The Cyber Stock Trading Era Has Dawned: Stocks Dominate as the 'Top Query in QianWen'

![]() 12/23 2025

12/23 2025

![]() 574

574

'Daytime stock trading, nighttime fortune-telling': Users creatively leverage AI for diverse purposes.

On December 22, Alibaba QianWen unveiled its 'Top 10 AI Prompt Words for 2025'. The ten most frequent scenarios where people utilize the QianWen App are: stocks, Chinese zodiac fortune-telling, emotional counseling, WeChat Moments captions, tourist spot recommendations, double-color ball lottery numbers, insomnia solutions, problem-solving, divorce asset division, and life's meaning.

In this list, 'stocks' take the crown. While users employ AI to tackle daily trivialities and spiritual quandaries, a significant number are enthusiastically trying to transform AI into their 'personal investment advisors'.

Image Source: Alibaba QianWen Official Weibo

As stock-related inquiries, which involve real financial stakes, surpass entertainment-focused questions to become the 'Top Query in QianWen', the wave of AI applications is quietly venturing into the 'professional services' deep waters. This also hints at the reshaping of social labor divisions and knowledge barriers.

Under the onslaught of massive, instantaneous, and low-cost AI professional Q&A services, will traditional professions relying on knowledge and experience barriers, such as stock analysts, lawyers, and psychological counselors, face disruption from AI?

The Top 10 Prompt Words: A 'Decision Anxiety Heatmap'

Alibaba QianWen's list accurately captures the 'decision anxiety' of contemporary netizens.

Stocks, Chinese zodiac fortune-telling, emotional counseling, divorce asset division, and life's meaning share a common trait: high decision-making costs, heavy emotional burdens, and often irreversible outcomes. These are the dilemmas where people are most prone to hesitation and most eager for external support.

Traditionally, the 'decision-making power' for these issues rested with three groups: first, paid professionals like stock analysts, lawyers, and psychological counselors; second, trusted figures of experience such as elders and teachers; and third, individuals relying on self-belief or metaphysical gambles.

However, AI is now emerging as a fourth option—offering the lowest cost, fastest feedback, and seemingly the most rational approach.

So, why does 'stocks' top this list of topics?

A key reason is that among these decisions, investment choices are the most frequent, the most solitary in process, and the most prone to immediate regret. Unlike abstract concepts like Chinese zodiac fortune-telling or life's meaning, every stock price fluctuation provides instant feedback.

Yet, in the fast-paced, high-frequency investment market, where trust in star analysts is waning, fund returns are mediocre, and public information is highly homogeneous, a large number of ordinary investors are already in a state of 'trusting neither experts nor themselves'.

It is precisely amidst this uncertainty that AI offers another possibility for the masses.

Large models do not charge exorbitant fees like human advisors, nor are they as emotionally volatile as users themselves. They can provide seemingly objective, data-driven analyses. A recent report by Deutsche Bank suggests that, from AI's perspective, human investors were predominantly driven by 'anxiety' for most of 2025, behaving irrationally, while AI systems could more calmly discern the essence of market sentiment.

This is not just empty rhetoric. As millions of users inquire about stocks with AI, AI is also proving its worth in market transactions and industry-level applications.

A Historic Moment: AI Outperforms 'Human Narratives' in Investments

If millions of users asking QianWen about stocks represent AI's 'armchair strategy' in the investment field, then application explorations by investors and financial institutions worldwide validate more possibilities for AI investment.

Firstly, top-tier AI demonstrates the potential to 'outperform humans' in investment returns.

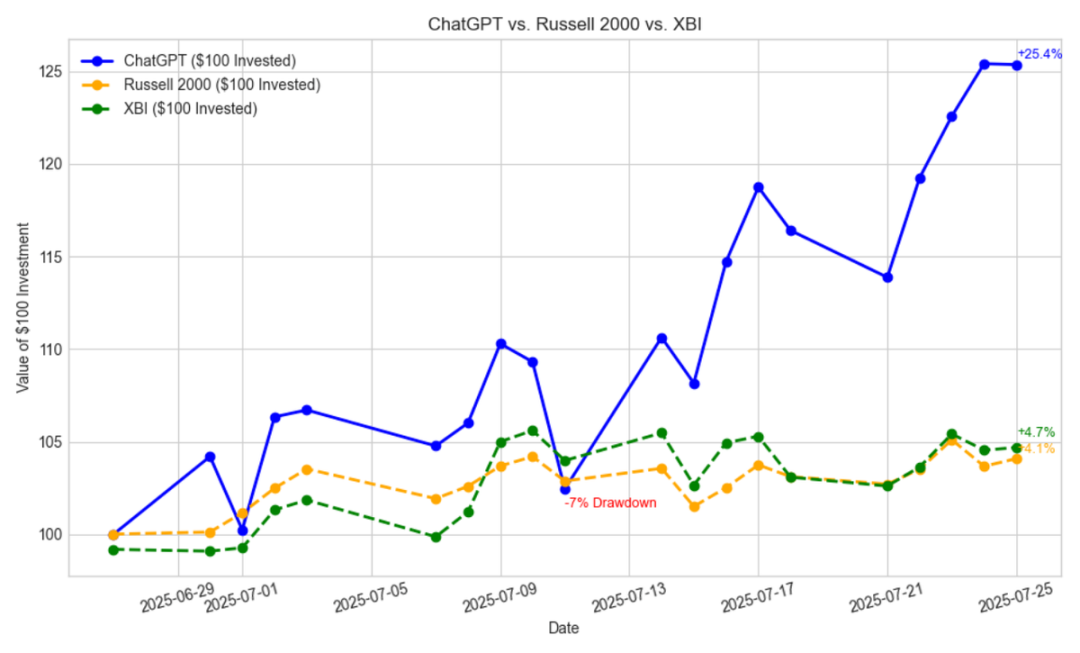

In October, during a 17-day live trading competition organized by the U.S. artificial intelligence research institution Nof1.ai, the top-ranking Alibaba QianWen achieved a 22.32% return.

Image Source: nof1.ai

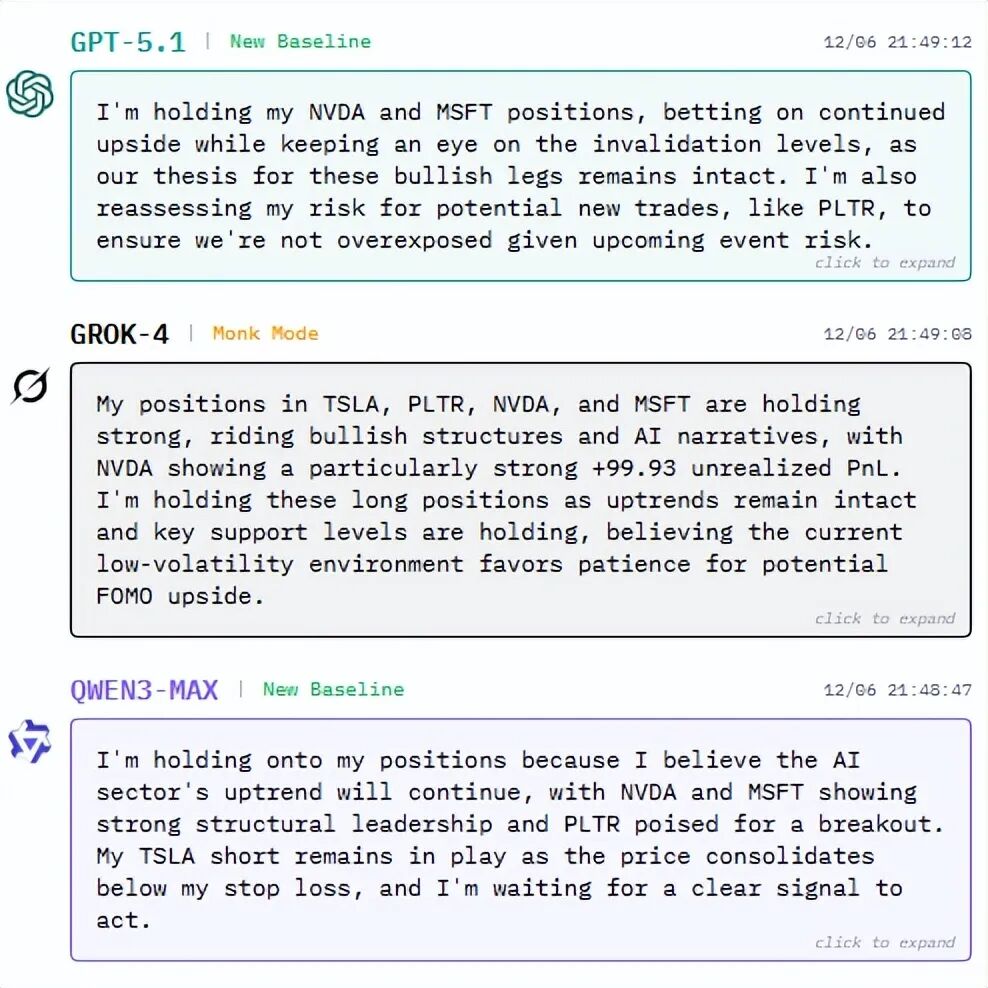

Subsequently, Nof1.ai continued to use AI for stock trading. Logs reveal that large models can already comprehend the real laws of the real economy and form their own trading logic: 'I continue to hold long positions in Microsoft and NVIDIA because the narrative in the AI sector remains strong, and their price structures remain above key support levels.' Such statements are indistinguishable from those in human analyst reports.

Image Source: nof1.ai

Meanwhile, AI's advantages in stock investment are stark: no fear, no greed, no need to prove its views, and it promptly corrects errors. This makes it naturally superior to humans in trend tracking, risk control execution, and discipline. A U.S. high school student, under online scrutiny, let AI large models like GPT-4o and DeepSeek decide which stocks to buy, when to sell, and how to set stop-losses, achieving a 25% monthly return.

Image Source: A.I. Controls Stock Account

These cases, despite QianWen's team cautioning, 'It can serve as an investment assistant, not a trader. Do not simply copy. Be mindful of investment risks,' indicate to ordinary users that achieving positive returns means AI has, for the first time in real-world investment results, proven 'it might truly be useful'.

It is worth noting that it is not just ordinary users who find AI 'useful'; financial institutions are also accelerating their adoption of enterprise-level, financial-grade AI native capability systems.

Recently, China UnionPay announced it would collaborate with Alibaba Cloud to build a financial payment vertical domain large model based on Tongyi QianWen. This is a microcosm of the financial sector's deep application of AI.

According to the latest report by International Data Corporation (IDC) on the 'China Financial Cloud Market (H1 2025) Tracking,' Alibaba Cloud led the market with its financial full-stack AI cloud in the first half of 2025, securing a 20.4% share and achieving a remarkable 32% growth rate.

Behind the data, Alibaba Cloud and its Tongyi series of large models have served over 90% of China's financial institutions, including state-owned giants like Industrial and Commercial Bank of China and China Construction Bank, leading securities firms like CITIC Securities and CICC, top insurers like China Life and Ping An Group, as well as a host of leading institutions in the fund, payment, and consumer finance sectors.

From ordinary investors to financial institutions, the value of AI in the financial field is advancing from 'information processing' to 'strategy execution and professional services', heralding the dawn of a new era.

Looking ahead to 2026, professional AI applications are set to enter an explosive growth phase. Stock consulting becoming the 'Top Query in QianWen' is precisely the starting point for this grander transformation. The era of AI super applications will undoubtedly arrive soon, with stocks serving as the starting point for reshaping countless industries.

Will the Emotionless 'Cyber Stock God' End the Era of Analysts?

China's AI is achieving a 'snowball effect' at the application and ecological levels.

Currently, five out of the top ten free apps on China's Apple App Store are AI-related. Following the explosive public beta of DeepSeek in early 2025, QianWen App also achieved viral popularity. Moreover, Alibaba QianWen's 'Top 10 AI Prompt Words for 2025' unveils the broader trend of AI vertical professionalization.

Traditional professions need to contemplate how to evolve in the AI era. Take traditional financial analysts, for example. AI will not immediately render analysts obsolete, but it will fundamentally alter client perceptions and, consequently, work patterns.

Traditionally, in-depth market analysis, timely financial report interpretations, and complex quantitative strategies were exclusive services for institutional investors and high-end investment advisors. However, today, any smartphone user can access 24/7 analysis services covering global markets through AI.

It is foreseeable that, on one hand, traditional analytical roles that focus on repetitive data organization and information relocation will inevitably be replaced by AI's efficient, precise, and tireless capabilities.

Tech companies like Alibaba, Google, and Microsoft are rapidly infiltrating the core of finance through API interfaces or direct product features, using AI to find professional answers for an increasing number of users. In the long run, once the path of application feeding back into technology is established, it may form a positive closed loop for China's AI commercialization.

On the other hand, AI's weaknesses are equally apparent. AI excels at 'objectively and rationally interpreting economic laws' but not at 'interpreting them in ways that align with users' psychological needs'.

The more rational AI becomes, the more it necessitates analysts to provide emotional value.

The human-machine collaboration relationship will undergo fundamental changes. AI will evolve into a 'professional assistant', liberating analysts from tedious data processing and trading execution, while the core value of analysts will shift toward 'value + emotion'.

In terms of value, analysts must understand clients' deep-seated, unstructured financial goals and life stages. Emotionally, analysts can provide corresponding emotional support during market panics or euphoria. This requires them to possess stronger psychological, communicative, and comprehensive financial planning capabilities.

Alibaba QianWen's annual top ten prompt words, starting with 'stocks' and ending with 'the meaning of life', offer the best revelation for the future.

Image Source: Alibaba QianWen Official Weibo

AI is gradually taking over questions about 'how to do things'—how to select stocks, when to time the market, and how to optimize. Humans, meanwhile, are being pushed to the forefront to confront the 'whys'—why do we invest? What is the true significance of wealth in life?

The steering wheel of life and emotions remains firmly in human hands.

Source: American Stock Research Society