Outpaced in 12 Years and Surpassed in 3: Meta Invests Billions in China's Post-90s Generation Amid Desperate Moves

![]() 01/04 2026

01/04 2026

![]() 448

448

Meta remains a formidable force in the AI landscape, but for now, its influence is limited to disrupting the status quo. On the main stage of technological competition, Meta, with its last-minute team and strategy changes, has fallen behind. Its billion-dollar acquisition of Manus further underscores its desperate state.

Startup Manus (Butterfly Effect) officially joins Meta, as shown on its official website.

According to LatePost, this acquisition amounts to billions of dollars, marking Meta's third-largest acquisition since its inception, trailing only WhatsApp and Scale AI in cost.

This deal has left even venture capital investors astounded.

The Butterfly Effect company, founded just three years ago, has indeed sparked a butterfly effect.

#1

The Butterfly Effect

Business Data Analysis

At the beginning and end of the year, Xiao Hong, a post-90s, triggered a seismic shift in the AI circle.

Early in the year, an AI agent named 'Manus' rapidly gained popularity online.

Manus's overnight success brought Xiao Hong and his Butterfly Effect into the public eye. Following the DeepSeek miracle, many drew parallels between the two companies, expecting Manus to have a similarly profound impact.

This may be a harbinger, as agents have become the focal point for tech giants this year.

Microsoft officially unveiled five core design patterns for enterprise-grade AI agents on its website.

Amazon introduced a full-stack solution centered around Amazon Bedrock AgentCore.

Google has also expanded its AI ecosystem from a single language model to a complete product system.

Industry insiders generally regard 2025 as the 'Year of the Agent.'

The juxtaposition of tech giants' revelry and Manus's temporary obscurity is striking.

After its overnight success, Manus quickly secured a new round of financing, with its post-investment valuation soaring from $85 million to $500 million.

However, as a startup lacking funds and talent, Manus's voice gradually faded in the following months.

In July, Manus relocated its headquarters out of China, significantly downsizing its domestic team. The 120-person team was reduced to just over 40 core technical personnel.

It seemed Manus would fade away like a shooting star.

But by the end of the year, the story took a dramatic turn. Manus was acquired by Meta, with the acquisition price skyrocketing to billions of dollars, more than doubling in less than a year.

For Xiao Hong and Manus, Meta's billion-dollar acquisition may be the best deal they could find in the short term.

Meta's move also shocked the AI circle. The acquisition negotiations were completed in an extremely short timeframe, spanning just over ten days. ZhenFund, an angel investor, even questioned whether the offer was genuine due to its rapidity.

This year, Meta has made more than one such seemingly reckless 'big bet.'

In June, Zuckerberg made a substantial investment of $14.3 billion in startup Scale AI. This move, reminiscent of 'buying the bone to get the horse,' allowed Zuckerberg to hire founder Wang Tao (Alexandr Wang).

Zuckerberg even went as far as to directly recruit top AI talent, offering four-year compensation packages totaling up to $300 million.

Considering these actions, Meta seems more interested in the people behind Manus than the company's products.

This year, the talent war in Silicon Valley has reached fever pitch.

OpenAI's financial report revealed that its equity incentives last year burned through $4.4 billion, exceeding its annual revenue by 19%. Equity incentives accounting for 119% of revenue are unprecedented in the startup phase of any tech company.

For Meta, which has already fallen behind in the AI race, recruiting talent to catch up may be the most effective strategy.

Such a passive situation should not have befallen Meta.

#2

Rising Early but Falling Behind

Business Data Analysis

Meta's AI layout (Note: kept as pinyin for context, means 'layout') was indeed early. As early as 2013, Zuckerberg began assembling Meta's AI team.

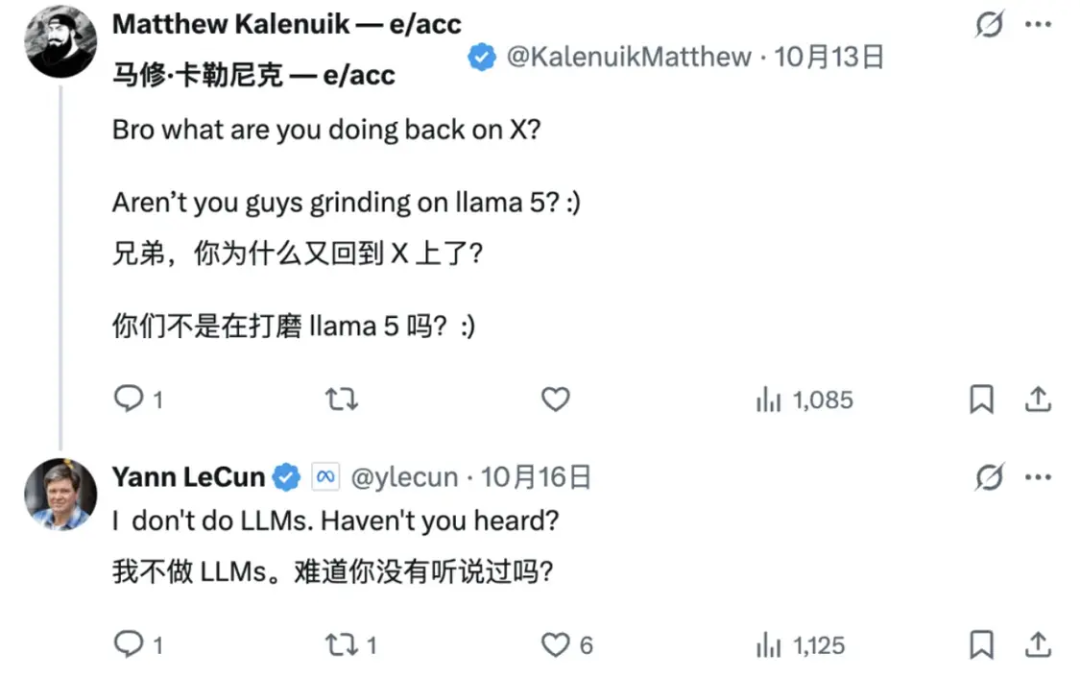

However, Zuckerberg placed too much faith in authority figures in his AI layout (Note: kept as pinyin for context, means 'layout').

At that time, Meta enlisted Yann LeCun to lead the effort. LeCun set stringent conditions:

1. Not relocating from New York;

2. Not resigning from his position at New York University;

3. Conducting open research, publicly releasing all work, and open-sourcing the code.

Under his leadership, the renowned FAIR lab was established.

As an academic, LeCun had ideological differences with Zuckerberg, a businessman. Under LeCun's guidance, Meta's approach was consistently open-source and dedicated to cutting-edge research. However, Zuckerberg's ultimate goal was commercialization.

Thus, from the outset, there was a disconnect within the FAIR lab. Zuckerberg established a 'GenAI' group outside FAIR to apply AI capabilities to products.

The plan was for the lab to focus on cutting-edge research, while the commercial group handled productization, ultimately forming a virtuous cycle. However, this premise relied on FAIR's technological capabilities remaining consistently ahead and a clear path to commercialization.

As it turned out, FAIR failed to meet Zuckerberg's expectations.

ChatGPT completely disrupted Zuckerberg's plans. In November 2022, ChatGPT's update to version 3.5 ignited the AI large model craze. Despite its early start, Meta failed to become a leader.

With its early accumulations, Meta could still keep pace.

In the open-source realm, Meta swiftly launched the Llama model in February 2023, emphasizing 'better performance with smaller parameters.' It's worth noting that while promoting 'open-source,' Meta, as a commercial entity, held back by only releasing weights and not fully disclosing training data, code, and licenses. Nevertheless, it made significant contributions to the open-source community.

With the Llama 2 model, Meta opened it up for commercial use. At that time, compared to the completely closed models of OpenAI and Google, Meta emerged as a 'lone warrior' combating closed-model giants in the large model arena.

In 2024, following the release of the Llama 3 series, Meta's reputation soared. The 450B version approached the capabilities of closed-source models, suggesting that Meta would be the sole flag-bearer for open-source models in the top-tier large model space.

But the story took a sharp turn in 2025.

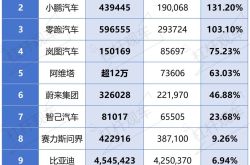

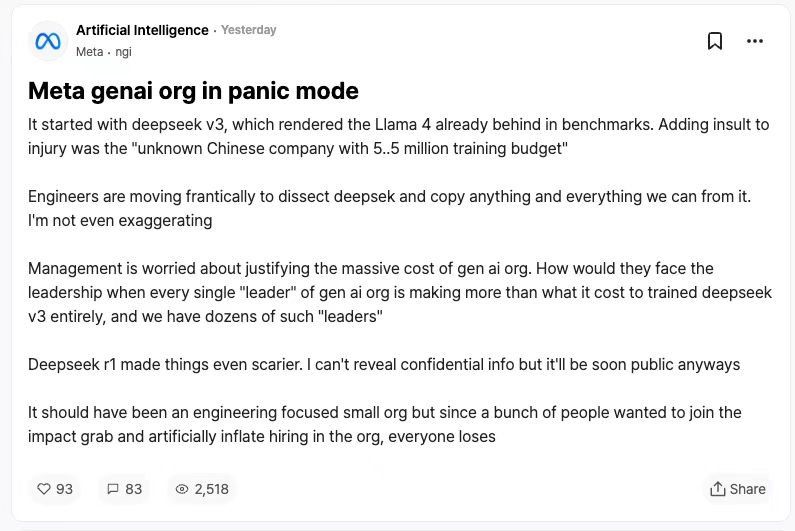

DeepSeek V3, hailing from across the ocean, unleashed a tsunami in the United States. This open-source model rivaled closed-source ChatGPT in capabilities, cost significantly less than its U.S. counterparts, and did not rely on high-end chips.

At that time, an internal memo circulating on social networks revealed that Meta's generative AI team was in a state of panic. 'It all started with DeepSeek V3, which left Llama 4 behind in benchmark tests.' 'Engineers are frantically dissecting DeepSeek, copying everything they can.'

On April 5, the Llama 4 series was released. According to reports at the time, Zuckerberg aimed to establish it as the global industry standard and hoped to achieve 1 billion users that year.

However, soon after its launch, feedback from the developer community indicated that Llama 4's performance fell short of expectations, even lagging behind competitors like DeepSeek in reasoning capabilities.

This was a significant setback. After 12 years of layout (Note: kept as pinyin for context, means 'layout'), being outpaced by a company founded less than three years ago undoubtedly fueled Zuckerberg's frustration.

Llama 4's Waterloo declared Meta's phased (Note: kept as pinyin for context, means 'phased/periodic') failure, necessitating damage control.

#3

Zuckerberg's Correction

Business Data Analysis

Humiliated, Zuckerberg initiated a complete reorganization of Meta's AI business. Consolidating resources and shifting towards closed-source models became Meta's primary strategy.

The FAIR lab was undoubtedly the first to face changes.

In late May, Meta split its AI department into an AI product team and an AGI foundational team, marking the beginning of a large-scale reorganization.

In June, after investing in Scale AI, Zuckerberg launched the 'Superintelligence Team' plan, with Scale AI founder Wang Tao taking the helm of the AI team.

For every newcomer's smile, there's an old hand's tear.

In July, Meta established the MSL team to integrate the AI product team and AGI foundational team.

In August, the MSL team was split into four groups: FAIR for foundational AI research, the Superintelligence R&D Group, the Product Group (including the Meta AI assistant), and the Infrastructure Group (including data centers and AI hardware).

In October, the AI department underwent a major shakeup, with approximately 600 layoffs. Affected areas included the AI infrastructure team, the Foundational Artificial Intelligence Research Department (FAIR), and other product-related positions. Meanwhile, the TBD lab, directly led by Wang Tao, remained unscathed and even expanded its recruitment efforts.

Over five months, the AI department underwent four large-scale reorganizations. These were not simple adjustments but a reshuffling of internal power structures. The original FAIR team and LeCun were gradually marginalized. LeCun, a Turing Award winner, reporting to the 28-year-old Wang Tao, sparked controversy.

Before the October layoffs, reports surfaced that LeCun might resign as FAIR's chief scientist. Ultimately, Meta retained him, but his role had been diminished.

Meta's strategy had undergone a 180-degree turn.

In December, Meta fully shifted towards closed-source models. Reports indicated that Zuckerberg was deeply involved in daily R&D, steering the company's strategy towards AI models with direct commercialization potential. A new model codenamed 'Avocado' is expected to launch in spring 2026, potentially as a closed-source offering.

Opting for a closed-source path was not difficult. Leading model representatives like OpenAI and Google have embraced closed-source models as the mainstream. Ultimately, Zuckerberg, never an idealist but a businessman, tied both the metaverse and AI large models to commercialization—a correction of his course.

Meta possesses immense energy and a burning desire to make an impact. Its every move may not yield results, but its disruptive power is undeniable.

During the AI team reorganization, Zuckerberg's actions had the most significant impact on competitors Google and OpenAI.

Previously, Zuckerberg's 'Superintelligence Team' comprised mostly individuals from OpenAI and Google DeepMind.

Meta's poaching caused quite a stir at OpenAI.

OpenAI founder Altman, who was poached, described Meta's behavior as somewhat repugnant.

The laid-off AI team also sparked a talent war in Silicon Valley. OpenAI, Google DeepMind, and NVIDIA extended olive branches, with OpenAI even offering 'eight-figure salaries plus the freedom to choose any research direction.'

Meta single-handedly threw the Silicon Valley talent war into disarray.

In late October, as Zuckerberg hinted at AI spending possibly exceeding $100 billion next year, Meta's influence on the AI market's supply and demand became apparent.

In November, Google's market value suddenly surged by approximately $530 billion, while chip giant NVIDIA's stock plummeted, erasing $620 billion in value.

The culprit behind this trillion-dollar market cap fluctuation was Meta. Reports indicated that Meta was in secret talks with Google, planning to spend billions on Google TPU (Tensor Processing Unit) chips by 2027. Meta is a core customer of NVIDIA.

A single order from Meta triggered a trillion-dollar market cap swing, highlighting the supergiant's influence.

However, this influence is largely a remnant of Meta's past accumulations. Meta urgently needs to find its niche in the AI era to match its current influence; otherwise, it risks becoming the next Yahoo or IBM.

#4

Meta's Darkest Hour

Business Data Analysis

Meta is currently facing such a predicament.

In its traditional stronghold, Meta's moat is being eroded. Competitors are evolving, with Twitter transforming into X and Zuckerberg's rival becoming the more influential Musk.

An even more formidable competitor hails from China. Data shows that TikTok has surpassed 2.05 billion monthly active users globally.

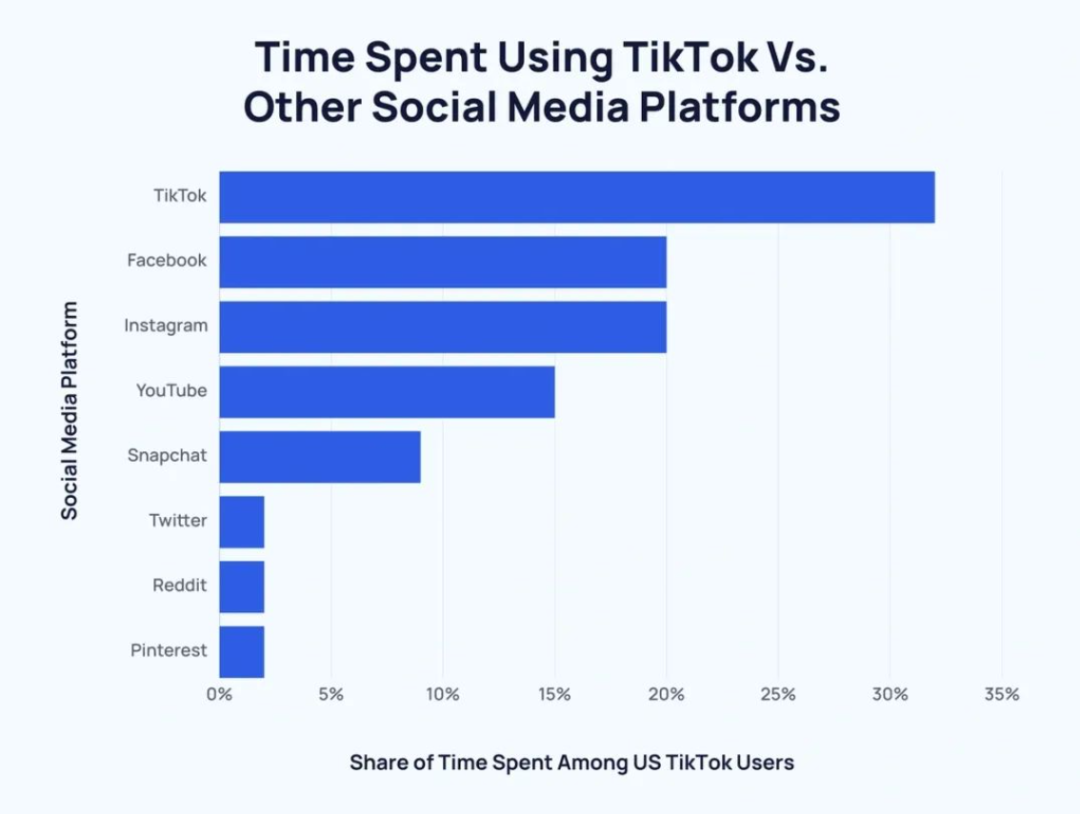

In terms of user potential and user stickiness, TikTok is highly likely to surpass Facebook and Instagram. Data shows that nearly 32% of Americans' social media time is spent on TikTok, far exceeding Facebook and Instagram. TikTok's user base is predominantly aged 18-34, with a very noticeable youthful demographic.

User volume represents advertising revenue, and the looseness of this business segment is very delicate for Meta's future prospects.

However, compared to the impact on its core business, Meta's strategy and management may pose even greater problems.

In 2021, Facebook marked a historic moment—its rebranding.

Zuckerberg released a one-hour-long video, explaining in detail why the company is named 'Meta.' He stated that the company is about to integrate its products to create a 'metaverse platform that transcends reality.'

That year, Meta ignited the metaverse, sparking infinite visions of the future among the public.

However, from the very beginning, the metaverse seemed like a castle in the air, and Meta's first steps were far from smooth.

Before the rebranding, Meta had already launched its metaverse product, Horizon Workrooms, which allowed 16 people to interact simultaneously in a virtual space. However, its crude design drew widespread ridicule.

Zuckerberg did not take it lightly. In 2022, he announced that $100 billion would be invested in metaverse R&D over the next decade; in 2023, Meta increased the budget for its 'Reality Labs' to $15 billion.

But in reality, it is likely that even Zuckerberg does not know how long the metaverse will take or how it will progress in the future.

Now, betting heavily on such an advanced concept as the metaverse without proving market acceptance and blindly investing real money, Zuckerberg is essentially gambling on a low-probability event.

Meta has achieved some results, but these accomplishments are merely peripheral for a company of Meta's scale. After four years of effort, Meta has achieved notable success in the global extended reality (XR, including virtual reality VR and augmented reality AR) headset market. According to a CounterPoint report, in the second quarter of this year, Meta's VR shipments accounted for 71% of the global market share.

While this market share seems extremely high, it is actually because the market has not yet taken off. In the second quarter, Meta's VR shipments were only 710,000 units, meaning that globally, the annual sales volume of AR is only around 4 million units.

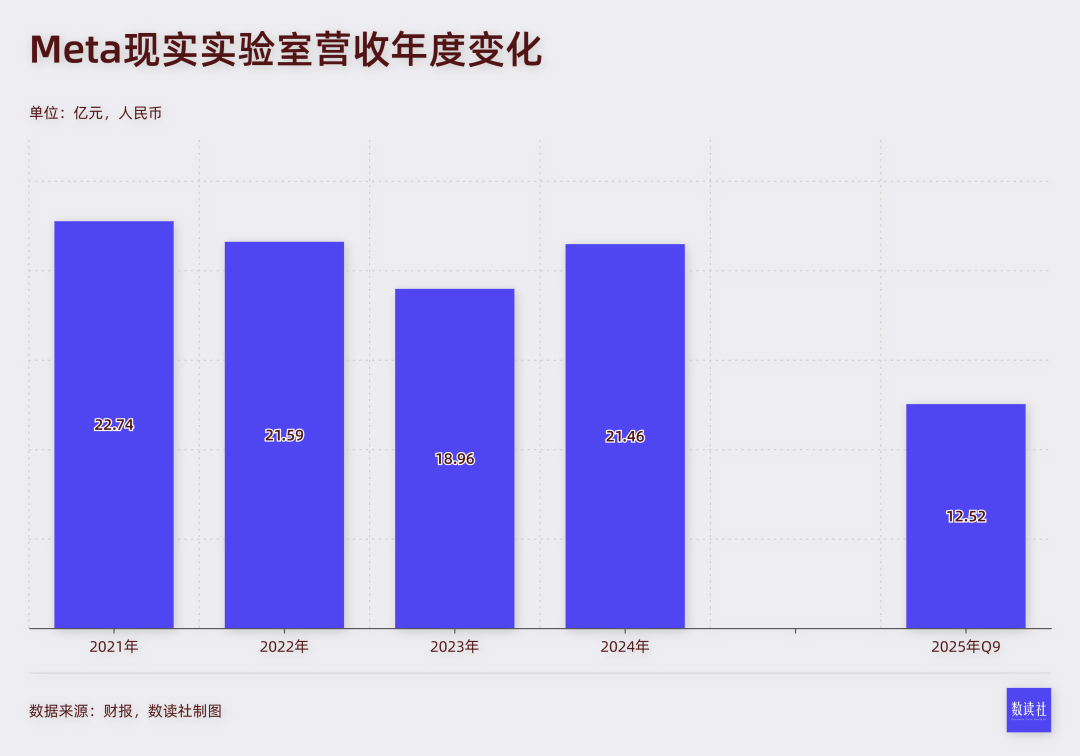

Reality Labs has been a pure money-burning division from the start. Data shows that Reality Labs, responsible for metaverse R&D, accumulated losses exceeding $40 billion from 2021 to 2024, with losses continuing in 2025.

Meanwhile, Reality Labs has never contributed more than 2% to Meta's overall revenue.

In the first three quarters of 2025, Reality Labs generated $1.252 billion in revenue, less than the same period in 2022. When this business was listed separately in 2021, Meta probably did not expect that year to be its peak, with stagnation or even regression ever since.

AI has introduced some variability to Meta's metaverse.

This year, smart glasses have emerged as a new trend, with major players like Alibaba, Baidu, and Xiaomi flocking to the market, and even automakers crossing over into the field.

Abroad, in addition to Apple's glasses, Google also announced that the first batch of AI glasses developed in collaboration will be launched next year.

Meta is also at the forefront, with its collaborative glasses, Ray-Ban, receiving a major update in 2023. Meta introduced AI capabilities, enabling the glasses to perform object recognition, real-time translation, weather inquiries, and more.

However, at this critical juncture, Reality Labs has not performed well.

Meta, which had an early layout (Chinese term meaning 'strategic positioning'), should have seized the opportunity, but the results have been disappointing.

The mixed reality glasses 'Phoenix,' originally scheduled for release in the second half of 2026, have been postponed to the first half of 2027, citing the need for more time to refine product details.

To fill technological gaps in biosensing and low-power AI algorithms, Meta acquired AI wearable device company Limitless.

By December, Meta announced budget cuts of up to 30% for its metaverse division.

With setbacks in both the metaverse and AI, Meta's current frantic moves seem more like treating symptoms rather than the root cause. Aggressively recruiting talent may even exacerbate internal chaos. Meta needs to reevaluate its strategic decisions, digest and streamline its aggressively poached teams, and prepare for the next industry opportunity.