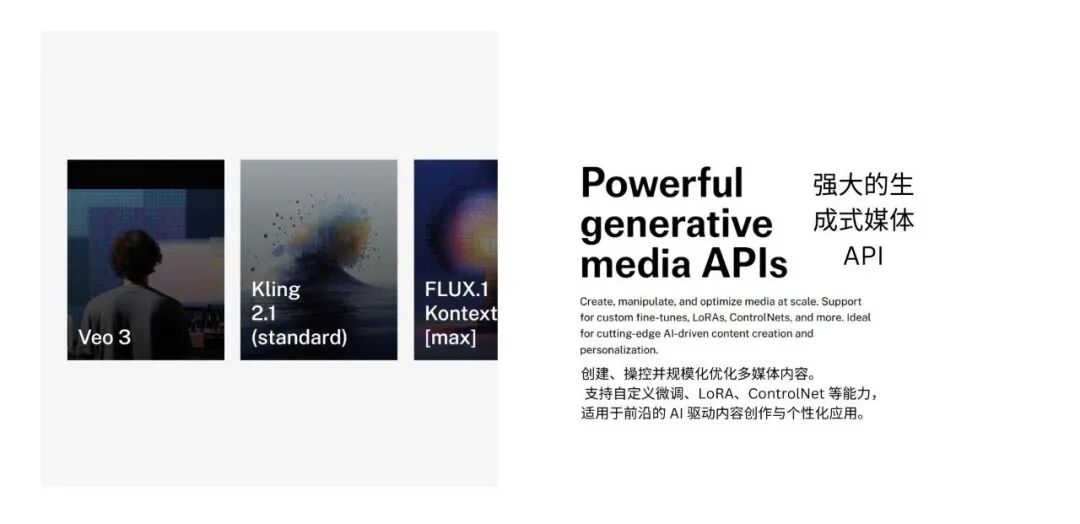

Fal.ai doesn't train foundational models, nor does it directly build applications. Instead, it operates at a layer that has long been underestimated—providing hosting, inference, scheduling, and scaling capabilities for multimodal models (encompassing images, videos, and audio). It packages GPU management, latency control, and stability issues into a directly callable infrastructure.

In 2023, companies like this were still dismissed as "infrastructure romantics." However, the situation has since changed. Multimodal generation is transitioning from mere demos to real business workflows. Advertising assets, e-commerce product images, and content effects are all entering high-frequency, real-time, and stable production stages. Once real-time performance becomes a strict requirement, whoever can reduce latency, lower costs, and stabilize systems gains genuine bargaining power.

Fal.ai's co-founder, Burkay Gur, noted in an interview with a16z that as model capabilities rapidly improve, the bottleneck for application deployment will no longer be the models themselves but inference efficiency and infrastructure stability. This insight was the driving force behind Fal.ai's evolution from inference optimization to a multimodal operational platform, forming the core logic behind Sequoia's repeated investments.

02

┃ The Key to Valuation Surge: From "Storytelling" to "Revenue Generation"

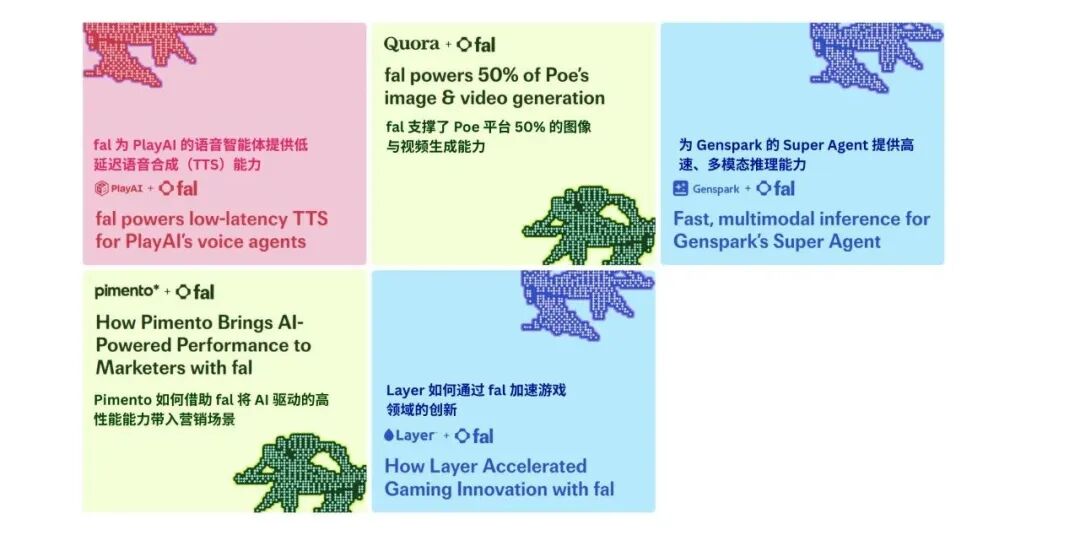

According to Bloomberg, by October of this year, Fal.ai had achieved over $200 million in annualized revenue, with clients including Adobe, Shopify, Canva, and Quora. This data has transformed Fal.ai from a company with a "future narrative" to a "market-validated" player.

More critically, the deal structure is noteworthy. This round of funding includes not only $140 million in primary capital but also secondary transactions involving existing shareholders. Such structures typically emerge when growth certainty has been validated, and capital begins to reallocate future returns. This is not a lifeline financing but a confirmation of Fal.ai's structural position.

03

┃ Who Are Fal.ai's Real Competitors?

Fal.ai's competitors extend far beyond similar startups.

The first category is cloud providers' AI platforms, such as AWS Bedrock. These platforms treat AI as part of cloud resource consumption. While they have strengths in customer relationships and compliance, they do not prioritize ultimate inference efficiency as a core product goal.

The second category is similar inference platforms, like Replicate and Fireworks. Although they offer hosting tools, Fal.ai targets "multimodal + real-time + production-grade" high-frequency workloads, embedding directly into real business workflows.

The third and most often overlooked category is in-house enterprise teams. Theoretically, it is feasible for enterprises to handle AI operations internally. However, real-world implementation requires bearing high costs for GPU procurement, assembling top-tier engineering teams, and undertaking long-term maintenance. Fal.ai's value lies in outsourcing this complexity.

In a conversation with The New Stack Agents, Burkay Gur stated, "Enterprises aren't buying models; they're buying the ability to reliably run them in the real world. The complexity of the operational layer is often underestimated but determines whether generative AI can enter core businesses."

04

┃ Key Takeaways for Enterprises

From an enterprise perspective, Fal.ai's $4.5 billion valuation is not just another funding headline but a clear signal.

First, multimodal AI has transitioned from experimental innovation to a candidate for infrastructure status. When a platform can stably serve clients like Adobe and Shopify while generating $200 million in revenue, the question shifts from "whether to use it" to "missing out on a de facto standard."

Second, the decision framework for "building AI in-house" is evolving. Models can be selected, and applications can be built internally, but the operational layer need not be reinvented. Just as few enterprises build data centers today, they may not need to build multimodal inference systems in the future.

Third, organizational structures will undergo a transformation. Once generative capabilities become as stable and callable as APIs, content, marketing, and design workflows will shift from project-based to system-based, moving from human bottlenecks to compute and throughput bottlenecks.

05

┃ Model Extravaganza, Pipeline Battle

Fal.ai's $4.5 billion valuation is less a recognition of a specific technology and more a pricing of a trend. As AI moves from demonstration to production, value will shift from "who builds better" to "who runs more stably." Sequoia is not betting solely on Fal.ai but on the judgment that the operational layer will become one of AI's most resilient business models.

For enterprises, the real question is evolving: Not whether to use Fal.ai, but whether to insist on building in-house when the multimodal operational layer forms standards, network effects, and ecological barriers externally.

In infrastructure-level competition, history repeatedly demonstrates that the cost of waiting often exceeds the cost of choosing wrong.