By 2025, the Procurement Volume of L4 Autonomous Vehicles Is Projected to Reach 28,000 Units. Which Enterprise Will Secure the Largest Market Share?

![]() 12/29 2025

12/29 2025

![]() 469

469

Recently, Jin Bing, who previously served as the Deputy Director-General and First-Level Inspector of the Policy and Regulation Department at the State Post Bureau, revealed at the '2025 Transportation Services Theme Launch Event' that by 2025, China's L4 autonomous vehicles will have been deployed in over 300 cities across the country. With an annual procurement volume of 28,000 units, these vehicles will also have successfully expanded their operations to more than 10 countries overseas.

This data signifies that China's L4 autonomous vehicle industry has transitioned from 'small-scale technological trials' to a phase of large-scale, commercialized industrial expansion.

Among the 28,000 annual procurement units of L4 autonomous vehicles, Neolix and Zelostech, as frontrunners in the industry, are undoubtedly the primary contributors to autonomous vehicle sales. They leverage their technological maturity, production capacity, and customer resource advantages to drive market growth.

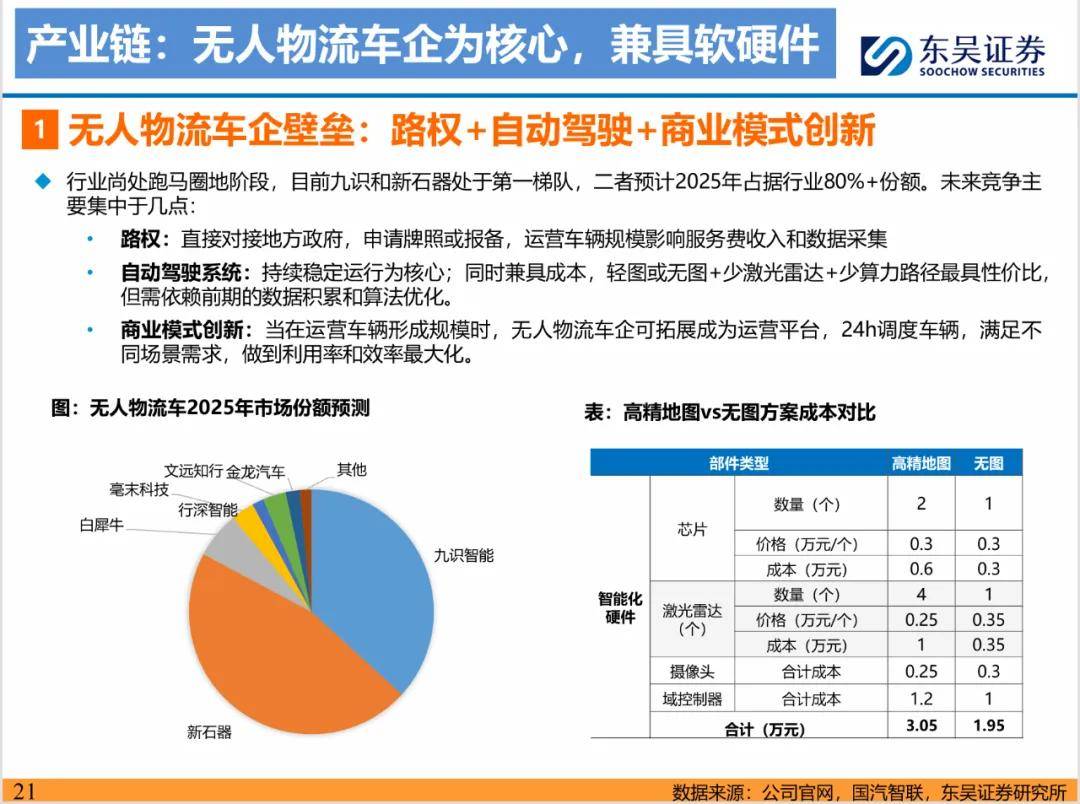

According to the latest publicly available data, Neolix has emerged as the enterprise with the highest procurement volume of L4 autonomous vehicles in 2025. Its annual sales have surpassed 15,000 units, accounting for 53% of the market. Zelostech follows closely behind, with a delivery volume of 10,000 units and a 36% market share in 2025. These top two duopolies collectively monopolize over 80% of the market, with the remaining share distributed among enterprises such as Bai Rhinoceros and China Post Science and Technology, as well as cross-border participants in niche scenarios. The industry concentration showcases a distinct pattern of 'leaders at the forefront, dispersion at the tail.'

This aligns with the prediction made in the 2025 mid-year report by Soochow Securities, which forecasts that Zelostech and new entrants will dominate the industry, collectively occupying over 80% of the market share.

I. Leading Duopolies: Monopolizing Over 80% of Procurement Volume, with Neolix Taking the Lead

Among the 28,000 L4 autonomous vehicle procurements in 2025, Neolix and Zelostech have secured the majority of mainstream orders, becoming the core contributors to procurement volume. They leverage their technological maturity, production capacity, and customer resource advantages to drive market growth.

1. Neolix: Over 15,000 Units Delivered in 2025, Accounting for Over 53%

As the first enterprise globally to achieve a 10,000-unit scale for L4 autonomous delivery fleets, Neolix's sales volume in 2025 (with delivery volume as the core reference metric) exceeded 15,000 units, accounting for over 53% of the total 28,000 procurements. This firmly establishes its position as the industry leader. Its order advantages are concentrated in three key areas:

Deep Cultivation of Express Scenarios and Expansion of Small B Clients: As a core supplier for SF Express, JD Logistics, and China Post, Neolix holds a leading position in the express industry's key accounts. JD Logistics' announcement at the end of 2025 to procure 1 million autonomous vehicles over the next five years further provides Neolix with significant growth potential. Meanwhile, Neolix vigorously expanded its express franchise network in 2025, leading to a rapid increase in orders from small clients.

Expansion into Urban Distribution Scenarios and Focus on Instant Logistics: In 2025, Neolix continued to innovate in urban distribution scenarios, with supermarkets, cold chains, fresh produce, hotels, and wholesale markets all beginning to introduce autonomous vehicles. Non-express scenarios now contribute half of Neolix's sales volume.

Simultaneously, Neolix and Didi Delivery launched autonomous vehicle delivery services in Qingdao, Linyi, Weifang, and other locations, deploying over 1,200 autonomous vehicles in Qingdao alone. This marks their entry into the instant logistics sector and opens up new growth points for autonomous vehicle deployment.

Self-Built Factories Ensure Scalable Delivery Capabilities: Relying on its self-built production base, Neolix has established a standardized production system, effectively reducing hardware costs while ensuring stable delivery. In September 2025, Neolix completed the production of its 10,000th autonomous vehicle, becoming the first enterprise globally to achieve a 10,000-unit scale for L4 autonomous fleets.

2. Zelostech: Nearly 10,000 Units Delivered in 2025, Accounting for Approximately 36%

Zelostech's delivery volume in 2025 reached 10,000 units, accounting for 36% of the total 28,000 procurements, second only to Neolix. Its growth primarily relies on a 'low-price strategy + penetration into the express industry':

Price Advantage Breaks the Market, Capturing Both Small and Large Clients: As an industry 'price breaker,' Zelostech was the first to break the high-price barrier of autonomous vehicles, precisely addressing the cost-sensitive pain points of small and medium-sized express outlets such as 'Shentong, Yuantong, Zhongtong, and Yunda' as well as J&T Express.

Leveraging its highly competitive pricing strategy, Zelostech became the primary supplier in China Post's 7,000-unit autonomous vehicle leasing procurement project, achieving a 'dual-line layout' of 'scaling up with small clients and setting benchmarks with large clients,' thereby establishing a solid order base.

Flexible Market Strategies Lower Usage Barriers: Zelostech innovatively introduced a 'bare vehicle price + FSD subscription fee' sales model, with bare vehicle prices starting as low as 19,800 yuan and FSD subscription service fees at 1,800 yuan per month. This significantly alleviates clients' one-time capital investment pressure, especially catering to the budget needs of small and medium-sized clients. Additionally, it launched monthly leasing services, allowing clients to flexibly adjust vehicle quantities based on demand, accelerating the promotion and penetration of autonomous vehicles in scenarios such as instant retail and regional distribution, further expanding market coverage.

Dual-Track Model of 'Contract Manufacturing + Self-Construction' Accelerates Production Capacity Ramp-Up: Zelostech adopted a parallel production capacity layout strategy of 'contract manufacturing cooperation + self-built factories.' On one hand, it reached contract manufacturing agreements with multiple automotive companies, leveraging mature manufacturing resources to quickly initiate mass production. On the other hand, it established self-built factories in Zigong, Sichuan; Huai'an, Jiangsu; Zhuji, Zhejiang; and Shantou, Guangdong, constructing a production capacity network covering Eastern, Southern, and Southwestern China. This effectively shortens delivery radii and reduces logistics costs.

Supported by this dual-track model, its monthly production capacity exceeded 1,000 units in the second half of 2025, with annual delivery volume increasing threefold compared to 2024, successfully achieving a 'leap from thousands to tens of thousands of units.'

II. Core Logic Behind Concentrated Procurement Volume: Triple Barriers of Technology, Cost, and Policy

The ability of leading enterprises to monopolize over 80% of procurement volume essentially stems from the combined advantages of 'technology-cost-policy,' which are also the core reasons why other small and medium-sized players find it difficult to break through:

Differences in Technological Maturity: The L4 autonomous driving solutions of Neolix and Zelostech exhibit a low accident rate of 1.5 times per 10,000 kilometers in complex urban scenarios, adapting to roads in over 300 cities nationwide through a 'light map mode.' In contrast, small and medium-sized players' technologies can only cover a single province or specific scenarios, lacking generalization capabilities and struggling to effectively break through in a broader market.

Significant Disparities in Cost Control Capabilities: Leading enterprises have reduced the hardware costs of unmanned logistics vehicles to below 80,000 yuan through 'scalable procurement + full-stack self-research.' Small and medium-sized players, due to small order volumes, face higher component procurement costs, with hardware costs exceeding those of leading enterprises. Coupled with insufficient financing capabilities, they cannot adopt a strategy of expanding volume at a loss, lacking price competitiveness.

Gaps in Policy Adaptation Efficiency: Neolix and Zelostech have obtained road rights in over 300 cities nationwide, enabling rapid response to local policy requirements. In contrast, small and medium-sized players, with limited resources, find it difficult to establish extensive operation and maintenance networks, making it challenging to obtain road rights in more cities and hindering their ability to undertake large national orders.

III. Short-Term Monopoly by Leading Enterprises Difficult to Break, Potential for Market Share Adjustments in 2026

The 28,000-unit procurement volume of L4 autonomous vehicles in 2025 not only marks the starting point for industry scaling but also establishes a market structure dominated by 'leading duopolies with small and medium-sized players in supporting roles.' This structure is expected to continue deepening over the next 1-3 years.

As emphasized by Jin Bing, the explosion of China's autonomous vehicle industry is not an isolated enterprise growth phenomenon but a 'systematic industrial transformation' driven by the combined effects of technological maturity, cost reductions, policy support, and market demand.

From a short-term perspective, industry procurement volume is expected to increase to 100,000 units in 2026 (predicted by Soochow Securities), with leading enterprises' production capacity and resource advantages further amplifying. Neolix aims to deliver 40,000-50,000 units in 2026, while Zelostech targets 30,000 units, with their combined market share expected to remain above 80%.

However, in the long term, structural opportunities still exist in the market. As autonomous vehicle application scenarios expand from last-mile express delivery to feeder transportation, cold chain logistics, pharmaceutical distribution, and other fields, significant differences in vehicle load capacity, range, temperature control, and compliance requirements across scenarios provide breakthrough opportunities for enterprises focusing on niche sectors.

Simultaneously, policy orientation and globalization layout will become new variables for industry growth. Domestically, with the expansion of L3 autonomous driving pilots and further opening of L4 road right policies, autonomous vehicle operation scenarios will extend from enclosed parks and urban roads to mainline logistics, with order volumes expected to grow exponentially.

Internationally, Chinese autonomous vehicle enterprises, leveraging their technological generalization capabilities, cost advantages, and mature operation and service systems, have successfully entered over 10 countries. Going forward, overseas expansion will become a new growth driver for leading enterprises. Both Neolix and Zelostech are planning overseas production capacity and localized operations, aiming to further expand their global market shares.

Furthermore, the core of industry competition will gradually shift from 'price wars' to 'value wars.' The price competition in 2025 has facilitated rapid industry popularization, but in the long term, mere low prices cannot sustain enterprise development. Clients will place greater emphasis on comprehensive values such as operational efficiency, after-sales service, and scenario adaptability.

Leading enterprises have begun to deploy full lifecycle services, constructing comprehensive 'product + service' solutions from vehicle delivery and operation and maintenance to algorithm iteration and upgrades. Small and medium-sized players, on the other hand, need to focus on niche scenarios and form differentiated competitiveness through technological deep cultivation to avoid falling into homogeneous competition.

Overall, the explosion of the L4 autonomous vehicle industry in 2025 is just the beginning. With continuous technological iteration, expanding scenarios, and improving policies, a more efficient, intelligent, and diversified autonomous vehicle industrial ecosystem is taking shape. China's autonomous vehicle industry is transitioning from a 'scaling explosion' phase to a 'high-quality development' stage.