Domestic Breakthrough in the Memory Chip Battle Amidst the AI Boom (Part III)

![]() 01/22 2026

01/22 2026

![]() 398

398

Authored by Qianyanjun

Source: Bowang Finance

The author posits that under the dual influence of the memory chip supercycle and the drive for domestic substitution, key players in the industrial chain are undergoing a revaluation. The investment approach should transcend mere financial performance analysis, shifting focus from the historical 'strong cyclical elasticity' to 'growth certainty' and 'technological leadership'.

The crux of this transformation lies in the fact that domestic industry leaders have transitioned from being 'unusable' to 'usable' and even 'user-friendly'. Leveraging the current unprecedented market window, their technological advancements, capacity expansions, and customer adoption are entering a phase of trackable and predictable acceleration. This shifts the evaluation paradigm beyond mere industry price cycle speculation, emphasizing the realization of growth logic, such as the sustainability of technological iterations, the fulfillment of capacity expansion plans, the optimization of customer structures, and the construction of long-term ecological niches. Their growth potential is partially offsetting the industry's cyclical volatility. Based on this analysis, the author has compiled a list of representative companies as follows:

01

IDM Manufacturing Duo: The Pillar of Self-Reliance

ChangXin Memory Technologies: In recent years, the company has experienced rapid growth, achieving a global market share of 3.97% by the second quarter of 2025. It ranks fourth globally and first in China in terms of production capacity, shipments, and sales. From the mass production of DDR4 to the launch of DDR5/LPDDR5X, the company has demonstrated steady technological progress. At IC China 2025, the DDR5 product showcased a speed of 8000Mbps and a particle capacity of 24Gb, demonstrating its competitiveness against international counterparts.

Figure: Product Introduction from ChangXin Memory Technologies' Official Website

From 2022 to the first three quarters of 2025, ChangXin Memory Technologies incurred cumulative losses of approximately 37 billion yuan. However, its revenue exceeded 32 billion yuan in the first three quarters of 2025, with profitability on the horizon. The company projects full-year 2025 revenue of 55-58 billion yuan, net profit of 2-3.5 billion yuan, and core net profit (excluding non-recurring items) of 2.8-3 billion yuan. Its Sci-Tech Innovation Board IPO application aims to raise 29.5 billion yuan, primarily for advanced technology R&D and capacity expansion. It stands as the core carrier of China's aspirations for DRAM self-sufficiency.

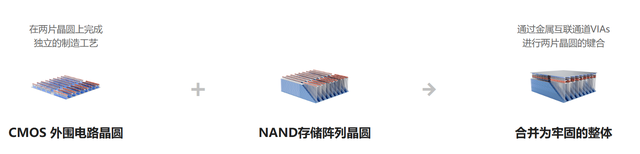

Yangtze Memory Technologies: A domestic leader in NAND Flash IDM. Its innovative Xtacking® architecture represents a core technological barrier, successfully leading its transition from 128-layer 'co-leading' to 232-layer 'leading', with the current 294-layer product achieving a yield rate exceeding 90%.

Figure: Detailed Explanation of Xtacking® Technology from Yangtze Memory Technologies' Official Website

Achieving the connection of billions of metal channels on an area the size of a fingernail and integrating them into a single entity with reliability comparable to processing on the same wafer, this technology brings more technological advantages and development possibilities for future 3D NAND. Its technology patent portfolio now carries international influence, and the trial production of its first production line with 45% local equipment content marks a crucial step toward supply chain self-reliance. Ranked on Hurun's '2025 Global Unicorn List' with a valuation of 160 billion yuan, Yangtze Memory Technologies debuted at 9th among China's top ten unicorns and 21st globally, becoming the semiconductor industry's highest-valued new unicorn.

02

Hidden Champions and Innovators in Key Segments

Longsys: Adopting a unique dual-mode approach of TCM (Technology Contract Manufacturing) and PTM (Product Technology Manufacturing), Longsys integrates self-developed controller chips (e.g., WM7400), in-house packaging and testing facilities, product design, and branding. This model enables deep alignment with local customer needs, offering rapid and flexible customized solutions—a flexibility that international giants struggle to match—thus establishing differentiated advantages in the embedded storage and solid-state drive markets.

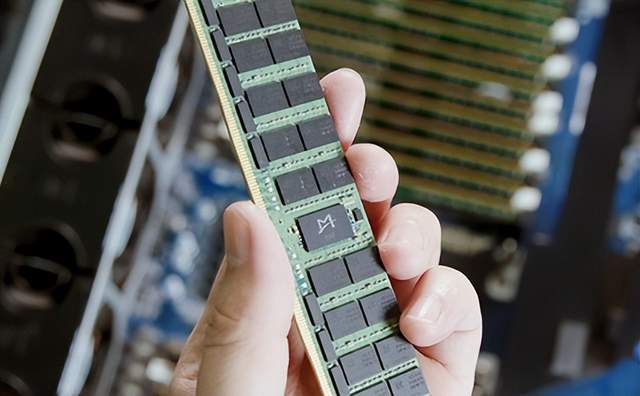

Figure: Memory Interface Chip from Montage Technology's Official Website

Montage Technology: A global leader in niche segments, Montage Technology holds a leading position in memory interface chips (especially in the DDR5 generation). These chips are indispensable core logic components for server memory modules and will directly and deterministically benefit from the explosive growth in global server DRAM demand, serving as a 'golden' link in the industrial chain.

03

Equipment and Materials: The 'Cornerstone' and 'Water Sellers' of Localization

NAURA Technology Group and Advanced Micro-Fabrication Equipment: As domestic semiconductor equipment leaders, they continue to make breakthroughs in key equipment for memory chip production lines, such as etching and thin-film deposition (PVD/CVD). The verification and adoption of their equipment are prerequisites for Yangtze Memory Technologies, ChangXin Memory Technologies, and others to increase production capacity and localization rates. Their growth logic is deeply intertwined with that of manufacturing leaders.

GigaDevice Semiconductor: A solid player in the Nor Flash niche storage market, GigaDevice Semiconductor is actively expanding into the DRAM business, representing a platform-based storage supplier.

Of course, numerous other outstanding domestic memory industry companies exist, which we will not enumerate here one by one. The 'supercycle' of memory chips, like a prism, refracts the intense glow of the struggle for core resources in the digital age. It transcends being merely an economic tale about prices and supply and demand; it is a national strategic narrative concerning computational sovereignty, data security, and industrial resilience.

Conclusion

For the global industry, AI has redefined the value coordinates of storage, driving capital and technology to converge at the pyramid's pinnacle—HBM and high-frequency DDR5. However, the giants' extreme focus on the high-end market, akin to an intense beam of light, illuminates the peak while inadvertently casting a long shadow over the mid-to-low-end market. The global supply chain's resilience map is being redrawn, and the seeds for ecological chain reconstruction have been sown.

For China, this 'cycle' has thus become a strategic opportunity not to be missed. Its significance transcends commercial profit and loss, directly addressing a fundamental question: In the wave of intelligence, can a nation possess the underlying capability to store and process its vast data? As emphasized by the head of ChangXin Memory Technologies, 'China needs a highly stable local DRAM production capacity supply.' Every layer stacked and every speed improvement by Yangtze Memory Technologies and ChangXin Memory Technologies is solidifying China's autonomous 'memory foundation' for the digital future.

The path to the future is clearly visible yet fraught with challenges. It first points to the sharpness of technological breakthroughs—whether China can achieve 'catching up' to 'keeping pace' in the most cutting-edge areas like HBM. Then, it tests the robustness of production capacity and yield rates—whether laboratory breakthroughs can be transformed into stable, large-scale, and cost-competitive high-quality production capacity. A deeper challenge lies in building the strength of an ecological closed loop, enabling the local industrial chain—from equipment and materials to design and applications—to form a risk-resistant positive cycle. Ultimately, all this will converge into the breadth of business models, aiming to evolve from 'substitutes' to indispensable 'participants' and even 'definers' in the global market.

The echoes of history remain clear: From Intel ending an era with a single chip to Samsung ascending to the throne through obsessive counter-cyclical investments, the scepter of the memory industry has always favored strategists who dare to go all-in at technological turning points and remain steadfast in their belief in the future during industry downturns.

Today, as the AI wave propels memory chips to an unprecedented strategic height, Chinese players, already holding their tickets, have stepped onto the main stage of this 'silicon-based oil' contest. The technological gap remains vast, the outcome far from determined, and the road inevitably bumpy. But one thing is certain: Whoever masters the ability to shape digital memory will hold the pen to write key chapters in the epic of the intelligent future. Every step forward by China's memory industry is adding a definitive, self-authored hue to this inevitable future.