Reaching the Second Place Globally! Google's Market Value Surpasses $4 Trillion, Overtaking Apple and Closing in on NVIDIA | B Insights

![]() 01/16 2026

01/16 2026

![]() 428

428

Google Reclaims the Throne.

On the 12th (Eastern Time), media outlets cited Apple's statement, announcing a multi-year partnership with Google.

Apple will leverage Google's Gemini model and cloud technology as the underlying foundation for its AI models, while also empowering the next generation of Siri.

Following the announcement, Alphabet's stock price, which had dipped 1% in early Monday trading, quickly erased its losses, surging to $334.04 and marking three consecutive days of record-high closings, successfully crossing the $4 trillion market value threshold.

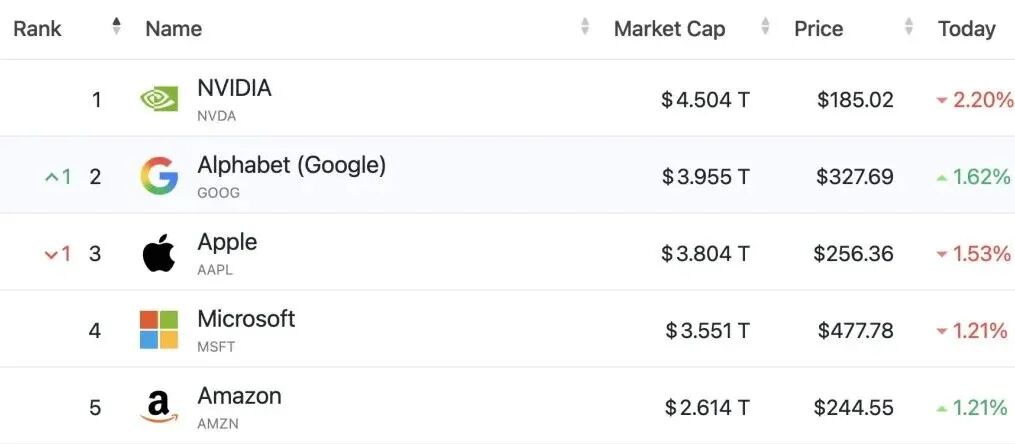

Last week, Google's parent company, Alphabet, successfully overtook Apple to become the world's second most valuable company by market capitalization—a testament to its emergence as a core winner in the artificial intelligence sector.

On Wednesday of last week, Alphabet's stock price rose 2.4%, closing with a market value of $3.89 trillion.

This performance enabled it to surpass Apple: Apple's Wednesday closing market value stood at $3.85 trillion, following six consecutive days of declines, with its market value evaporating by nearly 5%, a shrinkage of nearly $200 billion.

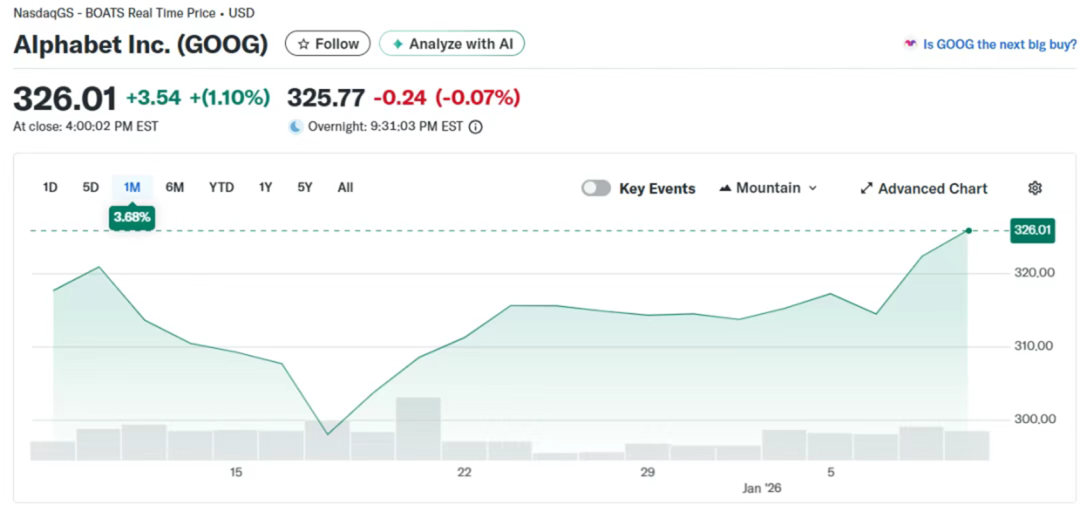

On Thursday of last week, Alphabet's lead over Apple widened further, with its stock price closing up 1.11% at $326 per share, hitting another all-time high intraday of $330.54 per share, and its total market value reaching $3.93 trillion, second only to NVIDIA's (NVDA) $4.50 trillion.

This marks the first time since 2019 that Google's parent company has surpassed Apple in market value.

(Image source: MarketWatch)

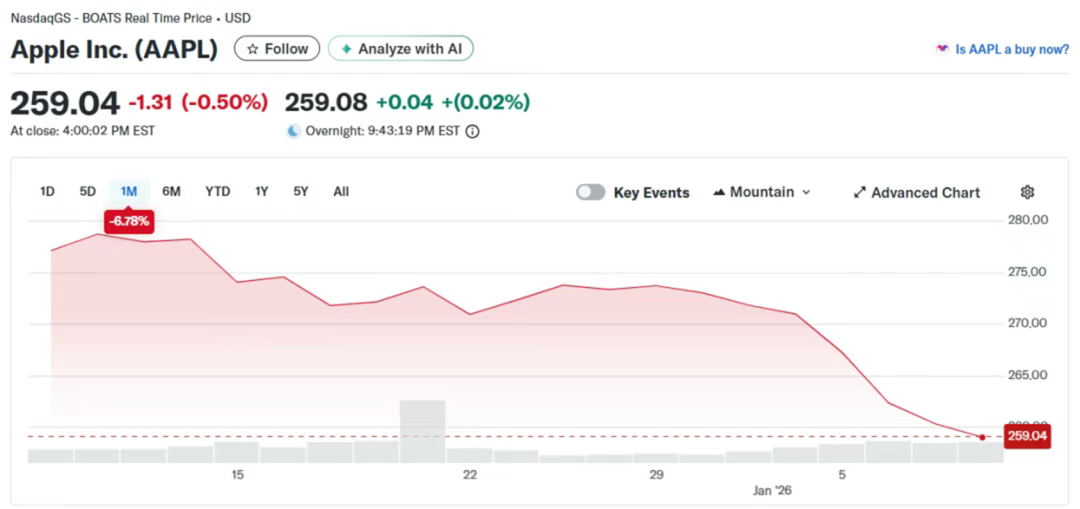

On the other hand, Apple's stock closed down 0.50% at $259.04 per share, dipping nearly 2% intraday to hit a new low in over two months, with its total market value shrinking to $3.81 trillion.

(Image source: MarketWatch)

Alphabet's stock price has surged recently, with a cumulative increase of over 65% in 2025, making it the best-performing stock among the 'Magnificent Seven' tech giants.

Apple's current total market value now lags Alphabet's by $120 billion.

More notably, its daily candlestick chart has displayed a rare seven-day losing streak, with the stock price cumulatively declining by over 5%. Such performance is far from a positive signal for Apple.

AI Full-Stack Deployment Becomes Core

Looking back to the beginning of the year, Google, the tech giant, was still mired in multiple operational uncertainties, including antitrust lawsuits and intensifying competition in its search business.

However, with the gradual implementation and effectiveness of its AI full-stack deployment in the second half of the year, its stock price successfully reversed its downturn and began a strong rebound. Today, most Wall Street institutions still see upside potential.

Multiple analyses point out that Google's parent company, Alphabet, has undergone a image makeover for its core business, Google: from a fading internet giant to a leading innovator in the artificial intelligence sector.

Its key growth engine is the gradual formation of its AI full-link closed loop.

The industry generally agrees that this reversal in market value rankings stems from the fundamental divergence in AI strategic paths between Google and Apple.

Since the generative AI wave swept the industry, Google has resolutely bet big on this track and caught up, finally achieving phased results by the end of last year.

Its launched Gemini 3 model is widely recognized by the market as surpassing OpenAI, which was once the 'benchmark of the AI industry.'

Meanwhile, Google unveiled its seventh-generation tensor processor, Ironwood, at the end of last year.

This customized AI chip, with its unique advantages, is seen as a strong alternative to NVIDIA's similar products.

Google's AI layout (translated as 'deployment') goes beyond just technological breakthroughs; its commercialization and user growth have also been impressive.

According to Google's official disclosure, the number of monthly active users for its Gemini app has surpassed 650 million, nearly doubling from 350 million in March last year in less than a year.

The market value overtaking is just the result; the real reason lies in the data voted by users.

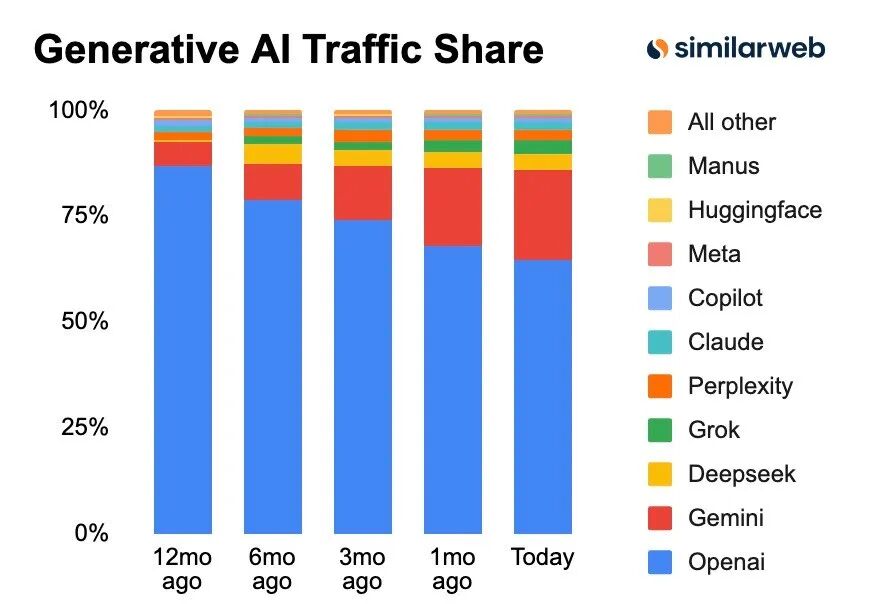

Take a look at these intuitive figures: Google Gemini's market share has soared from 5.7% twelve months ago to 21.5% now, successfully breaking through the key psychological threshold of 20%;

In contrast, ChatGPT's market share has plummeted from 86.7% to 64.5%. The rise and fall clearly highlight Google's AI product competitiveness.

Traffic Share of Platforms in the Generative AI Field (Image source: similarweb)

This means that one out of every five heavy AI users has migrated from other platforms (mainly ChatGPT) to Gemini.

The essence of this surge is not that Gemini's benchmark scores are much higher than GPT-4's, but a qualitative improvement in product experience.

Besides the continued strength of Google's traditional cash cow, advertising business, more importantly, the new growth expectations brought by AI products like Gemini are beginning to be accepted by the market.

Investopedia directly attributed this rally to 'AI progress + advertising revenue' when explaining it, and specifically mentioned that the launch of Gemini 3 has heightened market excitement.

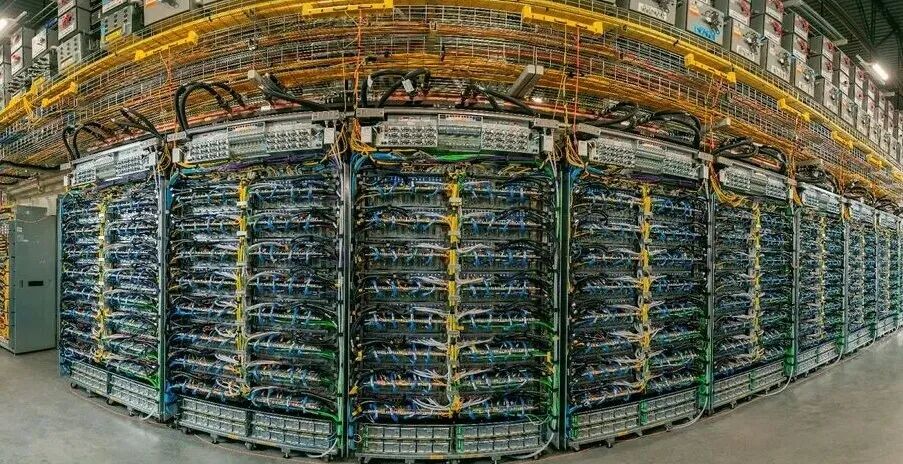

The core confidence supporting Google's strong lead lies in its 'trump card' of constructing an AI full-stack deployment.

Unlike other competitors that rely on renting computing power, Google possesses its self-developed TPU chips and a proprietary cloud service ecosystem.

This not only enables autonomous control over computing power costs but also forms a sustainable business closed loop by renting out computing power to others.

(Image source: GOOGLE)

In terms of product distribution channels, Google holds a natural advantage—the Android system with over 2 billion users worldwide, Google Search, and its office suite.

These have built a 'fast lane' for its AI products to reach a vast user base, enabling widespread reach without the need for additional channel construction.

The strong AI layout (translated as 'deployment') is also directly reflected in its performance. Google's quarterly financial report released in October last year was impressive, with quarterly revenue surpassing $100 billion for the first time, confirming its continuously improve (translated as 'continuous improvement') in commercial monetization capabilities.

NVIDIA's Moat: Can Google Break Through?

This inevitably sparks market debate: Is the gap between Google and NVIDIA, the market value leader, narrowing?

Looking ahead, industry insider Guo Tao believes that Google's market value has the potential to surpass NVIDIA's, with the key lying in its contend for (translated as 'competition for') dominance over AI industry standards and the scalable implementation of its full-stack ecosystem.

(Image source: X@stocksandincome)

'Currently, NVIDIA firmly occupies the core position in the AI computing power field with its chip products and supporting ecosystem, and its advantage in general computing power remains difficult to shake in the short term.'

'However, Google's differentiated competitive advantage has begun to emerge: its self-developed chips have successfully secured orders from multiple tech giants with their higher energy efficiency, gradually diverting market share,' Guo Tao further analyzed.

In the short term, the network effect formed by NVIDIA's existing ecosystem still constructs a deep moat.

But the key to long-term competition will ultimately focus on who dominates the formulation of AI technical standards and the speed of scalable implementation in application scenarios.

Multi-Line Pressure + AI Shortcomings

When interpreting the reasons behind Apple's overtaking, foreign media generally mention the key drag factor of 'slow AI integration progress,' a typical case of 'being outshone by peers.'

Logically, Apple's ecosystem is an excellent scenario for AI technology implementation, and its launched Apple Intelligence once carried high market expectations.

(Image source: Apple)

But the reality is that Apple lacks a hardcore, self-developed large model to support it, and its integration with ChatGPT has been underwhelming, disappointing both users and the capital market.

Although iPhone 17 sales have remained stable, Apple has consistently chosen not to make large-scale investments since ChatGPT ignited the global AI competition.

While this approach has avoided high capital expenditures, it has also led to a continuous downward adjustment in market expectations for its future growth potential.

External analysis suggests that Apple's lagging performance in the AI field stems from its internal lack of keen judgment on technological trends and insufficient related investment.

Nowadays, AI functionality has become a standard feature of smart devices, and Apple's shortcomings in product intelligence are gradually being exposed.

To make matters worse, besides its passive stance in the AI field, Apple also faces multiple challenges such as a slowdown in product innovation, the termination of its car-making project, and lackluster market response to Vision Pro. Its long-standing position as an innovation leader is now widely questioned by the market.

Who Will Dominate in This Changing Landscape?

If Apple wants to regain its market value advantage, it must take concrete and substantial measures in AI implementation and product innovation.

For Apple, this market value reversal is undoubtedly a loud wake-up call: its market value has plummeted from first to third globally, evaporating $200 billion in just one month.

The capital market has spoken with real money—investors lack confidence in Apple's AI strategy.

Merely promising to launch a new version of Siri in 2026 will not sway the market; only substantial actions can turn the situation around.

For the entire tech industry, this event is a clear signal of industry power shifts.

Apple, the absolute king of the mobile internet era, may become a follower in the AI wave, as a new industry power structure is taking shape.

Companies like NVIDIA, Google, and Microsoft, which made early bets on the AI track, are now entering a harvest phase.

As for whether Apple can turn the tide, find its rightful place in the AI era, and reclaim the top spot in global market value, remains uncertain.

But one thing is undeniable: time is running out for Apple.

The development speed of the AI track is astonishingly fast. Every quarter of delay widens its gap with the leading players and increases the risk of falling behind.

In fact, Apple's overtaking this time is not an accident but an inevitable result—in the core battleground of AI, Apple's pace has been too slow, missing key development opportunities.

Editor: Yang Lujie

Reference sources: Bloomberg, The Information, GOOGLE, APPLE

END